Best Way To Buy A Brand New Car: Your Ultimate Guide to a Smart Purchase

Best Way To Buy A Brand New Car: Your Ultimate Guide to a Smart Purchase cars.truckstrend.com

Buying a brand new car is often a thrilling milestone, a significant financial commitment, and for many, a dream come true. However, the path from desire to driveway can be fraught with potential pitfalls, from overpaying to succumbing to high-pressure sales tactics. The "best way to buy a brand new car" isn’t about finding a secret discount code; it’s about adopting a strategic, informed, and patient approach that empowers you to make a wise decision, secure the best possible deal, and drive away feeling confident, not regretful. This comprehensive guide will equip you with the knowledge and actionable insights to navigate the new car buying journey successfully.

Laying the Groundwork: Research, Needs Assessment, and Budgeting

Best Way To Buy A Brand New Car: Your Ultimate Guide to a Smart Purchase

Before you even set foot on a dealership lot, the most crucial work begins at home. This preparatory phase dictates much of your success and satisfaction.

1. Define Your Needs, Not Just Your Wants:

While that sleek sports car might catch your eye, does it truly align with your lifestyle? Consider:

- Purpose: Commuting, family transport, off-roading, cargo hauling?

- Passengers: How many people will you regularly carry?

- Cargo: Do you need space for groceries, sports equipment, or work tools?

- Fuel Efficiency: How much driving do you do, and what are gas prices like in your area?

- Climate: Do you need all-wheel drive for snow or a powerful AC for hot summers?

- Parking: Do you have tight parking spaces or a garage?

2. Thorough Vehicle Research:

Once you have a clearer idea of your needs, dive into research. Utilize reputable sources:

- Automotive Review Sites: Edmunds, Kelley Blue Book (KBB), Consumer Reports, Car and Driver, MotorTrend offer in-depth reviews, comparisons, and ownership costs.

- Safety Ratings: Check ratings from the National Highway Traffic Safety Administration (NHTSA) and the Insurance Institute for Highway Safety (IIHS).

- Reliability Data: J.D. Power, Consumer Reports, and various forums can provide insights into a vehicle’s long-term reliability and common issues.

- Resale Value: KBB and Edmunds also provide future resale value estimates, which impact your total cost of ownership.

3. Master Your Budget – Beyond the Sticker Price:

This is perhaps the most critical step. A new car’s cost extends far beyond its initial purchase price.

- Upfront Costs:

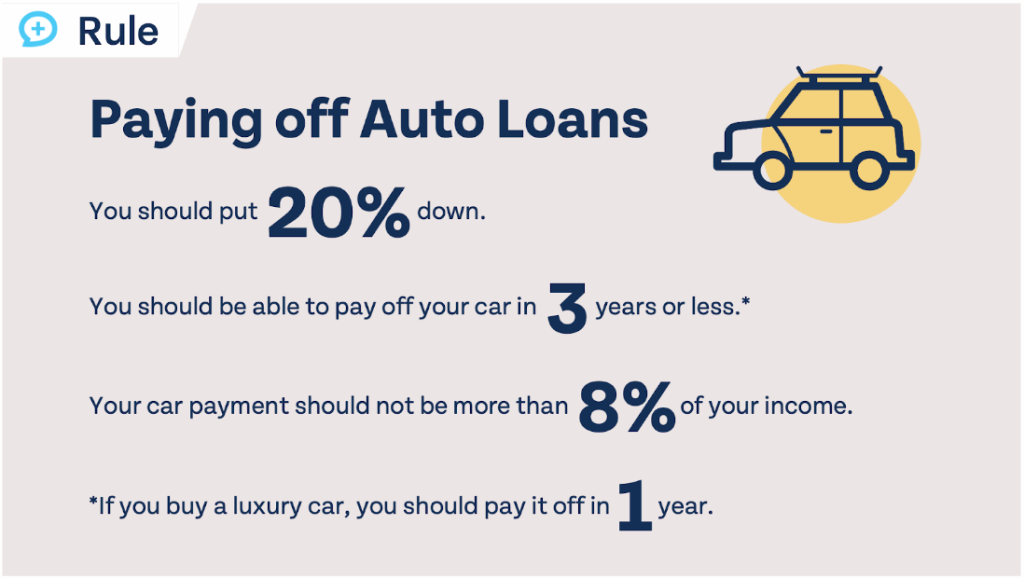

- Down Payment: A larger down payment reduces your loan amount and interest paid. Aim for at least 10-20% if financing.

- Sales Tax: Varies by state.

- Registration and Licensing Fees: State-specific.

- Dealer Fees: "Documentation fees" or "doc fees" are common but can vary wildly.

- Ongoing Costs:

- Monthly Loan/Lease Payment: The most obvious recurring cost.

- Car Insurance: Get quotes before you buy, as premiums vary significantly by vehicle model, your driving history, and location.

- Fuel: Estimate your annual fuel cost based on mileage and fuel type.

- Maintenance: Newer cars have less immediate maintenance, but factor in regular servicing.

- Repairs: While covered by warranty initially, consider long-term reliability.

- Affordability Rule of Thumb: Many financial experts suggest the "20/4/10 rule" – put down at least 20%, finance for no more than 4 years (48 months), and ensure your total monthly car expenses (payment, insurance, fuel) don’t exceed 10% of your gross monthly income. Adjust this based on your personal financial situation.

- Know Your Credit Score: Your credit score profoundly impacts the interest rate you’ll qualify for on a loan. Obtain your free credit report well in advance to identify any errors and understand your standing.

Navigating the Numbers: Financing Options

How you pay for your new car is as important as what car you choose. You generally have three main options: cash, a loan, or a lease.

1. Paying with Cash:

- Pros: No interest payments, immediate ownership, no monthly car payments (aside from insurance, fuel, etc.), and the ability to sell the car whenever you wish without a lien.

- Cons: Ties up a large sum of liquid capital that could be invested elsewhere or used for emergencies.

2. Traditional Car Loan (Financing):

This is the most common method.

- Getting Pre-Approved: Crucially, secure loan pre-approval from banks, credit unions, or online lenders before you visit the dealership. This gives you a concrete interest rate and empowers you to negotiate with the dealer from a position of strength, knowing your financing options. It also separates the car price negotiation from the financing negotiation.

- Interest Rates and Terms: Higher credit scores lead to lower interest rates. Longer loan terms (e.g., 72 or 84 months) mean lower monthly payments but significantly more interest paid over the life of the loan. Aim for the shortest term you can comfortably afford.

- Pros: Eventual ownership, freedom to drive unlimited miles, build equity.

- Cons: You pay interest, depreciation hits hardest in the first few years, and you’re responsible for maintenance beyond the warranty.

3. Leasing a New Car:

Leasing is essentially long-term renting.

- How it Works: You pay for the depreciation of the car during the lease term (typically 2-4 years) plus a finance charge. You never own the car unless you decide to buy it at the end of the lease for its residual value.

- Pros: Lower monthly payments than buying, you drive a new car every few years, most maintenance is covered by the warranty, and you avoid trade-in hassles.

- Cons: No ownership equity, mileage limits (excess mileage fees apply), wear and tear charges, perpetual car payments, and no customization.

- Consider Leasing If: You like driving new cars often, have a predictable commute (within mileage limits), and prefer lower monthly payments.

Mastering the Deal: Negotiation and Purchase Strategy

This is where many buyers feel most vulnerable. Preparation and a clear strategy are your best defenses.

1. Timing is Everything (Sometimes):

- End of the Month/Quarter/Year: Salespeople and dealerships often have quotas to meet, making them more eager to close deals.

- New Model Year Releases: As new models arrive, dealers want to clear out the previous year’s inventory, often leading to discounts.

- Holidays: Certain holidays (e.g., Memorial Day, Labor Day, Black Friday) can offer promotions.

2. Shop Multiple Dealerships:

Don’t settle for the first dealership. Get quotes from at least three different dealers, ideally online or via email, to compare prices for the exact same vehicle (trim, options, color). This fosters competition.

3. The Art of Negotiation – Focus on the Out-the-Door Price:

- Invoice Price vs. MSRP: MSRP (Manufacturer’s Suggested Retail Price) is the sticker price. Invoice price is what the dealer paid for the car (though dealers often have holdbacks and incentives not reflected on the invoice). Aim to negotiate slightly above invoice. Websites like Edmunds and KBB can provide invoice estimates.

- Negotiate the Total Price, Not the Monthly Payment: Salespeople often try to anchor you on a monthly payment, which allows them to manipulate the interest rate, loan term, or hidden fees. Always negotiate the total "out-the-door" price, which includes the vehicle price, taxes, and all fees.

- Separate Your Trade-In: If you have a trade-in, keep it out of the negotiation until you’ve agreed on the price of the new car. Otherwise, the dealer can play shell games, giving you a good trade-in value but inflating the new car price, or vice-versa. Consider selling your old car privately for a better return.

- Say No to Unnecessary Add-Ons: Dealers will push extras like extended warranties, paint protection, rust proofing, fabric protection, and VIN etching. These are often high-profit items for the dealer and can be significantly overpriced. Decline them unless you’ve thoroughly researched their value and decided they’re worth it. If you want an extended warranty, research third-party providers or negotiate it separately.

- Be Prepared to Walk Away: This is your ultimate power. If the deal isn’t right, or you feel pressured, politely leave. A good deal will often follow you out the door.

4. The Test Drive – Don’t Rush It:

Test drive the specific trim and engine you intend to buy. Drive it on various roads (city, highway, bumps, turns). Check visibility, comfort, technology features, and how it handles. Bring family members if they’ll be regular passengers.

5. Review the Paperwork Meticulously:

Before signing anything, read every line of the contract. Ensure the agreed-upon price, interest rate, fees, and trade-in value (if applicable) are accurately reflected. Question anything you don’t understand. Don’t be rushed.

Beyond the Lot: Protecting Your Investment

Your purchase isn’t complete until you’ve taken steps to protect your new asset.

- Insurance: Have your insurance policy ready before you drive off the lot. Ensure you have adequate coverage, including collision and comprehensive.

- Gap Insurance: If you’re financing and put down less than 20%, or if you have a long loan term, consider Gap Insurance. In case of a total loss, it covers the "gap" between what you owe on the loan and the car’s actual cash value (which rapidly depreciates).

- Follow Maintenance Schedules: Adhering to the manufacturer’s recommended service schedule is crucial for longevity, warranty validity, and resale value.

- Understand Your Warranty: Know what your factory warranty covers (bumper-to-bumper, powertrain) and for how long.

Strategic Investment for a New Car Purchase

| Phase/Strategy | Description/Action | Potential Benefit / Cost (Time/Effort/Financial) | Impact on Outcome |

|---|---|---|---|

| Pre-Purchase Research | Define needs, research models, safety, reliability, resale value. | Benefit: Informed decision, avoiding buyer’s remorse. Cost: Significant time. | Ensures the car meets your lifestyle and budget. |

| Budgeting & Credit Check | Calculate total ownership costs, assess affordability, check credit score. | Benefit: Financial stability, better loan rates. Cost: Time, self-discipline. | Prevents overspending, secures favorable financing terms. |

| Financing Pre-Approval | Secure loan offers from banks/credit unions before dealership visit. | Benefit: Strong negotiation leverage, competitive rates. Cost: Time/effort. | Separates financing from car price, potentially saving thousands in interest. |

| Multiple Dealer Quotes | Obtain "out-the-door" price quotes via email/phone from several dealerships. | Benefit: Competitive pricing, identifies best deals. Cost: Time/effort. | Ensures you get the lowest possible price on the vehicle. |

| Negotiate Total Price | Focus on the final "out-the-door" price, not just monthly payments. | Benefit: Transparency, avoids hidden fees. Cost: Firmness, patience. | Prevents dealer from manipulating loan terms or adding unnecessary charges. |

| Separate Trade-In | Negotiate new car price first, then discuss trade-in or sell privately. | Benefit: Maximizes trade-in value. Cost: Extra effort for private sale. | Prevents dealer from using trade-in as a negotiation tool against you. |

| Decline Add-Ons | Politely refuse overpriced dealer add-ons (extended warranties, coatings, etc.). | Benefit: Significant cost savings. Cost: Firmness. | Reduces overall purchase price, allows for better third-party options if desired. |

| Thorough Test Drive | Drive the specific model/trim on various roads, check features. | Benefit: Ensures comfort, functionality, suitability. Cost: Time. | Avoids practical disappointments after purchase. |

| Read All Paperwork | Carefully review the entire contract before signing. | Benefit: Prevents surprises, catches errors. Cost: Patience, attention to detail. | Ensures all agreed-upon terms are accurately reflected and no hidden clauses exist. |

| Post-Purchase Protection | Secure insurance, consider GAP insurance, plan for maintenance. | Benefit: Protects investment, ensures longevity. Cost: Ongoing financial. | Safeguards your asset and financial well-being after purchase. |

Frequently Asked Questions (FAQ)

Q1: Is it always better to buy a car at the end of the month?

A1: Generally, yes. Salespeople and dealerships often have monthly, quarterly, and annual quotas. Towards the end of these periods, they may be more motivated to offer better deals to meet targets.

Q2: Should I tell the dealer I have a trade-in immediately?

A2: It’s usually best to keep your trade-in out of the initial negotiation. Focus on getting the best "out-the-door" price for the new car first. Once that’s settled, then introduce the trade-in. This prevents the dealer from shifting numbers between the new car price and the trade-in value.

Q3: What’s the difference between MSRP and Invoice Price?

A3: MSRP (Manufacturer’s Suggested Retail Price) is the sticker price – what the manufacturer recommends the car be sold for. The Invoice Price is what the dealer theoretically paid the manufacturer for the car. Dealers typically pay less than invoice due to manufacturer incentives and holdbacks. Your goal is to negotiate a price between invoice and MSRP, closer to invoice.

Q4: Should I get an extended warranty from the dealership?

A4: Dealership extended warranties are often highly profitable for them and can be overpriced. While an extended warranty can offer peace of mind, it’s crucial to compare coverage and cost. Research third-party warranty providers, and if you buy from the dealer, negotiate the price aggressively. Many new cars come with a strong factory warranty, making an immediate extended warranty less critical.

Q5: How much down payment should I put on a new car?

A5: A common recommendation is to put down at least 10-20% of the car’s purchase price. A larger down payment reduces your loan amount, lowers your monthly payments, decreases the total interest paid, and helps you avoid being "upside down" on your loan (owing more than the car is worth) due to rapid initial depreciation.

Q6: Can I negotiate the destination charge?

A6: No. The destination charge (also called a freight charge) is a non-negotiable fee charged by the manufacturer to transport the vehicle from the factory to the dealership. It’s the same for all buyers of that specific model, regardless of where they buy it. It’s listed separately on the sticker and is a legitimate cost.

Conclusion

Buying a brand new car doesn’t have to be a daunting experience. The "best way to buy a brand new car" is not a single trick, but rather a methodical, well-researched, and financially savvy approach. By thoroughly understanding your needs, diligently researching vehicles, securing your financing in advance, and employing smart negotiation tactics, you empower yourself to navigate the dealership landscape with confidence. Remember, patience is a virtue, and being prepared to walk away is your strongest bargaining chip. Follow this guide, and you’ll not only drive away in your perfect new car but also with the satisfaction of knowing you secured the best possible deal. Happy driving!