How Much Is Insurance On A Brand New Car? Navigating the Costs of Protecting Your New Ride

How Much Is Insurance On A Brand New Car? Navigating the Costs of Protecting Your New Ride cars.truckstrend.com

The scent of a new car, the pristine finish, the latest technology – there’s nothing quite like the thrill of driving a brand-new vehicle off the dealership lot. It’s a significant investment, a symbol of freedom, and a source of immense pride. However, amidst the excitement, one crucial question often looms large: "How much is insurance on a brand new car?" This isn’t just a minor detail; it’s a major ongoing expense that can significantly impact your overall cost of ownership. Understanding the factors that drive these premiums, what coverages you absolutely need, and how to find the best rates is paramount to ensuring your new prized possession is adequately protected without breaking the bank.

This comprehensive guide will delve deep into the world of brand new car insurance, demystifying the costs, explaining the essential coverages, and providing actionable insights to help you secure optimal protection for your gleaming new ride.

How Much Is Insurance On A Brand New Car? Navigating the Costs of Protecting Your New Ride

Understanding the Basics: Why Brand New Cars Often Cost More to Insure

It might seem counterintuitive that a brand-new car, fresh off the assembly line with all its safety features, could be more expensive to insure than an older model. However, several key factors contribute to the higher premiums associated with new vehicles:

- Higher Value & Replacement Costs: The most obvious reason is the car’s initial purchase price. A brand-new car costs significantly more to replace or repair after an accident, theft, or other damage compared to an older, depreciated model. Insurers face higher potential payouts, which translates to higher premiums.

- Advanced Technology & Repair Complexity: Modern vehicles are packed with sophisticated technology – advanced driver-assistance systems (ADAS) like automatic emergency braking, lane-keeping assist, blind-spot monitoring, complex infotainment systems, and intricate sensors. While these features enhance safety, they are incredibly expensive to repair or recalibrate after even a minor fender bender. A seemingly small dent could require replacing a bumper with integrated sensors, dramatically increasing repair bills.

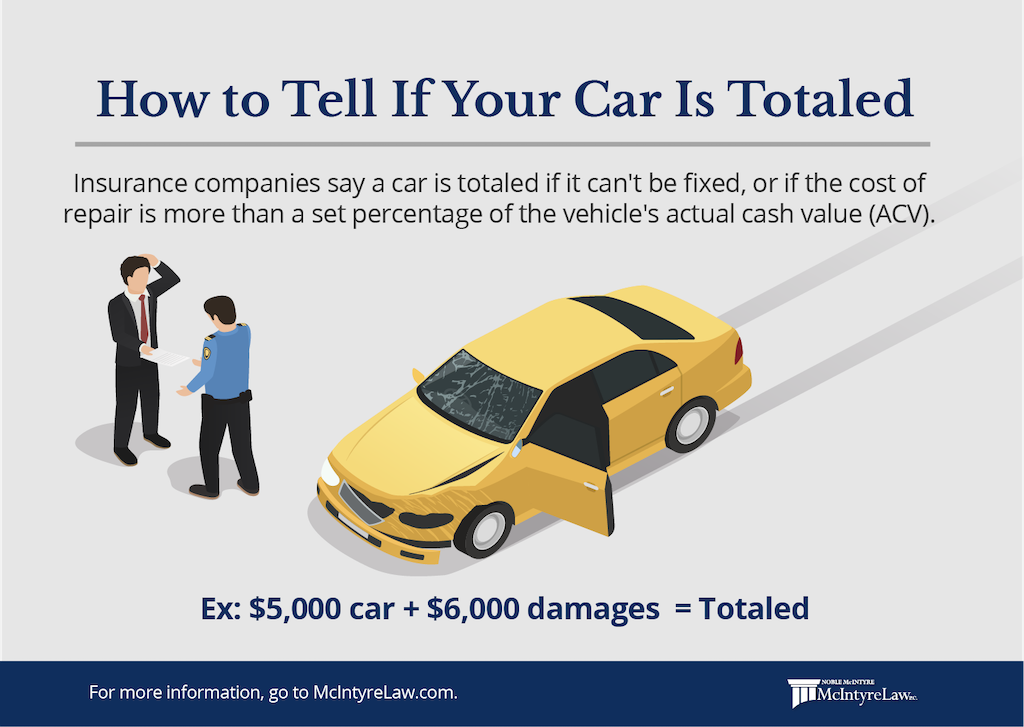

- Depreciation and GAP Insurance Necessity: While new cars depreciate rapidly, their initial value is high. If your brand-new car is totaled shortly after purchase, its actual cash value (ACV) might be less than what you owe on your loan or lease. This "gap" creates a significant financial risk, leading insurers to recommend (or lenders to require) GAP insurance, an additional coverage that adds to your premium.

- Theft Appeal: New, popular car models can be attractive targets for thieves, either for joyriding, parts, or resale. Higher theft rates in certain areas or for specific models can drive up comprehensive coverage costs.

- Financing/Leasing Requirements: If you’ve financed or leased your brand-new car, your lender or leasing company will almost certainly require you to carry "full coverage" – meaning both collision and comprehensive insurance, in addition to liability. This ensures their investment is protected, and these coverages are generally the most expensive parts of an auto insurance policy.

Key Factors Influencing Your Brand New Car Insurance Premium

The exact premium you pay for insuring a brand new car is not a fixed number. It’s a highly personalized calculation based on a multitude of factors, broadly categorized into those related to the car itself, the driver, and your chosen coverage.

Factors Related to the Car:

- Make, Model, and Year: Luxury vehicles, sports cars, and high-performance models typically have higher premiums due to their higher value, repair costs, and statistical likelihood of being driven aggressively. Even within sedans, some models are statistically more likely to be stolen or involved in accidents.

- Safety Features: While advanced safety features like ADAS can sometimes qualify you for discounts, the increased complexity and cost of repairing these systems often counteract any potential savings, leading to higher overall repair costs that influence premiums.

- Cost of Parts & Repairs: Cars with expensive, specialized, or hard-to-find parts (especially imported luxury vehicles) will cost more to insure.

- Vehicle Safety Ratings: Insurers look at ratings from organizations like the IIHS (Insurance Institute for Highway Safety) and NHTSA (National Highway Traffic Traffic Safety Administration). Cars with higher safety ratings for crashworthiness and occupant protection may qualify for lower rates on certain coverages.

Factors Related to the Driver:

- Driving Record: This is arguably the most significant factor. A clean driving record (no accidents, speeding tickets, or DUIs) will result in much lower premiums. Even a single moving violation can significantly increase your rates.

- Age and Experience: Younger, less experienced drivers (especially those under 25) typically pay the highest premiums, as they are statistically more likely to be involved in accidents. Premiums generally decrease with age and experience, up to a certain point.

- Location: Where you live and park your car profoundly impacts your rates. Urban areas with higher traffic density, theft rates, and vandalism statistics will have higher premiums than rural areas. Even specific zip codes within a city can have different rates.

- Credit Score (in most states): In many states, insurers use a credit-based insurance score as a predictor of how likely you are to file a claim. A higher credit score can lead to lower premiums.

- Marital Status: Married individuals often pay slightly less for car insurance, as they are statistically considered less risky.

- Annual Mileage: The more miles you drive, the higher your risk of being in an accident, leading to higher premiums. Some insurers offer low-mileage discounts.

- Gender: In some states (where it’s legally permitted), gender can still be a minor factor, with women sometimes paying slightly less.

Factors Related to Your Coverage Choices:

- Deductible Amount: This is the amount you pay out-of-pocket before your insurance kicks in for collision and comprehensive claims. Choosing a higher deductible (e.g., $1,000 instead of $500) will lower your premium, but you must be prepared to pay that amount if you file a claim.

- Coverage Limits: The maximum amount your insurer will pay for a claim. Higher liability limits (e.g., $250,000/$500,000 instead of state minimums) provide better protection but come with a higher premium.

- Types of Coverage Selected: Adding optional coverages like rental reimbursement, roadside assistance, or new car replacement will increase your overall premium.

Essential Coverages for a Brand New Car

When insuring a brand new car, you’ll need more than just the basic state-mandated liability coverage. Full protection typically involves a combination of several types of insurance:

- Liability Coverage (Bodily Injury & Property Damage): This is the most fundamental and legally required coverage in most states. It pays for damages and injuries you cause to other people and their property if you are at fault in an accident. Lenders will require you to carry adequate liability limits.

- Collision Coverage: This pays for damage to your own car resulting from a collision with another vehicle or object (e.g., a tree, guardrail), regardless of who is at fault. For a brand new car, this coverage is non-negotiable, especially if you have a loan or lease.

- Comprehensive Coverage: This protects your car from non-collision-related damage. This includes theft, vandalism, fire, falling objects, natural disasters (hail, floods), and hitting an animal. Like collision, this is essential for a new car and usually required by lenders.

- GAP (Guaranteed Asset Protection) Insurance: This is arguably the most critical and often overlooked coverage for a brand new car. Due to rapid depreciation, a new car can be worth less than your outstanding loan or lease balance very quickly. If your car is totaled, standard collision/comprehensive will only pay its actual cash value (ACV). GAP insurance covers the "gap" between the ACV and what you still owe, preventing you from being upside down on your loan.

- Uninsured/Underinsured Motorist (UM/UIM) Coverage: This protects you and your passengers if you’re involved in an accident with a driver who has no insurance or insufficient insurance to cover your damages and medical bills. Given the number of uninsured drivers, this is a highly recommended coverage for peace of mind.

- New Car Replacement Coverage (Optional Add-on): Some insurers offer this as an add-on. If your brand new car is totaled within a certain timeframe (e.g., 1-2 years) and mileage limit, this coverage will replace it with a brand new car of the same make and model, rather than just paying its depreciated actual cash value.

- Rental Car Reimbursement (Optional): Pays for a rental car while your vehicle is being repaired after a covered claim.

- Roadside Assistance (Optional): Provides services like towing, battery jump-starts, tire changes, and fuel delivery.

How to Get the Best Insurance Rate for Your Brand New Car

While new car insurance can be expensive, there are many strategies you can employ to mitigate the costs and find the most affordable yet comprehensive policy:

- Shop Around Extensively: Do not settle for the first quote you receive. Get quotes from at least 3-5 different insurance companies (national carriers, regional providers, and even online-only insurers). Rates can vary wildly between providers for the exact same coverage.

- Bundle Policies: Most insurers offer discounts if you bundle your auto insurance with other policies, such as homeowners, renters, or life insurance.

- Increase Your Deductibles: If you have an emergency fund to cover it, opting for a higher deductible (e.g., $1,000 instead of $500) on your collision and comprehensive coverage can significantly lower your premium.

- Ask About All Available Discounts: Insurers offer a plethora of discounts:

- Good Driver/Accident-Free: For maintaining a clean record.

- Good Student: For young drivers with good academic performance.

- Multi-Car: For insuring more than one vehicle on the same policy.

- Vehicle Safety Features: For anti-lock brakes, airbags, anti-theft devices, ADAS.

- Low Mileage: If you don’t drive much.

- Telematics/Usage-Based Insurance: Programs that monitor your driving habits (e.g., speed, braking) via an app or device; safe drivers can earn discounts.

- Professional/Affiliation: Discounts for certain professions or memberships (e.g., alumni associations, credit unions).

- Paid-in-Full: For paying your premium upfront.

- Choose Your Car Wisely: Research insurance costs before you buy. Some models are inherently more expensive to insure due to their value, repair costs, or theft rates. A slightly less powerful or luxurious model could save you hundreds annually on insurance.

- Maintain a Good Credit Score: As mentioned, a higher credit score can lead to lower premiums in most states.

- Consider Anti-Theft Devices: Installing approved anti-theft systems can sometimes qualify you for a discount on comprehensive coverage.

- Review Your Policy Annually: Your driving habits, car’s value, and life circumstances change. Review your policy with your agent annually to ensure you have adequate coverage and are still getting the best rates.

Estimated Annual Insurance Costs for Brand New Cars

It’s impossible to give an exact figure for "how much is insurance on a brand new car" without knowing all the specific details. However, we can provide a range based on common scenarios and vehicle types, assuming full coverage (Liability, Collision, Comprehensive, and GAP insurance).

Sample Annual Insurance Cost Ranges for Brand New Cars (Estimates)

| Car Type & Value (Approx.) | Driver Profile | Location Type | Key Coverages | Estimated Annual Premium Range |

|---|---|---|---|---|

| Economy Sedan | 30-year-old, | Suburban | Full Coverage | $1,400 – $2,200 |

| (e.g., Honda Civic, Corolla) | Clean Record | + GAP | ||

| Mid-Size SUV | 45-year-old, | Rural | Full Coverage | $1,500 – $2,500 |

| (e.g., RAV4, CR-V) | Clean Record | + GAP | ||

| Luxury Sedan | 35-year-old, | Urban | Full Coverage | $2,200 – $4,000+ |

| (e.g., BMW 3-Series, Audi A4) | Clean Record | + GAP | ||

| Sports Car | 22-year-old, | Urban | Full Coverage | $3,500 – $6,000+ |

| (e.g., Mustang GT, Camaro) | Minor Violation | + GAP | ||

| Electric Vehicle | 40-year-old, | Suburban | Full Coverage | $1,800 – $3,000 |

| (e.g., Tesla Model 3) | Clean Record | + GAP |

Disclaimer: These figures are broad estimates and can vary significantly based on your specific zip code, credit score, chosen deductibles, specific discounts, and the individual insurance company. Always get personalized quotes.

Practical Advice and Actionable Insights

- Get Quotes BEFORE You Buy: Never finalize a car purchase without first getting insurance quotes for that specific make and model. The difference in insurance costs could sway your decision between two similar vehicles.

- Understand "Actual Cash Value" (ACV): Most policies pay out based on ACV, which is the car’s market value at the time of the loss, not what you paid for it. This is why GAP insurance is so important for new cars.

- Don’t Skimp on Liability: While increasing deductibles can save money, never compromise on your liability limits. State minimums are often woefully inadequate to cover severe accident damages, leaving you personally responsible for the remainder.

- Read the Fine Print: Understand what your policy covers and, more importantly, what it doesn’t. Pay attention to exclusions, limits, and the claims process.

- Consider Driving Habits: If you drive infrequently or very safely, look into telematics programs that could reward you with lower premiums.

Frequently Asked Questions (FAQ) about New Car Insurance

Q1: Is insurance always more expensive for a new car than an old one?

A1: Generally, yes. New cars have higher replacement costs, more expensive parts, and advanced technology that drives up repair expenses, all contributing to higher premiums. However, a very old, rare, or high-performance older car could sometimes be more expensive to insure than a new economy car.

Q2: Do I really need GAP insurance for my brand new car?

A2: If you’ve financed or leased your car, yes, it’s highly recommended. New cars depreciate quickly. If your car is totaled, GAP insurance covers the difference between what you owe on your loan/lease and the car’s actual cash value paid by your standard collision/comprehensive coverage.

Q3: Can the specific car I choose affect my insurance rates significantly?

A3: Absolutely. The make, model, year, safety features, engine size, theft rate, and cost of repairs for a specific vehicle are major determinants of your insurance premium. Research insurance costs for different models before making a purchase decision.

Q4: How can I lower my insurance premium on a new car?

A4: Shop around for quotes, bundle policies, choose a higher deductible (if affordable), ask about all eligible discounts (good driver, multi-car, good student, telematics), maintain a clean driving record, and consider a car model that is less expensive to insure.

Q5: When should I get insurance for my new car?

A5: You must have insurance coverage in place before you drive your new car off the dealership lot. Most dealerships will require proof of insurance before handing over the keys. It’s best to arrange it a day or two in advance.

Q6: Does my credit score affect my car insurance rates?

A6: In most U.S. states (with exceptions like California, Hawaii, and Massachusetts), insurers use a credit-based insurance score as one factor in determining your premium. A higher credit score generally leads to lower rates.

Q7: What is "full coverage" and do I need it for a new car?

A7: "Full coverage" is a common term that typically refers to a policy that includes Liability, Collision, and Comprehensive insurance. If you have a loan or lease on your new car, your lender will almost certainly require you to carry full coverage to protect their asset. It’s also highly recommended even if you own the car outright, given the high replacement value.

Conclusion

Driving a brand-new car is an exciting milestone, but the financial realities of ownership extend beyond the purchase price and monthly payments. Understanding "How much is insurance on a brand new car" is a critical step in responsible car ownership. While new car insurance premiums are generally higher due to the vehicle’s value, advanced technology, and repair costs, being an informed consumer can save you a substantial amount.

By thoroughly researching different car models, comparing quotes from multiple insurers, leveraging all available discounts, and choosing appropriate coverages like GAP insurance, you can ensure your gleaming new ride is protected without draining your wallet. The peace of mind that comes with knowing your significant investment is adequately covered is truly priceless.