Car Brands With Cheapest Insurance: Your Comprehensive Guide to Affordable Coverage

Car Brands With Cheapest Insurance: Your Comprehensive Guide to Affordable Coverage cars.truckstrend.com

Buying a car is a significant investment, but the sticker price is only one piece of the financial puzzle. Often overlooked, yet equally crucial, is the ongoing cost of car insurance. For many, insurance premiums can add hundreds, if not thousands, to their annual vehicle expenses. This is why understanding which car brands tend to offer the cheapest insurance rates can be a game-changer for your budget.

"Car Brands With Cheapest Insurance" refers to specific manufacturers or, more accurately, certain models within those brands, that statistically incur lower insurance premiums compared to others. This isn’t just about luck; it’s a direct reflection of various factors, including the vehicle’s safety features, repair costs, theft rates, and overall market perception. By making an informed choice, you can significantly reduce your total cost of car ownership, freeing up funds for other financial goals or simply enjoying your drive without the burden of excessive premiums. This guide will delve into the intricacies of car insurance costs, highlight brands known for affordability, and provide actionable insights to help you secure the best rates.

Car Brands With Cheapest Insurance: Your Comprehensive Guide to Affordable Coverage

Why Do Some Car Brands Cost Less to Insure? Understanding the Underlying Factors

Insurance companies are in the business of assessing risk. The less risk a car brand or model presents, the lower the premium. Several key factors contribute to a vehicle’s insurance cost:

- Safety Ratings: Vehicles with higher safety ratings (from organizations like the IIHS and NHTSA) are less likely to result in severe injuries or fatalities in an accident. This translates to lower payouts for medical claims and liability, making them cheaper to insure. Brands that consistently prioritize robust safety features and excel in crash tests often fall into this category.

- Repair Costs and Parts Availability: Cars that are expensive to repair or require specialized, hard-to-find parts will naturally cost more to insure. This is because collision and comprehensive claims will be higher. Brands known for using common, readily available parts and having simpler repair processes tend to be more affordable to cover. Japanese and Korean manufacturers often excel here.

- Theft Rates: Vehicles that are frequently stolen are deemed higher risk. Insurance companies track theft data, and models that appear on "most stolen" lists will carry higher comprehensive insurance premiums. Cars that are less attractive to thieves or are equipped with advanced anti-theft technology can mitigate this risk.

- Performance and Power: High-performance vehicles, sports cars, and luxury models with powerful engines are associated with higher speeds and, consequently, a greater risk of accidents. They also tend to be more expensive to repair or replace. Mainstream, economy-focused models generally have lower performance figures and, thus, lower insurance costs.

- Vehicle Value and Depreciation: The higher the market value of a vehicle, the more expensive it is to replace if totaled. While depreciation reduces the value over time, new, expensive cars will always have higher comprehensive and collision costs. Brands that offer good value at lower price points often have cheaper insurance.

- Driver Demographics and Usage: While not strictly about the car brand, insurance companies also consider the typical driver profile associated with certain vehicles. For instance, a minivan might be associated with a family driver, while a sports coupe might be linked to a younger, potentially riskier driver.

Top Car Brands Generally Known for Cheaper Insurance

While specific models matter more than the brand itself, certain manufacturers have built a reputation for producing vehicles that consistently rank well in terms of insurance affordability. These brands often excel in the factors mentioned above:

- Subaru: Renowned for their symmetrical all-wheel drive and strong safety ratings, Subarus like the Forester, Outback, and Impreza often boast competitive insurance rates. Their EyeSight Driver Assist Technology suite contributes significantly to their safety appeal.

- Honda: A long-standing favorite, Honda’s reputation for reliability, safety, and widespread availability of parts makes models like the Civic, Accord, and CR-V generally affordable to insure. They are also less prone to theft than some other brands.

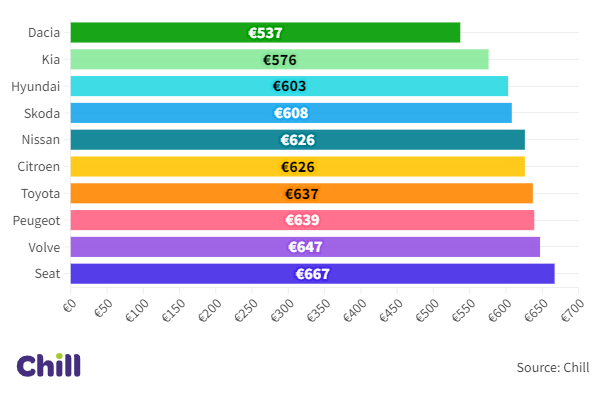

- Toyota: Similar to Honda, Toyota’s unparalleled reliability, high safety scores, and easily accessible, affordable parts make vehicles like the Corolla, Camry, and RAV4 very cost-effective to insure. Their hybrid models (e.g., Prius) also tend to have favorable rates due to their efficiency and typically cautious drivers.

- Volkswagen: While some VW models can be pricier, many of their popular offerings, like the Jetta and Tiguan, offer a good balance of safety, quality, and reasonable repair costs, leading to competitive insurance premiums.

- Hyundai: Over the past decade, Hyundai has significantly improved its safety features and reliability. Models such as the Elantra, Sonata, and Kona often provide excellent value and come with relatively low insurance costs, especially for their standard trims.

- Kia: Sharing platforms with Hyundai, Kia vehicles like the Forte, Soul, and Sportage also benefit from strong safety features and competitive pricing, making them attractive options for budget-conscious insurance shoppers.

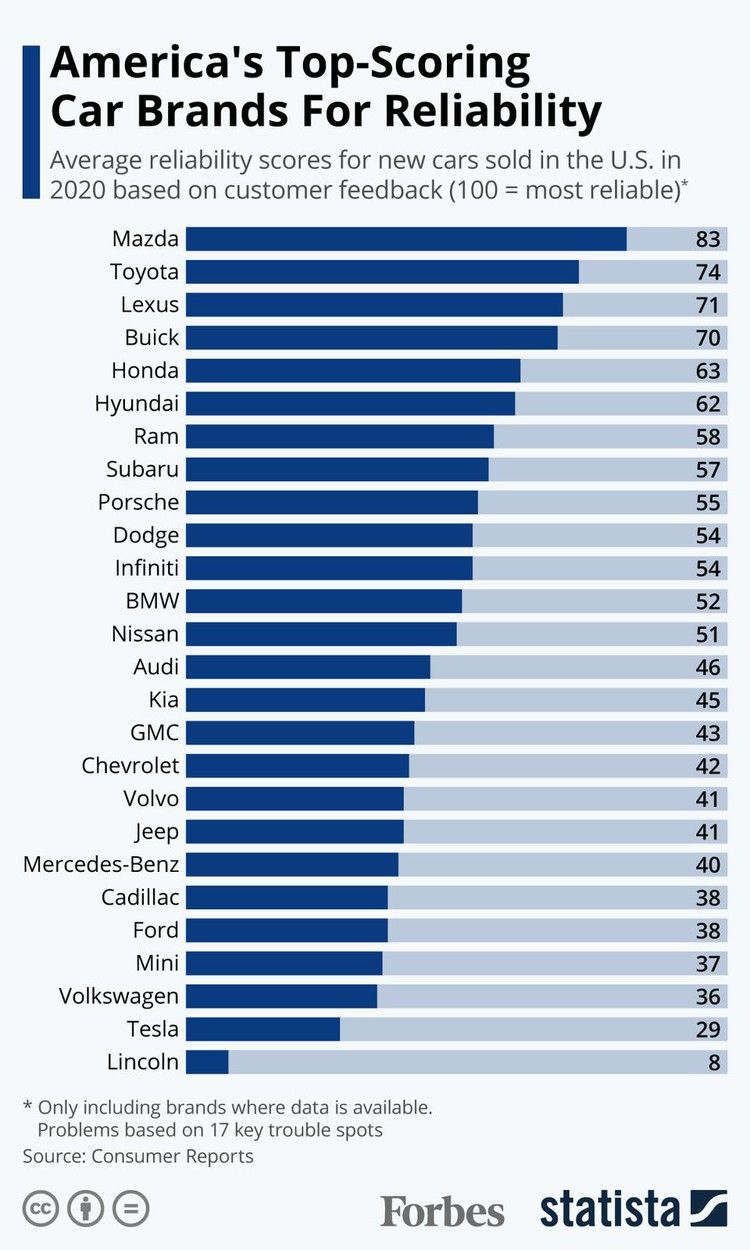

- Mazda: Mazda has carved a niche for itself with well-engineered, fun-to-drive cars that also prioritize safety. Models like the Mazda3 and CX-5 often have reasonable insurance rates due to their strong safety performance and moderate repair costs.

- Chevrolet (Certain Models): While Chevy has a broad lineup, their more mainstream and family-oriented models like the Malibu, Equinox, and Trax can offer very competitive insurance rates, especially when equipped with standard safety features.

Beyond the Brand: Model-Specific Insurance Costs

It’s crucial to understand that simply choosing a brand from the list above isn’t a guarantee of cheap insurance. The specific model, trim level, and even the engine size within that brand can significantly impact your premiums.

For example:

- A Honda Civic LX (base model sedan) will almost certainly be cheaper to insure than a Honda Civic Type R (high-performance variant). The Type R has a more powerful engine, is more likely to be driven aggressively, and parts for its specialized components are more expensive.

- A Toyota RAV4 LE (base SUV) will likely have lower insurance costs than a Toyota Supra (sports car), even though both are Toyotas.

- Within the same model, choosing a higher trim level with more advanced technology might slightly increase the premium due to higher replacement costs for sophisticated components. However, if those components include advanced safety features (like automatic emergency braking), they could also lead to discounts.

Always get quotes for the exact model and trim you are considering.

How to Research Insurance Costs Before Buying

The best way to ensure you’re getting a car with cheap insurance is to do your homework before you make a purchase.

- Get Multiple Quotes: This is the golden rule. Never settle for the first quote you receive. Use online comparison websites (e.g., Progressive, Geico, Allstate, State Farm, independent brokers) or call several insurance providers directly. Provide them with the exact VIN or the precise year, make, model, and trim of the vehicle you’re considering.

- Use Online Comparison Tools: Many insurance aggregators allow you to compare quotes from various providers side-by-side, making the process efficient.

- Consider Vehicle History: If buying a used car, a clean vehicle history report (e.g., CarFax) can indicate a well-maintained car, which might indirectly reflect lower risk.

- Check Safety Ratings: Consult the websites of the Insurance Institute for Highway Safety (IIHS) and the National Highway Traffic Safety Administration (NHTSA) for crash test ratings and safety feature evaluations. Look for vehicles that have received "Top Safety Pick" or 5-star ratings.

- Research Repair Costs and Parts Availability: A quick online search for "common repair costs [car model]" or "parts cost [car model]" can give you an idea of potential expenses. Vehicles with readily available, non-specialized parts are often cheaper to fix.

Tips for Further Reducing Car Insurance Costs (Regardless of Brand)

Even with a car brand known for cheap insurance, you can still take steps to lower your premiums:

- Bundle Policies: Combine your auto insurance with home, renters, or life insurance from the same provider for multi-policy discounts.

- Increase Your Deductible: Opting for a higher deductible (the amount you pay out-of-pocket before insurance kicks in) can significantly lower your premium. Just ensure you can afford the higher deductible if an accident occurs.

- Maintain a Clean Driving Record: Avoid accidents and traffic violations. A spotless record is the single most effective way to keep your premiums low.

- Take a Defensive Driving Course: Many insurers offer discounts for completing an approved defensive driving course.

- Utilize Low Mileage Discounts: If you don’t drive much, inform your insurer. Many companies offer discounts for drivers who log fewer miles annually.

- Install Anti-Theft Devices: Alarms, immobilizers, or GPS tracking systems can lead to discounts on your comprehensive coverage.

- Good Student Discounts: If you’re a student with good grades, many insurers offer discounts.

- Ask About All Available Discounts: Don’t hesitate to ask your agent about every possible discount you might qualify for. These can include professional affiliations, good payment history, or even being paperless.

- Review Your Policy Annually: Your needs and the market change. Shop around and compare quotes at least once a year, or whenever your policy is up for renewal.

Challenges and Considerations

While aiming for cheap insurance is smart, there are a few things to keep in mind:

- Location Matters: Insurance rates vary dramatically by zip code due to factors like local accident rates, theft rates, and population density. A car that’s cheap to insure in a rural area might be more expensive in a major city.

- Driver Profile is Key: Your age, driving history, credit score (in some states), marital status, and even occupation can influence your rates more than the car itself.

- New vs. Used: While newer cars often have more advanced safety features, their higher replacement value can mean higher premiums. Older cars might be cheaper to insure for collision/comprehensive but might lack modern safety tech.

- Trade-offs: Sometimes, the car with the absolute cheapest insurance might not be the car you truly want or need. Balance the cost savings with your personal preferences, lifestyle, and desired features.

Estimated Annual Insurance Cost Table for Popular "Cheaper to Insure" Models

Disclaimer: These figures are highly generalized estimates for a hypothetical average driver (e.g., 30-40 years old, clean record, good credit) in a moderate-cost state. Actual costs will vary significantly based on your specific profile, location, chosen coverage limits, and current market conditions. Always obtain personalized quotes.

| Car Brand | Model (Commonly Cheaper Trim) | Estimated Annual Insurance Cost Range (Relative) | Key Reasons for Lower Cost |

|---|---|---|---|

| Toyota | Corolla (LE/SE) | $1,200 – $1,650 (Low) | Excellent safety ratings, high reliability, low theft rates, affordable parts, popular with safe drivers. |

| Toyota | Camry (LE/SE) | $1,300 – $1,750 (Low) | Similar to Corolla, but slightly higher due to larger size/value. Still very reliable and safe. |

| Toyota | RAV4 (LE/XLE) | $1,350 – $1,800 (Low to Moderate) | Popular family SUV, strong safety, good reliability, widespread parts. Higher than sedans due to SUV class. |

| Honda | Civic (LX/EX) | $1,250 – $1,700 (Low) | Very popular, good safety, reliable, common parts, low theft risk compared to some other popular models. |

| Honda | CR-V (LX/EX) | $1,300 – $1,750 (Low to Moderate) | Family-friendly SUV, excellent safety scores, good reliability. Slightly higher than Civic due to SUV class. |

| Subaru | Impreza (Base/Premium) | $1,300 – $1,750 (Low) | Standard AWD, strong safety features (EyeSight), good crash test performance. |

| Subaru | Forester (Base/Premium) | $1,350 – $1,800 (Low to Moderate) | Very safe family SUV, high visibility, durable, often driven by careful owners. |

| Hyundai | Elantra (SE/SEL) | $1,200 – $1,600 (Low) | Strong warranty, improving safety scores, competitive pricing, good reliability. |

| Kia | Forte (LX/LXS) | $1,200 – $1,600 (Low) | Shares platform with Elantra, similar benefits of affordability, good features for the price, decent safety. |

| Mazda | Mazda3 (2.5 S/Select) | $1,250 – $1,700 (Low) | Excellent safety ratings, refined driving experience, generally lower theft rates than some competitors, good reliability. |

| Chevrolet | Malibu (LS/RS) | $1,300 – $1,750 (Low to Moderate) | Mainstream sedan, readily available parts, generally considered a lower risk for theft and high-speed incidents compared to sportier models. |

| Volkswagen | Jetta (S/Sport) | $1,250 – $1,700 (Low) | Solid build quality, good safety features, relatively affordable to repair, not a high-performance vehicle. |

Frequently Asked Questions (FAQ)

Q1: Does the color of my car affect my insurance rates?

A: No, the color of your car has absolutely no impact on your insurance premiums. This is a common myth. Insurers care about the make, model, year, engine size, safety features, and driver behavior, not aesthetics.

Q2: Is a luxury car always more expensive to insure?

A: Generally, yes. Luxury cars typically have higher MSRPs, more expensive specialized parts, and often incorporate complex technology that is costly to repair or replace. They can also be targeted more by thieves.

Q3: How much does my driving record impact insurance costs?

A: Your driving record is one of the most significant factors. Accidents, traffic violations (especially speeding tickets or DUIs), and claims history will substantially increase your premiums. A clean record, conversely, is rewarded with lower rates.

Q4: Can I get cheaper insurance if I drive less?

A: Yes, many insurance companies offer "low mileage discounts" for drivers who drive below a certain number of miles per year (e.g., less than 7,500 or 10,000 miles). Some even offer usage-based insurance programs where your premium is based on how and how much you drive, tracked by a telematics device.

Q5: Should I get full coverage or just liability?

A: This depends on the value of your car and your financial situation.

- Liability coverage is legally required in most states and covers damages you cause to others.

- Full coverage (which includes collision and comprehensive) protects your own vehicle against damage from accidents, theft, vandalism, and natural disasters.

If you have a loan or lease, full coverage is usually mandatory. If your car is older and has low cash value, dropping collision/comprehensive might save you money, but you’d be responsible for repairs or replacement if your car is damaged.

Concluding Summary

Navigating the world of car insurance can seem daunting, but by understanding the factors that influence premiums and knowing which car brands and models tend to offer more affordable coverage, you can make a financially savvy decision. Brands like Toyota, Honda, Subaru, Hyundai, and Kia frequently appear on lists for cheaper insurance due to their strong safety records, reliability, and reasonable repair costs.

However, remember that the "cheapest" car insurance is not solely determined by the brand; your individual driving history, location, chosen coverage, and the specific model and trim level all play significant roles. The most effective strategy is to research thoroughly, compare multiple quotes for the exact vehicle you’re considering, and actively seek out discounts. By adopting a proactive approach, you can drive away in a vehicle that not only meets your needs but also keeps your insurance premiums comfortably within your budget, allowing you to enjoy the open road with greater peace of mind.