Car Insurance For Brand New Car: A Comprehensive Guide to Protecting Your Investment

Car Insurance For Brand New Car: A Comprehensive Guide to Protecting Your Investment cars.truckstrend.com

Purchasing a brand new car is an exhilarating experience, a significant milestone that often represents years of saving, research, and anticipation. The scent of new car upholstery, the pristine paint job, the cutting-edge technology – it’s an investment in comfort, convenience, and often, a reflection of personal achievement. However, the excitement of driving off the dealership lot should immediately be followed by a critical consideration: how to adequately protect this substantial asset. This is where car insurance for a brand new car becomes not just a legal requirement, but an indispensable shield for your peace of mind and financial security.

Unlike insuring an older, depreciated vehicle, insuring a brand new car presents unique challenges and opportunities. Its higher replacement cost, susceptibility to rapid depreciation, and often mandatory full coverage requirements from lenders or lessors mean that standard, minimal coverage simply won’t suffice. This comprehensive guide will delve into the nuances of car insurance for brand new cars, offering practical advice, detailing essential coverage types, and outlining strategies to secure the best protection for your prized possession.

Car Insurance For Brand New Car: A Comprehensive Guide to Protecting Your Investment

Understanding the Unique Needs of a Brand New Car

A brand new car stands apart from its used counterparts in several key ways that directly impact its insurance needs. Recognizing these distinctions is the first step towards securing appropriate coverage.

Firstly, a new car has a higher initial value. Should it be involved in an accident and deemed a total loss, the cost to replace it is significantly higher than that of an older vehicle. This necessitates robust coverage limits. Secondly, new cars experience rapid depreciation, particularly in the first year. This phenomenon, often referred to as "drive-off depreciation," means that a car’s market value can drop significantly the moment it leaves the dealership. If your new car is totaled shortly after purchase, its actual cash value (ACV) might be less than what you owe on your loan, leaving you in a financially precarious "upside-down" position.

Thirdly, financing or leasing agreements almost invariably mandate comprehensive and collision coverage, along with specific liability limits, to protect the lender’s interest in the vehicle. You won’t be able to drive off the lot without proof of adequate insurance. Lastly, modern new cars are equipped with advanced technology and safety features. While these can sometimes lead to discounts, they can also make repairs more complex and expensive, potentially increasing the cost of claims. Protecting these intricate systems requires an insurance policy that acknowledges their value and repair complexity.

Essential Coverage Types for Brand New Cars

When insuring a brand new car, a basic liability policy is rarely sufficient. You’ll want to consider a suite of coverages designed to protect your investment comprehensively.

- Collision Coverage: This pays for damage to your car resulting from a collision with another vehicle or object (e.g., a tree, a pole). Given the high cost of repairing or replacing a new car, collision coverage is paramount.

- Comprehensive Coverage: This protects your vehicle against non-collision incidents. This includes damage from fire, theft, vandalism, falling objects, natural disasters (hail, floods), and animal strikes. For a new car, which is a significant asset, comprehensive coverage offers broad protection against unforeseen circumstances.

- Liability Coverage (Bodily Injury & Property Damage): This is legally required in most states. Bodily injury liability covers medical expenses and lost wages for others injured in an accident you cause, while property damage liability covers damage to another person’s property. For new car owners, it’s advisable to carry higher liability limits to protect your assets in case of a severe accident.

- Guaranteed Asset Protection (GAP) Insurance: This is arguably the most critical add-on for a financed or leased new car. If your car is totaled or stolen and its actual cash value (ACV) is less than your outstanding loan balance, GAP insurance covers the "gap" between what your standard policy pays out and what you still owe the lender. Without it, you could be left paying off a loan for a car you no longer own.

- New Car Replacement Coverage: Some insurers offer this endorsement, which, if your brand new car (typically within its first year or two, and under a certain mileage) is totaled, will pay for a brand new car of the same make, model, and trim level, rather than just its depreciated actual cash value. This is a significant benefit for new car owners.

- Original Equipment Manufacturer (OEM) Parts Coverage: After an accident, this endorsement ensures that your car is repaired using original manufacturer parts, rather than aftermarket or used parts. This can be crucial for maintaining the integrity, performance, and warranty of your new vehicle.

- Rental Car Reimbursement: If your new car is in the shop for covered repairs after an accident, this coverage helps pay for a rental car, minimizing disruption to your daily life.

- Roadside Assistance: While many new cars come with manufacturer roadside assistance, having it through your insurance policy can offer a backup for services like towing, battery jump-starts, tire changes, or lockout services.

Factors Influencing Premiums for Brand New Cars

The cost of insuring a brand new car can vary significantly. Several factors play a role in determining your premium:

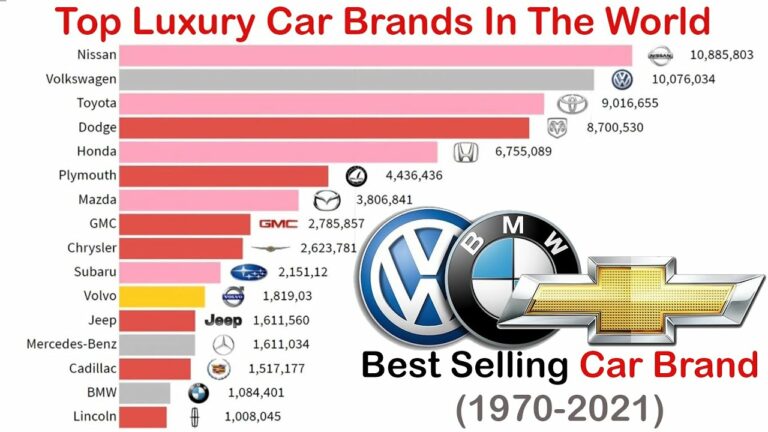

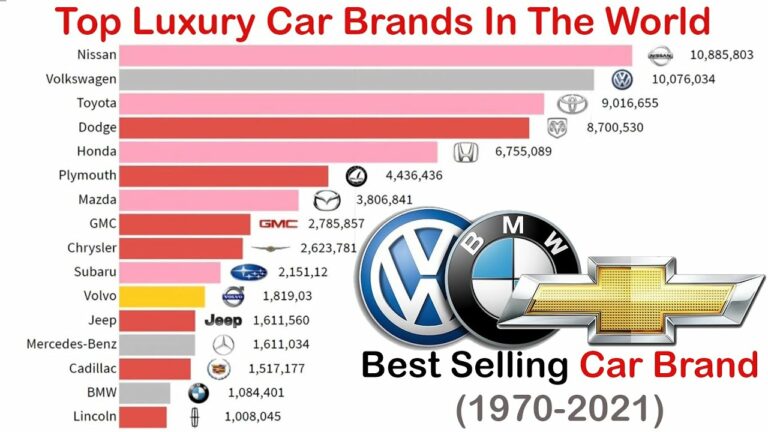

- Car Make, Model, and Trim: Luxury vehicles, sports cars, and those with expensive or specialized parts generally have higher premiums. Vehicles with higher safety ratings and lower theft rates might qualify for discounts.

- Driver Profile: Your age, driving record (tickets, accidents), credit score (in states where permitted), and marital status all impact your rates. Experienced drivers with clean records typically pay less.

- Location: Urban areas with higher traffic density, theft rates, or vandalism incidents often lead to higher premiums than rural areas.

- Coverage Limits and Deductibles: Choosing higher liability limits and lower deductibles (the amount you pay out-of-pocket before insurance kicks in) will result in higher premiums.

- Annual Mileage: How much you drive your new car can influence rates, with lower mileage potentially leading to discounts.

- Security Features: Anti-theft devices, alarm systems, and vehicle tracking systems can sometimes qualify for discounts.

How to Get the Best Insurance for Your New Car

Securing optimal coverage at a competitive price requires a proactive approach. Here’s how to navigate the process:

- Shop Around Extensively: Do not settle for the first quote you receive. Obtain quotes from multiple insurance providers – national companies, regional insurers, and even independent agents who can shop different carriers for you. Prices for the exact same coverage can vary by hundreds or even thousands of dollars.

- Bundle Policies: Many insurers offer discounts for bundling your auto insurance with other policies, such as home, renters, or life insurance. This can be a significant saving.

- Inquire About All Possible Discounts: Don’t assume your insurer will automatically apply all eligible discounts. Ask about:

- Good Driver/Accident-Free Discounts: For a clean driving record.

- Multi-Car Discount: If you insure more than one vehicle with the same company.

- Anti-Theft Device Discount: For factory-installed or aftermarket security systems.

- Good Student Discount: If applicable for younger drivers.

- Low Mileage Discount: For those who don’t drive much.

- Professional/Alumni Discounts: Some occupations or university affiliations offer special rates.

- Pay-in-Full/Auto-Pay Discounts: For paying your premium upfront or setting up automatic payments.

- Consider Higher Deductibles (Carefully): While lower deductibles mean less out-of-pocket in a claim, they also mean higher premiums. If you have a healthy emergency fund, opting for a higher deductible ($500 or $1,000) can significantly reduce your annual premium. Just ensure you can comfortably afford the deductible if a claim arises.

- Review Coverage Needs Annually: As your car ages, its value will decrease. While new car replacement and GAP insurance are crucial in the first few years, they may become less relevant over time. Periodically reassess your coverage to ensure it still aligns with your car’s value and your financial situation.

- Read the Fine Print: Before signing any policy, thoroughly review the terms and conditions. Understand the exclusions, limitations, and claim process.

Challenges and Solutions

Insuring a brand new car can present a few challenges, but each has a viable solution:

- Challenge: High Premiums. New cars, by their nature, are more expensive to insure due to their value and repair costs.

- Solution: Implement the strategies mentioned above: shop around aggressively, maximize discounts, and consider adjusting deductibles to a comfortable level. Also, research insurance costs before buying a specific car model; some cars are inherently cheaper to insure.

- Challenge: Depreciation Risk. The rapid drop in value can leave you upside down on your loan if the car is totaled early on.

- Solution: Invest in GAP insurance. This is a small added cost that provides immense financial protection against depreciation. New car replacement coverage is another excellent solution for complete peace of mind.

- Challenge: Immediate Insurance Need. You cannot drive your new car off the lot without proof of insurance.

- Solution: Arrange your insurance before you even pick up the car. Have your policy number and proof of insurance readily available when you go to the dealership. Many insurers offer an immediate bind option over the phone or online.

- Challenge: Complex Repairs for Advanced Tech. Modern cars are packed with sensors, cameras, and intricate systems that are costly to repair if damaged.

- Solution: Ensure your comprehensive and collision coverages are robust. Consider OEM parts coverage to guarantee quality repairs that maintain your car’s original specifications and warranty.

Sample Car Insurance Price Table for Brand New Cars (Illustrative Estimates)

The actual cost of car insurance varies widely based on numerous factors including driver age, location, driving history, credit score, specific vehicle trim, and chosen deductibles/limits. The table below provides illustrative annual premium estimates for a brand new car, assuming a clean driving record and standard comprehensive coverage with GAP insurance and New Car Replacement for a 3-year term. These are examples only and should not be taken as actual quotes.

| Car Type & Example MSRP | Driver Profile | Annual Premium Estimate | Key Coverages Included (Sample) | Notes |

|---|---|---|---|---|

| Economy Sedan | Young Driver (22, single) | $2,800 – $4,500 | Collision, Comprehensive, Liability (100/300/100), GAP, New Car Replacement, Rental Reimbursement ($30/day), Roadside Assist. | Higher premium due to driver age; basic car model keeps it somewhat lower. |

| (e.g., Honda Civic LX) | Experienced Driver (40, married) | $1,200 – $2,000 | Collision, Comprehensive, Liability (100/300/100), GAP, New Car Replacement, Rental Reimbursement ($30/day), Roadside Assist. | Significantly lower due to age, experience, and potentially multi-policy/multi-car discounts. |

| Mid-Range SUV | Young Driver (22, single) | $3,500 – $5,500 | Collision, Comprehensive, Liability (100/300/100), GAP, New Car Replacement, Rental Reimbursement ($40/day), Roadside Assist, OEM Parts. | SUV’s higher MSRP and potential repair costs increase premium; driver age remains a major factor. |

| (e.g., Toyota RAV4 XLE) | Experienced Driver (40, married) | $1,500 – $2,500 | Collision, Comprehensive, Liability (100/300/100), GAP, New Car Replacement, Rental Reimbursement ($40/day), Roadside Assist, OEM Parts. | Good balance of coverage for a popular family vehicle. |

| Luxury Sedan | Experienced Driver (40, married) | $2,500 – $4,000 | Collision, Comprehensive, Liability (250/500/250), GAP, New Car Replacement, Rental Reimbursement ($50/day), Roadside Assist, OEM Parts. | Higher MSRP and repair costs for luxury vehicles contribute to higher premiums, even for experienced drivers. |

| (e.g., BMW 3 Series) | High-Risk Driver (40, married, recent accident) | $4,500 – $7,000+ | Collision, Comprehensive, Liability (250/500/250), GAP, New Car Replacement, Rental Reimbursement ($50/day), Roadside Assist, OEM Parts. | Driving record significantly impacts premium, despite age. |

| Sports Car | Experienced Driver (40, single) | $3,500 – $6,000+ | Collision, Comprehensive, Liability (250/500/250), GAP, New Car Replacement, Rental Reimbursement ($50/day), Roadside Assist, OEM Parts. | High performance, higher theft risk, and expensive parts lead to top-tier premiums. |

| (e.g., Ford Mustang GT) |

Note: Deductibles (e.g., $500 or $1,000 for collision/comprehensive) would be applied to these estimates.

Always obtain personalized quotes from multiple insurance providers for accurate pricing.

Frequently Asked Questions (FAQ)

Q1: Do I need car insurance before I drive my brand new car off the dealership lot?

A1: Yes, absolutely. It is illegal in most places to drive without insurance, and dealerships will require proof of insurance before allowing you to take possession of the vehicle. Arrange your policy to be effective on the day of purchase.

Q2: What is GAP insurance, and do I really need it for a brand new car?

A2: GAP (Guaranteed Asset Protection) insurance covers the difference between your car’s actual cash value (ACV) at the time of a total loss and the remaining balance on your auto loan or lease. You absolutely should consider it for a brand new, financed, or leased car, as new vehicles depreciate rapidly, and you could owe more than the car is worth if it’s totaled early on.

Q3: Will my new car’s advanced safety features lower my premium?

A3: Potentially, yes. Features like automatic emergency braking, lane departure warning, blind-spot monitoring, and adaptive cruise control can reduce the likelihood of accidents or injuries, and many insurers offer discounts for vehicles equipped with them. Always ask your insurer about these potential savings.

Q4: How often should I review my new car’s insurance policy?

A4: It’s advisable to review your policy at least once a year, especially around renewal time. This allows you to check for new discounts, adjust coverage as your car depreciates, and ensure your policy still meets your evolving needs and budget. Also, review it after any major life changes (e.g., marriage, moving, new driver in the household).

Q5: What happens if my brand new car is totaled shortly after I buy it?

A5: If you have standard comprehensive and collision coverage, your insurer will typically pay out the car’s actual cash value (ACV) at the time of the loss. This is where GAP insurance and New Car Replacement coverage become vital. With GAP, the remaining loan balance is covered. With New Car Replacement, you could get a brand new car of the same make/model. Without these, you might be left with a financial shortfall.

Q6: Can I use my old car’s insurance for my new car temporarily?

A6: Most insurance policies offer a grace period (typically 7-30 days) during which your new vehicle is automatically covered under your existing policy, but often only with the same limits and coverages as your old car. However, it’s always best to notify your insurer immediately upon purchase and get the new vehicle formally added to your policy to ensure full and appropriate coverage, especially for a brand new car. Do not rely solely on a grace period.

Conclusion

Insuring a brand new car is a critical step that should be given as much thought and research as the purchase of the vehicle itself. It’s not just about meeting legal requirements; it’s about protecting a substantial financial investment and securing your peace of mind. By understanding the unique needs of new cars, opting for essential coverages like GAP and New Car Replacement, diligently shopping for the best rates, and leveraging available discounts, you can ensure your gleaming new ride is protected against the unforeseen. Drive confidently, knowing that your brand new car, and your financial future, are well-guarded.