Car Insurance For Brand New Car: Your Essential Guide to Protecting Your Investment

Car Insurance For Brand New Car: Your Essential Guide to Protecting Your Investment cars.truckstrend.com

The exhilarating scent of a new car, the pristine interior, the quiet hum of a fresh engine – few feelings compare to driving a brand new vehicle off the dealership lot. It’s a significant investment, a symbol of freedom, and often, a source of immense pride. But amidst the excitement, one crucial step often gets overlooked or underestimated: securing the right car insurance. For a brand new car, insurance isn’t just a legal necessity; it’s a vital shield that protects your substantial financial outlay from the moment you take possession.

This comprehensive guide delves into the nuances of car insurance for brand new cars, explaining why it’s different, what specific coverages you need, and how to navigate the process to ensure your gleaming new ride is adequately protected.

Car Insurance For Brand New Car: Your Essential Guide to Protecting Your Investment

Why Brand New Cars Demand Specialized Insurance Attention

While all cars need insurance, a brand new vehicle presents unique considerations that differentiate its insurance needs from a used car. Understanding these distinctions is the first step toward securing appropriate coverage.

The Depreciation Dilemma

One of the most significant factors unique to new cars is rapid depreciation. The moment a new car leaves the lot, its value begins to drop – sometimes by 10-20% in the first year alone. This accelerated loss of value creates a significant challenge if your car is stolen or totaled shortly after purchase. A standard insurance policy typically pays out the Actual Cash Value (ACV) of your vehicle at the time of loss, which is its market value minus depreciation. This ACV can be substantially less than what you paid for the car, and more importantly, less than what you still owe on a loan or lease.

Higher Replacement and Repair Costs

Newer vehicles, especially those equipped with advanced technology and specialized parts, often have higher repair costs. In the event of an accident, even minor damage can lead to expensive fixes. Furthermore, replacing a brand new car entirely means covering its full, undepreciated cost, which is significantly higher than an older, used model.

Loan and Lease Requirements

If you’ve financed or leased your new car, your lender or leasing company will almost certainly require you to carry comprehensive and collision coverage, often with specific minimum deductibles and liability limits. This is to protect their financial interest in the vehicle. Failing to meet these requirements can lead to the lender force-placing expensive insurance on your behalf.

Essential Coverages for Your New Vehicle

To adequately protect your brand new car, you’ll need more than just the basic state-mandated liability coverage. Here are the core components and specialized add-ons crucial for new vehicles:

1. Liability Coverage

This is the fundamental coverage that pays for damages and injuries you cause to other people and their property in an at-fault accident. While legally required, it’s wise to carry higher limits than the minimum for a new car, as you’re operating a potentially higher-value and more powerful vehicle.

2. Collision Coverage

Collision coverage pays for damages to your own vehicle resulting from a collision with another vehicle or object (e.g., a tree, a guardrail), regardless of who is at fault. For a brand new car, this is non-negotiable, as even minor scrapes can be costly to repair.

3. Comprehensive Coverage

Often called "Other Than Collision" coverage, comprehensive protects your car from damages not involving a collision. This includes theft, vandalism, fire, falling objects, natural disasters (hail, floods), and animal strikes. Given the high value of a new car, comprehensive coverage is essential for protecting against unpredictable events.

4. Uninsured/Underinsured Motorist Coverage (UM/UIM)

This coverage protects you if you’re hit by a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages and medical bills. For a new car, ensuring you can cover your own vehicle’s repairs or replacement in such a scenario is vital.

Specialized Add-Ons Critical for New Cars:

- Gap Insurance: This is arguably the most important add-on for a financed or leased new car. If your car is totaled or stolen and its ACV is less than what you owe on your loan or lease, gap insurance pays the difference. Without it, you could be left making payments on a car you no longer own.

- New Car Replacement Coverage: If your new car is totaled or stolen within a specified period (e.g., 1-3 years) and mileage limit, this coverage pays to replace it with a brand new car of the same make and model, rather than just its depreciated ACV. This is incredibly valuable for preserving your initial investment.

- Original Equipment Manufacturer (OEM) Parts Coverage: After an accident, standard policies may allow for the use of aftermarket parts in repairs. OEM parts coverage ensures that your car is repaired with brand-specific, factory-made components, helping to maintain its integrity, warranty, and resale value.

- Roadside Assistance: While many new cars come with manufacturer-provided roadside assistance for a period, having it through your insurance policy can provide peace of mind once the manufacturer’s coverage expires.

- Rental Car Reimbursement: If your new car is in the shop for covered repairs after an accident, this coverage helps pay for a rental car, minimizing disruption to your daily life.

How to Insure Your Brand New Car: A Step-by-Step Guide

Getting insurance for your new car is a straightforward process, but timing and preparation are key.

- Shop Before You Buy: Ideally, start comparing insurance quotes before you even finalize your car purchase. This allows you to factor the insurance cost into your overall budget and avoid any last-minute surprises.

- Gather Vehicle Information: You’ll need the exact make, model, year, VIN (Vehicle Identification Number – you can get this from the dealer), safety features, and any anti-theft devices.

- Determine Your Coverage Needs: Based on whether you’re financing, leasing, or paying cash, and your personal risk tolerance, decide on the essential coverages (liability, comprehensive, collision) and crucial add-ons like Gap and New Car Replacement.

- Compare Quotes from Multiple Insurers: Don’t settle for the first quote. Use online comparison tools, independent agents, or contact several major insurance companies directly. Prices for the exact same coverage can vary significantly.

- Inform Your Current Insurer (if applicable): If you already have car insurance, contact your current provider. They might offer a multi-car discount, and you may be able to temporarily transfer coverage from your old car to the new one for a short grace period (check their policy carefully).

- Purchase Your Policy: Once you’ve chosen an insurer and policy, finalize the purchase. You’ll typically need to provide proof of insurance to the dealership before you can drive the car off the lot.

- Review Your Policy Annually: As your car ages and your financial situation changes, your insurance needs might evolve. Review your policy annually to ensure it still meets your requirements.

Important Considerations and Practical Advice

Navigating the world of car insurance for a new car involves more than just picking a policy. Here’s what else to keep in mind:

Factors Influencing Your Premium

Several elements impact the cost of insuring your brand new car:

- Vehicle Cost & Repairability: More expensive cars, luxury vehicles, and those with complex parts (e.g., electric vehicles) often cost more to insure.

- Safety Features: Advanced driver-assistance systems (ADAS) like automatic emergency braking, lane-keeping assist, and blind-spot monitoring can sometimes lead to discounts.

- Anti-Theft Devices: Factory-installed or aftermarket alarms and tracking systems can lower comprehensive premiums.

- Your Driving Record: A clean driving history with no accidents or violations will result in lower premiums.

- Your Age & Experience: Younger, less experienced drivers generally pay more.

- Your Location: Urban areas with higher traffic density and crime rates typically have higher premiums.

- Credit Score: In many states, a good credit score can lead to lower insurance rates.

- Deductible Amount: Choosing a higher deductible (the amount you pay out-of-pocket before insurance kicks in) will lower your premium, but ensure you can afford it in an accident.

Maximizing Your Savings

While insuring a new car can be more expensive, there are ways to keep costs down:

- Bundle Policies: Combine your auto insurance with home, renters, or life insurance for multi-policy discounts.

- Ask About Discounts: Inquire about discounts for good students, safe drivers, low mileage, telematics programs (tracking driving habits), professional affiliations, and more.

- Maintain a Good Driving Record: Avoid tickets and accidents.

- Choose a Car with Good Safety Ratings: Research cars with high safety scores and lower theft rates before buying.

- Pay Annually: Many insurers offer a discount for paying your premium in full annually rather than monthly.

Potential Challenges and Solutions

- The "Depreciation Trap" (Challenge): You owe more than the car is worth, and standard ACV coverage won’t cover your loan.

- Solution: Always get Gap Insurance if you are financing or leasing a new car.

- Underinsuring (Challenge): Not having enough liability or opting out of comprehensive/collision to save money.

- Solution: Prioritize full coverage (collision and comprehensive) and aim for high liability limits (e.g., $100,000/$300,000/$100,000) to protect your assets.

- Impulse Buying (Challenge): Not considering insurance costs when budgeting for the car.

- Solution: Get insurance quotes before you commit to a purchase. It might influence your choice of vehicle.

- Repair Quality (Challenge): Aftermarket parts affecting your new car’s integrity and warranty.

- Solution: Add OEM Parts Coverage to your policy.

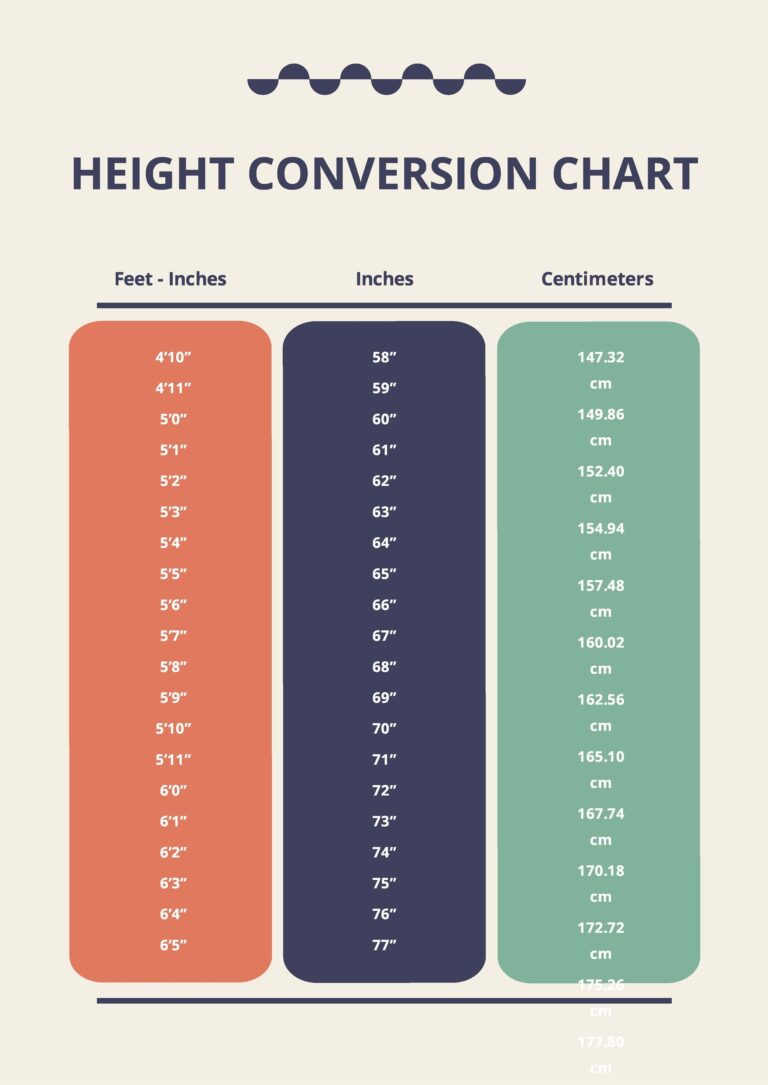

Illustrative Price Guide for Car Insurance For Brand New Car

It’s crucial to understand that actual car insurance premiums vary widely based on numerous individual factors (driver’s age, driving record, location, credit score, vehicle model, specific safety features, chosen deductibles, and available discounts). The table below provides hypothetical and illustrative annual premium ranges for different coverage scenarios for a brand new car. These are not actual quotes and are intended only to give a general idea of potential costs.

| Coverage Type/Scenario | Illustrative Annual Premium Range | Key Considerations & Value Proposition |

|---|---|---|

| Basic Liability Only | $800 – $1,500 | Not Recommended for New Cars. Minimal legal protection, offers no coverage for your own vehicle damage or theft. |

| Standard Full Coverage | $1,500 – $3,000 | Includes Liability, Collision, and Comprehensive. This is the minimum recommended for a new car. |

| Full Coverage + Gap Insurance | $1,700 – $3,300 | Highly Recommended for financed/leased new cars. Protects against the depreciation gap if your car is totaled. |

| Full Coverage + New Car Replacement | $1,800 – $3,500 | Excellent for peace of mind. Replaces your totaled/stolen new car with another new one (within specified limits). |

| Premium Package (All above + OEM Parts, Roadside, Rental Reimbursement) | $2,000 – $4,000+ | Comprehensive protection for your investment, ensuring factory-grade repairs and minimal disruption. |

| Factors Influencing Cost | Varies Wildly | Driver’s Age & Record, Location, Vehicle MSRP & Safety Features, Deductibles, Credit Score, Available Discounts. |

| Disclaimer: | These ranges are purely illustrative and do not reflect actual pricing. Always obtain personalized quotes from multiple insurance providers based on your specific circumstances. |

Frequently Asked Questions (FAQ) About New Car Insurance

Q1: Do I need insurance before I drive my new car off the dealership lot?

A1: Yes, absolutely. Most dealerships will require proof of insurance before allowing you to take possession of the vehicle. It’s also illegal to drive without insurance in nearly all states.

Q2: What’s the difference between Gap Insurance and New Car Replacement Coverage?

A2: Gap Insurance covers the "gap" between what you owe on your loan/lease and your car’s Actual Cash Value (ACV) if it’s totaled or stolen. New Car Replacement Coverage replaces your totaled/stolen new car with a brand new one of the same make and model, without deducting for depreciation (within policy limits). Gap insurance protects your finances, while new car replacement protects your ability to get another new car.

Q3: Will my new car’s advanced safety features lower my premium?

A3: Potentially, yes. Features like automatic emergency braking, lane departure warning, adaptive cruise control, and blind-spot monitoring can reduce the likelihood of accidents, which some insurers recognize with discounts. Always ask your insurer about these potential savings.

Q4: Is it more expensive to insure a new car than an older one?

A4: Generally, yes. New cars are more valuable, cost more to repair or replace, and are often equipped with more expensive technology, leading to higher insurance premiums compared to older, depreciated models.

Q5: Can I use my old car’s insurance policy for my new car?

A5: Most insurance companies offer a grace period (typically 7-30 days) during which your existing policy may temporarily cover your newly acquired vehicle. However, it’s crucial to inform your insurer immediately after purchasing your new car to ensure proper coverage and update your policy. Don’t rely on the grace period for long-term protection.

Q6: How much liability coverage should I get for a new car?

A6: While state minimums exist, they are often insufficient. For a new car, aim for higher liability limits, such as $100,000 per person for bodily injury, $300,000 per accident for bodily injury, and $100,000 for property damage (100/300/100). This provides much better protection for your assets in the event of a serious at-fault accident.

Conclusion

Purchasing a brand new car is a significant milestone, a testament to hard work and future aspirations. Protecting this investment with the right car insurance is not merely a formality but a critical component of responsible car ownership. By understanding the unique needs of a new vehicle, prioritizing essential coverages like comprehensive, collision, and especially gap insurance, and taking advantage of available discounts, you can ensure your pride and joy is shielded from the unforeseen.

Don’t let the excitement of a new car overshadow the importance of comprehensive protection. Take the time to research, compare, and choose a policy that offers peace of mind, allowing you to enjoy every mile of your new journey, knowing your valuable asset is well-protected.