Car Brands With Lowest Insurance: A Comprehensive Guide to Affordable Coverage

Car Brands With Lowest Insurance: A Comprehensive Guide to Affordable Coverage cars.truckstrend.com

The dream of owning a car often comes with the less glamorous reality of recurring costs, and among the most significant of these is car insurance. While factors like your driving record, age, location, and credit score play a pivotal role, the make and model of your vehicle also heavily influence your premium. Understanding which car brands generally boast lower insurance rates can be a game-changer for your budget, transforming a seemingly small saving into thousands of dollars over the lifetime of your vehicle.

This comprehensive guide will delve into the world of car brands with the lowest insurance, exploring the underlying reasons behind these cost efficiencies and providing actionable insights to help you make an informed decision.

Car Brands With Lowest Insurance: A Comprehensive Guide to Affordable Coverage

Understanding Car Insurance Costs: Beyond the Brand

Before we pinpoint specific brands, it’s crucial to grasp the multifaceted nature of car insurance pricing. Insurers assess risk, and that risk is a combination of the driver and the vehicle. While your personal profile (driving history, age, location, marital status, credit score, etc.) is highly influential, the car itself contributes significantly based on:

- Safety Features and Ratings: Vehicles with advanced safety features (e.g., automatic emergency braking, lane-keeping assist) and high crash-test ratings (from organizations like NHTSA and IIHS) are less likely to result in injury or severe damage, leading to lower claims and thus lower premiums.

- Repair Costs and Parts Availability: Cars that are expensive to repair, require specialized parts, or have parts that are difficult to source will naturally cost more to insure. Brands with readily available, affordable parts and simpler repair processes tend to have lower premiums.

- Theft Rates: Models frequently targeted by thieves are riskier to insure. Insurers track theft data, and if a particular model has a high theft rate, its insurance costs will reflect that risk.

- Engine Size and Performance: High-performance vehicles with powerful engines are associated with higher speeds and more aggressive driving, leading to a greater likelihood of accidents. Consequently, they often carry higher insurance premiums.

- Vehicle Value and Depreciation: More expensive cars cost more to replace or repair after an accident, driving up collision and comprehensive coverage costs. How quickly a car depreciates can also influence its insurable value over time.

- Popularity and Widespread Use: Brands and models that are widely popular often benefit from economies of scale in parts manufacturing and a broader network of mechanics familiar with their repair, indirectly contributing to lower insurance costs.

Key Characteristics of Low-Insurance Car Brands

The car brands that consistently appear on "lowest insurance" lists share several common characteristics:

- Exceptional Safety Records: These brands prioritize safety, often earning top ratings in crash tests and equipping their vehicles with robust standard safety features.

- Economical to Repair: They utilize widely available, standard parts that are not excessively expensive, making post-accident repairs more affordable for insurers.

- Lower Theft Appeal: Their models are typically less attractive to car thieves compared to high-end luxury or performance vehicles.

- Modest Performance & Family-Oriented Design: They generally focus on reliability, fuel efficiency, and practicality rather than raw speed or luxury, appealing to a demographic statistically less prone to high-risk driving.

- Strong Reliability Reputation: Fewer mechanical breakdowns mean fewer claims related to vehicle issues (though this is more for mechanical breakdown insurance, it often correlates with overall lower risk perception).

Top Car Brands Typically Associated with Lower Insurance Costs

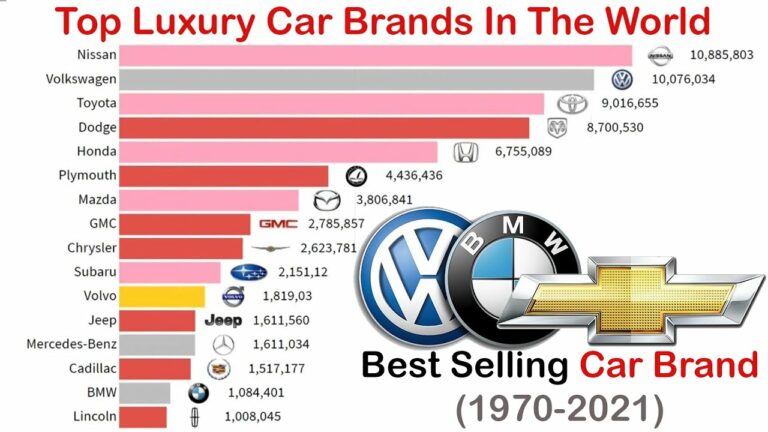

While specific models within a brand will always vary, certain manufacturers consistently produce vehicles that are cheaper to insure across their lineup. Here are some of the most prominent:

- Honda: Brands like Honda, particularly models such as the Civic, CR-V, and HR-V, are perennial favorites for affordable insurance. Their excellent safety ratings, widespread availability of parts, high reliability, and modest theft rates contribute significantly. Honda vehicles are known for their longevity, making them a safe bet for insurers.

- Toyota: Toyota is synonymous with reliability and safety. Models like the Corolla, Camry, RAV4, and Prius are consistently among the cheapest to insure. Their reputation for minimal breakdowns, high resale value (which surprisingly can help by showing they are well-maintained), and low repair costs due to parts commonality are major factors. Toyota also invests heavily in safety technology.

- Subaru: Often praised for their standard all-wheel drive and strong safety performance (especially models like the Outback, Forester, and Impreza), Subarus tend to have very low comprehensive and collision claims. Their owners are often seen as responsible, family-oriented drivers, which influences insurer perception. They also boast impressive IIHS safety ratings.

- Hyundai/Kia: In recent years, Hyundai and Kia have made significant strides in design, quality, and safety, while maintaining competitive pricing. Models like the Elantra, Forte, Kona, and Soul offer good value and come equipped with a solid suite of safety features. Their parts are generally affordable, and they haven’t historically been high on theft lists (though some specific models have seen recent upticks, which could impact future rates, so it’s worth checking current data).

- Mazda: Mazda has quietly built a reputation for reliable, fun-to-drive cars that are also safe and relatively inexpensive to insure. The Mazda3 and CX-5 are good examples. While offering a more engaging driving experience than some rivals, they don’t venture into high-performance territory that would spike insurance costs. Their parts are also reasonably priced.

- Chevrolet (Certain Models): While Chevy has a wide range of vehicles, their more economical, family-oriented models like the Malibu or Equinox can offer competitive insurance rates. These tend to be robust, with widely available parts and lower theft rates than some of their sportier counterparts.

How to Research and Compare Insurance Costs for Specific Models/Brands

Even within the "lowest insurance" brands, rates can vary significantly by model, trim, and your individual profile. Here’s how to get the most accurate picture:

- Get Multiple Quotes: Never settle for the first quote. Use online comparison tools (e.g., Progressive, Geico, Allstate, State Farm, independent brokers) to get quotes from several insurers.

- Provide Accurate Information: Be precise with your personal details, driving history, and vehicle information (VIN, trim level, optional features).

- Consider the Trim Level: A base model of a Toyota Corolla will almost certainly be cheaper to insure than a fully loaded, higher-performance XSE trim.

- Factor in Safety Features: Inquire about specific safety features your potential car has (e.g., blind-spot monitoring, adaptive cruise control) as these can sometimes qualify for discounts.

- Test Drive Insurance: Before you commit to buying a car, get insurance quotes for it. This is a crucial step that many buyers overlook.

Beyond the Brand: Other Strategies to Lower Your Car Insurance

While choosing a low-insurance car brand is a great start, combining it with these strategies can lead to even greater savings:

- Maintain a Clean Driving Record: This is paramount. Avoid accidents and traffic violations.

- Improve Your Credit Score: In many states, a good credit score correlates with lower premiums.

- Choose a Higher Deductible: If you can afford to pay more out-of-pocket in case of a claim, raising your deductible can significantly lower your premium.

- Bundle Policies: Combine your car insurance with home, renters, or life insurance for multi-policy discounts.

- Install Anti-Theft Devices: Alarms and tracking systems can lead to discounts.

- Take Defensive Driving Courses: Some insurers offer discounts for completing approved safety courses.

- Utilize Telematics Programs: "Pay-as-you-drive" or "usage-based" insurance programs monitor your driving habits (speed, braking, mileage) and can reward safe drivers with lower rates.

- Review Your Policy Annually: Your needs and the market change. Shop around yearly to ensure you’re getting the best rate.

- Reduce Coverage on Older Cars: For very old cars with low value, consider dropping comprehensive and collision coverage if the premium outweighs the car’s replacement cost.

Potential Challenges and Considerations

- "Lowest Insurance" is Relative: What’s cheapest for one person may not be for another due to individual factors. Always get personalized quotes.

- Newer vs. Older Models: While older cars generally have lower collision/comprehensive costs (due to lower value), newer models often have advanced safety features that can offset some of that.

- Luxury Trims: Even within a typically affordable brand, a high-end luxury or performance trim will likely be more expensive to insure.

- Regional Variations: Insurance costs vary wildly by state, city, and even zip code due to factors like population density, theft rates, and accident statistics.

- Sudden Popularity or Issues: A brand or model that was once cheap to insure could see rates rise if it suddenly becomes a target for theft, or if a widespread defect emerges.

Table: Factors Contributing to Lower Insurance Costs by Brand (Illustrative)

Please note: "Average Annual Insurance Cost Tendency" is a generalization for representative models within the brand and can vary wildly based on specific model, driver, location, and coverage choices. It is purely illustrative of a general trend.

| Car Brand | Key Representative Models (Examples) | General Safety Ratings (NHTSA/IIHS) | General Repair Costs (Parts & Labor) | General Theft Rates | Overall Insurance Tendency (for typical models) |

|---|---|---|---|---|---|

| Honda | Civic, CR-V, HR-V | Excellent (Top Safety Pick) | Economical | Low to Moderate | Low |

| Toyota | Corolla, Camry, RAV4, Prius | Excellent (Top Safety Pick+) | Economical | Low | Low |

| Subaru | Outback, Forester, Impreza | Excellent (Top Safety Pick+) | Moderate to Economical | Low | Low |

| Hyundai | Elantra, Kona, Tucson | Good to Excellent (Top Safety Pick) | Economical | Low to Moderate | Low to Moderate |

| Kia | Forte, Soul, Seltos | Good to Excellent (Top Safety Pick) | Economical | Low to Moderate | Low to Moderate |

| Mazda | Mazda3, CX-5, CX-30 | Excellent (Top Safety Pick+) | Economical | Low | Low |

| Chevrolet | Malibu, Equinox, Trax | Good to Excellent | Economical | Low to Moderate | Low to Moderate (for non-performance models) |

Disclaimer: This table provides general trends and is not a guarantee of specific insurance costs. Individual premiums depend on numerous personal and vehicle-specific factors.

Frequently Asked Questions (FAQ)

Q: Is it always cheaper to insure an older car?

A: Not necessarily. While an older car’s lower value means cheaper comprehensive and collision coverage, it might lack modern safety features that can earn discounts on newer vehicles. Also, older parts can sometimes be harder or more expensive to source for repairs, potentially increasing costs.

Q: Does the color of my car affect insurance?

A: No, the color of your car has no bearing on insurance rates. This is a common myth. Insurers care about the make, model, year, engine size, safety features, and claims history, not aesthetics.

Q: Do electric cars have lower insurance rates?

A: It varies. While some electric vehicles (EVs) might be cheaper to insure due to their safety features and lower risk of theft (as they often lack high-performance appeal), others can be more expensive due to higher initial purchase costs, expensive battery replacements, and specialized repair needs. It’s crucial to get quotes for specific EV models.

Q: How often should I compare insurance quotes?

A: It’s highly recommended to compare quotes at least once a year, especially at renewal time. Your personal circumstances change, and so do insurance rates and available discounts. You might find a better deal elsewhere.

Q: Can I get low insurance on a sports car?

A: Generally, no. Sports cars are inherently more expensive to insure due to their high performance, higher likelihood of aggressive driving, and often higher repair or replacement costs. However, maintaining a pristine driving record, opting for a higher deductible, and bundling policies can help mitigate some of the cost.

Concluding Summary

Choosing a car brand with a reputation for lower insurance costs is a smart financial move that can significantly reduce your overall cost of car ownership. Brands like Honda, Toyota, Subaru, Hyundai, Kia, and Mazda consistently offer vehicles that are cheaper to insure due to their strong safety records, affordable repair costs, and lower theft rates.

However, remember that the brand is only one piece of the puzzle. Your personal driving history, location, chosen coverage, and even your credit score play equally vital roles. The key to truly low insurance premiums lies in a combination of selecting a statistically "low-risk" vehicle and maintaining safe driving habits, all while diligently comparing quotes from multiple providers. By taking a strategic approach, you can drive with peace of mind, knowing you’ve secured the best possible coverage at an affordable rate.