Buying A Brand New Car With No Credit

Buying A Brand New Car With No Credit cars.truckstrend.com

The dream of driving a brand new car off the lot is a common one, filled with the allure of that new car smell, pristine condition, and the latest technology. For many, however, this dream is often tempered by a significant hurdle: credit. Specifically, for those with "no credit," the path to a new vehicle can seem entirely blocked. Traditional lenders heavily rely on a robust credit history to assess risk, making the idea of Buying A Brand New Car With No Credit appear almost impossible.

But what exactly does "no credit" mean, and why is it such a challenge? "No credit" doesn’t mean you have a history of missed payments or defaults; it simply means you haven’t established enough of a borrowing history for credit bureaus to generate a FICO score. This often applies to young adults just starting out, recent immigrants, or individuals who have always preferred to pay for everything in cash. While admirable in its financial prudence, this lack of a credit footprint makes you an unknown entity to lenders, who prefer predictability.

Buying A Brand New Car With No Credit

However, the good news is that Buying A Brand New Car With No Credit is not an insurmountable task. It requires a different approach, strategic planning, and an understanding of alternative pathways. This comprehensive guide will illuminate these paths, providing practical advice and actionable insights to help you navigate the process and drive away in the new car you desire, even without an established credit history.

Understanding the Landscape: No Credit vs. Bad Credit

Before delving into strategies, it’s crucial to distinguish between "no credit" and "bad credit," as the solutions for each differ significantly.

- No Credit: This means you have little to no credit history. You haven’t taken out loans, used credit cards consistently, or had your financial activities reported to credit bureaus. As a result, you have no FICO score, or your score is very low due to insufficient data. Lenders view you as a "credit ghost"—they have no data to assess your reliability.

- Bad Credit: This indicates a history of financial mismanagement, such as late payments, defaults, bankruptcies, or high debt. You have a low FICO score, often below 600, signaling to lenders that you are a high-risk borrower.

While both scenarios present challenges, "no credit" is often viewed more favorably than "bad credit" by some lenders. With no credit, the lender’s concern isn’t your past financial irresponsibility, but rather your unproven ability to manage debt. This distinction opens doors to specific programs and strategies not typically available to those with a poor credit history.

The Challenges of Buying New with No Credit

Despite the distinction, Buying A Brand New Car With No Credit still presents several hurdles:

- Lender Risk Aversion: Without a credit history, lenders can’t predict your payment behavior, making them hesitant to approve a significant loan for a brand new vehicle.

- Higher Interest Rates: If you do get approved for a loan, expect a higher interest rate. Lenders compensate for the increased risk by charging more, meaning you’ll pay more over the life of the loan.

- Larger Down Payment Requirements: Lenders will almost certainly require a substantial down payment to reduce their financial exposure. This shows your commitment and reduces the loan-to-value ratio.

- Limited Financing Options: Your choices for lenders and loan types will be narrower. Big banks might be less willing, while smaller credit unions or specific dealer programs might be more accommodating.

- Less Negotiating Power: With fewer options, you might have less leverage to negotiate on price or terms.

Strategic Pathways for Buying A Brand New Car With No Credit

Overcoming these challenges requires a multi-pronged approach. Here are the most effective strategies:

1. The Power of a Substantial Down Payment

This is arguably the most impactful strategy for Buying A Brand New Car With No Credit. A large down payment significantly reduces the loan amount, thereby lowering the lender’s risk. If you can put down 20% to 30% or more of the car’s purchase price, lenders become much more comfortable, even without a credit history.

- Actionable Insight: Start saving aggressively. The more you can put down, the better your chances of approval and securing a more favorable interest rate. It also reduces your monthly payments and total interest paid over time.

2. Enlist the Help of a Co-signer

A co-signer is an individual with excellent credit who agrees to take on the legal responsibility for your loan if you fail to make payments. Their strong credit history essentially "lends" credibility to your application.

- Benefits: This can unlock access to better interest rates and increase your chances of approval. It also helps you build your own credit history as you make timely payments.

- Considerations: Choose a co-signer carefully (e.g., a trusted family member). Understand that if you default, their credit will be severely damaged, and they will be legally obligated to repay the loan. This can strain relationships. Ensure both parties understand the full implications.

3. Explore Dealership First-Time Buyer Programs

Many automotive manufacturers and dealerships offer specific programs designed for individuals with limited or no credit history. These programs are tailored to help new buyers establish credit while getting into a new car.

- Requirements: Typically, these programs require proof of stable income, a minimum down payment (often 10-15%), proof of residency, and a steady job history (e.g., 6 months to 1 year).

- Actionable Insight: Contact dealerships directly and inquire about their "first-time buyer" or "college graduate" programs. Be prepared to provide extensive documentation beyond what a typical buyer might need.

4. Leverage Credit Unions

Credit unions are non-profit financial institutions often known for being more flexible and community-oriented than large commercial banks. They may be more willing to work with individuals who have limited credit, especially if you have an existing relationship with them (e.g., a savings account).

- Benefits: Credit unions often offer competitive interest rates and may consider factors beyond just your credit score, such as your employment history, savings, and relationship with the institution.

- Actionable Insight: Join a local credit union (membership requirements are usually minimal) and establish a savings account. After a few months, inquire about their auto loan options for members with no credit.

5. Build Credit First (The Proactive Approach)

While not a direct strategy for Buying A Brand New Car With No Credit right now, taking steps to build your credit before applying for a car loan can make the process significantly smoother and more affordable.

- Methods:

- Secured Credit Card: You deposit money as collateral, which becomes your credit limit. Use it responsibly and pay it off in full each month.

- Credit Builder Loan: Offered by some credit unions or community banks, where the loan amount is held in an account until you’ve made all payments.

- Small Personal Loan: If approved for a small loan, consistent, on-time payments will help.

- Rent Reporting: Services that report your on-time rent payments to credit bureaus.

- Timeline: Building a significant credit history takes time, typically 6-12 months for an initial score to appear and longer for a robust history. If you’re not in a rush, this is a highly recommended long-term strategy.

Preparing for the Purchase: Essential Steps

Regardless of the strategy you choose, thorough preparation is key to successfully Buying A Brand New Car With No Credit.

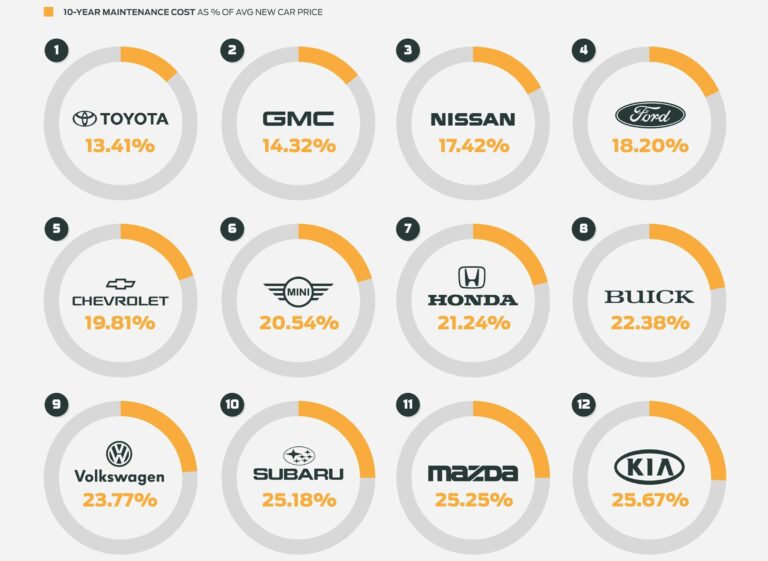

- Determine Your Budget: Don’t just think about the monthly car payment. Factor in insurance, fuel, maintenance, registration, and potential extended warranties. Use an online calculator to understand total ownership costs.

- Gather Documentation: Lenders will require extensive proof of your financial stability. Prepare:

- Proof of Income (recent pay stubs, W-2s, bank statements)

- Proof of Residency (utility bills, lease agreement)

- Proof of Employment (employer contact, letter of employment)

- Identification (driver’s license, passport)

- Bank Statements (showing consistent savings and income)

- Research Your Desired Car: Know the make, model, and trim level you want. Research its MSRP, common dealer discounts, and any available manufacturer incentives. This knowledge empowers you during negotiations.

- Get Pre-Approved (If Possible): Even with no credit, some credit unions or online lenders might offer conditional pre-approvals. This gives you leverage at the dealership, showing you’re a serious buyer with financing already lined up.

Navigating the Dealership with No Credit

Once you’ve prepared, approaching the dealership requires a specific mindset:

- Be Upfront and Honest: Clearly communicate your credit situation. Don’t waste time with lenders who aren’t equipped to handle no-credit applicants.

- Focus on the Total Cost: Don’t just fixate on the monthly payment. High interest rates can inflate the total cost significantly. Ask for the full breakdown of the loan.

- Negotiate Wisely: Even with limited options, try to negotiate the car’s price. Remember, the dealer wants to sell a car.

- Read the Fine Print: Carefully review all loan documents, especially the interest rate, loan term, and any hidden fees. Don’t be rushed.

- Consider a Simpler Model: You might need to adjust your expectations. A less expensive, entry-level new car might be more attainable than a fully loaded luxury model.

Illustrative Financial Considerations for Buying A Brand New Car With No Credit

The actual costs of Buying A Brand New Car With No Credit can vary widely based on your chosen strategy, the car’s price, and market conditions. This table provides illustrative scenarios to help you understand the potential financial implications.

| Scenario/Strategy | Typical Down Payment Needed | Estimated Interest Rate Range (APR) | Monthly Payment Impact (on $25k loan, 60 months) | Total Cost Over Loan Term (Illustrative) | Key Benefit/Drawback |

|---|---|---|---|---|---|

| Substantial Down Payment | 20-30%+ ($5,000 – $7,500+) | 6% – 10% | ~$483 – $533 | $28,980 – $31,980 | Lower risk, lower total interest. Requires significant savings. |

| With Co-signer | 10-20% ($2,500 – $5,000) | 4% – 8% | ~$460 – $510 | $27,600 – $30,600 | Better rates, builds your credit. Puts co-signer at risk. |

| First-Time Buyer Program | 10-15% ($2,500 – $3,750) | 7% – 12% | ~$496 – $560 | $29,760 – $33,600 | Tailored for no credit. Specific program requirements. |

| Credit Union Approach | 10-20% ($2,500 – $5,000) | 5% – 10% | ~$472 – $533 | $28,320 – $31,980 | More flexible, community-focused. Requires membership. |

| Build Credit First | 0-10% (After building) | 3% – 7% | ~$450 – $496 | $27,000 – $29,760 | Best rates, more options. Takes time to establish credit. |

Note: These figures are estimates and will vary based on individual circumstances, market rates, specific lender policies, and the actual price of the vehicle.

Conclusion: Driving Your Dream Forward

Buying A Brand New Car With No Credit is undoubtedly a challenging endeavor, but it is far from impossible. It requires a combination of strategic planning, financial discipline, and a willingness to explore alternative avenues. By understanding the distinction between no credit and bad credit, saving for a substantial down payment, leveraging the support of a co-signer, or exploring specific programs offered by dealerships and credit unions, you can significantly improve your chances.

The journey might be longer, and the initial costs potentially higher due to interest rates, but successfully securing a new car loan with no credit also serves as a powerful step towards building a robust credit history. Each on-time payment contributes positively to your financial footprint, paving the way for easier and more affordable borrowing in the future. With patience, persistence, and the right strategy, the dream of that brand new car can become a reality, marking a significant milestone on your path to financial independence.

Frequently Asked Questions (FAQ)

Q1: Is it truly possible to buy a brand new car with no credit history?

A1: Yes, it is possible, but it’s more challenging than with established good credit. It typically requires a substantial down payment, a co-signer, or utilizing specific first-time buyer programs or credit unions.

Q2: What’s the main difference between "no credit" and "bad credit"?

A2: "No credit" means you haven’t established enough borrowing history for a credit score to be generated. "Bad credit" means you have a history of missed payments or financial difficulties, resulting in a low credit score. Lenders view "no credit" as less risky than "bad credit."

Q3: How much of a down payment do I typically need if I have no credit?

A3: While there’s no fixed rule, aiming for a down payment of 20% or more of the car’s purchase price significantly increases your chances of approval and can lead to better interest rates. Some specific programs might accept 10-15%.

Q4: Can a co-signer really help me get a new car loan with no credit?

A4: Absolutely. A co-signer with good credit adds their financial credibility to your loan application, reducing the lender’s risk and making you more likely to be approved for a loan, potentially with a lower interest rate. However, remember the co-signer is equally responsible for the loan.

Q5: What are "first-time buyer" programs, and how do they work?

A5: These are special financing programs offered by car manufacturers or dealerships designed for individuals with limited or no credit history. They often require proof of stable income, a steady job, and a modest down payment. They aim to help new buyers establish credit.

Q6: How long does it take to build enough credit to buy a car without these special strategies?

A6: It typically takes at least 6 months of consistent, responsible credit activity (like using a secured credit card or a small personal loan) for a FICO score to be generated. To build a robust history that unlocks prime rates, it can take 1-2 years or more.

Q7: Will I pay higher interest rates if I buy a car with no credit?

A7: Yes, it’s highly likely. Lenders charge higher interest rates to compensate for the increased risk associated with lending to someone without a proven credit history. As you build credit, you can potentially refinance the loan later at a lower rate.

Q8: Should I consider buying a used car instead if I have no credit?

A8: While this article focuses on new cars, buying a used car can often be an easier entry point for someone with no credit. Used cars are generally less expensive, meaning you might need a smaller loan or down payment. It can also be a good way to build credit before upgrading to a new vehicle.