Brand New Car Insurance Price: Your Comprehensive Guide to Protecting Your Latest Investment

Brand New Car Insurance Price: Your Comprehensive Guide to Protecting Your Latest Investment cars.truckstrend.com

The thrill of driving a brand new car off the lot is unparalleled – the pristine paint, the new car smell, the latest technology at your fingertips. But before you hit the open road, there’s a crucial step that often gets overlooked in the excitement: securing the right insurance. Understanding "Brand New Car Insurance Price" is not just about finding the cheapest premium; it’s about safeguarding a significant investment and ensuring peace of mind against unforeseen circumstances.

Unlike insuring a used vehicle, a brand new car comes with unique considerations that can significantly impact its insurance cost and the types of coverage you absolutely need. This comprehensive guide will delve into what influences these prices, the essential coverages, how to secure the best rates, and address common queries, empowering you to make an informed decision for your prized possession.

Brand New Car Insurance Price: Your Comprehensive Guide to Protecting Your Latest Investment

Understanding the Unique Aspects of Insuring a Brand New Car

Insuring a brand new vehicle differs substantially from covering a pre-owned one, primarily due to its higher initial value, susceptibility to rapid depreciation, and often, more advanced technology. These factors dictate not only the premium but also the specific types of coverage that become indispensable.

- Higher Initial Value: A new car, by definition, has a higher market value than a comparable used one. This directly translates to higher potential payout costs for insurers in the event of a total loss or significant damage, thus driving up premiums.

- Rapid Depreciation: New cars begin to depreciate the moment they leave the dealership. This "new car smell" depreciation can be a significant concern if the car is totaled shortly after purchase, as its actual cash value (ACV) might be less than what you owe on your loan or lease.

- Advanced Technology & Repair Costs: Modern new cars are packed with sophisticated sensors, cameras, and computer systems. While these enhance safety and performance, they also make repairs more complex and costly, requiring specialized parts and labor.

- Specialized Coverages: Due to these unique aspects, certain coverages become highly recommended, if not essential, for new cars:

- New Car Replacement Coverage: This invaluable endorsement ensures that if your new car is totaled within a specific timeframe (e.g., 1-3 years) and mileage limit, the insurer will replace it with a brand new vehicle of the same make, model, and trim, rather than just paying out its depreciated actual cash value.

- Gap Insurance: Crucial for financed or leased new cars, Gap (Guaranteed Asset Protection) insurance covers the "gap" between your car’s actual cash value (what the insurer pays out if totaled) and the outstanding balance on your loan or lease. Without it, you could be left paying for a car you no longer own.

- Original Equipment Manufacturer (OEM) Parts Coverage: This ensures that if your car needs repairs after an accident, only genuine manufacturer parts are used, maintaining the vehicle’s integrity and warranty.

Key Factors Influencing Brand New Car Insurance Price

The price you pay for brand new car insurance is a complex calculation influenced by a multitude of variables. Understanding these factors is the first step toward finding a policy that offers both comprehensive protection and affordability.

-

The Car Itself:

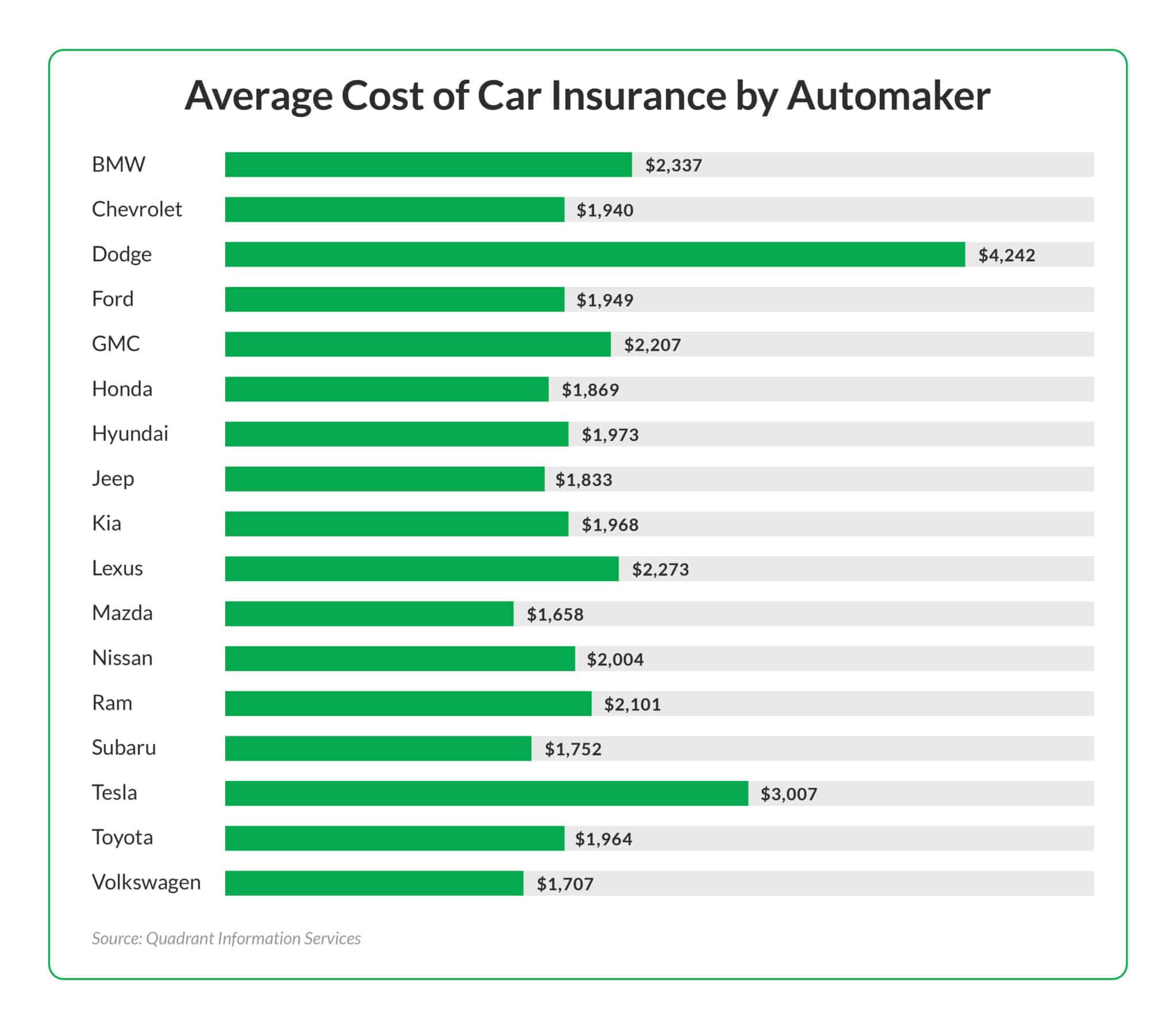

- Make, Model, Year, Trim: High-performance sports cars, luxury vehicles, or models with a history of high theft rates generally cost more to insure. Conversely, vehicles with excellent safety ratings, lower repair costs, and readily available parts tend to have lower premiums.

- Safety Features: Advanced driver-assistance systems (ADAS) like automatic emergency braking, lane-keeping assist, and adaptive cruise control can qualify for discounts, but they can also increase repair costs if damaged.

- Anti-Theft Devices: Factory-installed immobilizers, alarms, and tracking systems can lead to significant discounts.

-

The Driver’s Profile:

- Driving Record: A clean record with no accidents or violations is the single biggest factor for lower premiums. Speeding tickets, DUIs, or at-fault accidents will drastically increase costs.

- Age and Experience: Younger, less experienced drivers (especially under 25) typically face higher rates due to statistical risk. As drivers gain experience and maintain a clean record, premiums tend to decrease.

- Location: Urban areas with higher traffic density, theft rates, and accident frequency generally have higher premiums than rural areas. Your specific zip code can make a difference.

- Credit Score (where applicable): In many states, insurers use credit-based insurance scores as a factor, correlating higher scores with lower risk and thus lower premiums.

- Marital Status & Gender: Married individuals often receive lower rates, as statistics suggest they are less likely to file claims. Gender can be a factor in some regions, though its influence is diminishing due to non-discrimination laws.

- Occupation & Annual Mileage: Certain professions might qualify for discounts. Lower annual mileage can also lead to reduced premiums as it signifies less exposure to risk.

-

Coverage Choices & Deductibles:

- Liability Limits: Higher liability limits (e.g., $100,000/$300,000 bodily injury, $50,000 property damage) offer greater protection but result in higher premiums. It’s advisable to carry robust liability coverage, especially with a new car.

- Deductibles: The amount you pay out-of-pocket before your insurance kicks in. Higher deductibles (e.g., $1,000 instead of $500) lead to lower premiums, but require you to have more cash readily available for claims.

- Additional Endorsements: Adding coverages like New Car Replacement, Gap Insurance, Roadside Assistance, or Rental Reimbursement will increase your premium, but offer invaluable protection for a new vehicle.

-

The Insurance Provider:

- Different insurance companies have varying risk assessment models, pricing algorithms, and discount structures. What one insurer quotes as expensive, another might offer at a competitive rate. This highlights the importance of shopping around.

Types of Coverage Essential for Brand New Cars

While some coverages are legally mandated, others are highly recommended for new vehicles to ensure comprehensive protection.

- Liability Insurance: Legally required in most states.

- Bodily Injury Liability: Covers medical expenses and lost wages for people injured in an accident you cause.

- Property Damage Liability: Covers damage to other people’s property (vehicles, fences, buildings) in an accident you cause.

- Collision Coverage: Pays for damage to your own vehicle resulting from a collision with another vehicle or object, regardless of fault. Essential for protecting your investment.

- Comprehensive Coverage: Protects your car against non-collision incidents such as theft, vandalism, fire, falling objects, natural disasters (hail, floods), and animal impacts. Given the high value of new cars, this is non-negotiable.

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: Protects you and your passengers if you’re involved in an accident with a driver who has no insurance or insufficient insurance to cover your damages.

- New Car Specific Coverages (Highly Recommended):

- New Car Replacement: As detailed above, replaces your totaled new car with a brand new one.

- Gap Insurance: Covers the loan/lease gap if your new car is totaled.

- OEM Parts Coverage: Ensures genuine manufacturer parts are used for repairs.

- Rental Car Reimbursement: Covers the cost of a rental car while your vehicle is being repaired after a covered claim.

- Roadside Assistance: Provides help for flat tires, dead batteries, lockouts, and towing.

How to Get the Best Price for Brand New Car Insurance

Finding affordable insurance for your new car doesn’t mean compromising on coverage. Strategic planning and smart shopping can lead to significant savings.

- Shop Around Extensively: This is the golden rule. Obtain quotes from at least 3-5 different insurance providers – national carriers, regional companies, and even local brokers. Prices can vary by hundreds or even thousands of dollars for the exact same coverage.

- Bundle Policies: Most insurers offer discounts if you bundle your auto insurance with other policies, such as homeowners, renters, or life insurance.

- Increase Your Deductibles: If you have a healthy emergency fund, consider opting for higher deductibles (e.g., $1,000 or $2,500) for collision and comprehensive coverage. This will lower your premium, but ensure you can comfortably cover the deductible if you need to file a claim.

- Inquire About Discounts: Don’t assume discounts will be automatically applied. Ask your agent about every possible discount:

- Good Driver/Accident-Free: For maintaining a clean record.

- Good Student: For young drivers with good academic performance.

- Multi-Car: For insuring multiple vehicles on one policy.

- Low Mileage: For drivers who don’t drive much.

- Anti-Theft Devices: For factory-installed or aftermarket security systems.

- Defensive Driving Course: For completing an approved safety course.

- Professional/Affinity Group: For members of certain organizations or professions.

- Pay-in-Full/Automatic Payment: For paying your premium annually or setting up automatic deductions.

- Choose Your Car Wisely: Before purchasing, research the insurance costs associated with different makes and models. Some vehicles are inherently more expensive to insure due to their performance, theft rates, or repair costs.

- Maintain a Good Driving Record: This cannot be stressed enough. A clean record is your most powerful tool for lower premiums over time.

- Improve Your Credit Score: If credit-based insurance scores are used in your state, a higher credit score can lead to lower rates.

- Review Your Policy Annually: Your insurance needs and the market can change. Review your policy at least once a year to ensure you still have the best coverage for the best price.

Potential Challenges and Solutions

Insuring a new car can present a few challenges, but each has a viable solution.

- Challenge: High Initial Cost of Premiums.

- Solution: Leverage discounts, compare quotes extensively, and consider slightly higher deductibles if financially feasible.

- Challenge: Rapid Depreciation Leading to Being "Upside Down" on a Loan.

- Solution: Purchase Gap Insurance. This is the primary safeguard against owing more than your car is worth if it’s totaled.

- Challenge: Complexity of Coverage Options.

- Solution: Work with a knowledgeable insurance agent who can explain each coverage type in detail and tailor a policy to your specific needs. Don’t be afraid to ask questions.

- Challenge: Understanding the Claims Process.

- Solution: Familiarize yourself with your policy’s claims procedures beforehand. Keep all necessary documents (policy number, contact info) readily accessible. In the event of an accident, document everything thoroughly (photos, witness info).

Sample Price Range Table Illustrating Impact of Variables

It’s impossible to provide exact brand new car insurance prices as they vary wildly based on individual factors. However, this table illustrates hypothetical annual premium ranges to demonstrate how different car types and driver profiles can influence costs.

| Car Type (Example) | Driver Profile (Example) | Estimated Annual Premium Range | Key Influencing Factors |

| :—————– | :———————– | :—————————– | :————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————————-“`html

<!DOCTYPE html>

Brand New Car Insurance Price: Your Comprehensive Guide to Protecting Your Latest Investment

The thrill of driving a brand new car off the lot is unparalleled – the pristine paint, the new car smell, the latest technology at your fingertips. But before you hit the open road, there’s a crucial step that often gets overlooked in the excitement: securing the right insurance. Understanding “Brand New Car Insurance Price” is not just about finding the cheapest premium; it’s about safeguarding a significant investment and ensuring peace of mind against unforeseen circumstances.

Unlike insuring a used vehicle, a brand new car comes with unique considerations that can significantly impact its insurance cost and the types of coverage you absolutely need. This comprehensive guide will delve into what influences these prices, the essential coverages, how to secure the best rates, and address common queries, empowering you to make an informed decision for your prized possession.

Understanding the Unique Aspects of Insuring a Brand New Car

Insuring a brand new vehicle differs substantially from covering a pre-owned one, primarily due to its higher initial value, susceptibility to rapid depreciation, and often, more advanced technology. These factors dictate not only the premium but also the specific types of coverage that become indispensable.

- Higher Initial Value: A new car, by definition, has a higher market value than a comparable used one. This directly translates to higher potential payout costs for insurers in the event of a total loss or significant damage, thus driving up premiums.

- Rapid Depreciation: New cars begin to depreciate the moment they leave the dealership. This “new car smell” depreciation can be a significant concern if the car is totaled shortly after purchase, as its actual cash value (ACV) might be less than what you owe on your loan or lease.

- Advanced Technology & Repair Costs: Modern new cars are packed with sophisticated