Best Brand To Lease A Car: Your Ultimate Guide to Smart Vehicle Choices

Best Brand To Lease A Car: Your Ultimate Guide to Smart Vehicle Choices cars.truckstrend.com

In today’s dynamic automotive market, leasing a car has become an increasingly popular alternative to outright purchase. It offers flexibility, lower monthly payments, and the perennial joy of driving a new vehicle every few years. But with a myriad of manufacturers vying for your attention, the crucial question arises: what is the best brand to lease a car?

This comprehensive guide will delve into the nuances of car leasing, dissecting the factors that make certain brands shine in the leasing landscape, and equipping you with the knowledge to make an informed decision tailored to your needs and lifestyle. Choosing the best brand to lease a car isn’t about finding a universally superior option, but rather identifying the brand that aligns perfectly with your priorities, whether they be luxury, reliability, cutting-edge technology, or pure value.

Best Brand To Lease A Car: Your Ultimate Guide to Smart Vehicle Choices

Why Brand Matters in Car Leasing

When you lease a car, you’re essentially paying for the depreciation of the vehicle during the lease term, plus interest and fees. This fundamental concept makes a brand’s residual value – its projected worth at the end of the lease – a paramount factor. Brands known for holding their value well often translate into lower monthly lease payments because the difference between the initial MSRP and the residual value is smaller.

Beyond residual value, the best brand to lease a car will also offer competitive money factors (the equivalent of an interest rate), attractive incentives, and a diverse range of models that appeal to various market segments. Manufacturers with strong financial services arms often have more flexibility in structuring appealing lease deals. Therefore, understanding a brand’s reputation for reliability, customer service, and its approach to leasing is crucial.

Top Brands for Leasing: A Detailed Breakdown

Let’s explore some of the top contenders for the best brand to lease a car, categorized by their primary strengths:

1. Luxury & Performance: BMW, Mercedes-Benz, Audi, Lexus

- Why they excel: These brands consistently top lists for luxury car leases due to strong residual values, attractive lease programs often subsidized by the manufacturers, and the desire of consumers to experience premium features and performance without the long-term commitment of ownership. Their vehicles are packed with advanced technology, luxurious interiors, and powerful engines, making them ideal for those who prioritize driving experience and status.

- Benefits: Access to cutting-edge technology, superior comfort and performance, excellent dealer support, and often bundled maintenance packages. High residual values mean competitive monthly payments for a premium vehicle.

- Considerations: While monthly payments might be lower than financing, the overall cost over the lease term is still substantial. Excess mileage and wear-and-tear penalties can be costly.

2. Reliability & Value: Honda, Toyota, Subaru

- Why they excel: Renowned for their bulletproof reliability and strong resale values, Honda and Toyota consistently rank high for lease desirability. Their vehicles depreciate slowly, which directly translates to lower lease payments. Subaru also offers excellent residual values, particularly on its AWD models, appealing to those in diverse climates.

- Benefits: Low maintenance costs, excellent fuel efficiency (especially with hybrid options), practical designs, and a reputation for trouble-free ownership. Their leases are often straightforward with fewer hidden complexities.

- Considerations: While reliable, they might not offer the same level of luxury or cutting-edge performance as premium brands. Lease incentives might not be as aggressive as brands looking to boost market share.

3. Technology & Innovation: Tesla, Hyundai, Kia

- Why they excel: Tesla dominates the EV market and, despite high MSRPs, can offer competitive lease rates due to strong demand and high residual values for its electric vehicles. Hyundai and Kia have made remarkable strides in recent years, offering stylish designs, advanced tech features (including strong EV and hybrid lineups), and impressive warranties. Their aggressive push into new segments often comes with attractive lease incentives to gain market share.

- Benefits: Access to the latest automotive technology, excellent infotainment systems, and a growing range of efficient electric and hybrid vehicles. Often more features for the money compared to some legacy brands.

- Considerations: Tesla’s lease terms can be rigid (e.g., no purchase option at the end of the lease for some models). The long-term residual value of rapidly evolving EV technology can be a slight unknown, though currently strong.

4. American Mainstays: Ford, Chevrolet, Ram

- Why they excel: These brands offer a vast range of vehicles, from popular SUVs and crossovers (Explorer, Equinox) to the best-selling trucks (F-150, Silverado, Ram 1500). They often have significant manufacturer incentives and rebates, especially on trucks and less popular models, which can drastically lower lease payments. Their robust dealer networks make service and support widely accessible.

- Benefits: Diverse vehicle options, strong incentives, and the ability to customize leases for specific needs (e.g., higher mileage allowances for truck users).

- Considerations: Residual values can be more volatile than Japanese counterparts, and some models may not hold their value as well, requiring more aggressive incentives to make leases appealing.

5. Budget-Friendly Options: Nissan, Mazda, Volkswagen

- Why they excel: These brands often present compelling lease deals, providing a balance of features, style, and affordability. Mazda, in particular, is lauded for its driving dynamics and premium-feeling interiors, often at a non-premium price point. Volkswagen offers European styling and engineering at competitive prices. Nissan frequently has aggressive lease offers to move inventory.

- Benefits: Lower entry costs, attractive monthly payments, and a good balance of features for the price. Ideal for those seeking a new car experience without breaking the bank.

- Considerations: While good value, their residual values might not be as strong as Honda or Toyota, meaning the attractiveness of the lease deal is often tied to manufacturer incentives rather than inherent vehicle value retention.

Factors Influencing Lease Deals (Beyond Brand)

While the best brand to lease a car is a crucial starting point, several other factors significantly impact your final lease payment:

- Residual Value: The estimated value of the car at the end of the lease term. A higher residual value means you’re paying for less depreciation, resulting in lower monthly payments.

- Money Factor (Interest Rate): This is the financing charge on a lease, expressed as a decimal. A lower money factor means less interest paid over the lease term.

- MSRP (Capitalized Cost): The sticker price of the car. Just like buying, you can negotiate the capitalized cost down, which directly reduces your monthly payment.

- Incentives & Rebates: Manufacturers often offer special lease cash, low money factors, or other promotions that can significantly reduce your monthly payment.

- Credit Score: A strong credit score (typically 700+) is essential to qualify for the best money factors and lease terms.

- Lease Term & Mileage Allowance: Shorter terms (24-36 months) often have higher residual values. Lower mileage allowances (e.g., 10,000 miles/year) also lead to lower payments, but exceeding them can be costly.

How to Choose the Best Brand for YOU

Finding the best brand to lease a car is a personal journey. Here’s a practical guide:

-

Assess Your Needs & Budget:

- Budget: What’s your comfortable monthly payment range? How much are you willing to put down?

- Lifestyle: Do you need space for a family, or is a compact sedan sufficient? Do you commute long distances or mostly drive in the city?

- Driving Habits: Be realistic about your annual mileage. Overages are expensive.

- Priorities: Is luxury, fuel efficiency, technology, or reliability most important to you?

-

Research Residual Values: Look up current and historical residual values for models you’re considering. Websites like Edmunds or ALG (Automotive Lease Guide) can provide insights.

-

Compare Manufacturer Incentives: Visit manufacturer websites and dealer sites to see current lease specials. These change monthly, so timing is key.

-

Test Drive Multiple Brands & Models: Don’t just look at numbers. Get behind the wheel. How does the car feel? Is the technology intuitive? Does it meet your comfort and driving style expectations?

-

Read Reviews & Consult Experts: Check reputable automotive review sites (e.g., Kelley Blue Book, Consumer Reports, MotorTrend) for long-term reliability and owner satisfaction reports.

Potential Challenges & Solutions

While leasing offers many advantages, be aware of potential pitfalls:

- Mileage Overages: Exceeding your contracted mileage can result in significant per-mile charges (e.g., $0.15-$0.30 per mile).

- Solution: Be realistic about your driving habits from the outset and negotiate a higher mileage allowance if needed, even if it slightly increases your monthly payment.

- Excessive Wear & Tear: Dings, dents, scratches, and tire wear beyond "normal" can incur penalties.

- Solution: Understand the lease agreement’s definition of "normal wear and tear." Consider purchasing an optional "wear and tear waiver" if available, though this adds to the cost. Keep the car well-maintained.

- Early Termination Fees: Getting out of a lease early can be very expensive, often requiring you to pay most of the remaining payments and penalties.

- Solution: Only lease if you’re confident you’ll keep the car for the full term. Explore lease transfer services if circumstances change, but be aware of associated fees.

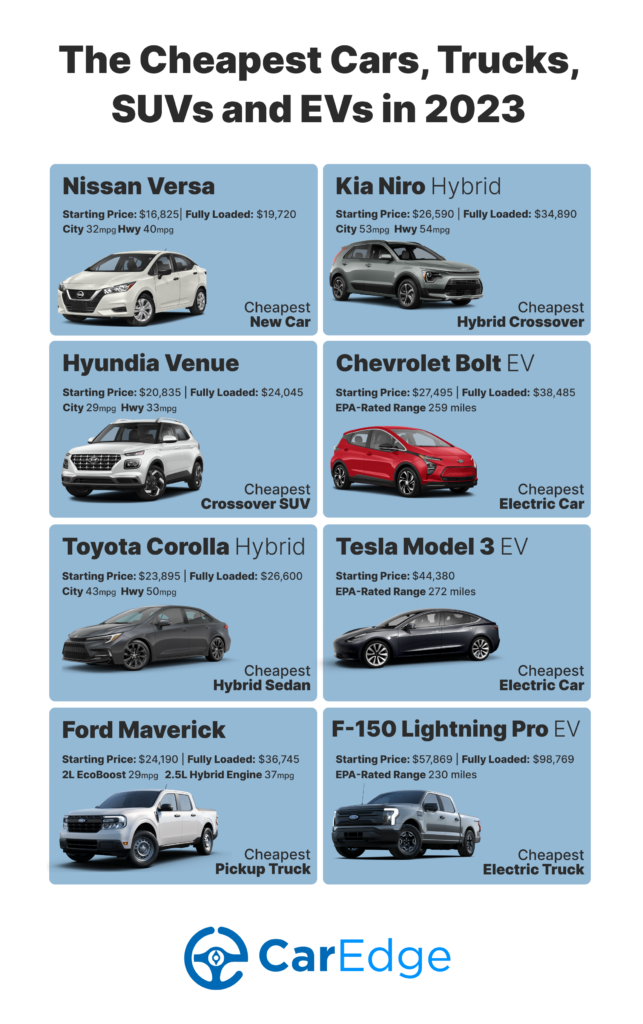

Sample Lease Cost Expectations by Brand Type

Please note: These figures are estimates for common models within each category, based on a 36-month lease with 10,000-12,000 miles/year, excellent credit, and typical down payments. Actual prices vary significantly based on trim, options, current incentives, location, and individual creditworthiness.

| Brand Type & Example Model | Typical MSRP Range | Typical Down Payment | Estimated Monthly Payment Range | Key Leasing Advantage |

|---|---|---|---|---|

| Luxury (BMW 3 Series) | $45,000 – $60,000 | $2,500 – $4,500 | $550 – $800 | High Residuals, Premium Experience |

| Reliable Value (Honda CR-V) | $30,000 – $40,000 | $1,500 – $3,000 | $350 – $500 | Strong Residuals, Low Depreciation |

| Tech/EV (Tesla Model 3) | $40,000 – $55,000 | $3,000 – $5,000 | $450 – $700 | Strong Demand, EV Tech |

| American Mainstay (Ford F-150) | $45,000 – $65,000 | $2,000 – $4,000 | $500 – $750 | Aggressive Incentives, Versatility |

| Budget-Friendly (Mazda CX-5) | $28,000 – $38,000 | $1,000 – $2,500 | $300 – $450 | Competitive Pricing, Value |

Note: "Typical Down Payment" often includes the first month’s payment, security deposit, and acquisition fees.

Frequently Asked Questions (FAQ)

Q1: Is leasing better than buying?

A: It depends on your situation. Leasing is often better if you like driving a new car every few years, have lower annual mileage, want lower monthly payments, and don’t want the hassle of selling a used car. Buying is better if you drive a lot, want to own the car long-term, customize it, or pay it off and have no monthly payments.

Q2: What’s a good credit score for leasing?

A: Generally, a FICO score of 700 or higher is considered excellent and will qualify you for the best money factors (interest rates) on a lease. Scores below 650 may result in higher rates or denial.

Q3: Can I negotiate a lease price?

A: Yes! You can negotiate the capitalized cost (the selling price of the car) and the trade-in value (if applicable). You can also inquire about the money factor and try to negotiate it, although it’s often set by the manufacturer. Always aim to get the best "out-the-door" price before talking about lease specifics.

Q4: What happens at the end of a lease?

A: At the end of your lease, you typically have three options:

- Return the vehicle: You turn the car in, pay any excess mileage or wear-and-tear charges, and walk away.

- Buy the vehicle: You can purchase the car for its residual value (plus any purchase option fees).

- Lease a new vehicle: You can use the returning vehicle as a stepping stone to a new lease, potentially rolling over any remaining equity (or negative equity) into the new deal.

Q5: Can I lease a used car?

A: While less common, some dealerships or third-party companies offer used car leases, particularly for certified pre-owned (CPO) vehicles. However, new car leases typically offer the best rates and terms due to manufacturer incentives and predictable depreciation.

Concluding Summary

Identifying the best brand to lease a car isn’t about finding a single, universally superior option, but rather a strategic alignment of your personal needs with a brand’s strengths. Whether you prioritize the luxury and performance of a BMW, the unwavering reliability of a Toyota, the cutting-edge technology of a Tesla, or the robust versatility of a Ford, there’s a brand and a lease deal out there for you.

By understanding the key factors that influence lease payments—residual value, money factor, incentives, and your credit score—and by diligently researching, test-driving, and negotiating, you can navigate the leasing landscape with confidence. The ultimate best brand to lease a car is the one that offers you the most value, fits your budget, and brings you joy behind the wheel for the duration of your lease term. Happy leasing!