How Much Is Insurance On A Brand New Car? Unveiling the True Cost of Your Dream Ride

How Much Is Insurance On A Brand New Car? Unveiling the True Cost of Your Dream Ride cars.truckstrend.com

The exhilarating scent of a new car, the pristine shine, the cutting-edge technology – few purchases rival the excitement of driving a brand new vehicle off the lot. Yet, amidst the joy and anticipation, a crucial question often looms, sometimes understated, sometimes overwhelming: "How much is insurance on a brand new car?" Understanding this cost is paramount, as it can significantly impact your total budget and the long-term affordability of your dream machine. Insurance isn’t merely an optional add-on; it’s a legal requirement in most places and a vital financial safeguard that protects your significant investment and shields you from potentially catastrophic liabilities.

This comprehensive guide will demystify the cost of insuring a brand new car, breaking down the factors that influence premiums, exploring essential coverage options, and providing actionable strategies to manage and potentially reduce your insurance expenses. By the end, you’ll be equipped with the knowledge to make informed decisions and budget effectively for your new set of wheels.

How Much Is Insurance On A Brand New Car? Unveiling the True Cost of Your Dream Ride

Why Brand New Cars Often Cost More to Insure

It’s a common observation that insurance premiums for new vehicles tend to be higher than for older, comparable models. Several key factors contribute to this phenomenon:

- Higher Replacement Value: A brand new car’s market value is at its peak. In the event of a total loss, the insurer would have to pay out a much larger sum to replace it compared to an older vehicle. This higher potential payout directly translates to higher premiums.

- Cost of Repairs: Modern cars, especially new ones, are packed with advanced technology – intricate sensors, sophisticated safety systems, complex infotainment units, and specialized body materials (like aluminum or carbon fiber). Repairing these components often requires specialized tools, training, and more expensive parts, driving up the cost of collision and comprehensive claims. Even a minor fender bender can involve replacing expensive sensors embedded in bumpers or grilles.

- Theft Risk: While not universally true for all new models, some desirable new cars are higher targets for theft, particularly for parts or resale. Insurers assess these risks and adjust premiums accordingly.

- Depreciation Curve: New cars experience rapid depreciation, especially in the first few years. While this might seem counterintuitive to higher insurance, it ties back to the initial high replacement cost. Insurers are covering that peak value at the start.

- Mandatory Coverage Requirements: When financing or leasing a new car, lenders almost always require "full coverage," which includes collision and comprehensive insurance, in addition to liability. This comprehensive protection, while essential, inherently costs more than basic liability-only policies often carried on older, fully paid-off vehicles.

Essential Coverages for Your Brand New Car

Insuring a new car isn’t just about meeting legal minimums; it’s about protecting your significant investment. Here are the crucial types of coverage you should consider for a brand new vehicle:

- Liability Insurance: This is the foundational coverage, legally required in most states. It covers damages (bodily injury and property damage) you cause to other people and their vehicles/property if you’re at fault in an accident. For a new car, carrying higher liability limits is wise, as major accidents can lead to astronomical costs that exceed minimum coverage.

- Collision Coverage: This pays for damages to your own vehicle resulting from a collision with another car or object, regardless of who is at fault. Given the high repair costs of new cars, collision coverage is indispensable.

- Comprehensive Coverage: This protects your car from non-collision-related damages, such as theft, vandalism, fire, natural disasters (hail, floods), falling objects, and animal impacts. It’s especially important for new cars due to their high value and susceptibility to these risks.

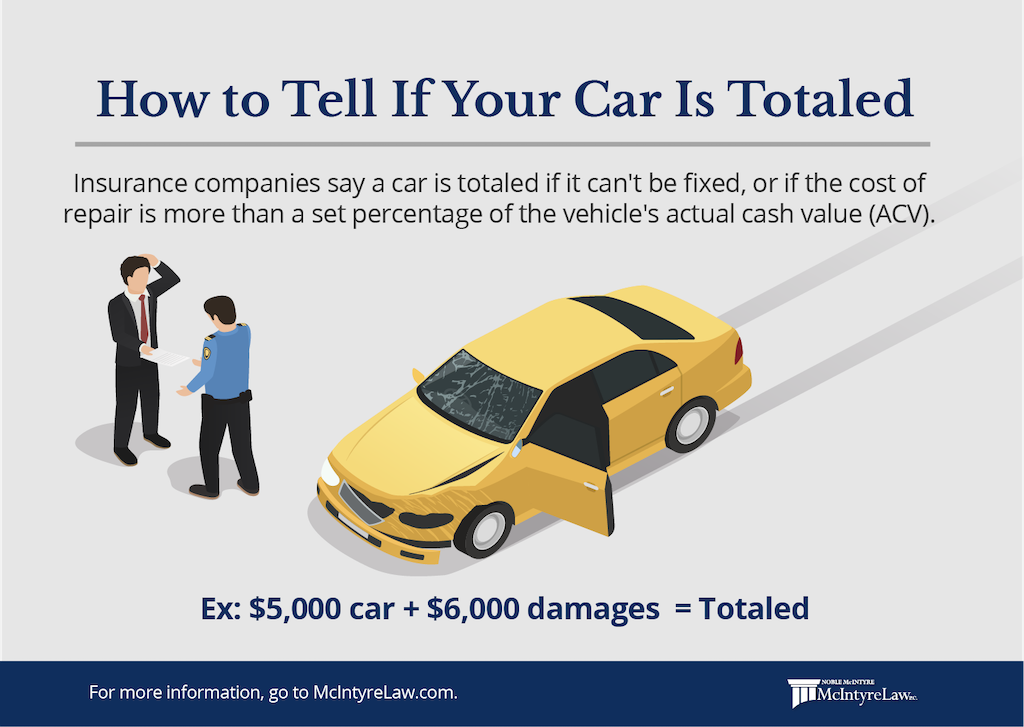

- GAP Insurance (Guaranteed Asset Protection): This is arguably the most critical add-on for a brand new car, especially if you finance or lease. New cars depreciate rapidly. If your car is totaled or stolen early in your ownership, you might owe more on your loan or lease than the car’s actual cash value (what your standard collision/comprehensive policy would pay out). GAP insurance covers this "gap" between what you owe and what the car is worth, preventing you from being upside down on your loan.

- New Car Replacement Coverage: Some insurers offer this endorsement, which pays for a brand new car of the same make and model if your new vehicle is totaled within a specified timeframe (e.g., first 1-3 years) rather than just its depreciated actual cash value. This can be a valuable peace of mind for new car owners.

- Uninsured/Underinsured Motorist (UM/UIM): This protects you if you’re hit by a driver who has no insurance or insufficient insurance to cover your damages and medical bills. Given the number of uninsured drivers on the road, this coverage is highly recommended.

Factors That Drive Your New Car Insurance Premium

While the "newness" of the car plays a role, your personal profile and choices also heavily influence the final premium. Insurers assess a wide range of variables to calculate your risk:

- The Car Itself:

- MSRP/Value: Higher price tags mean higher premiums.

- Make and Model: Luxury cars, sports cars, and high-performance vehicles typically cost more to insure due to higher repair costs, theft rates, and increased risk of speeding/accidents.

- Safety Features: Advanced safety features (e.g., automatic emergency braking, lane-keeping assist, adaptive cruise control) can sometimes lead to discounts, as they reduce the likelihood of accidents or the severity of injuries.

- Repair Costs/Parts Availability: Cars with readily available and cheaper parts generally have lower premiums.

- Theft Rates: Models with high theft rates will command higher insurance costs.

- Your Driver Profile:

- Age and Experience: Younger, less experienced drivers (especially under 25) typically pay significantly more due to higher accident statistics.

- Driving Record: A clean driving record (no accidents, tickets) is your best friend for lower premiums. Prior incidents will increase your rates.

- Credit Score (in most states): Insurers use credit-based insurance scores as a predictor of risk. A higher score often leads to lower premiums.

- Gender and Marital Status: Statistically, married individuals and women sometimes pay slightly less than single men, though these differences are becoming less pronounced.

- Location: Urban areas with higher traffic density, theft rates, and accident rates usually have higher premiums than rural areas. Your specific zip code can make a big difference.

- Annual Mileage: The more you drive, the higher your risk of an accident, leading to higher premiums.

- Your Policy Choices:

- Deductible Amount: This is the amount you pay out-of-pocket before your insurance kicks in for collision and comprehensive claims. Choosing a higher deductible will lower your premium, but means you’ll pay more upfront if you file a claim.

- Coverage Limits: Opting for higher liability limits or additional coverages like GAP insurance will increase your premium but provide greater protection.

Strategies to Lower Your New Car Insurance Costs

Even with a brand new car, there are numerous ways to mitigate the insurance cost:

- Shop Around Extensively: This is the single most effective strategy. Get quotes from at least 3-5 different insurance companies. Premiums can vary wildly between insurers for the exact same coverage. Use online comparison tools, independent agents, and direct insurers.

- Bundle Your Policies: Many insurers offer discounts for bundling auto insurance with other policies like home, renters, or life insurance.

- Choose a Higher Deductible: If you have a healthy emergency fund, consider increasing your collision and comprehensive deductibles. A higher deductible means a lower premium, but be sure you can comfortably afford the deductible amount if you need to file a claim.

- Inquire About Discounts: Ask your insurer about every possible discount:

- Multi-car discount: If you insure more than one vehicle.

- Good driver discount: For maintaining a clean record.

- Good student discount: For young drivers with good grades.

- Defensive driving course discount: Completing an approved safety course.

- Low mileage discount: If you don’t drive much.

- Safety features discount: For cars with advanced safety tech (e.g., anti-lock brakes, airbags, anti-theft devices, automatic emergency braking).

- Paperless/EFT discount: For managing your policy online or setting up automatic payments.

- Maintain a Good Driving Record: Avoid tickets and accidents. A clean record is the most powerful long-term factor in keeping your rates low.

- Improve Your Credit Score: If you’re in a state where credit is used, a better credit score can lead to significant savings.

- Consider the Car Model Wisely: Before buying, research the insurance costs for different makes and models. Some cars are simply cheaper to insure than others, even within the same class.

- Drop Unnecessary Coverage (Eventually): While not advisable for a brand new car, once your car ages and its value significantly depreciates, you might consider dropping collision and comprehensive coverage if the annual premium outweighs the car’s actual cash value. This is a decision for later in the car’s life.

- Utilize Telematics/Usage-Based Insurance: Some insurers offer programs where a device tracks your driving habits (speed, braking, mileage). Safe drivers can earn substantial discounts.

The Quote Process: What You Need and How to Get It

Getting an accurate insurance quote for your brand new car is straightforward but requires specific information:

- Vehicle Information:

- Year, Make, Model

- VIN (Vehicle Identification Number) if available

- Trim level (e.g., LX, EX, Touring)

- Safety features and anti-theft devices

- Purchase price or MSRP

- Driver Information:

- Full name and date of birth for all drivers

- Driver’s license number

- Driving history (accidents, tickets within the last 3-5 years)

- Occupation and education level

- Credit score (or permission for a soft credit pull)

- Policy Details:

- Desired coverage limits (liability, collision, comprehensive)

- Deductible amounts

- Any desired add-ons (GAP, new car replacement, roadside assistance)

- Annual mileage estimate

- Usage of the vehicle (commute, pleasure, business)

How to Get Quotes:

- Online Comparison Sites: Websites like Compare.com, TheZebra.com, or NerdWallet allow you to input your information once and get multiple quotes from different insurers.

- Direct Insurers’ Websites: Visit the sites of major carriers like GEICO, Progressive, State Farm, Allstate, Liberty Mutual, etc., to get direct quotes.

- Independent Insurance Agents: An independent agent works with multiple insurance companies and can shop around on your behalf, often finding competitive rates and providing personalized advice.

Illustrative Guide: Factors Influencing New Car Insurance Premiums

Below is an illustrative table demonstrating how various factors can impact the cost of insuring a brand new car. Please note: These are general indications of impact, not exact dollar figures, as actual premiums vary widely based on individual circumstances, location, and insurer.

| Factor | Description | Impact on Premium (Relative) |

|---|---|---|

| Car’s MSRP/Value | Higher original price of the vehicle. | Higher |

| Vehicle Type | Sports car, luxury car, high-performance SUV vs. economy sedan. | Higher (for sports/luxury) |

| Safety Features | Presence of advanced driver-assistance systems (ADAS), anti-lock brakes, multiple airbags. | Lower (potential discounts) |

| Repair Costs/Parts | Complexity and cost of parts and labor for typical repairs. | Higher |

| Theft Rates | Model’s historical susceptibility to theft. | Higher |

| Driver Age | Young/inexperienced drivers (under 25) vs. mature drivers (25-65). | Higher (for young) |

| Driving Record | Presence of accidents, speeding tickets, DUIs. | Significantly Higher |

| Credit Score | Lower credit-based insurance score (in states where allowed). | Higher |

| Location (Zip Code) | Urban vs. rural, crime rates, traffic density in your area. | Variable (higher in urban) |

| Annual Mileage | Driving many miles per year vs. occasional use. | Higher |

| Deductible Amount | Choosing a lower deductible ($250-$500) vs. a higher one ($1,000+). | Higher (for lower deductible) |

| Coverage Limits | Opting for minimum liability vs. high limits and comprehensive coverage. | Higher (for more coverage) |

| Bundling Policies | Insuring car only vs. bundling with home/renters insurance. | Lower (potential discounts) |

| Discounts Applied | Eligibility for good student, multi-car, anti-theft, defensive driving, etc. | Lower |

Frequently Asked Questions (FAQ)

Q1: Is insurance always more expensive on a brand new car?

A1: Generally, yes. Brand new cars have a higher replacement value, more expensive parts, and often require comprehensive coverage (especially if financed), which drives up premiums compared to older vehicles.

Q2: What is GAP insurance and do I really need it for a new car?

A2: GAP (Guaranteed Asset Protection) insurance covers the "gap" between what you owe on your car loan/lease and the car’s actual cash value if it’s totaled or stolen. Given how quickly new cars depreciate, it’s highly recommended if you finance or lease, as it prevents you from owing money on a car you no longer have.

Q3: Does the color of my new car affect insurance rates?

A3: No, the color of your car does not affect insurance rates. This is a common myth. Insurers care about the make, model, year, safety features, and driver profile, not the paint job.

Q4: How can I get the cheapest insurance for my brand new car?

A4: The best strategies include shopping around for quotes from multiple insurers, bundling your policies, choosing a higher deductible you can afford, maintaining a clean driving record, and asking about all available discounts.

Q5: Will my credit score affect my new car insurance premium?

A5: In most states, yes. Insurers use credit-based insurance scores as a factor in determining premiums, as studies suggest a correlation between credit history and the likelihood of filing a claim. A higher credit score often leads to lower rates.

Q6: Should I get new car replacement coverage?

A6: If you’re concerned about depreciation and want to ensure you can replace your totaled new car with another brand new one (rather than just its depreciated value), then new car replacement coverage can be a valuable add-on, typically for the first few years of ownership.

Conclusion

Driving a brand new car is an exciting milestone, but understanding the accompanying insurance costs is crucial for financial peace of mind. While premiums for new vehicles tend to be higher due to their value and repair complexity, being an informed consumer empowers you to navigate the insurance landscape effectively. By understanding the factors that influence your rates, exploring essential coverage options like GAP insurance, diligently shopping for quotes, and actively seeking out discounts, you can significantly influence your bottom line.

Remember, the true cost of a brand new car isn’t just its sticker price; it’s the sum of the purchase, financing, maintenance, fuel, and, critically, the ongoing insurance premiums. By factoring in all these elements from the start, you can ensure your dream car remains a source of joy, not financial stress, for years to come.