Car Brands With Lowest Insurance: A Comprehensive Guide to Saving on Your Auto Policy

Car Brands With Lowest Insurance: A Comprehensive Guide to Saving on Your Auto Policy cars.truckstrend.com

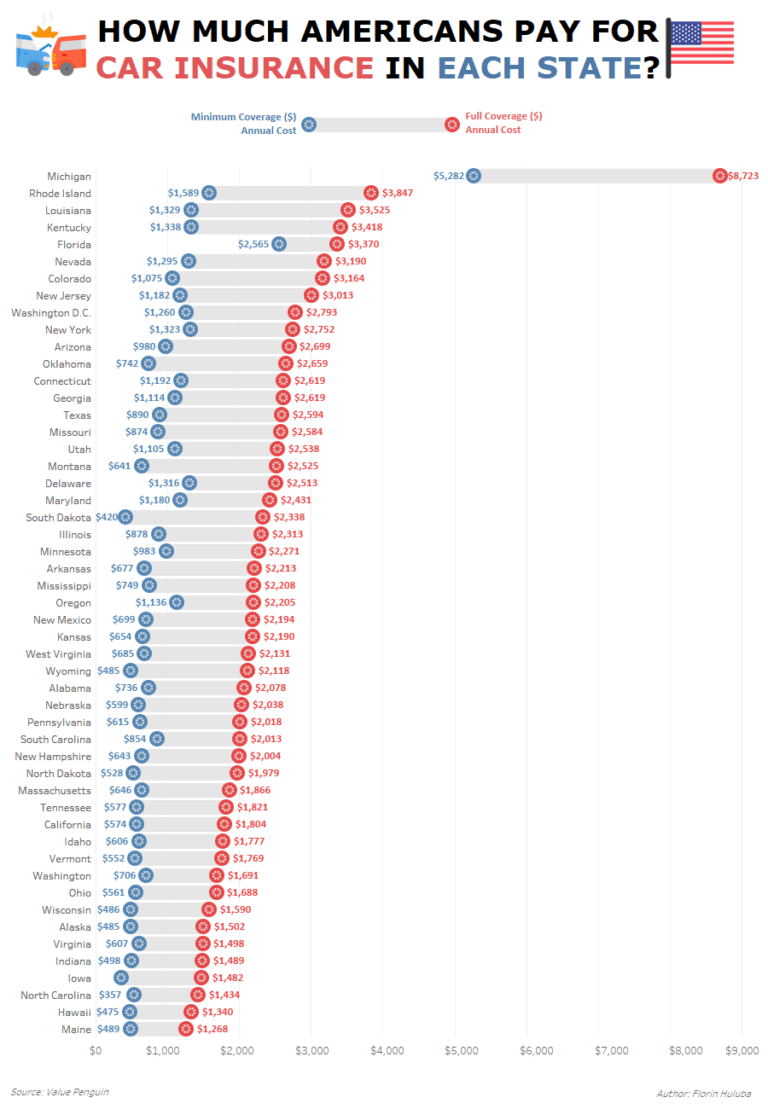

Buying a car is a significant investment, but the initial purchase price is only one part of the equation. A crucial ongoing expense that often surprises new car owners is auto insurance. Premiums can vary wildly depending on a multitude of factors, and one of the most impactful is the car brand and specific model you choose. Understanding which car brands generally command lower insurance rates can lead to substantial long-term savings, making your dream car more affordable to own and operate.

This comprehensive guide delves into the world of auto insurance, exploring why certain car brands are cheaper to insure, highlighting specific brands known for lower premiums, and offering practical advice on how to secure the most affordable policy for your vehicle.

Car Brands With Lowest Insurance: A Comprehensive Guide to Saving on Your Auto Policy

Understanding Insurance Cost Factors: Why Some Brands Are Cheaper to Insure

Insurance companies are in the business of assessing risk. The lower the perceived risk associated with a particular vehicle, the lower your premium is likely to be. Several key factors influence how an insurer calculates the risk profile of a car brand and model:

- Vehicle Safety Ratings: This is paramount. Cars with excellent crash test results (e.g., from the IIHS Top Safety Pick+ list or NHTSA 5-star ratings) and advanced safety features (ADAS like automatic emergency braking, lane-keeping assist, blind-spot monitoring) are less likely to be involved in accidents or cause severe injuries, thus reducing potential payout costs for the insurer. Brands that consistently prioritize safety tend to have lower premiums.

- Repair Costs & Parts Availability: If a car is expensive to fix after an accident, its insurance will be higher. This is influenced by the cost of parts (e.g., specialized components for luxury or high-performance vehicles), the complexity of repairs, and the availability of parts. Domestic and widely popular import brands often have more affordable and readily available parts, leading to lower repair costs.

- Theft Rates: Cars that are frequently stolen are riskier to insure. Insurers track theft data closely. Vehicles that are less desirable to thieves or equipped with robust anti-theft systems (like engine immobilizers) typically enjoy lower comprehensive coverage premiums.

- Engine Size & Performance: High-performance vehicles with powerful engines are often driven more aggressively and are statistically more likely to be involved in high-speed accidents. Insurers view these cars as higher risk, leading to elevated premiums. Economy cars or models with smaller engines generally cost less to insure.

- Vehicle Type: Sedans and smaller SUVs are often cheaper to insure than sports cars, luxury vehicles, or large trucks. The utility and typical usage patterns associated with certain vehicle types play a role.

- Demographics of Typical Buyer: While not a direct factor tied to the car itself, insurers often have data on the typical demographics of buyers for certain car brands. For example, brands often associated with mature, responsible drivers with clean records might see slightly lower rates across the board.

- Depreciation and Resale Value: A car that holds its value well might seem like it would be more expensive to insure, but it can sometimes indicate reliability and lower overall risk for the insurer in terms of potential total loss payouts.

Top Car Brands Generally Known for Lower Insurance Premiums

Based on the factors above, certain car brands consistently appear on lists for having lower average insurance premiums. It’s crucial to remember that specific models within these brands can vary, but these brands generally offer a good starting point for budget-conscious buyers.

- Subaru: Renowned for their symmetrical All-Wheel Drive (AWD) system and excellent safety ratings, Subaru vehicles often boast strong crash test performance. Their typical buyer demographic tends to be mature and safety-conscious, and theft rates are generally lower than many other brands. Models like the Forester, Outback, and Impreza are often cited for affordable insurance.

- Toyota: A perennial leader in reliability, Toyota vehicles are known for their low repair costs and widely available parts. They consistently earn high safety ratings and many models, like the Corolla and Camry, are driven by a broad, generally responsible demographic. Lower theft rates for many popular models also contribute to reduced premiums.

- Honda: Similar to Toyota, Honda offers a strong blend of reliability, safety, and reasonable repair costs. Their popular models like the Civic, CR-V, and Accord are family-friendly and appeal to a wide range of drivers, often leading to competitive insurance rates.

- Hyundai/Kia: These South Korean brands have made significant strides in safety and reliability over the past decade. With excellent warranties, improving crash test results, and a focus on value, their parts are often competitively priced. Models like the Elantra, Kona, and Seltos often present good insurance value.

- Mazda: While known for their "zoom-zoom" driving dynamics, Mazda vehicles also boast impressive safety ratings and are often overlooked by thieves compared to more popular brands. Their focus on driver engagement doesn’t always translate to excessive power, keeping insurance rates reasonable for models like the Mazda3 and CX-5.

- Volkswagen: Known for solid German engineering and good build quality, Volkswagen models like the Jetta and Tiguan often perform well in safety tests. Their parts availability in North America is good, contributing to manageable repair costs.

- Chevrolet (Certain Models): While Chevy offers a wide range of vehicles, some of their more economical sedans and smaller SUVs (e.g., Malibu, Equinox) can be quite affordable to insure due to widespread parts availability, simpler repair processes, and their appeal to a broad consumer base.

How to Find the Lowest Insurance for YOUR Car: Practical Advice

While choosing a brand known for lower insurance is a great start, your individual premium will depend on many personal factors. Here’s how to actively seek out the lowest rates:

- Get Multiple Quotes: This is the golden rule. Insurance companies use different algorithms and have varying appetites for risk. What’s expensive with one insurer might be affordable with another. Compare quotes from at least 3-5 different providers.

- Bundle Policies: If you have homeowner’s or renter’s insurance, bundling it with your auto policy through the same provider can often lead to significant discounts.

- Increase Your Deductible: A higher deductible (the amount you pay out-of-pocket before insurance kicks in) will lower your monthly premium. Just ensure you can comfortably afford your chosen deductible in case of an accident.

- Look for Discounts: Ask about every possible discount: good driver, good student, low mileage, anti-theft devices, multi-car, professional affiliations, defensive driving courses, and more.

- Maintain a Clean Driving Record: Accidents and traffic violations will significantly increase your premiums. Drive safely and responsibly.

- Improve Your Credit Score: In many states, your credit score is a factor in determining insurance premiums. A higher score often indicates greater financial responsibility, which insurers appreciate.

- Consider Telematics/Usage-Based Insurance: Many insurers offer programs that track your driving habits (speed, braking, mileage) via an app or device. Safe drivers can earn significant discounts.

- Choose the Right Coverage Levels: Understand what coverage you need. While state minimums are required, they often don’t provide enough protection. However, overly comprehensive coverage for an older, low-value car might not be cost-effective.

- Research Before You Buy: Before committing to a car, get insurance quotes for specific models you’re considering. This foresight can save you hundreds, if not thousands, over the years.

Important Considerations Beyond Brand

While the car brand and model are crucial, remember that your personal profile and choices also heavily influence your premium:

- Driver Profile: Your age, gender, location (urban vs. rural), driving history (accidents, tickets), and credit score (in most states) all play a significant role.

- Coverage Levels: The amount of liability, comprehensive, and collision coverage you choose will directly impact your premium.

- Insurance Provider: As mentioned, different companies have different pricing structures.

- Usage: How much you drive (annual mileage) and for what purpose (commuting, pleasure, business) can also affect rates.

Table: Illustrative Factors for Lower Insurance Premiums by Car Brand

Note: This table provides qualitative insights into why certain brands/models tend to have lower insurance costs. Actual prices vary greatly based on individual circumstances, location, and specific vehicle trim.

| Car Brand/Model Example | Key Factors for Low Insurance | Typical Driver Profile (General) | Why It’s Cheaper (General Reasons) |

|---|---|---|---|

| Toyota Corolla/Camry | Excellent Safety Ratings, Low Repair Costs, High Reliability, Low Theft Rates, Accessible Parts | Commuters, Families, Budget-Conscious | Proven reliability means fewer claims; widely available parts keep repair costs down; low appeal to thieves. |

| Honda Civic/CR-V | Strong Safety Ratings, Reliable, Moderate Repair Costs, Good Resale Value | Young Professionals, Families, Commuters | Good balance of safety and cost-effectiveness; parts readily available; broad appeal means stable risk profile. |

| Subaru Forester/Outback | Top Safety Pick+, Symmetrical AWD (less prone to certain accidents), Lower Theft Rates, Stable Buyer Demographics | Outdoors Enthusiasts, Families, Safety-Conscious | Exceptional safety features reduce injury/damage claims; perceived as less "flashy" for thieves; responsible owners. |

| Hyundai Elantra/Kona | Good Safety Features, Excellent Warranty (indicates reliability), Competitive Parts Pricing, Modern Tech | Value Seekers, First-Time Buyers, Urban Drivers | Improved safety tech reduces accident severity; competitive parts market for repairs; appealing for budget-conscious. |

| Mazda3/CX-5 | High Safety Ratings, Good Reliability, Lower Theft Rates, Not High-Performance Focused | Drivers Seeking Value & Engagement, Smaller Families | Strong safety performance; often overlooked by thieves compared to more common targets; balanced performance. |

| Volkswagen Jetta/Tiguan | Solid Build Quality, Good Safety Scores, Accessible Parts, Generally Not High-Performance | Commuters, Small Families, Value-Oriented | Reputable engineering contributes to safety; parts are readily available within the VW network; not seen as "high risk." |

| Chevrolet Malibu/Equinox | Widespread Parts Availability, Simpler Repair Processes, Common Vehicle Type | General Commuters, Families, Domestic Brand Loyalty | Extensive parts network reduces repair costs; broad appeal means a diverse and often lower-risk driver base. |

Concluding Summary

Choosing a car brand with a reputation for lower insurance costs is a smart financial move that can significantly impact your total cost of car ownership. Brands like Toyota, Honda, Subaru, Hyundai, Kia, Mazda, and certain Chevrolet and Volkswagen models consistently offer better insurance value due to their emphasis on safety, reliability, affordable repair costs, and lower theft rates. However, remember that your personal driving history, chosen coverage, and the specific model and trim level will also heavily influence your final premium. Always get multiple quotes before purchasing a vehicle to ensure you’re getting the best possible rate.

Frequently Asked Questions (FAQ)

Q1: Is it always cheaper to insure an older car?

A1: Not necessarily. While the comprehensive and collision portions of an older car’s policy might be cheaper (due to lower vehicle value), parts for very old cars can be hard to find and expensive. Additionally, older cars often lack modern safety features, which can increase the risk of injury and property damage, potentially raising liability costs.

Q2: Does car color affect insurance premiums?

A2: No, car color has no direct impact on insurance premiums. This is a common myth. Insurers care about the make, model, year, engine size, safety features, and the car’s claims history, not its paint job.

Q3: Do electric cars (EVs) have lower insurance premiums?

A3: Generally, electric cars can sometimes have higher insurance premiums than comparable gasoline cars. This is often due to higher purchase prices, specialized and potentially expensive battery repairs, and a lack of long-term claims data for newer EV models. However, some insurers offer discounts for EVs due to their lower environmental impact or advanced safety features.

Q4: How much can advanced safety features lower my premium?

A4: Advanced Driver-Assistance Systems (ADAS) like automatic emergency braking, lane-keeping assist, adaptive cruise control, and blind-spot monitoring can significantly reduce the likelihood and severity of accidents. While the exact discount varies by insurer, these features can lead to savings of 5% to 20% or more on certain coverages.

Q5: Can I get an insurance quote before I buy a car?

A5: Absolutely, and it’s highly recommended! You can get quotes for specific makes, models, and years of vehicles you’re considering. This allows you to factor in potential insurance costs when making your purchasing decision, preventing any unpleasant surprises.