Financing A Branded Title Car: Your Comprehensive Guide to Navigating the Niche Market

Financing A Branded Title Car: Your Comprehensive Guide to Navigating the Niche Market cars.truckstrend.com

In the ever-evolving automotive landscape, finding a reliable vehicle at an affordable price can feel like a quest. For many, branded title cars emerge as a tempting option, promising significant savings compared to their clean-title counterparts. However, the allure of a lower price tag often comes with a unique set of challenges, particularly when it comes to financing a branded title car. This comprehensive guide will demystify the process, offering insights, practical advice, and actionable steps to help you navigate this niche market successfully.

A "branded title" isn’t just a quirky label; it signifies that a vehicle has experienced a significant event that affects its value and insurability. This could range from severe damage (salvage, rebuilt), environmental impact (flood, hail), or even manufacturer buybacks (lemon law). While these vehicles are often perfectly safe and functional after proper repairs and inspections, their past history casts a long shadow over traditional lending practices. Understanding this distinction is the first critical step in approaching the financing puzzle.

Financing A Branded Title Car: Your Comprehensive Guide to Navigating the Niche Market

Understanding Branded Titles: What You Need to Know Before You Buy

Before you even think about financing a branded title car, you must understand what you’re getting into. A branded title is a permanent mark on a vehicle’s history, indicating it has sustained significant damage or has been involved in certain legal/financial situations.

- Salvage Issued when an insurance company declares a vehicle a "total loss" because the cost of repairs exceeds a certain percentage of its market value (which varies by state). A salvage vehicle cannot be legally driven on public roads.

- Rebuilt/Reconstructed Once a salvage vehicle has been repaired and passed a rigorous state inspection, its title can be changed to "rebuilt" or "reconstructed." This means it’s roadworthy again, but its history is permanently marked.

- Flood Indicates the vehicle has sustained significant water damage, which can lead to complex and often hidden electrical, mechanical, and rust issues.

- Lemon Issued when a manufacturer has repurchased a vehicle due to persistent, unfixable defects under "lemon laws."

- Hail Denotes significant damage from hail, typically cosmetic, but can sometimes affect structural integrity if severe.

- Odometer Rollback: Indicates tampering with the odometer to misrepresent mileage. This is illegal and severely devalues the vehicle.

Each brand carries different implications for safety, longevity, and resale value. The common thread is that all branded titles suggest a higher inherent risk to lenders, making financing a branded title car a less straightforward process than with a clean title vehicle.

Why Financing Branded Title Cars is Different

The primary reason financing a branded title car is more challenging than a clean title vehicle stems from the perceived risk by lenders. Banks and credit unions operate on the principle of minimizing risk.

- Higher Depreciation & Lower Resale Value: Branded title cars generally depreciate faster and have significantly lower resale values compared to their clean-title counterparts. If a borrower defaults, the lender may recover less money by repossessing and selling the vehicle.

- Uncertainty of Condition: Even after being rebuilt and inspected, there’s a lingering uncertainty about potential hidden issues or long-term reliability due to the vehicle’s past trauma.

- Insurance Complications: Insuring a branded title car, especially for full coverage (collision and comprehensive), can be difficult and more expensive. Some insurers may refuse to offer full coverage, which is often a requirement for a financed vehicle.

- Limited Marketability: Should the lender need to repossess and sell the vehicle, the pool of potential buyers for a branded title car is much smaller, making it harder to liquidate the asset quickly and for a good price.

These factors translate into higher interest rates, stricter eligibility criteria, larger down payment requirements, and sometimes shorter loan terms for those seeking to finance a branded title car.

Sources of Financing for Branded Title Cars

While traditional lenders might shy away, options for financing a branded title car do exist. You just need to know where to look and be prepared for different terms.

- Specialty Lenders: A growing number of niche lenders specialize in "non-prime" auto loans, including those for branded title vehicles. These lenders have a higher tolerance for risk and a better understanding of the branded title market. They often have specific underwriting criteria for these types of cars.

- Local Credit Unions: Credit unions are often more flexible and community-oriented than large banks. They might be more willing to work with members on unique financing situations, especially if you have a strong relationship with them.

- Personal Loans (Unsecured Loans): If you have excellent credit, you might qualify for an unsecured personal loan. Since this loan isn’t tied to the car itself, the lender doesn’t care about the title brand. However, interest rates on personal loans are typically higher than secured auto loans.

- Home Equity Loans or Lines of Credit (HELOC): If you own a home with sufficient equity, a home equity loan or HELOC can offer very competitive interest rates. The risk here is that your home serves as collateral, so defaulting could lead to foreclosure.

- "Buy Here, Pay Here" Dealerships: These dealerships offer in-house financing, often without stringent credit checks. While convenient, they typically charge extremely high interest rates (often 20-30% APR or more) and may have unfavorable terms. This should generally be considered a last resort for financing a branded title car.

- Cash/Savings: Undoubtedly the best option. Paying cash eliminates interest payments, simplifies the purchase, and avoids the complexities of finding a lender. If you can save up, this is the most cost-effective approach.

- Seller Financing (Private Party): In rare cases, a private seller might be willing to offer financing, especially if they are highly motivated or you have a strong personal relationship. This is uncommon and requires a detailed, legally binding agreement.

The Application Process: What Lenders Look For

When you apply to finance a branded title car, lenders will scrutinize your application even more closely than usual. Be prepared to provide extensive documentation.

- Excellent Credit Score: A high credit score (700+) is crucial. It signals to lenders that despite the car’s history, you are a responsible borrower.

- Stable Income and Employment: Lenders want to see consistent income that demonstrates your ability to make payments.

- Substantial Down Payment: Expect to put down a much larger down payment than you would for a clean title car, often 20-50% of the vehicle’s value. This reduces the lender’s risk significantly.

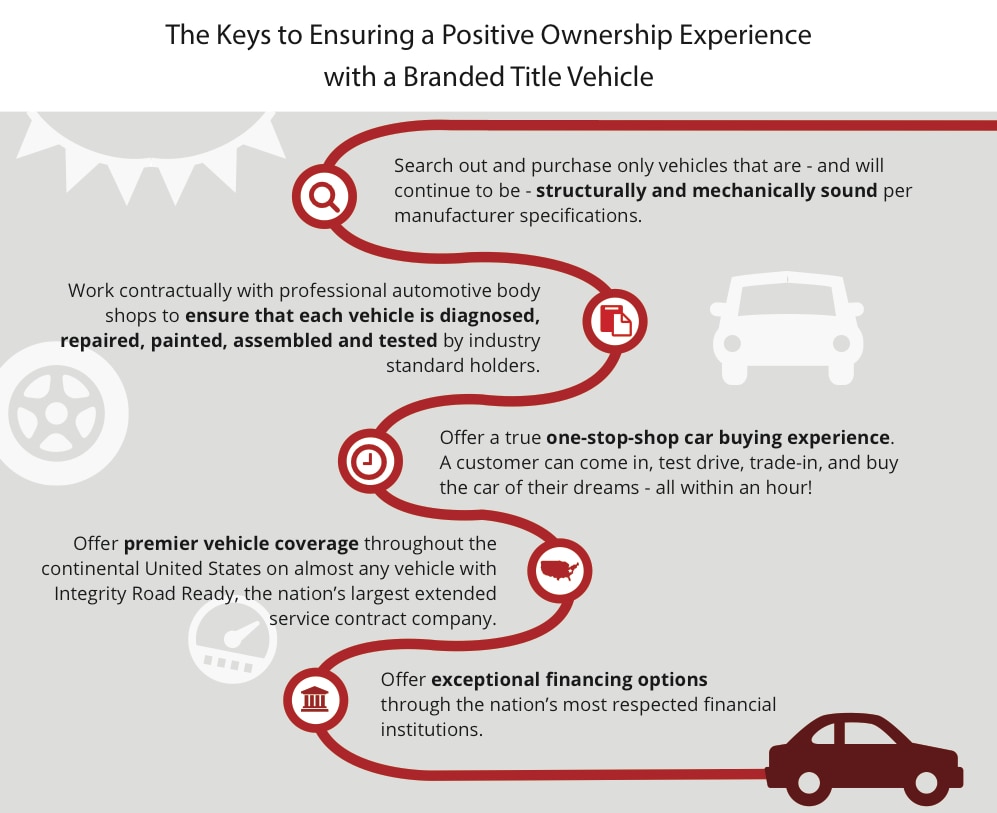

- Detailed Vehicle Inspection Report: A pre-purchase inspection (PPI) from a certified, independent mechanic (ideally one who specializes in the vehicle’s make) is non-negotiable. This report should detail the car’s current condition, the quality of any repairs, and identify any potential issues. Lenders may require this.

- Proof of Rebuild Quality: If it’s a rebuilt title, documentation of the repairs and the state inspection certificate proving its roadworthiness will be essential.

- Lower Loan-to-Value (LTV) Ratio: Lenders will aim for a lower LTV, meaning the loan amount will be a smaller percentage of the vehicle’s appraised value.

Key Considerations Before Committing

Financing a branded title car is a significant decision that requires thorough due diligence beyond just securing a loan.

- Thorough Pre-Purchase Inspection (PPI) is Non-Negotiable: This cannot be stressed enough. Hire an independent, reputable mechanic to inspect the car thoroughly. Ensure they are experienced with branded title vehicles and look for issues related to the original damage.

- Vehicle History Reports are Crucial: Obtain comprehensive reports from services like CarFax or AutoCheck. These will detail the original incident, repair history, mileage discrepancies, and previous ownership. Cross-reference this information with the seller’s claims.

- Insurance Implications: Contact multiple insurance providers before purchasing. Some companies won’t insure branded title cars for comprehensive or collision coverage, or they will charge significantly higher premiums. Understand what coverage you can get and at what cost.

- Future Resale Value: Be realistic. A branded title car will always have a lower resale value and a smaller buyer pool. If you plan to sell it in a few years, factor in this depreciation.

- Warranty Status: Branded title cars almost universally lose their original manufacturer’s warranty. Investigate if any reputable third-party extended warranties cover branded title vehicles (many do not).

- State-Specific Regulations: Titling, registration, and inspection requirements for branded title vehicles vary significantly by state. Understand your state’s laws before purchasing.

Tips for Successful Financing

Navigating the complexities of financing a branded title car requires strategic planning.

- Save a Substantial Down Payment: The more you put down, the less you need to borrow, which reduces lender risk and increases your chances of approval.

- Improve Your Credit Score: Before applying, take steps to boost your credit score. Pay down debts, dispute errors, and make all payments on time.

- Shop Around for Lenders: Don’t just accept the first offer. Contact specialty lenders, multiple credit unions, and compare personal loan rates.

- Be Prepared with Documentation: Have your PPI report, vehicle history reports, proof of income, and credit score readily available.

- Understand the True Cost: Factor in not just the loan payments, but also higher insurance premiums, potential future repair costs, and the accelerated depreciation.

- Negotiate the Price Effectively: Given the challenges in financing and reselling branded title cars, you have significant leverage to negotiate a lower purchase price.

- Consider the Car’s Age and Mileage: Newer cars with lower mileage, even with a branded title, might be more appealing to lenders and potentially more reliable.

Comparison Table: Financing Options for Branded Title Cars

| Financing Type | Typical Interest Rate Range (APR) | Typical Loan Term | Pros | Cons | Eligibility/Considerations |

|---|---|---|---|---|---|

| Specialty Lenders | 8% – 25%+ | 24-60 months | More likely to approve branded titles; understand the market; focus on vehicle value and borrower’s ability to pay. | Higher interest rates than traditional auto loans; may require larger down payment. | Good credit preferred but flexible; strong income/employment; vehicle must pass their specific criteria/inspection. |

| Credit Unions | 6% – 15%+ | 36-72 months | Often more flexible than large banks; member-focused; potentially better rates than specialty lenders. | Still cautious with branded titles; may require significant down payment or strong credit score. | Membership required; good credit history; established relationship with the credit union can help. |

| Personal Loans (Unsecured) | 8% – 36%+ | 12-60 months | Not tied to the car’s title; lender doesn’t care about the brand; funds can be used freely. | Higher interest rates than secured auto loans; often lower loan amounts; requires excellent credit for best rates. | Excellent credit score (750+ for best rates); stable income; existing relationship with bank/lender. |

| Home Equity Loan/HELOC | 4% – 10% | 5-30 years | Lowest interest rates; often tax-deductible interest. | Your home is collateral; risk of foreclosure if you default; lengthy application process. | Must own a home with significant equity; good credit score; stable income. |

| "Buy Here, Pay Here" | 20% – 36%+ | 12-48 months | Easiest approval, especially for bad credit; in-house financing. | Extremely high interest rates; unfavorable terms; often predatory practices; may not report to all credit bureaus. | Little to no credit check; steady income, regardless of credit score. Generally, a last resort. |

| Cash/Savings | 0% | N/A | No interest payments; no loan application; full ownership immediately; greater negotiation power. | Requires significant upfront capital. | Sufficient liquid funds available. |

Note: Interest rates are estimates and can vary significantly based on credit score, lender, market conditions, and specific vehicle details.

Frequently Asked Questions (FAQ) about Financing A Branded Title Car

Q1: Can I get a traditional bank loan for a branded title car?

A1: It’s highly unlikely. Most large, traditional banks and national lenders have strict policies against financing branded title vehicles due to the perceived higher risk. You’ll need to explore specialty lenders, credit unions, or personal loan options.

Q2: Will insurance be more expensive for a branded title car, and can I get full coverage?

A2: Yes, insurance is generally more expensive, and obtaining full coverage (collision and comprehensive) can be challenging. Some insurers may refuse to offer it, or they might only cover the vehicle’s "actual cash value" at the time of loss, which is often lower for branded titles. Always get insurance quotes before buying.

Q3: What kind of down payment should I expect when financing a branded title car?

A3: Lenders typically require a much larger down payment, often ranging from 20% to 50% of the vehicle’s purchase price. This significantly reduces their risk.

Q4: Is it ever a good idea to buy a branded title car?

A4: Yes, but only under very specific circumstances and with extreme caution. If you find a well-repaired vehicle, have it thoroughly inspected by an independent mechanic, understand the full history, and can secure reasonable financing and insurance, it can offer significant savings. They are best for long-term ownership, not frequent reselling.

Q5: How do I find a reputable mechanic for a pre-purchase inspection of a branded title car?

A5: Look for mechanics with strong online reviews, certifications (e.g., ASE certified), and ideally, experience with the specific make and model you’re considering. Ask if they have experience inspecting rebuilt or branded title vehicles. Referrals from trusted sources are also valuable.

Q6: What’s the difference between a "salvage" and a "rebuilt" title?

A6: A "salvage" title means the vehicle has been declared a total loss by an insurance company and is not legal to drive. A "rebuilt" or "reconstructed" title means the salvage vehicle has been repaired, passed a state-mandated inspection, and is now deemed roadworthy. Lenders will only consider financing rebuilt titles, never salvage.

Conclusion

Financing a branded title car is not for the faint of heart, but it is certainly not impossible. While the journey involves more hurdles than a standard auto loan, the potential for substantial savings makes it an attractive option for savvy buyers. The key to success lies in meticulous research, unwavering due diligence, and a realistic understanding of the risks and rewards.

By thoroughly understanding the different types of branded titles, exploring niche financing options, preparing a robust application, and, most importantly, prioritizing a comprehensive pre-purchase inspection, you can navigate this unique segment of the automotive market with confidence. A branded title car, when chosen wisely and financed strategically, can prove to be a remarkably cost-effective and reliable mode of transportation. Just remember: knowledge, patience, and caution are your most valuable assets in this pursuit.