2019 Top Car Brands: A Retrospective on Automotive Excellence

2019 Top Car Brands: A Retrospective on Automotive Excellence cars.truckstrend.com

The year 2019 stands as a fascinating benchmark in automotive history, representing a pre-pandemic landscape where established giants continued to dominate while disruptive forces were steadily gaining traction. Understanding the "Top Car Brands" of 2019 isn’t just about listing sales figures; it’s about dissecting the strategies, innovations, and consumer preferences that shaped the global automotive industry on the cusp of significant transformation. This comprehensive guide will delve into what made these brands leaders, offering insights into the market dynamics, technological advancements, and consumer desires of that pivotal year.

Understanding the Automotive Landscape of 2019

2019 Top Car Brands: A Retrospective on Automotive Excellence

Before diving into specific brands, it’s crucial to grasp the broader context of the 2019 automotive market. Globally, 2019 saw a slight deceleration in new vehicle sales after several years of consistent growth. Factors such as ongoing trade tensions, particularly between the US and China, economic uncertainties in key markets like Europe, and tightening emissions regulations began to cast shadows on the industry.

Despite these headwinds, certain trends were undeniable:

- SUV and Crossover Domination: The relentless consumer shift towards SUVs and crossovers continued unabated, pushing manufacturers to expand their utility vehicle lineups at the expense of traditional sedans and hatchbacks.

- Early Electrification Efforts: While still a niche segment, electric vehicles (EVs) and hybrids were gaining momentum, driven by increasing environmental awareness, government incentives, and the disruptive influence of Tesla.

- Connectivity and Autonomy: Advanced driver-assistance systems (ADAS) were becoming more commonplace, and infotainment systems were evolving rapidly, offering seamless smartphone integration and enhanced user experiences. The conversation around autonomous driving, though still futuristic, was becoming more concrete.

- Brand Loyalty and Reliability: For many consumers, long-standing reputations for reliability, safety, and resale value remained paramount in purchasing decisions.

The "top" brands of 2019 excelled not just in sales volume but also in adapting to these evolving trends, maintaining strong brand equity, and offering compelling products that resonated with a diverse global customer base.

Methodology for Determining Top Car Brands in 2019

Identifying the "top" car brands requires a multi-faceted approach beyond simple sales numbers. While volume is a primary indicator, other factors paint a more complete picture of a brand’s influence and success in 2019:

- Global Sales Volume & Market Share: This is the most straightforward metric, indicating which brands moved the most units worldwide. Groups like Volkswagen and Toyota consistently vie for the top spot when all their sub-brands are factored in.

- Brand Value & Equity: Financial valuations of brands, reflecting their market perception, customer loyalty, and potential for future growth.

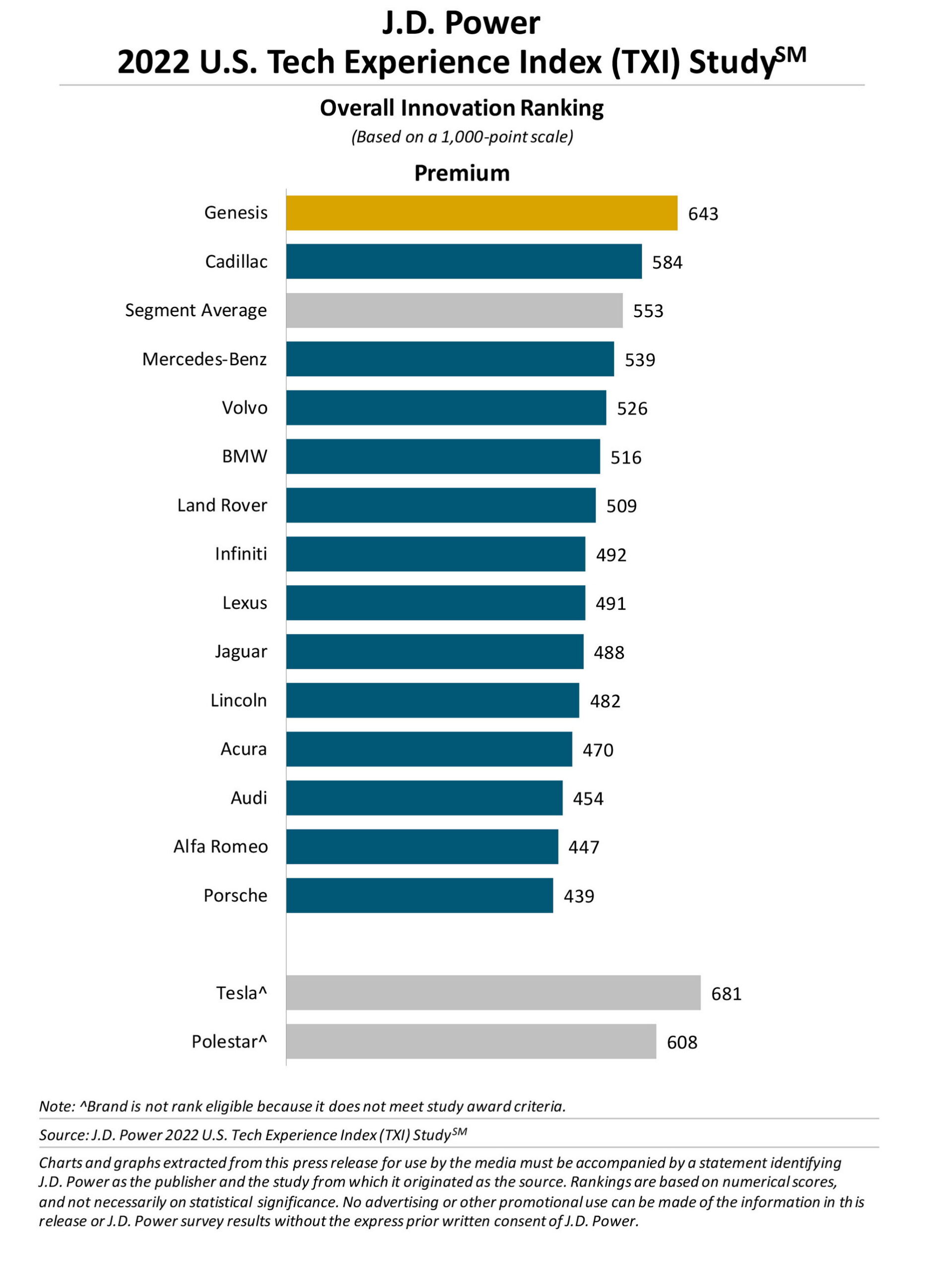

- Customer Satisfaction & Reliability: Data from organizations like J.D. Power, Consumer Reports, and various national automotive associations provide insights into vehicle quality, owner satisfaction, and long-term reliability.

- Innovation & Technology Adoption: A brand’s commitment to developing and integrating cutting-edge technologies, whether in powertrain efficiency, safety features, connectivity, or autonomous driving, was crucial for future relevance.

- Market Adaptability: How well a brand adapted its product portfolio to changing consumer tastes (e.g., more SUVs) and regulatory environments (e.g., stricter emissions standards).

By considering these dimensions, we can appreciate the nuanced reasons behind a brand’s success in 2019.

The Dominant Players: Volume Leaders of 2019

In 2019, the global automotive market continued to be largely dominated by a few titanic groups, each leveraging vast portfolios and global manufacturing footprints.

Toyota (and Lexus, Daihatsu, Hino)

As a consistent global leader, Toyota’s success in 2019 was built on its unwavering reputation for reliability, durability, and strong resale value. Its diverse lineup, from the ubiquitous Corolla and Camry to the ever-popular RAV4 and Highlander SUVs, ensured broad appeal. Toyota was also a pioneer and continued leader in hybrid technology, offering fuel-efficient alternatives across many of its models long before others fully embraced electrification. Their conservative yet effective approach ensured steady demand even amidst market fluctuations.

Volkswagen Group (VW, Audi, Porsche, Skoda, Seat, Lamborghini, Bentley, Bugatti)

The Volkswagen Group’s strength in 2019 lay in its sheer breadth and depth. From affordable Skoda models to ultra-luxury Bugattis, the group covered nearly every segment. The core Volkswagen brand maintained strong sales in Europe and China with popular models like the Golf, Tiguan, and Passat. Audi and Porsche continued to drive significant profits, while the group was also heavily investing in its "MEB" electric vehicle platform, signaling its aggressive push into the EV future, even if production volumes were still modest in 2019.

Ford

Ford’s performance in 2019 was heavily buoyed by its dominant position in the North American truck and SUV market, particularly with the F-Series pickup trucks, which remained the best-selling vehicles in the U.S. for decades. Globally, Ford was undergoing a restructuring, shedding less profitable sedan lines in favor of SUVs and commercial vehicles. Its focus was clearly shifting towards higher-margin segments and strategic partnerships for future technologies.

General Motors (Chevrolet, GMC, Cadillac, Buick)

Similar to Ford, General Motors’ strength in 2019 was largely concentrated in North America, with strong sales of Chevrolet Silverado and GMC Sierra trucks, and popular SUVs like the Chevrolet Equinox and Traverse. GM was also strategically exiting less profitable international markets to streamline operations and focus on electrification and autonomous driving initiatives, though these were still in early stages of market impact.

Hyundai-Kia

The South Korean duo continued its impressive ascent in 2019, offering increasingly stylish, well-equipped, and value-packed vehicles. Their focus on improving quality, expanding SUV lineups (e.g., Hyundai Kona, Palisade; Kia Seltos, Telluride), and offering competitive warranties resonated with consumers seeking modern features without a premium price tag. Both brands were also early adopters of hydrogen fuel cell technology and expanding their EV offerings.

The Ascent of Luxury: Premium Brands in 2019

The premium segment remained highly competitive in 2019, with German brands largely dominating, but with strong challenges from Japanese and Swedish contenders.

- Mercedes-Benz: Continued its reign as a top luxury seller, driven by a refreshed lineup of SUVs (GLC, GLE) and its iconic C-Class and E-Class sedans. Its focus on cutting-edge technology, luxurious interiors, and a wide range of powertrains appealed to affluent buyers.

- BMW: Maintained its reputation for driving dynamics, expanding its SUV (X-series) offerings significantly to meet market demand. BMW’s commitment to sportiness combined with increasing luxury and technology kept it competitive.

- Audi: Known for its sophisticated design, advanced technology (like Quattro AWD and Virtual Cockpit), and high-quality interiors, Audi continued to be a strong performer, especially in Europe and China. Its e-tron SUV marked a significant step into the EV luxury market.

- Lexus: Toyota’s luxury arm maintained its appeal through unparalleled reliability, refined comfort, and strong customer service. Its RX SUV remained a bestseller, while the brand slowly introduced more emotive designs.

- Volvo: Continued its remarkable resurgence, driven by elegant Scandinavian design, industry-leading safety features, and a commitment to electrification. Its XC60 and XC90 SUVs were particularly successful, appealing to buyers seeking understated luxury and family-friendly practicality.

Niche Innovators and Emerging Trends

While the large players held the bulk of the market, 2019 also saw the continued rise of brands pushing boundaries and capturing specific segments.

- Tesla: The undisputed disruptor, Tesla continued to redefine the EV market. In 2019, the Model 3 was scaling up production rapidly, making EVs more accessible, while the Model S and X maintained their premium appeal. Tesla’s direct-to-consumer sales model and software-centric approach challenged traditional automotive norms.

- Subaru: A niche player with outsized loyalty, Subaru thrived in 2019 due to its standard Symmetrical All-Wheel Drive, strong safety ratings, and rugged outdoor image. Models like the Forester and Outback resonated with adventurous buyers.

- Mazda: Though smaller in sales volume, Mazda earned critical acclaim in 2019 for its commitment to driving enjoyment, premium interior design, and innovative Skyactiv engine technology, which delivered impressive fuel efficiency without sacrificing performance.

Practical Advice for Car Buyers in 2019

For those looking to purchase a car in 2019, several considerations were paramount, many of which remain relevant for used car buyers today:

- Embrace the SUV/Crossover: If you needed versatility, higher seating, and potentially AWD, 2019 offered an unprecedented array of excellent SUV and crossover options across all price points.

- Consider Hybrid Technology: With fuel prices always a concern, 2019 was a great year to explore hybrid options from Toyota, Honda, and others, offering significant fuel savings without "range anxiety."

- Prioritize Safety Features: Advanced Driver-Assistance Systems (ADAS) like automatic emergency braking, lane-keeping assist, and adaptive cruise control were becoming more standard. These features significantly enhance safety and reduce driver fatigue.

- Evaluate Infotainment & Connectivity: Apple CarPlay and Android Auto were widespread, transforming the in-car experience. Ensure the system is intuitive and offers the connectivity you need.

- Think About Resale Value: Brands with strong reputations for reliability (e.g., Toyota, Honda, Subaru, Lexus) often command higher resale values, which is an important long-term financial consideration.

- Test Drive Multiple Options: The sheer variety of vehicles available meant that a thorough test drive of competing models was essential to find the perfect fit for your driving style and needs.

Challenges and Outlook from 2019

The top car brands of 2019, while successful, were also grappling with significant challenges that would shape the industry’s future:

- Navigating Trade Tensions: Tariffs and trade disputes created uncertainty and increased costs, particularly impacting global supply chains.

- Stricter Emissions Regulations: Governments worldwide were pushing for lower emissions, forcing massive investments in EV and hybrid technology, as well as more efficient internal combustion engines.

- The Electrification Race: While early, 2019 marked the clear beginning of the EV transition. Brands that hadn’t invested heavily in electric platforms faced a daunting catch-up challenge.

- Mobility Services: The rise of ride-sharing and subscription services began to pose questions about traditional car ownership models, prompting manufacturers to explore new business avenues.

- Technological Disruption: Beyond EVs, the push for autonomous driving and advanced connectivity required immense R&D budgets, challenging profitability.

Top Car Brands of 2019: Key Information

Here’s a table summarizing some of the top car brands of 2019, highlighting their market position, key models, and approximate price ranges. Note that "Starting Price Range" is a broad estimate for their most popular models in 2019 USD.

| Brand | Primary Market Strength in 2019 | Key Models (2019) | Market Segment | Approx. Starting Price Range (2019 USD) | Noteworthy Trend/Characteristic in 2019 |

|---|---|---|---|---|---|

| Toyota | Global volume leader, reliability, hybrid pioneer | RAV4, Camry, Corolla, Highlander | Mainstream | $20,000 – $45,000+ | Hybrid technology leadership, strong SUV lineup. |

| Volkswagen Group | Global diversity, European/Chinese dominance, luxury portfolio | Golf, Tiguan, Jetta, Atlas (VW); A4, Q5 (Audi) | Mainstream/Premium | $20,000 – $60,000+ | Significant investment in electric vehicle platforms (MEB). |

| Ford | North American truck/SUV dominance, F-Series strength | F-150, Explorer, Escape, Mustang | Mainstream | $25,000 – $60,000+ | Phasing out sedans in North America, focus on commercial vehicles. |

| General Motors | North American truck/SUV strength, large SUVs | Silverado, Equinox, Sierra, Traverse | Mainstream/Premium | $25,000 – $70,000+ | Restructuring global operations, focus on higher-margin segments. |

| Hyundai-Kia | Value, design, improving quality, expanding SUV range | Elantra, Santa Fe, Kona (Hyundai); Forte, Sportage (Kia) | Mainstream | $18,000 – $40,000+ | Aggressive expansion of SUV models, competitive features. |

| Honda | Reliability, efficient engines, strong compact/mid-size segments | Civic, CR-V, Accord, Pilot | Mainstream | $20,000 – $40,000+ | Strong reputation for engineering and fuel efficiency. |

| Mercedes-Benz | Luxury, technology, brand prestige, strong SUV sales | C-Class, E-Class, GLC, GLE | Luxury | $40,000 – $100,000+ | Leading luxury sales, expanding EQ (EV) sub-brand. |

| BMW | Driving dynamics, premium feel, expanding SUV lineup | 3 Series, 5 Series, X3, X5 | Luxury | $40,000 – $100,000+ | Strong balance of performance and luxury, increasing focus on SUVs. |

| Audi | Sophisticated design, advanced technology, Quattro AWD | A3, A4, Q5, Q7 | Luxury | $35,000 – $90,000+ | Introduction of the e-tron SUV, digital cockpit leadership. |

| Tesla | EV market leader, disruptive technology, direct sales | Model 3, Model S, Model X | Premium EV | $40,000 – $100,000+ | Rapid production scaling of Model 3, software-centric approach. |

(Note: Prices are approximate MSRP for base models and can vary significantly based on trim, options, and regional markets.)

Frequently Asked Questions (FAQ) about 2019 Top Car Brands

Q1: What was the best-selling car brand globally in 2019?

A1: In terms of total vehicle sales across its brands (including Lexus, Daihatsu, Hino), the Toyota Group was often cited as the top-selling automaker globally in 2019, closely followed by the Volkswagen Group.

Q2: Which luxury car brands were most popular in 2019?

A2: Mercedes-Benz, BMW, and Audi consistently led the luxury segment in terms of global sales volume in 2019, often referred to as the "German Big Three." Lexus and Volvo also performed very strongly.

Q3: What were the major trends influencing car sales in 2019?

A3: The continued rise of SUVs and crossovers, early but growing adoption of electric and hybrid vehicles, increasing integration of advanced safety features (ADAS), and evolving in-car connectivity were key trends. Economic uncertainties and trade tensions also played a role.

Q4: Was 2019 a good year for overall car sales?

A4: Globally, 2019 saw a slight decline in new vehicle sales compared to the peak years leading up to it. While some markets remained strong, others experienced slowdowns due to various economic and geopolitical factors.

Q5: How did electric vehicles (EVs) perform in 2019?

A5: EV sales were still a relatively small percentage of the overall market in 2019 but were growing rapidly. Tesla was the dominant player, particularly with the Model 3, and traditional automakers like Audi (e-tron) and Porsche (Taycan debut) began to launch their first serious long-range EVs.

Q6: What factors should I consider if buying a used 2019 model car today?

A6: When buying a used 2019 model, consider the vehicle’s mileage, maintenance history, condition, and any remaining warranty. Research its reliability ratings for that specific year and model, check for recalls, and evaluate if its technology (e.g., infotainment, ADAS) still meets your needs. Many 2019 models offer a great balance of modern features and good value.

Conclusion

The year 2019 represented a significant moment for the automotive industry. It was a period where traditional strengths—reliability, manufacturing prowess, and brand loyalty—continued to define leadership, primarily held by giants like Toyota, Volkswagen, and Ford. Yet, beneath the surface, the seeds of future transformation were rapidly sprouting. The ascent of SUVs, the undeniable, albeit nascent, shift towards electrification led by Tesla, and the increasing integration of advanced technology signaled the dawn of a new era.

The top car brands of 2019 were those that not only mastered the present market but also began to strategically position themselves for the profound changes ahead. Their success provides a valuable historical lens, demonstrating resilience, adaptability, and the relentless pursuit of innovation that continues to drive the automotive world forward. Looking back, 2019 was less about a finishing line and more about a pivotal turning point, setting the stage for the industry’s dramatic evolution in the years that followed.