Car Brands With Cheapest Insurance: Navigating the Road to Affordable Coverage

Car Brands With Cheapest Insurance: Navigating the Road to Affordable Coverage cars.truckstrend.com

In the journey of car ownership, the initial sticker price is just one part of the financial equation. A significant, often overlooked, ongoing cost is car insurance. For many, finding a vehicle that offers reliable transportation without breaking the bank on premiums is a top priority. While personal factors like driving history, age, and location play a massive role, the car brand and model you choose can also significantly impact how much you pay for insurance. This comprehensive guide delves into "Car Brands With Cheapest Insurance," helping you understand the underlying factors and identify vehicles that tend to offer more budget-friendly coverage.

Understanding which car brands are typically cheaper to insure is not merely about saving money; it’s about making an informed decision that contributes to your long-term financial well-being. It empowers you to select a vehicle that aligns with your budget, preventing sticker shock when the insurance bill arrives.

Car Brands With Cheapest Insurance: Navigating the Road to Affordable Coverage

Understanding Car Insurance Costs: Beyond the Brand

Before diving into specific brands, it’s crucial to grasp that insurance premiums are a complex calculation based on numerous variables. The car brand is a piece of the puzzle, but it’s not the only one. Insurers assess risk, and this risk is influenced by:

- Driver Demographics: Your age, gender, marital status, driving record (accidents, tickets), credit score (in most states), and even your occupation can all affect your rates.

- Location: Urban areas typically have higher rates due to increased traffic, theft, and vandalism. Rural areas often see lower rates.

- Coverage Type and Deductible: The more comprehensive your coverage (e.g., full coverage vs. liability only) and the lower your deductible, the higher your premium will be.

- Vehicle Characteristics: This is where the car brand and model come into play. Insurers look at:

- Safety Features and Ratings: Cars with higher safety ratings and advanced driver-assistance systems (ADAS) like automatic emergency braking or lane-keeping assist can qualify for discounts.

- Repair Costs: Vehicles with easily accessible, affordable parts and simpler repair processes tend to be cheaper to insure. Luxury or high-performance cars often have specialized, expensive parts.

- Theft Rates: Models frequently targeted by thieves will have higher comprehensive coverage costs.

- Engine Size and Horsepower: High-performance vehicles are associated with higher speeds and greater accident risk, leading to higher premiums.

- Vehicle Value and Depreciation: The higher the car’s value, the more an insurer might have to pay out in case of a total loss. Vehicles that hold their value well might also see slightly higher comprehensive rates.

Therefore, while certain brands generally offer cheaper insurance, the specific model, trim level, and your personal profile are equally, if not more, important.

Characteristics of Cars That Are Cheaper to Insure

Insurance companies evaluate vehicles based on their statistical likelihood of being involved in an accident, being stolen, or incurring high repair costs. Cars that tend to be cheaper to insure typically share these characteristics:

- High Safety Ratings: Vehicles with top scores from organizations like the Insurance Institute for Highway Safety (IIHS) and the National Highway Traffic Safety Administration (NHTSA) demonstrate a lower risk of injury to occupants, reducing potential medical and liability claims.

- Lower Repair Costs: Common, non-specialized parts that are readily available and simple to replace lead to lower repair bills after an accident, which translates to lower premiums.

- Lower Theft Rates: Cars that are less frequently stolen pose less risk to insurers, particularly for comprehensive coverage.

- Moderate Performance: Everyday sedans, compact cars, and smaller SUVs with standard engines are generally cheaper to insure than sports cars, luxury vehicles, or high-horsepower trucks. They are perceived as less likely to be driven recklessly.

- Lower Initial Value and Slower Depreciation: Less expensive cars cost less for insurers to replace in the event of a total loss.

- Practicality Over Flashiness: Vehicles often chosen by families or individuals prioritizing reliability and economy over speed or luxury tend to have lower accident rates and thus cheaper insurance.

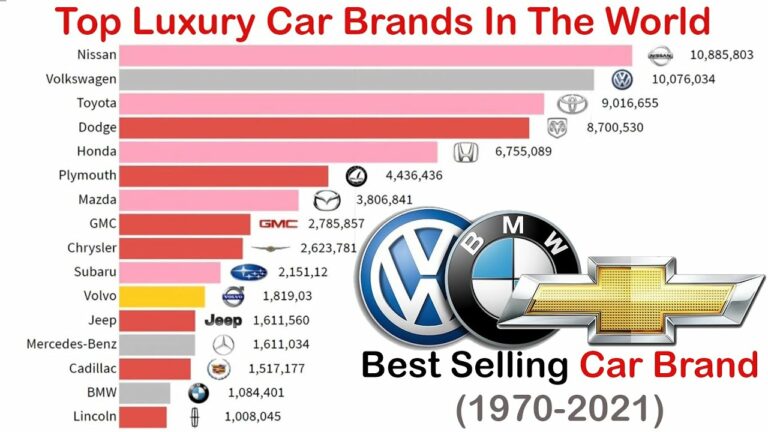

Top Car Brands Generally Associated with Cheaper Insurance

Based on the characteristics above, several car brands consistently appear on lists of vehicles that are more affordable to insure. These brands often excel in safety, reliability, and widespread availability of parts, making them a lower risk for insurance companies.

- Toyota: Renowned for reliability, safety, and widespread availability of parts, Toyota models like the Corolla, Camry, and RAV4 are consistently among the cheapest to insure. They often come equipped with excellent safety features (Toyota Safety Sense) and have low theft rates for their standard models.

- Honda: Similar to Toyota, Honda vehicles like the Civic (non-Si or Type R), CR-V, and Accord (base models) are known for their safety, dependability, and reasonable repair costs. Their popularity means parts are abundant and mechanics are familiar with them.

- Subaru: While often associated with all-wheel drive, Subaru’s strong emphasis on safety (especially with their EyeSight driver-assist technology) and good crash test ratings make models like the Impreza, Forester, and Outback attractive to insurers. They also have a reputation for being driven responsibly.

- Hyundai/Kia: These Korean brands have made significant strides in safety, reliability, and design. Models such as the Hyundai Elantra, Kona, Venue, Kia Forte, Soul, and Seltos offer great value, good safety features, and generally lower repair costs due to widespread parts availability. Their acquisition costs are also often lower.

- Mazda: Increasingly recognized for their safety and reliability, Mazda models like the Mazda3 and CX-5 offer a balance of driving dynamics and practicality, often appealing to more mature drivers, which can translate to lower insurance rates.

- Nissan: While some models can be pricier, Nissan’s more economical options like the Sentra, Versa, and Rogue often feature well-regarded safety technology and are less frequently targeted by thieves compared to high-performance vehicles.

- Volkswagen: Particularly for their sedans and compact SUVs like the Jetta, Golf (non-GTI/R), and Tiguan, Volkswagen vehicles offer solid build quality and good safety features, contributing to moderate insurance costs.

Important Caveat: Even within these brands, specific models and trim levels can drastically alter insurance costs. A Toyota Supra or a Honda Civic Type R, for instance, will be significantly more expensive to insure than a standard Corolla or Civic due to their performance characteristics and higher risk profiles.

How to Research and Compare Insurance Costs for Specific Brands/Models

The best way to know the true cost of insurance for a car you’re considering is to get quotes before you buy.

- Get Quotes Early: As soon as you narrow down your car choices, obtain insurance quotes for each specific make, model, and trim level.

- Provide Accurate Information: Be prepared to provide details like the VIN (if you have it), exact year, make, model, trim, and any specific safety features. This ensures the most accurate quote.

- Use Online Comparison Tools: Websites like Policygenius, Insurify, or NerdWallet allow you to compare quotes from multiple insurers simultaneously, saving you time and effort.

- Contact Multiple Insurers Directly: Don’t rely on just one or two quotes. Reach out to national providers (State Farm, Geico, Progressive, Allstate, etc.) and local independent agents who can shop around for you.

- Understand Coverage Levels: Ensure you’re comparing "apples to apples" by requesting quotes for the same coverage types, deductibles, and limits across all insurers.

- Ask About Discounts: Inquire about all available discounts. These can include good driver discounts, multi-policy discounts (bundling home and auto), good student discounts, anti-theft device discounts, low mileage discounts, and more.

Beyond the Brand: Other Strategies to Lower Your Premiums

While choosing a car from a "cheaper to insure" brand is a great start, there are many other actionable strategies to keep your premiums down:

- Maintain a Clean Driving Record: This is paramount. Avoiding accidents and traffic violations is the single most effective way to keep your rates low over the long term.

- Improve Your Credit Score: In most states, insurers use credit-based insurance scores. A higher score often translates to lower premiums.

- Increase Your Deductible: Opting for a higher deductible (e.g., $1,000 instead of $500) means you pay more out-of-pocket if you make a claim, but your monthly premiums will be lower.

- Bundle Policies: Many insurers offer discounts if you purchase multiple policies (e.g., auto and home insurance) from them.

- Utilize Telematics/Usage-Based Insurance: Many insurers offer programs that monitor your driving habits (speed, braking, mileage). Safe drivers can earn significant discounts.

- Take a Defensive Driving Course: Some insurers offer discounts for completing approved defensive driving courses, especially for younger drivers.

- Review Your Policy Regularly: Your needs and circumstances change. Periodically review your coverage to ensure you’re not over-insured for an older vehicle or missing out on new discounts.

- Consider Dropping Comprehensive/Collision on Older Cars: For very old cars with low market value, the cost of full coverage might outweigh its benefit.

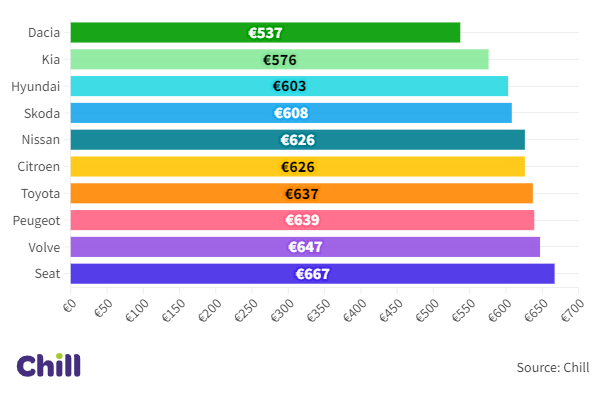

Car Brands with Cheapest Insurance: A General Overview Table

This table provides a general overview of car brands and models that are frequently associated with lower insurance costs, along with the common reasons why. Please remember that actual costs are highly individual and depend on many factors.

| Car Brand | Representative Models (Commonly Cheaper to Insure) | Key Reasons for Lower Insurance Costs | Relative Insurance Cost Index (1=Cheapest, 5=Most Expensive) |

|---|---|---|---|

| Toyota | Corolla, Camry, RAV4, Prius | High safety ratings, low theft rates, reliable, affordable parts, wide availability, strong resale. | 1-2 |

| Honda | Civic (non-Si/Type R), CR-V, HR-V, Accord (base) | Excellent safety, reliability, low repair costs, popular but not high-risk for standard models. | 1-2 |

| Subaru | Impreza, Forester, Outback | Strong safety features (EyeSight), good crash test results, AWD often a factor in safety perception. | 2 |

| Hyundai | Elantra, Kona, Venue, Tucson | Improving safety, lower acquisition cost, good warranty, lower theft rates for many models, affordable parts. | 2-3 |

| Kia | Forte, Soul, Seltos, Sportage | Similar to Hyundai: Value, safety tech, good warranties, moderate repair costs, accessible parts. | 2-3 |

| Mazda | Mazda3, CX-30, CX-5 | Good safety ratings, reliable, often driven by mature and cautious drivers. | 2-3 |

| Nissan | Sentra, Versa, Rogue | Economical, good safety features on newer models, widely available and affordable parts. | 2-3 |

| Volkswagen | Jetta, Golf (non-GTI/R), Tiguan | Solid safety, good build quality, often chosen for practicality and reliability. | 2-3 |

Disclaimer: This table provides general insights. Actual insurance costs depend on numerous individual factors including your driving record, location, age, coverage limits, deductible, and the specific trim level and year of the vehicle. Always get multiple quotes for the exact car you intend to purchase and your personal profile.

Frequently Asked Questions (FAQ)

Q: Is a new car always more expensive to insure than an old one?

A: Generally, yes. Newer cars are more valuable, costing more for insurers to replace or repair. However, older cars might lack modern safety features, which could slightly offset this. Very old cars might also have high collision or comprehensive rates if parts are scarce.

Q: Does the color of my car affect insurance?

A: No, the color of your car has absolutely no impact on insurance premiums. This is a common myth. Insurers care about the make, model, year, engine size, safety features, and theft rates, not the paint job.

Q: Can I get cheaper insurance if I drive less?

A: Yes! Many insurers offer low-mileage discounts or usage-based insurance programs (telematics) that track your actual driving habits and mileage. If you drive less, you’re statistically less likely to be in an accident, leading to lower premiums.

Q: What’s the difference between liability and full coverage?

A: Liability coverage pays for damages and injuries you cause to other people and their property. It’s the minimum required by law in most states. Full coverage typically includes liability plus comprehensive (covers damages to your car from non-collision events like theft, fire, hail) and collision (covers damages to your car from a collision, regardless of fault). Full coverage is always more expensive but offers greater protection.

Q: Does my credit score affect car insurance?

A: In most states, yes. Insurers use credit-based insurance scores as a predictor of risk. Studies have shown a correlation between higher credit scores and a lower likelihood of filing claims. A good credit score can lead to lower premiums.

Q: Why do sports cars cost more to insure?

A: Sports cars are typically more expensive to insure because they are often associated with higher speeds, more aggressive driving, and thus a greater risk of accidents. They also tend to have higher repair costs due to specialized parts and are more frequently targeted by thieves.

Conclusion

Choosing a car brand with historically cheaper insurance can be a smart financial move, but it’s crucial to remember that it’s just one piece of the puzzle. Brands like Toyota, Honda, Subaru, Hyundai, Kia, Mazda, and Nissan often lead the pack due to their strong safety records, reliability, and widespread parts availability. However, your personal driving record, location, chosen coverage, and even the specific trim of the vehicle will ultimately dictate your final premium.

The key takeaway is to approach car buying with insurance costs in mind. Don’t just fall in love with a car; get quotes for it. By combining the wisdom of choosing a generally "cheaper to insure" brand with diligent research and smart driving habits, you can navigate the road to car ownership with confidence and significant savings.