Best Car Brands To Lease: Your Comprehensive Guide to Smart Driving

Best Car Brands To Lease: Your Comprehensive Guide to Smart Driving cars.truckstrend.com

In the dynamic world of automotive finance, leasing has emerged as a highly attractive option for many drivers. Offering the allure of driving a new car every few years with potentially lower monthly payments than financing a purchase, it’s a financial pathway that aligns perfectly with a modern, flexible lifestyle. But not all car brands are created equal when it comes to the art of the lease. Understanding the "Best Car Brands To Lease" isn’t just about finding a good deal; it’s about identifying manufacturers whose vehicles and financial programs are inherently structured to make leasing a more advantageous and predictable experience.

This comprehensive guide will delve into the nuances of car leasing, exploring the critical factors that elevate certain brands above others in the leasing landscape. Whether you’re a seasoned leaser or considering it for the first time, equipping yourself with this knowledge will empower you to make an informed decision that saves you money and maximizes your driving pleasure.

Best Car Brands To Lease: Your Comprehensive Guide to Smart Driving

Understanding Car Leasing: Why Brand Choice Matters

At its core, leasing a car means you’re paying for the depreciation of the vehicle during the term of your lease, plus interest (known as the "money factor") and fees. You don’t own the car; you essentially rent it for an extended period, typically 24 to 48 months. This model brings several advantages:

- Lower Monthly Payments: Since you’re not paying for the full purchase price, monthly lease payments are often significantly lower than loan payments for the same vehicle.

- New Car More Often: Enjoy the latest features, safety technology, and styling trends by upgrading to a new model every few years.

- Warranty Coverage: Most lease terms fall within the manufacturer’s bumper-to-bumper warranty period, minimizing unexpected repair costs.

- Less Hassle at Trade-in: At the end of the lease, you simply return the car (assuming it meets mileage and wear-and-tear guidelines), avoiding the complexities of selling or trading in a used vehicle.

However, these benefits are amplified or diminished depending on the brand you choose. The "best" brands for leasing are those whose intrinsic value, market strategy, and financial programs create the most favorable leasing terms for the consumer.

Key Factors That Make a Car Brand "Good to Lease"

When evaluating which brands shine in the leasing arena, several critical factors come into play. These elements directly impact your monthly payments and the overall value proposition of your lease.

1. High Residual Values

This is arguably the most crucial factor. The residual value is the estimated value of the car at the end of the lease term, expressed as a percentage of its Manufacturer’s Suggested Retail Price (MSRP). A higher residual value means the car is expected to depreciate less during your lease, and since you’re paying for that depreciation, a higher residual directly translates to lower monthly payments. Brands known for their reliability, strong demand, and a history of holding their value tend to have higher residual values.

2. Manufacturer Lease Programs and Incentives

Many manufacturers offer subsidized lease programs to make their vehicles more attractive. This can include:

- Lower Money Factors: Essentially a low interest rate on the lease.

- Capitalized Cost Reductions: Similar to a rebate, reducing the initial value of the car for leasing purposes.

- Special Lease Deals: Promotional offers on specific models that significantly drop monthly payments.

Brands that frequently offer competitive and aggressive lease incentives are often excellent choices. They use these programs to stimulate sales and move inventory, benefiting the consumer.

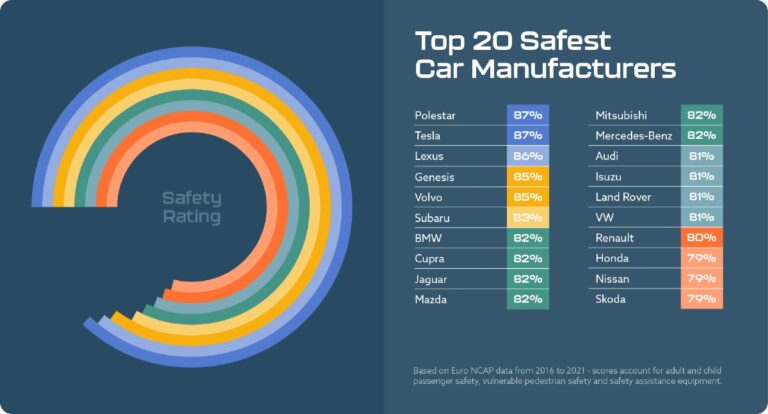

3. Reliability and Maintenance Costs

While your car is typically under warranty during a lease, choosing a brand known for its reliability means fewer trips to the service center and less potential for out-of-pocket expenses for minor issues not covered by warranty or for routine maintenance. Brands with a strong reputation for durability offer peace of mind throughout the lease term.

4. Variety of Models and Trim Levels

A brand that offers a diverse portfolio of vehicles – from fuel-efficient sedans and versatile SUVs to capable trucks and luxury performance cars – provides more options for finding a model that perfectly fits your needs and budget. This breadth allows you to compare different lease offerings within the same brand.

5. Brand Reputation and Customer Service

A positive experience extends beyond the vehicle itself. Brands known for excellent customer service, a robust dealer network, and a generally good reputation can make the entire leasing process, from application to lease-end, much smoother.

Top Car Brands Generally Recommended for Leasing (and Why)

Based on the factors above, certain brands consistently rank high for their leasing potential. It’s important to remember that specific deals vary by month, region, and model, but these brands generally offer a strong foundation for favorable leases.

1. Honda

- Why they’re good to lease: Honda vehicles consistently boast some of the highest residual values in the industry, thanks to their legendary reliability, strong demand, and broad appeal. Models like the CR-V, Civic, and Accord are perennial favorites, and Honda frequently offers competitive lease programs.

- Best for: Drivers seeking reliability, practicality, and excellent value retention.

2. Toyota

- Why they’re good to lease: Similar to Honda, Toyota is a powerhouse of reliability and high resale value. Their vehicles, including the RAV4, Camry, and Highlander, are known for their longevity, which translates directly into strong residual values. Toyota’s lease programs are often very competitive.

- Best for: Dependability, low running costs, and a wide range of popular models.

3. Lexus

- Why they’re good to lease: As Toyota’s luxury arm, Lexus inherits much of its parent company’s reliability and exceptional build quality. This, combined with their premium brand image, leads to strong residual values in the luxury segment. Lexus often offers attractive lease incentives, making luxury ownership more accessible.

- Best for: Those desiring luxury, comfort, and reliability without the steeper depreciation often associated with other premium brands.

4. BMW / Mercedes-Benz / Audi (German Luxury)

- Why they’re good to lease: While their residuals might not always match Toyota or Honda, German luxury brands frequently offer highly subsidized lease programs. They use leasing as a primary sales tool to keep their models fresh in the market. This means you can often drive a high-end luxury vehicle for a surprisingly competitive monthly payment, especially on popular models like the BMW 3 Series, Mercedes C-Class, or Audi A4.

- Best for: Enthusiasts of performance, cutting-edge technology, and brand prestige who want to experience luxury without a long-term commitment.

5. Subaru

- Why they’re good to lease: Subaru vehicles, particularly their SUVs like the Forester and Outback, enjoy incredibly strong demand and high residual values, especially in regions with challenging weather. Their standard Symmetrical All-Wheel Drive system is a significant draw, contributing to their appeal and value retention.

- Best for: Outdoor enthusiasts, those in snowy climates, and drivers prioritizing safety and AWD capability.

6. Hyundai / Kia

- Why they’re good to lease: These Korean brands have made significant strides in design, quality, and technology. They offer a compelling value proposition, often packing more features for the price than competitors. Their improving reliability and aggressive lease incentives (often tied to their desire to gain market share) make them increasingly attractive for leasing.

- Best for: Value-conscious buyers seeking modern features, stylish design, and good warranty coverage.

7. Mazda

- Why they’re good to lease: Mazda has carved out a niche with its "premium for the people" approach, offering upscale interiors and engaging driving dynamics at a non-luxury price point. Their residuals have been steadily improving, and they often have attractive lease deals for models like the CX-5 and Mazda3.

- Best for: Drivers who appreciate sophisticated design, engaging driving, and a premium feel without a premium price tag.

How to Choose the Best Brand for YOUR Lease

While the above brands are generally strong for leasing, the "best" brand for you depends on your individual needs and preferences.

- Assess Your Needs & Budget: What type of vehicle do you need (sedan, SUV, truck, EV)? What’s your realistic monthly budget? How many miles do you drive annually?

- Research Specific Models: Even within a strong brand, residual values can vary significantly between models and trim levels. Use resources like Edmunds, Kelley Blue Book, and ALG (Automotive Lease Guide) to research specific model residuals.

- Compare Current Lease Offers: Manufacturer websites and dealership ads will showcase current lease specials. Don’t just look at the monthly payment; also note the "due at signing" amount and the included mileage.

- Test Drive: Always test drive several models from different brands to get a feel for their driving dynamics, comfort, and features.

- Consider Insurance Costs: Get insurance quotes for the models you’re considering, as these can vary significantly and add to your overall monthly cost.

Tips for Securing the Best Lease Deal on Your Chosen Brand

Once you’ve identified a few target brands and models, follow these tips to optimize your lease:

- Understand Lease Components: Familiarize yourself with the MSRP, Capitalized Cost (negotiated selling price), Residual Value, Money Factor (interest rate), and Mileage Allowance. Negotiating the Capitalized Cost is your primary leverage point.

- Negotiate the "Selling Price": Treat the Capitalized Cost (the agreed-upon price of the car for the lease calculation) as if you were buying the car outright. A lower capitalized cost directly reduces your monthly payment.

- Shop Around for Money Factor: The money factor is essentially the interest rate. While set by the manufacturer, dealers can sometimes mark it up. Compare offers from different dealerships.

- Minimize Down Payment: While a larger down payment reduces your monthly payment, if the car is totaled or stolen early in the lease, you could lose that money. Often, it’s better to pay higher monthly payments than a large lump sum upfront. Aim for only first month’s payment and fees due at signing.

- Look for Factory Incentives: Manufacturers often offer lease-specific incentives that aren’t advertised as general rebates. Ask your dealer or check manufacturer websites.

- Be Mindful of Mileage: Accurately estimate your annual mileage. Going over your mileage allowance can result in hefty per-mile fees at lease end.

- Read the Fine Print: Understand wear-and-tear guidelines, early termination clauses, and any disposition fees.

Potential Challenges and Solutions

While leasing offers many advantages, be aware of potential challenges:

- Market Fluctuations: Economic shifts or changes in manufacturer strategy can impact lease deals. Solution: Be flexible with your timing and research current offers.

- High-Demand Models: Extremely popular models (like new EVs or certain SUVs) might have less favorable lease terms initially due to strong demand. Solution: Consider slightly less popular trims or models, or wait for incentives to appear.

- Wear and Tear Charges: Excessive damage beyond normal wear can result in fees. Solution: Maintain your vehicle well, consider purchasing wear-and-tear protection plans if offered, and address minor issues before lease end.

- Early Termination Fees: Getting out of a lease early can be very expensive. Solution: Only lease if you’re confident you’ll keep the car for the full term. Explore lease transfer services if your circumstances change.

Best Car Brands To Lease: Illustrative Lease Price Table

Please Note: The following table provides illustrative hypothetical examples based on general market trends and typical manufacturer programs. Actual lease prices vary significantly based on location, specific trim level, current manufacturer incentives, your credit score, negotiation, chosen mileage allowance, and market conditions at the time of leasing. These figures are for comparative purposes only and should not be taken as real-time quotes.

| Brand/Model (Example) | MSRP (Approx.) | Est. Residual Value (36mo/10k mi, % of MSRP) | Hypothetical Monthly Payment (36mo/10k mi) | Hypothetical Due at Signing (incl. 1st mo pymt) | Key Leasing Advantage |

|---|