Brand New Car Tax: A Comprehensive Guide to Understanding and Navigating the Costs

Brand New Car Tax: A Comprehensive Guide to Understanding and Navigating the Costs cars.truckstrend.com

The allure of a brand new car is undeniable – that fresh scent, the pristine paint, the promise of reliability and cutting-edge technology. But before the keys are handed over and the engine purrs to life, there’s an often-overlooked yet significant financial hurdle: the Brand New Car Tax. Far from being a simple, flat fee, this tax is a complex mosaic of charges that can significantly impact the total cost of your vehicle. Understanding it is not just about budgeting; it’s about making informed decisions that can save you a substantial amount of money and ensure a smooth purchase process.

This comprehensive guide will demystify the Brand New Car Tax, breaking down its various components, explaining how it’s calculated, and offering practical advice to navigate this essential aspect of car ownership. Whether you’re a first-time buyer or a seasoned motorist, a clear grasp of these taxes is crucial for a financially sound and stress-free acquisition.

Brand New Car Tax: A Comprehensive Guide to Understanding and Navigating the Costs

What Exactly is Brand New Car Tax?

At its core, "Brand New Car Tax" isn’t a singular, universally applied levy, but rather an umbrella term encompassing a variety of government charges imposed on the purchase of a newly manufactured vehicle. These taxes are typically paid at the point of sale or registration and are designed to generate revenue for public services, encourage specific consumer behaviors (like buying eco-friendly vehicles), or manage road usage.

Unlike annual road taxes or fuel duties, which are ongoing costs of ownership, new car taxes are generally one-off payments associated with the initial acquisition and registration of a vehicle. The specific types, rates, and calculation methods vary significantly from one country, state, or even city to another, reflecting different economic policies, environmental priorities, and infrastructure needs.

Unpacking the Components: Types and Categories of Brand New Car Tax

To truly understand the Brand New Car Tax, it’s essential to dissect its common components. While the nomenclature might differ, most jurisdictions apply some combination of the following:

1. Sales Tax / Value Added Tax (VAT)

This is perhaps the most common component. It’s a percentage of the vehicle’s purchase price (or the value of goods and services, as with VAT) that is added to the final cost.

- Sales Tax (e.g., USA, Canada): Applied at the state or provincial level, often ranging from 0% to over 10%. It’s typically calculated on the agreed-upon sale price of the vehicle before any other fees are added.

- Value Added Tax (VAT) / Goods and Services Tax (GST) (e.g., Europe, Australia): A consumption tax applied at various stages of production and sale, but for the consumer, it’s usually included in the sticker price or added at checkout. Rates can be significant, often 15-25%.

2. Registration Tax / First Registration Fee

This is a mandatory fee paid to register the vehicle with the relevant government authority (e.g., Department of Motor Vehicles, Ministry of Transport). It allows the car to be legally operated on public roads and grants it a license plate.

- Purpose: To cover administrative costs of issuing plates, titles, and maintaining vehicle records.

- Calculation: Can be a flat fee, or vary based on vehicle type, weight, or even purchase price.

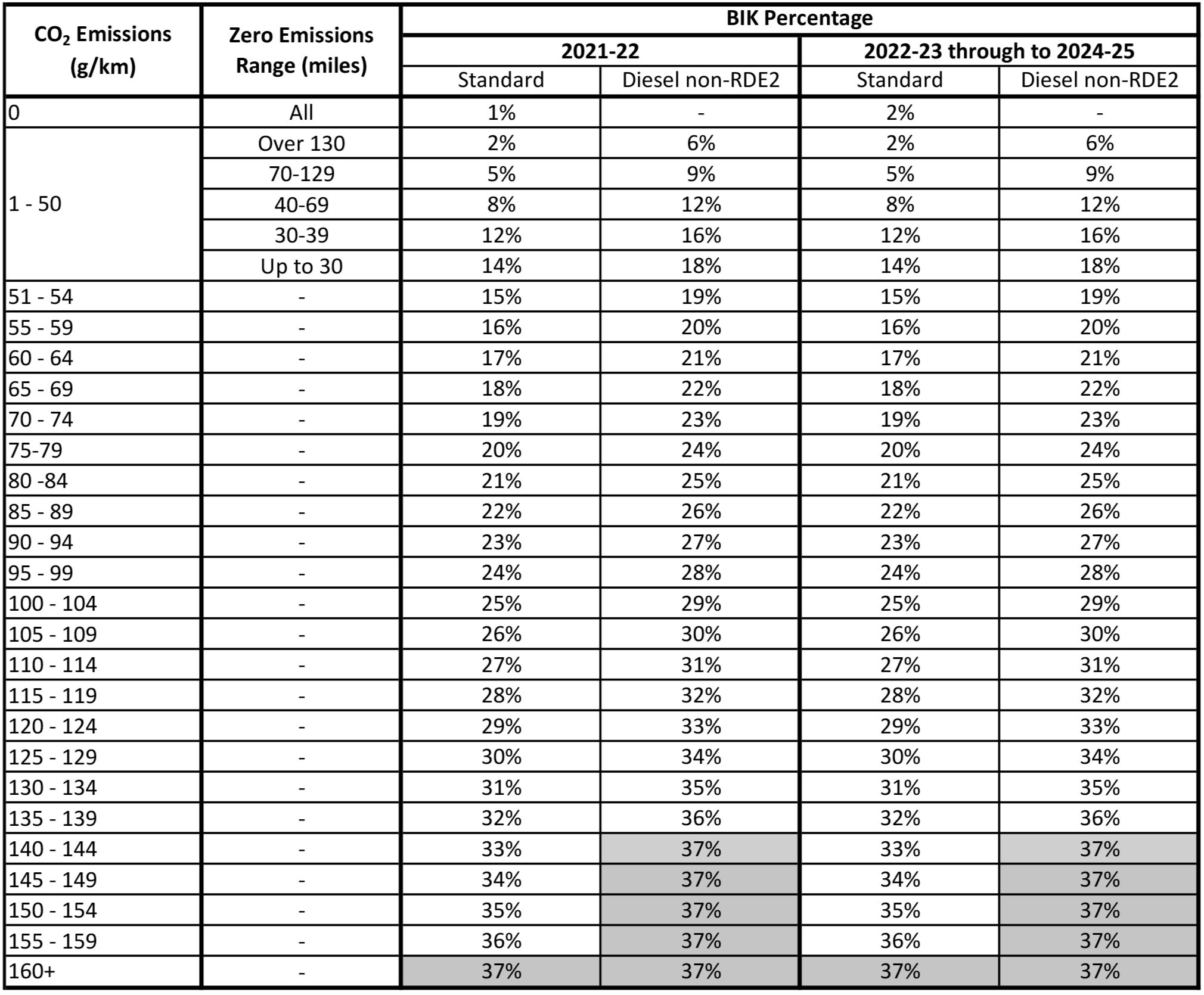

3. Emissions-Based Tax (CO2, NOx)

Increasingly prevalent globally, these taxes are designed to discourage the purchase of high-polluting vehicles and incentivize environmentally friendly choices.

- Purpose: To meet environmental targets, reduce air pollution, and fund green initiatives.

- Calculation: Directly linked to the vehicle’s CO2 emissions (grams per kilometer), fuel efficiency, or levels of other pollutants (e.g., nitrogen oxides – NOx). Higher emissions typically mean significantly higher taxes. This can be a substantial part of the total tax in many European countries.

4. Luxury Tax

Some jurisdictions impose an additional tax on vehicles exceeding a certain price threshold, deeming them "luxury" items.

- Purpose: To generate additional revenue from high-value purchases and address wealth distribution.

- Calculation: Applied as a percentage of the amount by which the vehicle’s price exceeds a predefined luxury threshold.

5. Weight-Based Tax

Less common for new car purchases specifically, but some regions factor vehicle weight into registration fees or specific one-off charges, recognizing that heavier vehicles cause more road wear.

6. Specific Regional/Local Levies

Beyond the major categories, there can be smaller, localized taxes or fees. These might include:

- Stamp Duty: A tax on certain legal documents, including vehicle purchase agreements in some places.

- Infrastructure Levy: A charge dedicated to funding road improvements or public transport.

- Dealer Processing Fees: While not a government tax, these are often non-negotiable fees charged by dealerships to cover administrative costs, and they add to the out-the-door price.

How Brand New Car Tax is Calculated: Factors at Play

The calculation of Brand New Car Tax is a multi-faceted process, combining several of the above components. Here’s a general overview of the factors that influence the final figure:

- Vehicle’s Base Price: This is the starting point for sales tax, VAT, and potentially luxury tax. A higher purchase price almost always means a higher tax bill.

- CO2 Emissions (g/km): Crucial in many countries, particularly in Europe. Vehicles with lower CO2 emissions often receive significant tax breaks or even exemptions, while high-emission models face steep penalties.

- Fuel Type: Electric vehicles (EVs) and plug-in hybrids (PHEVs) frequently enjoy reduced or zero new car taxes in many regions, as part of government incentives for green transport. Diesel vehicles, due to higher NOx emissions, sometimes face higher taxes than petrol equivalents.

- Engine Size/Cubic Capacity (CC): Less common for new car tax (more for annual road tax), but some older systems or specific regions might still use this as a factor.

- Vehicle Weight: As mentioned, heavier vehicles can incur higher fees in some areas, reflecting their greater impact on road infrastructure.

- Jurisdiction-Specific Rates: The percentages and fixed fees for each tax component are entirely dependent on where you are buying the car. What might be a 5% sales tax in one state could be a 20% VAT in another country, plus an emissions penalty.

Example Scenario (Hypothetical):

Let’s imagine buying a new car with a base price of €30,000 in a country with the following new car taxes:

- VAT: 20%

- First Registration Fee: €500 (flat fee)

- Emissions Tax: €10 per g/km over 120 g/km. Car emits 150 g/km.

- Luxury Tax: 5% on amount over €40,000 (N/A in this case)

Calculation:

- VAT: €30,000 * 20% = €6,000

- First Registration Fee: €500

- Emissions Tax: (150 g/km – 120 g/km) €10 = 30 €10 = €300

- Total Brand New Car Tax: €6,000 (VAT) + €500 (Registration) + €300 (Emissions) = €6,800

In this example, the €30,000 car would cost €36,800 out the door, excluding dealer fees or other accessories.

Why Do We Pay Brand New Car Tax? Purpose and Benefits

The imposition of Brand New Car Tax isn’t arbitrary. It serves several key purposes for governments and society:

- Revenue Generation: The primary reason. These taxes contribute significantly to national and local treasuries, funding public services such as healthcare, education, infrastructure development (roads, bridges), and public safety.

- Environmental Incentives: Emissions-based taxes are powerful tools to encourage consumers to choose more fuel-efficient and lower-emission vehicles, helping countries meet climate targets and improve air quality. Tax breaks for EVs are a direct example of this.

- Traffic Management and Congestion Reduction: In some dense urban areas, high vehicle taxes can subtly discourage car ownership, promoting public transport or alternative mobility solutions.

- Fair Contribution to Infrastructure: Cars contribute to wear and tear on roads and require extensive infrastructure. These taxes are seen as a way for vehicle owners to contribute to the upkeep and expansion of the road network.

- Economic Stabilization/Redistribution: Luxury taxes, in particular, aim to generate more revenue from higher-value purchases, potentially contributing to broader economic equity.

Important Considerations Before Buying

Navigating the Brand New Car Tax landscape requires foresight and diligence. Here are crucial considerations for any prospective buyer:

- Research Local Tax Laws Thoroughly: Never assume. Tax rates and rules are highly localized. Use official government websites or reputable automotive resources specific to your region.

- Factor Tax into Your Total Budget: The advertised price of a car often excludes taxes and fees. Always ask for the "out-the-door" price that includes all applicable taxes and charges. This is crucial for accurate budgeting.

- Understand the Impact of Vehicle Choice: Your choice of engine, fuel type, and even optional extras can significantly alter your tax bill, especially with emissions-based taxes. A slightly more expensive but lower-emission model might save you money in taxes in the long run.

- Inquire About Exemptions or Reduced Rates: Many governments offer incentives for specific vehicle types (e.g., electric vehicles, hydrogen fuel cell cars) or for certain buyers (e.g., disabled individuals). Ask your dealer or check government resources.

- Dealer Transparency: A reputable dealer should be able to provide a clear, itemized breakdown of all taxes and fees associated with your purchase. Don’t hesitate to ask for this in writing.

- Beware of Hidden Fees: Distinguish between government-mandated taxes and optional or inflated dealer fees (e.g., "documentation fees" that seem excessive). While some dealer fees are legitimate, always question anything unclear.

Challenges and Solutions in Navigating New Car Taxes

The Brand New Car Tax system, while serving important purposes, can present challenges for buyers:

- Complexity of Calculations: The interplay of various percentages, fixed fees, and emissions bands can be confusing, making it hard for buyers to independently verify the total.

- Solution: Demand a detailed, itemized breakdown from the dealer. Utilize online tax calculators provided by government agencies or reputable automotive sites.

- High Upfront Costs: The cumulative effect of these taxes can add thousands to the purchase price, making a new car seem unaffordable for some.

- Solution: Budget for taxes from the outset. Consider financing options that include taxes. Explore models with lower tax implications (e.g., smaller engines, lower emissions, or electric vehicles if incentives apply).

- Changing Regulations: Tax laws, especially those related to emissions, can change frequently, making it hard to keep up.

- Solution: Stay updated by checking official government automotive tax portals or consulting with a knowledgeable dealer. Purchase decisions should factor in current regulations.

- Lack of Transparency: Some less scrupulous dealerships might not be fully transparent about all fees until late in the sales process.

- Solution: Insist on full disclosure of all "out-the-door" costs early on. Get everything in writing before signing any agreements.

Practical Advice and Actionable Insights

- Always Get a Full Breakdown: Before you sign anything, demand a comprehensive, itemized list of every charge that makes up the total price of the car, distinguishing clearly between the vehicle price, government taxes, and dealer fees.

- Utilize Online Tax Calculators: Many government transport or revenue agencies provide online tools where you can input vehicle details (price, emissions, fuel type) to get an estimate of the taxes due. This is an excellent way to cross-reference dealer figures.

- Consider the "Tax-Efficient" Car: If budget is a major concern, research models known for lower emissions or those that qualify for significant tax breaks in your region. Often, the long-term savings on taxes (both new car tax and annual road tax) can outweigh a slightly higher initial purchase price for a more eco-friendly model.

- Don’t Forget About Incentives: Actively seek out information on government incentives for specific vehicle types (e.g., grants for EVs, tax credits for low-emission vehicles). These can dramatically reduce your overall cost.

- Budget for More Than Just the Sticker Price: Beyond the Brand New Car Tax, remember to budget for registration, licensing, insurance, and potentially extended warranties or service plans.

Conceptual Breakdown of Brand New Car Tax Components and Calculation Factors

As "Brand New Car Tax" is not a single, universal levy, a definitive "price table" is impossible to provide. Instead, here is a conceptual table illustrating the various components that typically make up the total new car tax, along with the factors influencing their calculation. This table highlights how different elements contribute to the final cost.

| Tax Component | Basis of Calculation | Typical Rates / Factors | Notes & Considerations |

|---|---|---|---|

| Sales Tax / VAT | Vehicle Purchase Price | Sales Tax: 0% – 10%+ (State/Province-dependent) | Most common tax. Varies significantly by jurisdiction. VAT is often 15-25% in many countries. |

| VAT: 15% – 25% (Country-dependent) | Usually calculated on the final negotiated price before other fees. | ||

| First Registration Fee | Flat Fee / Vehicle Type / Weight / Price | Flat Fee: $50 – $500+ (Jurisdiction-dependent) | Covers administrative costs for issuing license plates and title. Can be tiered. |

| Varies: Based on vehicle category, weight, or value | Often a one-time fee upon initial registration. | ||

| Emissions-Based Tax | CO2 Emissions (g/km) / Fuel Type / Engine Size | Tiered System: e.g., €5 – €5000+ (per vehicle) | Highly variable. Lower emissions = lower tax (or even zero). High emissions = significant penalties. |

| Thresholds: e.g., tax starts above 100g/km CO2 | Strong incentive for eco-friendly vehicles. Can be substantial in Europe. | ||

| Luxury Tax | Portion of Price Above Threshold | Percentage: 3% – 10%+ (on excess value) | Applied only to vehicles exceeding a specific price point (e.g., $50,000 or €60,000). |

| Threshold: e.g., >$40,000 or >€50,000 | Less common than sales/VAT or emissions taxes, but significant where applied. | ||

| Weight-Based Levy | Vehicle Curb Weight | Tiered System: e.g., $0.50 – $2 per kg (over base) | Less common as a standalone "new car tax," sometimes integrated into registration fees. |

| Acknowledges road wear caused by heavier vehicles. | |||

| Local/Regional Levies | Flat Fee / Specific Criteria | Small Fees: $10 – $100+ | May include stamp duty, infrastructure levies, or specific city surcharges. |

| Often minor compared to major taxes, but add to the total. |

Disclaimer: This table provides a conceptual framework. Actual tax rates, thresholds, and specific components are highly dependent on the country, state, and local regulations where the vehicle is purchased and registered. Always consult official government sources for the most accurate and up-to-date information.

Frequently Asked Questions (FAQ) about Brand New Car Tax

Q1: Is Brand New Car Tax the same everywhere?

A: Absolutely not. It varies significantly by country, state, province, and sometimes even city. Each jurisdiction has its own set of rules, rates, and tax components (e.g., sales tax, VAT, emissions tax, luxury tax).

Q2: Can I avoid Brand New Car Tax?

A: Generally, no. Brand New Car Tax (in its various forms) is a mandatory charge for legally purchasing and registering a new vehicle. However, you can often reduce your tax liability by choosing a lower-priced vehicle, a vehicle with lower emissions, or taking advantage of specific government incentives (e.g., for electric vehicles).

Q3: Does Brand New Car Tax apply to used cars?

A: For the most part, no. The term "Brand New Car Tax" specifically refers to the initial taxes on a newly manufactured vehicle. Used cars typically incur sales tax (or VAT) on their purchase price, but not the specific "first registration" or "emissions-based" taxes designed for brand new vehicles, which are usually a one-time charge.

Q4: How does buying an Electric Vehicle (EV) affect the Brand New Car Tax?

A: In many regions, buying an EV can significantly reduce or even eliminate certain components of the Brand New Car Tax. This is a common government incentive to encourage the adoption of greener transportation. EVs often receive exemptions from emissions-based taxes and may qualify for reduced sales tax or direct grants/rebates.

Q5: Is the Brand New Car Tax refundable if I return the car?

A: This depends on the specific jurisdiction and the reason for the return. Sales tax or VAT might be refundable if the entire transaction is unwound (e.g., within a cooling-off period). However, specific registration fees or one-time emissions taxes may not be fully refundable, as they are tied to the initial act of registration. Always check the terms of your purchase agreement and local laws.

Q6: Who collects the Brand New Car Tax?

A: Typically, the car dealership collects all applicable taxes from the buyer at the time of purchase and then remits them to the relevant government authorities (e.g., state revenue department, national tax agency, department of motor vehicles).

Conclusion

The Brand New Car Tax, while complex and varied, is an unavoidable part of purchasing a new vehicle. Far from being a mere footnote, these taxes can represent a significant portion of your total investment. By understanding the different types of taxes, how they are calculated, and the factors that influence them, you empower yourself to make smarter purchasing decisions.

Armed with knowledge about sales tax, VAT, emissions levies, and other potential charges, you can accurately budget, explore tax-efficient vehicle options, and confidently navigate discussions with dealerships. Ultimately, a clear understanding of the Brand New Car Tax isn’t just about fulfilling a legal obligation; it’s about taking control of your financial journey and driving away with peace of mind.