Can I Buy A Brand New Car With Bad Credit?

Can I Buy A Brand New Car With Bad Credit? cars.truckstrend.com

The allure of a brand new car is undeniable: that fresh car smell, the latest technology, a full warranty, and the peace of mind that comes with being the first owner. For many, it represents a significant life milestone or a much-needed upgrade. However, if your credit score is less than stellar, this dream can quickly turn into a daunting question: "Can I buy a brand new car with bad credit?"

The short answer is yes, it is often possible, but it comes with significant challenges, higher costs, and requires a strategic approach. This comprehensive guide will delve into the realities of purchasing a new car with a poor credit history, outlining the hurdles you’ll face, the strategies to overcome them, and what to consider before signing on the dotted line.

Can I Buy A Brand New Car With Bad Credit?

Understanding Bad Credit and Its Impact on Car Loans

Before diving into the "how," it’s crucial to understand what "bad credit" means in the eyes of an auto lender and why it poses a challenge.

What is Considered Bad Credit?

Credit scores, primarily FICO and VantageScore, range from 300 to 850. While definitions can vary slightly among lenders, generally:

- Excellent: 800-850

- Very Good: 740-799

- Good: 670-739

- Fair: 580-669

- Poor/Bad: 300-579

If your score falls into the "Fair" or "Poor/Bad" category, especially below 620, you’ll typically be considered a "subprime" borrower. This means lenders perceive you as a higher risk for defaulting on a loan.

Why Lenders Are Hesitant:

Lenders are in the business of assessing risk. A low credit score signals past financial difficulties, such as missed payments, high debt, collections, bankruptcies, or foreclosures. From a lender’s perspective, this history suggests a higher probability that you might not repay the new car loan as agreed. To mitigate this increased risk, lenders either:

- Deny the loan outright.

- Approve the loan with significantly less favorable terms, primarily much higher interest rates.

The Direct Impact on Your Loan:

- Higher Interest Rates: This is the most significant consequence. While someone with excellent credit might get an APR of 3-6%, a borrower with bad credit could face rates ranging from 10-25% or even higher. This dramatically increases the total cost of the car over the life of the loan.

- Stricter Loan Terms: Lenders might require a larger down payment, offer shorter loan terms (leading to higher monthly payments), or conversely, very long terms (e.g., 72 or 84 months) to make monthly payments seem affordable, which in turn leads to paying much more in interest over time.

- Limited Lender Options: Many prime lenders (banks, credit unions) prefer to work with borrowers who have good credit. You’ll likely need to seek out subprime lenders or specialized bad credit auto financing companies.

The Challenges of Buying a Brand New Car with Bad Credit

While possible, buying new with bad credit presents more obstacles than buying a used car.

- Rapid Depreciation: New cars lose a significant portion of their value the moment they’re driven off the lot. This rapid depreciation increases the lender’s risk, as the car’s value quickly falls below the loan amount, creating "negative equity." With bad credit, this risk is amplified for the lender.

- Higher Price Tag: New cars are inherently more expensive than their used counterparts. A larger loan amount means more risk for the lender and a higher monthly payment and total interest for you.

- Less Room for Negotiation: While you can negotiate the price of a new car, there’s less flexibility compared to the used car market, where private sellers or smaller dealerships might be more willing to deal.

- Limited Choice of Models: Dealerships might steer you towards less popular or lower-priced new models that are easier to finance for subprime borrowers, rather than the car you truly want.

Strategies to Improve Your Chances (Before You Shop)

Preparation is key when buying a car with bad credit. The more steps you take beforehand, the better your chances of securing favorable terms.

- Know Your Credit Score and Report: Obtain free copies of your credit report from all three major bureaus (Equifax, Experian, TransUnion) via AnnualCreditReport.com. Review them meticulously for errors. Dispute any inaccuracies, as correcting them can boost your score. Understanding your score gives you a realistic expectation of what you’ll face.

- Save for a Larger Down Payment: This is arguably the most impactful strategy. A substantial down payment (10-20% or more of the car’s price) reduces the amount you need to borrow, thereby lowering the lender’s risk. It also helps offset the rapid depreciation of a new car, reducing the chance of negative equity.

- Improve Your Debt-to-Income (DTI) Ratio: Lenders look at your DTI, which is your total monthly debt payments divided by your gross monthly income. A lower DTI indicates you have more disposable income to cover new loan payments. Pay down existing debts, especially high-interest credit card balances, before applying for a car loan.

- Get Pre-Approved from Multiple Lenders: Don’t rely solely on the dealership’s financing. Apply for pre-approval with credit unions, banks, and online subprime lenders that specialize in bad credit auto loans. This gives you a concrete offer to compare against dealer financing and provides negotiating power. Make sure to do this within a short window (14-45 days) to minimize the impact on your credit score from multiple inquiries.

- Consider a Co-signer: If you have a trusted family member or friend with excellent credit, asking them to co-sign can significantly improve your chances and secure a lower interest rate. However, be aware that the co-signer is equally responsible for the loan, and any missed payments will affect their credit as well. This should only be done with a clear understanding of the risks involved for both parties.

- Have Proof of Income and Stability: Gather recent pay stubs, bank statements, utility bills, and proof of residence to demonstrate your financial stability to lenders. Steady employment and residence are positive indicators.

Navigating the Dealership with Bad Credit

Once you’ve done your homework, it’s time to approach the dealership.

- Be Honest and Transparent: Don’t try to hide your credit situation. Dealerships will run a credit check anyway. Being upfront allows them to work with you more effectively.

- Shop for the Car Price and the Loan Separately: Your primary goal should be to get the best possible price on the car itself, and then the best possible financing terms. Don’t let a dealer roll the two together into a "monthly payment" discussion without dissecting each component.

- Focus on the Total Cost, Not Just Monthly Payments: Dealers often focus on a low monthly payment to make a car seem affordable. However, a low monthly payment over a very long term (e.g., 84 months) with a high interest rate means you’ll pay significantly more in total interest. Always ask for the total cost of the car, including all interest and fees.

- Avoid Unnecessary Add-ons: Dealers may try to sell you extended warranties, GAP insurance (which can be good, but often cheaper elsewhere), paint protection, or other extras. While some may be useful, they inflate the loan amount and your monthly payments, making it harder to get approved with bad credit and costing you more in interest.

- Negotiate Wisely: Even with bad credit, you can still negotiate the vehicle’s purchase price. Do your research on the car’s market value.

- Be Prepared to Walk Away: If the terms offered are unreasonable, or you feel pressured, be prepared to leave. There are other dealerships and lenders. Your financial well-being is more important than driving a specific new car immediately.

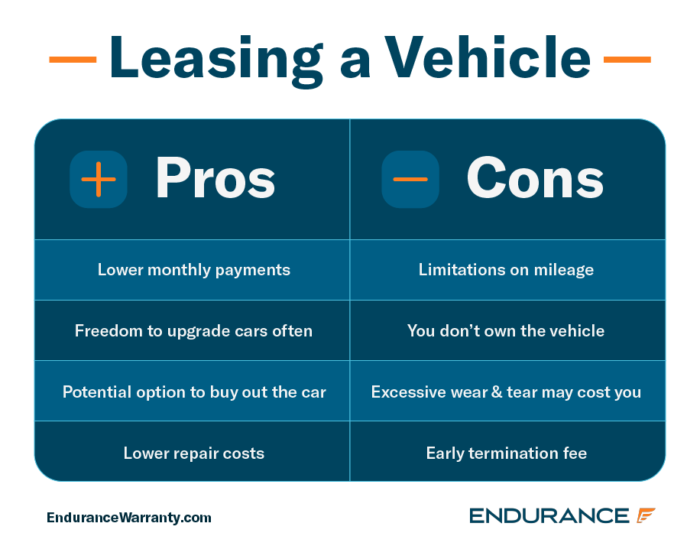

Alternative Considerations (If a New Car is Too Much)

For many with bad credit, a brand new car simply isn’t the most financially prudent choice. Consider these alternatives:

- Used Car: A used car (especially one a few years old) has already gone through its steepest depreciation phase. They are significantly cheaper, meaning a smaller loan amount, lower payments, and less risk for both you and the lender. This is often the more sensible path for rebuilding credit.

- Buy Here Pay Here (BHPH) Dealerships: These dealerships offer in-house financing and often approve borrowers regardless of credit history. However, their interest rates are typically very high (often the maximum allowed by law), and their car prices can be inflated. Use them as a last resort.

- Wait and Improve Your Credit: The best long-term strategy is to spend 6-12 months actively working on improving your credit score before buying a car. Pay all bills on time, reduce credit card balances, and avoid new debt. A higher credit score will unlock much lower interest rates, saving you thousands over the life of the loan.

Practical Advice and Actionable Insights

- Prioritize a Substantial Down Payment: This is your strongest leverage.

- Understand Your Budget Holistically: Factor in not just the car payment, but also insurance (which can be higher for new cars and for drivers with bad credit), fuel, maintenance, and registration.

- Research Thoroughly: Know the car’s value and potential loan terms before you step into a dealership.

- Don’t Be Afraid to Say No: If the deal isn’t right for you, walk away.

- Use the Loan as a Stepping Stone: If you do get a loan, make every payment on time. This is a powerful way to rebuild your credit score, opening doors to better financial products in the future.

Impact of Credit Score on a New Car Loan (Example Table)

This table illustrates how different credit score ranges can affect the terms and total cost of a hypothetical $30,000 new car loan over 60 months. These are estimates and actual rates can vary widely.

| Credit Score Range | Est. Interest Rate (APR) | Loan Term | Monthly Payment (Est.) | Total Interest Paid (Est.) | Total Cost of Car (Est.) |

|---|---|---|---|---|---|

| Excellent (780+) | 3.5% | 60 months | $545 | $2,700 | $32,700 |

| Good (670-739) | 6.0% | 60 months | $579 | $4,740 | $34,740 |

| Fair (580-669) | 10.0% | 60 months | $638 | $8,280 | $38,280 |

| Bad (500-579) | 15.0% | 60 months | $714 | $12,840 | $42,840 |

| Very Bad (<500) | 20.0% | 60 months | $791 | $17,460 | $47,460 |

Note: This table assumes a $0 down payment for simplicity to highlight interest impact. A significant down payment would reduce the loan amount and, consequently, the monthly payment and total interest paid for all credit tiers.

As you can see, the difference between excellent credit and bad credit on a $30,000 car loan can be over $14,000 in additional interest paid. This stark difference underscores why improving your credit or considering alternatives is so vital.

Frequently Asked Questions (FAQ)

Q1: What credit score is typically considered "bad" for a car loan?

A1: Generally, a FICO score below 620 is considered subprime or bad credit for an auto loan. Lenders may classify anything below 580 as "very bad."

Q2: Will a large down payment really help me get a new car with bad credit?

A2: Absolutely. A large down payment reduces the amount you need to borrow, lowers the lender’s risk, and can significantly improve your chances of approval, potentially even leading to a lower interest rate.

Q3: Is it better to buy a new or used car with bad credit?

A3: For most people with bad credit, a used car is a more financially sensible option. They are less expensive, depreciate slower after the initial years, and involve smaller loan amounts, leading to lower monthly payments and total interest.

Q4: Can I get pre-approved for a car loan with bad credit?

A4: Yes, some credit unions, online lenders, and subprime auto finance companies specialize in pre-approvals for borrowers with bad credit. Getting pre-approved helps you understand your budget before you shop and gives you leverage at the dealership.

Q5: What is a "buy here pay here" dealership?

A5: A "buy here pay here" (BHPH) dealership offers in-house financing, meaning they are both the seller and the lender. They often approve borrowers regardless of credit history but typically charge very high interest rates and may have higher car prices. They are generally considered a last resort.

Q6: How does a co-signer help me get a car loan with bad credit?

A6: A co-signer with good credit adds their creditworthiness to your application, reducing the lender’s risk. This can help you get approved or secure a lower interest rate. However, the co-signer is equally responsible for the loan.

Q7: Will applying for multiple car loans hurt my credit score?

A7: When you apply for loans, it results in a "hard inquiry" on your credit report, which can slightly lower your score. However, credit scoring models typically count multiple inquiries for the same type of loan (like auto loans) within a short period (usually 14-45 days) as a single inquiry, minimizing the impact. This allows you to shop for the best rates without undue credit damage.

Conclusion

The dream of owning a brand new car is attainable even with bad credit, but it’s crucial to approach the process with eyes wide open and a well-thought-out strategy. While it’s possible, it often comes at a significantly higher cost due to elevated interest rates and stricter terms.

By understanding your credit situation, diligently preparing with a substantial down payment, exploring pre-approval options, and being a smart negotiator, you can navigate the challenges. However, for many, the most financially prudent path may involve considering a reliable used car or, ideally, taking time to actively rebuild your credit score. Your ultimate goal should be to make an informed decision that not only gets you into a vehicle but also sets you on a path to a healthier financial future.