China Car Sales By Brand 2017: A Comprehensive Analysis of a Pivotal Year

China Car Sales By Brand 2017: A Comprehensive Analysis of a Pivotal Year cars.truckstrend.com

The automotive industry is a global titan, and at its heart, the Chinese market stands as an undisputed colossus. In 2017, China solidified its position as the world’s largest automotive market, selling millions of vehicles and dictating global trends. Understanding "China Car Sales By Brand 2017" is not merely an exercise in data analysis; it’s a deep dive into the strategic maneuvers of global giants, the burgeoning strength of domestic challengers, and the evolving preferences of a dynamic consumer base. This period was pivotal, characterized by significant growth, shifting market dynamics, and the early ripples of transformative trends like new energy vehicles and the SUV boom. This comprehensive article will dissect the 2017 landscape, offering insights into which brands thrived, why, and what lessons can be drawn from this crucial year.

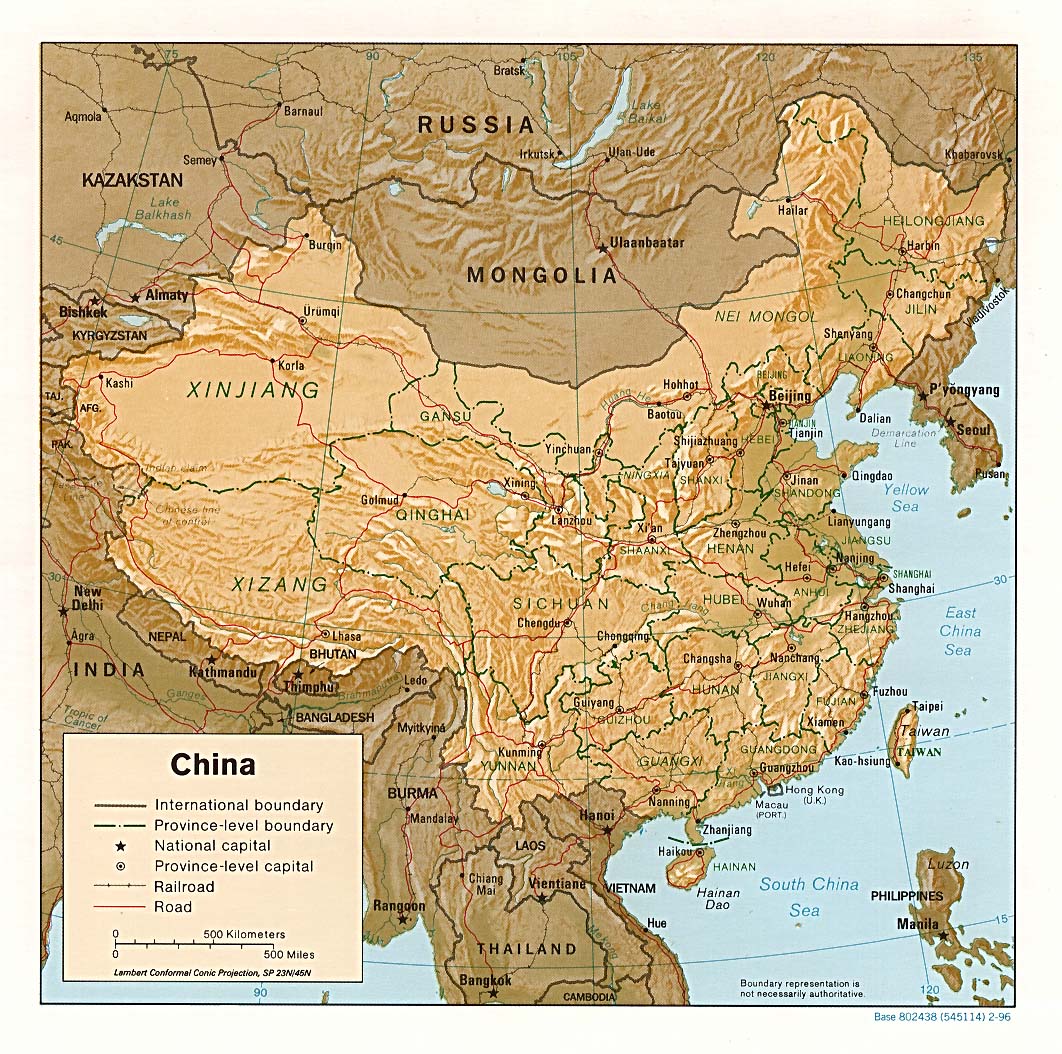

The Landscape of the Chinese Automotive Market in 2017

China Car Sales By Brand 2017: A Comprehensive Analysis of a Pivotal Year

In 2017, China’s automotive market recorded total vehicle sales of approximately 28.88 million units, representing a modest but significant year-on-year growth of around 3.04%. While the growth rate was slower than the double-digit surges of previous years, largely due to the tapering off of a tax incentive for small-engine vehicles, the sheer volume remained staggering. Passenger vehicle sales, the primary focus for brand analysis, reached roughly 24.72 million units.

This period was marked by continued urbanization, a rising middle class with increasing disposable incomes, and extensive infrastructure development that fueled demand across various vehicle segments. The market was a complex tapestry of intense competition, with global automotive powerhouses vying for dominance against increasingly sophisticated and competitive domestic brands. Beyond sheer volume, 2017 highlighted crucial shifts in consumer preference, segment performance, and the growing influence of government policies on industry direction.

Dominance and Dynamics of Foreign and Joint Venture Brands

Foreign brands, predominantly operating through joint ventures (JVs) with Chinese partners, continued to command a significant portion of the market in 2017. Their success was built on established brand recognition, proven technology, diverse model lineups, and extensive, well-developed dealer networks.

Volkswagen (VW) remained the undisputed sales leader in China, a testament to its long-standing presence and deep localization strategy. Through its joint ventures with SAIC (SAIC-VW) and FAW (FAW-VW), the German giant offered a comprehensive range of vehicles, from popular sedans like the Lavida and Sagitar to rapidly expanding SUV offerings. VW’s ability to understand and cater to Chinese consumer tastes, combined with its reputation for quality, ensured its continued top-tier performance.

General Motors (GM), another major player, leveraged its multi-brand strategy effectively. Brands like Buick, Chevrolet, and Cadillac contributed significantly, while its highly successful Wuling and Baojun brands (under the SAIC-GM-Wuling JV) captured the mass market and increasingly sophisticated entry-level segments with popular models like the Baojun 510 SUV. GM’s diversified portfolio allowed it to compete across various price points and segments.

Japanese automakers—Honda, Toyota, and Nissan—also demonstrated robust performance. Known for their reliability, fuel efficiency, and increasingly stylish designs, these brands saw strong sales, particularly with their SUV models and hybrid technologies. Honda’s CR-V and Civic, Toyota’s Corolla and RAV4, and Nissan’s Sylphy and X-Trail were consistent best-sellers. Their prudent expansion and focus on quality resonated well with Chinese buyers.

Other notable foreign players included Ford, which faced some headwinds but maintained a strong presence, and Hyundai/Kia, which experienced significant sales declines in 2017 due to geopolitical tensions and increased competition from local brands. Despite challenges, the overall narrative for foreign and JV brands in 2017 was one of sustained dominance, driven by strong product offerings and deeply embedded market strategies.

The Ascendance of Domestic Chinese Brands

2017 marked a pivotal year for domestic Chinese automotive brands, signaling their rapid ascendance from budget-friendly alternatives to formidable competitors. Years of investment in R&D, design, and manufacturing quality began to pay off, enabling them to capture an increasing share of the market.

Geely Automobile stood out as a beacon of success, achieving remarkable growth rates. Its strategic acquisitions (like Volvo Cars) and strong internal product development led to a lineup of increasingly sophisticated and appealing vehicles, including the Emgrand sedan and Boyue SUV. Geely’s creation of the Lynk & Co brand further demonstrated its ambition to compete in premium segments.

Changan Automobile and Great Wall Motors (especially its SUV-focused Haval brand) also solidified their positions. Changan benefited from a broad model range and strong local market understanding, while Haval continued to dominate the SUV segment with popular models like the H6. Their strategies primarily revolved around offering feature-rich SUVs at competitive price points, directly challenging foreign brands in this burgeoning segment.

SAIC Motor, beyond its successful JVs, saw its own brands like Roewe and MG gain traction, particularly with their focus on connected and new energy vehicles. BYD, a pioneer in new energy vehicles (NEVs), continued its leadership in the electric and plug-in hybrid segments, leveraging strong government support and early mover advantage. Other brands like Chery and GAC Motor also made significant strides, improving product quality and expanding their market reach.

The key to the domestic brands’ success in 2017 lay in their agility, deep understanding of local consumer preferences (especially the SUV craze), aggressive pricing strategies, and early adoption of new technologies, particularly in the NEV space. While still facing challenges in brand loyalty compared to established foreign players, their improved product quality and value proposition were undeniable.

Performance in the Luxury Segment

The luxury car segment in China continued its robust growth trajectory in 2017, driven by increasing affluence and the aspirational value associated with premium brands. The "Big Three" German marques—Audi, BMW, and Mercedes-Benz—maintained their dominant positions, each achieving impressive sales figures.

Mercedes-Benz notably experienced the highest growth rate among the three, benefiting from a fresh product lineup and effective marketing. BMW also saw strong demand for its expanded range of sedans and SUVs, while Audi, despite facing some initial dealer-related challenges early in the year, recovered to post strong sales, leveraging its long-standing presence and strong brand loyalty.

Their success was underpinned by several factors: localized production (which reduces import duties and allows for tailored models like extended-wheelbase sedans), sophisticated marketing campaigns, and a growing network of premium dealerships. Beyond the German trio, other luxury brands like Cadillac, Lexus, and Volvo also saw increasing traction, appealing to a diversifying luxury market seeking exclusivity and specific brand values. The luxury segment highlighted the increasing sophistication and purchasing power of Chinese consumers.

Key Trends and Influencing Factors in 2017

Several overarching trends and policy shifts significantly influenced China’s automotive sales landscape in 2017:

-

The Unstoppable SUV Mania: The demand for Sport Utility Vehicles continued its exponential rise. SUVs appealed to Chinese consumers for their perceived safety, higher driving position, spacious interiors, and versatility, making them the primary growth driver for both foreign and domestic brands. Brands that successfully expanded their SUV lineups reaped significant rewards.

-

New Energy Vehicles (NEVs) on the Rise: 2017 marked a pivotal year for NEVs (comprising Battery Electric Vehicles and Plug-in Hybrid Electric Vehicles). Fueled by aggressive government subsidies, favorable licensing policies (especially in congested cities), and a growing environmental consciousness, NEV sales surged. BYD remained a leader, but many traditional automakers, both foreign and domestic, began to heavily invest and launch their own NEV models, recognizing the future direction of the market.

-

Policy Impact: The gradual phasing out of the purchase tax incentive for small-engine (1.6L and below) vehicles, which had significantly boosted sales in 2016, led to a more subdued growth rate in 2017. This shift encouraged automakers to focus on higher-margin vehicles and prompted consumers to consider larger engine options or NEVs. Tighter emission standards also began to influence product development.

-

Market Diversification and Tier-Cities: While major Tier 1 and 2 cities showed signs of saturation, demand continued to expand rapidly in Tier 3, 4, and even lower-tier cities. These emerging markets became crucial growth engines, prompting brands to tailor their distribution networks and product offerings to cater to different regional preferences and economic realities.

-

Connectivity and Digitalization: Though still nascent compared to later years, the importance of in-car connectivity, smart features, and digital sales channels began to gain traction. Automakers started integrating more advanced infotainment systems and exploring online sales models, recognizing the digitally savvy nature of Chinese consumers.

Practical Insights and Strategic Considerations

For automotive manufacturers, investors, and market analysts, 2017 offered invaluable lessons:

- Localization is Key: Success in China demands more than just importing models. Deep localization – from R&D and design to manufacturing and marketing – is crucial for meeting specific Chinese consumer needs and navigating complex regulations.

- Embrace the SUV Trend (and Diversify): While the SUV boom was undeniable, smart brands understood the need for a diversified portfolio that also included competitive sedans and MPVs to capture all segments.

- Invest Heavily in NEVs: 2017 clearly indicated that NEVs were not just a niche but the future of the market, driven by strong policy support and environmental awareness. Early and sustained investment in EV technology, infrastructure, and supply chains became critical.

- Build Strong Local Partnerships: For foreign brands, maintaining robust and collaborative joint ventures was paramount. For domestic brands, strategic alliances (both domestic and international) could accelerate technology transfer and market reach.

- Understand Policy Dynamics: The Chinese government plays a significant role in shaping the auto market through incentives, quotas, and regulations. Staying abreast of and adapting to these policy shifts is essential for long-term success.

- Focus on Value and Quality: Chinese consumers were becoming more discerning. Domestic brands proved that a combination of competitive pricing, improved quality, and feature-rich offerings could win market share.

China Car Sales By Brand 2017: Detailed Sales Table

Here’s a snapshot of the top-selling passenger vehicle brands in China for 2017, based on available industry data. Please note that exact figures can vary slightly between reporting agencies, but these represent the general ranking and approximate volumes.

| Rank | Brand | Sales (Units) (Approx.) | Market Share (%) (Approx.) | Category | Key Models (Examples) |

|---|---|---|---|---|---|

| 1 | Volkswagen | 3,185,000 | 12.88% | Foreign (JV) | Lavida, Sagitar, Passat, Tiguan |

| 2 | General Motors (JV) | 2,000,000+ (Brand level) | 8.09% | Foreign (JV) | Buick Excelle, Chevrolet Cruze |

| 3 | Geely | 1,247,000 | 5.04% | Domestic | Boyue, Emgrand, Vision |

| 4 | Honda | 1,416,000 | 5.73% | Foreign (JV) | CR-V, Civic, XR-V |

| 5 | Nissan | 1,520,000 | 6.15% | Foreign (JV) | Sylphy, X-Trail, Qashqai |

| 6 | Toyota | 1,290,000 | 5.22% | Foreign (JV) | Corolla, RAV4, Camry |

| 7 | Buick | 1,180,000 | 4.77% | Foreign (JV) | Excelle, Envision, GL8 |

| 8 | Changan | 1,060,000 | 4.29% | Domestic | CS75, CS55, Eado |

| 9 | Great Wall (Haval) | 1,070,000 | 4.33% | Domestic | Haval H6, H2, H9 |

| 10 | Ford | 1,190,000 | 4.82% | Foreign (JV) | Focus, Escort, Kuga |

| 11 | Hyundai | 816,000 | 3.30% | Foreign (JV) | Elantra, Tucson |

| 12 | Baojun | 1,016,000 | 4.11% | Domestic (JV) | 510, 730, 310 |

| 13 | Audi | 595,000 | 2.41% | Foreign (Luxury JV) | A4L, A6L, Q5 |

| 14 | BMW | 590,000 | 2.39% | Foreign (Luxury JV) | 3 Series, 5 Series, X1 |

| 15 | Mercedes-Benz | 588,000 | 2.38% | Foreign (Luxury JV) | C-Class, E-Class, GLC |

Note: Sales figures are primarily for passenger vehicles and may represent brand-level sales, which include models produced by joint ventures. Total GM China sales include all its brands, while the table attempts to break down by individual brand where reported.

Frequently Asked Questions (FAQ)

Q1: What was the total car sales volume in China in 2017?

A1: In 2017, the total vehicle sales in China reached approximately 28.88 million units, with passenger vehicle sales accounting for about 24.72 million units.

Q2: Which brand sold the most cars in China in 2017?

A2: Volkswagen (VW) remained the top-selling brand in China in 2017, largely due to its strong joint venture presence and diverse model lineup.

Q3: How did Chinese domestic brands perform in 2017?

A3: Chinese domestic brands saw significant growth and increased market share in 2017. Brands like Geely, Changan, and Great Wall (Haval) performed exceptionally well, driven by strong SUV offerings and improved product quality.

Q4: What was the impact of government policies on car sales in 2017?

A4: The phasing out of the purchase tax incentive for small-engine vehicles (1.6L and below) contributed to a slower overall growth rate compared to previous years. However, strong government support for New Energy Vehicles (NEVs) led to a surge in their sales.

Q5: Were New Energy Vehicles significant in 2017?

A5: Yes, 2017 was a pivotal year for NEVs. Sales of electric vehicles and plug-in hybrids saw substantial growth, driven by government subsidies, preferential policies (like easier license plate acquisition in major cities), and a growing focus on environmental protection.

Conclusion

China Car Sales By Brand 2017 tells a compelling story of a market in dynamic transition. It was a year where established foreign giants maintained their lead through strategic localization and broad portfolios, while ambitious domestic brands rapidly gained ground by intelligently leveraging market trends like the SUV craze and the nascent NEV boom. The slower overall growth rate hinted at increasing market maturity, but the underlying shifts in brand performance and consumer preferences laid the groundwork for the intense competition and technological innovation that would define the Chinese automotive landscape in the years to come. Understanding 2017 is crucial for anyone seeking to grasp the enduring complexities and immense opportunities within the world’s most vital automotive market.