Can You Insure A Car With A Branded Title? Unveiling the Truth About Salvage, Rebuilt, and Other Special Titles

Can You Insure A Car With A Branded Title? Unveiling the Truth About Salvage, Rebuilt, and Other Special Titles cars.truckstrend.com

The allure of a significantly lower purchase price often draws consumers to vehicles with a branded title. Whether it’s a car that was once deemed a "total loss" due to an accident, flood, or other major event, these vehicles can represent a substantial saving. However, a common and critical question arises for prospective owners: "Can you insure a car with a branded title?" The short answer is yes, but it’s far from a straightforward "yes." Insuring a vehicle with a branded title introduces a unique set of challenges, considerations, and potential limitations that every buyer must understand before committing.

This comprehensive guide will delve into the intricacies of branded titles, their impact on insurability, and how you can navigate the insurance landscape to protect your investment. We’ll explore the types of branded titles, the reasons insurers approach them with caution, and provide actionable advice to help you secure the coverage you need.

Can You Insure A Car With A Branded Title? Unveiling the Truth About Salvage, Rebuilt, and Other Special Titles

Understanding Branded Titles: What They Mean for Your Car

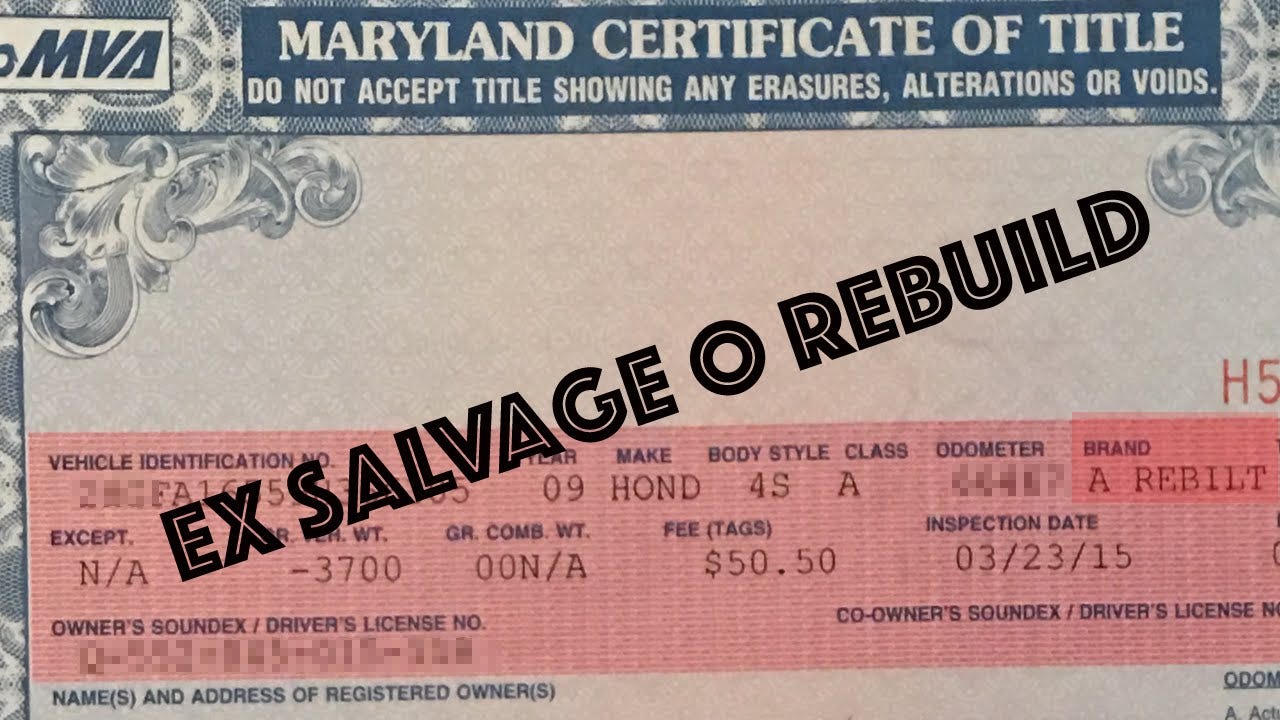

A "branded title" is essentially a permanent label affixed to a vehicle’s title by a state’s Department of Motor Vehicles (DMV) or equivalent authority. This brand indicates a significant event in the vehicle’s history that affects its value, safety, or legal status. Unlike a "clean title," which signifies no major issues, a branded title serves as a warning flag, alerting future owners to potential past problems.

Here are the most common types of branded titles:

- Salvage This is perhaps the most recognized brand. A salvage title is issued when an insurance company declares a vehicle a "total loss." This means the cost of repairing the damage (from an accident, flood, fire, vandalism, etc.) exceeds a certain percentage of the car’s actual cash value (ACV) – typically 70% to 90%, depending on the state. A salvage titled vehicle is not roadworthy and cannot be legally registered or driven.

- Rebuilt/Reconstructed Once a vehicle with a salvage title has been repaired and passes a rigorous state inspection, its title can be upgraded to "rebuilt" or "reconstructed." This indicates that the vehicle is now roadworthy, but its history as a total loss remains permanently etched on its title. These are the most common branded title vehicles consumers seek to insure and drive.

- Flood Issued to vehicles that have sustained significant water damage, often to the point where critical electrical systems, engine components, or the interior are compromised. Even if repaired, hidden corrosion and long-term electrical issues can persist.

- Lemon Some states issue a "lemon" brand for vehicles that have had repeated, unfixable defects under the manufacturer’s warranty, as defined by "lemon laws."

- Odometer Rollback This brand indicates that the vehicle’s odometer has been tampered with to show fewer miles than actually driven, a fraudulent act.

- Junk/Scrap Similar to salvage but implies the vehicle is only good for parts or scrap metal, and is generally beyond economical repair for road use.

The primary reason these titles are issued is to protect consumers. They provide transparency about a vehicle’s past, helping buyers make informed decisions and preventing the sale of potentially unsafe or overvalued vehicles. However, for insurers, they represent a heightened risk.

The Insurance Landscape for Branded Title Cars

The question "Can you insure a car with a branded title?" is often met with nuanced answers from insurance providers. The good news is, yes, it is generally possible to insure a car with a branded title, especially a rebuilt one. However, the terms, availability of coverage, and premiums will differ significantly from a clean-title vehicle.

Why Insurers Hesitate (or Charge More):

- Higher Risk of Future Claims: Insurers are wary of hidden or latent damage that might surface later, leading to more claims. A vehicle that was severely damaged once might be more susceptible to issues down the line, even after repairs.

- Difficulty in Valuing for Total Loss: If a branded title car is involved in another accident and declared a total loss, determining its Actual Cash Value (ACV) becomes complex. Its pre-existing "brand" severely devalues it, making it harder for insurers to calculate a fair payout. They often base payouts on a percentage of a clean title car’s value or its salvage value, which can be significantly lower than what the owner might expect.

- Potential for Fraud: While most owners are legitimate, the history of some branded title vehicles can be murky, raising concerns about potential fraud or misrepresentation of repairs.

Types of Coverage Available:

- Liability Coverage (Mandatory): This is the easiest type of coverage to obtain for a branded title vehicle. Liability insurance covers damages you cause to other people or their property in an accident. Since it doesn’t cover your vehicle, insurers are generally less concerned about your car’s history. Most states require minimum liability coverage to drive legally.

- Collision and Comprehensive Coverage (Optional): This is where the challenge lies. Collision covers damage to your vehicle from an accident, regardless of fault, while comprehensive covers non-collision events like theft, vandalism, fire, or natural disasters.

- Some insurers will refuse to offer these coverages for certain branded titles (especially salvage or flood).

- Others will offer it but with specific conditions:

- Mandatory Inspections: You may be required to have the vehicle thoroughly inspected by a qualified mechanic or a state-approved inspector to verify its roadworthiness and the quality of repairs.

- Higher Premiums: Expect to pay more for collision and comprehensive coverage compared to a similar clean-title vehicle.

- Limited Payouts: Policies might explicitly state that in the event of a total loss, the payout will be significantly less than a clean-title car, reflecting its branded status and diminished value. This is a crucial point to understand.

Navigating the Insurance Process: Steps to Insure a Branded Title Car

Insuring a branded title car requires diligence and transparency. Here’s a step-by-step guide:

- Understand the Title Type: Before you even buy, know the specific brand on the title. A rebuilt title is significantly easier to insure than a salvage or flood title.

- Gather Comprehensive Documentation: For a rebuilt vehicle, collect all records of repairs, including receipts for parts, labor, and detailed descriptions of the work performed. Photos of the vehicle before, during, and after repairs can also be incredibly helpful. Ensure you have the official state inspection certificate that converted the salvage title to rebuilt.

- Get a Pre-Purchase Inspection (PPI): Even if not required by an insurer, a thorough inspection by an independent, trusted mechanic before purchase is highly recommended. This can uncover hidden issues and give you leverage in negotiations.

- Shop Around Extensively: Don’t just call one or two major insurers. Many large national carriers have strict policies against insuring branded titles for full coverage. You’ll likely need to:

- Contact multiple major insurers: Some might be more lenient than others.

- Look for smaller, regional, or specialized insurance companies: These carriers sometimes have a higher risk appetite or more flexible underwriting for unique situations.

- Consider an independent insurance agent/broker: They work with multiple carriers and can often find niche policies or companies willing to insure branded titles.

- Be Transparent and Honest: When getting quotes, always disclose the vehicle’s branded title status upfront. Failing to do so could lead to your policy being voided if a claim arises.

- Understand Policy Limitations and Exclusions: Pay very close attention to the fine print, especially regarding total loss valuations and any specific exclusions related to the car’s branded status. Ask direct questions about how a total loss payout would be calculated.

- Be Prepared for Inspections: Your chosen insurer may require their own inspection of the vehicle before issuing collision or comprehensive coverage. This is standard procedure to verify the quality of repairs and the car’s current condition.

Factors Influencing Insurability and Premiums

Several factors play a role in how easily you can insure a branded title car and what you’ll pay:

- Type of Branded A rebuilt title is the most insurable. Salvage, flood, or junk titles are significantly harder, often only qualifying for liability.

- Quality and Documentation of Repairs: Professionally done repairs with detailed records are crucial. DIY or shoddy repairs will make insurance virtually impossible.

- State Regulations: Some states have specific laws regarding branded titles and insurance, which can affect availability and cost.

- Insurance Company Policy: Each insurer sets its own underwriting guidelines. Some are simply more risk-averse than others.

- Vehicle Make, Model, and Age: High-value, luxury, or performance vehicles, even with a branded title, might be harder to insure for full coverage due to their inherent repair costs. Older, less valuable cars might be easier for liability, but collision/comprehensive might still be tough.

- Your Driving Record: A clean driving history always works in your favor, regardless of the car’s title.

Benefits and Challenges of Owning a Branded Title Car

Owning a branded title vehicle comes with its own set of pros and cons:

Benefits:

- Significant Cost Savings: The primary benefit is the lower purchase price, often 20-50% less than a comparable clean-title vehicle.

- Opportunity for a Newer/Nicer Car: You might be able to afford a newer model or a car with more features than you could otherwise.

- Lower Depreciation: Since you bought it for less, the depreciation hit will be less severe in absolute terms.

Challenges:

- Insurance Difficulties: Higher premiums, potential denial of full coverage, and lower total loss payouts are significant hurdles.

- Lower Resale Value: When you go to sell, expect to sell for significantly less than a clean-title version. The branded title is permanent.

- Financing Challenges: Many lenders are reluctant to finance branded title vehicles due to their reduced value and higher risk.

- Potential for Unforeseen Mechanical Issues: Even with professional repairs, there’s always a risk of latent issues, especially with flood or extensive structural damage.

- Warranty Issues: Manufacturer warranties are typically voided once a vehicle receives a salvage title.

Tips for Successful Insurance and Ownership

- Be Patient: Finding the right insurance can take time and effort.

- Prioritize Safety: Ensure all repairs meet or exceed safety standards. Your life depends on it.

- Maintain Meticulous Records: Keep every piece of paper related to the car’s history, repairs, and inspections. This is invaluable for insurance claims and eventual resale.

- Don’t Overpay: Remember the insurance and resale challenges when negotiating the purchase price. The discount should be substantial.

- Budget for Unexpected Repairs: Set aside a contingency fund for any issues that may arise due to the car’s past.

Factors Affecting Insurance Cost & Coverage for Branded Title Cars

| Factor | Impact on Premium (vs. Clean Title) | Impact on Coverage Availability (Collision/Comprehensive) | Notes |

|---|---|---|---|

| Title Type: Salvage | Very High / Often Uninsurable | Extremely Limited / Often Unavailable | Typically only liability is offered, if at all. Not road legal. |

| Title Type: Rebuilt/Reconstructed | High (10-40% higher) | Limited but Possible | Most common type to insure. Requires proof of repair & inspection. |

| Title Type: Flood | High (20-50% higher) | Limited | High risk of electrical/long-term issues; harder to insure than rebuilt. |

| Title Type: Lemon | Moderate to High | Possible with scrutiny | Depends on nature of original defect and its resolution. |

| Quality of Repairs (for Rebuilt) | Lower (if professional/documented) | Higher (if professional/documented) | DIY or shoddy repairs significantly increase premiums or lead to denial. |

| Independent Inspection (Pre-Insurance) | Can help lower | Can improve chances | Demonstrates roadworthiness and integrity to the insurer. |

| Insurer Type: Major National | Varies (often higher or denial) | Varies (often stricter) | Many have blanket policies against full coverage for branded titles. |

| Insurer Type: Smaller/Specialized | Potentially lower | Higher likelihood | More willing to assess on a case-by-case basis. May require specific inspections. |

| Vehicle Age/Value | Higher for newer/more valuable | Harder for newer/more valuable | Insurers prefer lower Actual Cash Value (ACV) for total loss calculations; high value is higher risk. |

| Driver’s Record | Significantly impacts | Always a factor | A clean driving record always helps mitigate higher branded title premiums. |

| State Regulations | Varies significantly | Varies significantly | Some states mandate insurers to offer certain coverages; others have no specific rules. |

| Declared Value by Insurer | Directly impacts payout | Limited to this declared value | Insurer may set a specific maximum payout for total loss based on branded status. |

Frequently Asked Questions (FAQ)

Q: Is it harder to get insurance for a branded title car?

A: Yes, it is generally harder to get comprehensive and collision coverage for a branded title car than for a clean-title vehicle. You may need to shop around more and deal with higher premiums or specific requirements.

Q: Will my premium be higher for a branded title car?

A: For collision and comprehensive coverage, yes, expect your premiums to be noticeably higher due to the perceived increased risk. Liability-only coverage may not see as drastic a price difference.

Q: Can I get full coverage (collision/comprehensive) on a branded title car?

A: Yes, it is possible, especially for "rebuilt" titles, but it’s not guaranteed. Many insurers will offer it, but often with conditions like mandatory inspections, higher deductibles, and lower payout limits in case of a total loss.

Q: What documents do I need to insure a rebuilt title car?

A: You’ll typically need the vehicle’s title showing the "rebuilt" brand, documentation of all repairs (receipts, service records), and the state inspection certificate that converted it from salvage to rebuilt. Photos of the repair process can also be helpful.

Q: Will a branded title affect my car’s resale value?

A: Absolutely. A branded title significantly reduces a car’s resale value, often by 20-50% or more compared to a comparable clean-title vehicle. It also limits your pool of potential buyers.

Q: Are all branded titles the same in the eyes of an insurer?

A: No. Insurers view different branded titles differently. A "rebuilt" title is generally the most insurable, while "salvage," "flood," or "junk" titles are much more challenging, often only qualifying for liability coverage.

Q: What if my car was repaired by a previous owner?

A: It’s still your responsibility to provide documentation of the repairs and the car’s current roadworthiness. Always request these records from the seller before purchase. Without them, it will be much harder to secure insurance.

Concluding Summary

Insuring a car with a branded title, particularly a rebuilt one, is indeed possible, but it demands a proactive and informed approach. While the initial cost savings of purchasing such a vehicle can be tempting, it’s crucial to weigh these benefits against the potential complexities of securing adequate insurance, navigating higher premiums, and understanding limitations on total loss payouts.

Transparency with insurers, meticulous record-keeping of repairs, and diligent shopping around are key to a successful outcome. By understanding the nuances of branded titles and their implications for insurance, you can make an educated decision and ensure your unique vehicle is properly protected on the road. Remember, a branded title car can be a great value, but only if you’re fully prepared for the journey of owning and insuring it.