Can I Trade In A Brand New Car?

Can I Trade In A Brand New Car? cars.truckstrend.com

Purchasing a brand new car is often an exciting milestone, a significant investment, and a symbol of personal achievement. However, what happens when that initial euphoria fades, or circumstances change, leading you to consider trading in a vehicle you’ve only just driven off the lot? The question "Can I trade in a brand new car?" might seem counterintuitive, perhaps even financially reckless, but it’s a situation more common than one might imagine. This comprehensive guide will explore the realities, challenges, and options involved in trading in a vehicle that is, by all accounts, still practically brand new.

The Reality of Trading In a Brand New Car – Is It Even Possible?

Can I Trade In A Brand New Car?

Let’s cut straight to the chase: Yes, you absolutely can trade in a brand new car. Dealerships are in the business of buying and selling vehicles, and while they prefer a clear profit margin, they will certainly consider taking your recently purchased car as a trade-in. Whether it’s been a few days, a few weeks, or a couple of months since you bought it, a dealership will appraise its value and offer you a trade-in price.

However, the possibility of trading it in comes with a significant caveat: you will almost certainly incur a financial loss. This isn’t due to any malice on the dealership’s part, but rather the immutable law of automotive economics: depreciation.

The Silent Killer: Immediate Depreciation

Depreciation is the single most critical factor when considering trading in a brand new car. It’s the silent killer of your car’s value, and it hits hardest the moment you drive a new vehicle off the dealership lot.

- The "New Car Premium" Disappears Instantly: A significant portion of a new car’s value is tied to its "newness" – the fact that it has never been owned, titled, or driven. The moment you sign the papers and drive it away, it transitions from "new" to "used" in the eyes of the market, even if it only has five miles on the odometer.

- The Steep Initial Drop: Industry estimates vary, but it’s commonly cited that a new car can lose anywhere from 10-20% of its value the moment it leaves the lot. Within the first year, this figure can climb to 20-30% or even more. This rapid initial depreciation is the primary reason you will likely face a substantial financial setback.

- Impact on Your Loan (Negative Equity): If you financed your brand new car, especially with little or no down payment, you’re almost guaranteed to be "upside down" or have "negative equity" on your loan. This means you owe more on the car than it is currently worth. When you trade it in, that negative equity doesn’t disappear; it typically gets rolled into the loan for your next vehicle, increasing your new monthly payments and total interest paid.

Reasons You Might Consider Trading In Your Brand New Car

While the financial implications are daunting, there are legitimate reasons why someone might find themselves in this predicament:

- Buyer’s Remorse: Perhaps the most common reason. The car doesn’t feel right, the features aren’t what you expected, it’s uncomfortable, or you simply don’t love it as much as you thought you would.

- Financial Changes: An unexpected job loss, a medical emergency, or a sudden change in income might necessitate a more affordable vehicle or a way to reduce monthly expenses.

- Lifestyle Changes: A new baby might mean you need a larger SUV instead of a compact sedan. A move to a rural area might demand a truck or an AWD vehicle instead of a city car. Or perhaps your daily commute drastically changed.

- Better Deal Found: You might discover another vehicle that genuinely fits your needs better, offers superior features, or comes with a more attractive financing deal.

- Mechanical Issues/Reliability Concerns: While a brand new car should be reliable, a "lemon" or persistent, unfixable issues (though often covered by warranty or lemon laws) could push someone to seek a different vehicle.

The Process: How to Trade In a Brand New Car

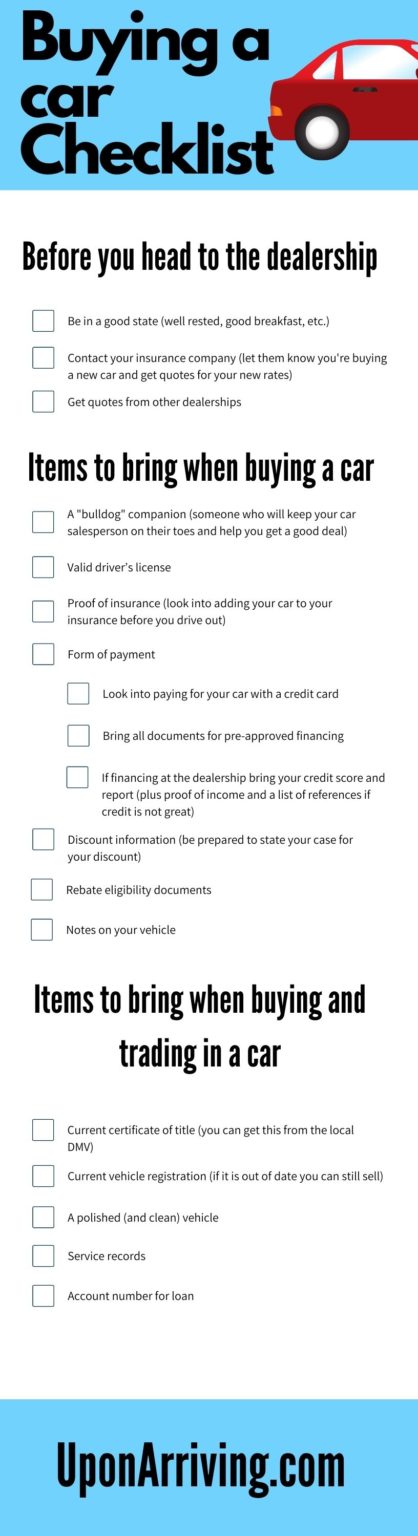

If you’ve decided that trading in your brand new car is your best course of action, understanding the process is crucial to minimizing your loss.

Step 1: Assess Your Current Financial Position

- Determine Your Loan Payoff Amount: Contact your lender (bank or credit union) to get the exact payoff amount for your current car loan. This is the amount needed to clear your debt.

- Estimate Your Car’s Current Value: Use online appraisal tools like Kelley Blue Book (KBB.com), Edmunds.com, or NADAguides.com. Be honest about the car’s condition, mileage, and features. Remember, these are estimates, and a dealer’s offer will likely be lower.

- Calculate Your Negative Equity: Subtract your estimated trade-in value from your loan payoff amount. If the payoff is higher, that difference is your negative equity.

Step 2: Get Multiple Appraisals

Don’t settle for the first offer. Visit several dealerships (both new car dealerships and used car lots) to get competitive trade-in appraisals. Some dealerships might be more motivated to acquire specific makes or models. You can also try online car buying services (like Carvana, Vroom, or local equivalents) for instant cash offers.

Step 3: Understand and Address Negative Equity

This is often the most challenging part. If you have negative equity, you have a few options:

- Roll it into the New Loan: The most common approach. The negative equity is added to the purchase price of your new car, increasing your new loan amount. Be cautious, as this can put you deeper "underwater" on the next vehicle.

- Pay it Out of Pocket: If you have the cash, paying off the negative equity directly is the financially soundest option, as it prevents you from financing a depreciating asset.

- Negotiate Harder: While dealers need to make a profit, a good negotiation on the new car’s price or a better trade-in offer can help offset some of the negative equity.

Step 4: Negotiate Strategically

When you’re ready to make a deal, remember these tips:

- Separate the Deals: Always negotiate the price of the new car first, independent of your trade-in. Once you’ve agreed on a price for the new vehicle, then introduce your trade-in. This prevents the dealer from manipulating figures to make it seem like you’re getting a good deal on both.

- Know Your Numbers: Be firm about what you expect for your trade-in based on your research and multiple appraisals.

- Be Prepared to Walk Away: If the numbers don’t work, or you feel pressured, be ready to leave. There’s always another dealership.

Alternatives to Trading In a Brand New Car

Before taking the plunge and accepting a significant loss, consider these alternatives:

-

Selling Privately:

- Pros: This almost always yields the highest return, as you bypass the dealer’s profit margin. You can potentially get closer to the market value.

- Cons: It requires time, effort, and patience. You’ll need to advertise, deal with potential buyers, arrange test drives, and handle all the paperwork (especially tricky with an outstanding loan, as you’ll need to coordinate with your lender for the title release). It also comes with the hassle of vetting serious buyers from time-wasters.

-

Refinancing Your Current Loan: If your primary issue is high monthly payments or an unfavorable interest rate, you might be able to refinance your existing car loan with a different lender for a lower rate or a longer term. This can reduce your monthly burden without incurring a trade-in loss.

-

Lease Transfer (if applicable): If your "brand new car" was actually a lease, some leasing companies allow lease transfers. This lets someone else take over your payments and lease agreement, freeing you from the commitment. However, it’s less common for outright purchases.

-

Keeping the Car: If the reasons for wanting to trade are minor (e.g., slight buyer’s remorse that doesn’t impact functionality or significant financial strain), sometimes the most financially prudent decision is to simply keep the car and ride out the initial depreciation curve. The longer you own it, the less impact the immediate depreciation will have on your overall ownership cost.

Important Considerations and Tips

- Read Your Original Contract: Review your original purchase agreement and loan documents. Are there any early payoff penalties?

- Mileage Matters: Even on a "brand new" car, every mile adds to its depreciation. The fewer miles it has, the better your chances of a slightly higher trade-in value.

- Condition is Key: Keep the car pristine. Any dings, scratches, or interior wear will reduce its appraised value.

- Timing Your Trade: While the initial depreciation is steep, sometimes trading in before the car hits certain mileage milestones (e.g., 5,000 or 10,000 miles) can be slightly advantageous.

- Be Prepared for a Loss: Mentally prepare yourself for the financial hit. It’s almost inevitable.

- Don’t Hide Anything: Be transparent about the car’s history, condition, and any outstanding issues. Honesty builds trust and avoids problems later.

Estimated Depreciation and Financial Impact Table

This table illustrates the typical financial loss you might experience when trading in a brand new car, using a hypothetical $30,000 vehicle purchase with a $0 down payment. Note: These are estimates and actual values will vary based on make, model, market demand, and original purchase terms.

| Time Since Purchase | Estimated Depreciation Percentage (Cumulative) | Example Financial Loss on a $30,000 Car | Typical Negative Equity on $30,000 Loan (Approx.) |

|---|---|---|---|

| Day 1 (Off Lot) | 10-15% | $3,000 – $4,500 | $3,000 – $4,500 |

| 1 Month | 15-20% | $4,500 – $6,000 | $4,500 – $6,000 |

| 3 Months | 18-25% | $5,400 – $7,500 | $5,400 – $7,500 |

| 6 Months | 20-28% | $6,000 – $8,400 | $6,000 – $8,400 |

| 1 Year | 25-35% | $7,500 – $10,500 | $7,500 – $10,500 |

The "Typical Negative Equity" assumes the loan balance has barely decreased due to early payments being mostly interest, and no significant down payment was made.

Frequently Asked Questions (FAQ)

Q1: How soon can I trade in a new car?

A1: Technically, you can trade it in as soon as you own it – even the very next day. However, the financial loss will be most severe the sooner you do it due to immediate depreciation.

Q2: Will I lose money trading in a brand new car?

A2: Almost certainly, yes. The rapid depreciation of new vehicles means you will likely owe more on your loan than the car is worth (negative equity), resulting in a financial loss.

Q3: What is "negative equity" when trading in a car?

A3: Negative equity (or being "upside down") means the outstanding balance on your car loan is greater than the current market value of your vehicle. When you trade it in, this difference must be paid off or rolled into your new car loan.

Q4: Should I pay off my loan before trading in?

A4: You don’t have to, as the dealership can handle the payoff as part of the transaction. However, if you have negative equity, paying it off out of pocket before the trade-in prevents you from rolling it into a new loan, which is generally a financially healthier approach if you can afford it.

Q5: Is it better to sell my brand new car privately or trade it in?

A5: Selling privately will almost always yield a higher price, as you capture the dealer’s profit margin. However, it requires more time, effort, and personal responsibility. Trading in offers convenience but at a greater financial cost.

Q6: Does mileage really matter for a brand new car trade-in?

A6: Yes, absolutely. While it might seem negligible, even a few thousand miles on a car that was just bought can significantly impact its "used" value. Lower mileage generally translates to a better trade-in offer.

Conclusion

Trading in a brand new car is unequivocally possible, but it comes with a high price tag. The moment a new vehicle leaves the dealership, its value plummets, making immediate depreciation and the likelihood of negative equity your primary financial adversaries. While compelling reasons like buyer’s remorse or unforeseen life changes can prompt such a decision, it’s crucial to approach it with a clear understanding of the financial implications.

Before making any moves, thoroughly assess your financial situation, research your car’s true market value, and explore all alternatives, including private sale or simply holding onto the car for longer. If you do proceed with a trade-in, be prepared for a loss, negotiate shrewdly, and ensure you understand every aspect of the deal. Sometimes, cutting losses early is a necessary evil, but often, patience and a pragmatic approach to vehicle ownership can save you thousands in the long run.