Lease Semi Trucks For Sale: Your Comprehensive Guide to Acquiring Commercial Vehicles

Lease Semi Trucks For Sale: Your Comprehensive Guide to Acquiring Commercial Vehicles cars.truckstrend.com

In the dynamic world of logistics and transportation, acquiring reliable semi-trucks is a cornerstone of success. For many businesses and aspiring owner-operators, the traditional path of outright purchasing a truck, with its substantial upfront costs and ongoing maintenance burdens, can be a significant hurdle. This is where the concept of "Lease Semi Trucks For Sale" comes into play, offering a flexible and often more financially viable alternative.

While the phrase "Lease Semi Trucks For Sale" might sound a bit like an oxymoron – you’re typically leasing something, not selling a lease – it broadly refers to the availability of semi-trucks through lease agreements, often with an option to purchase at the end of the term. It’s about finding opportunities to acquire and utilize commercial vehicles without the immediate burden of full ownership, providing a pathway to fleet expansion or independent operation with controlled costs and greater financial agility. This comprehensive guide will delve into the nuances of leasing semi trucks, exploring its benefits, types, critical considerations, and how to navigate the process effectively.

Lease Semi Trucks For Sale: Your Comprehensive Guide to Acquiring Commercial Vehicles

Understanding "Lease Semi Trucks For Sale": What Does It Mean?

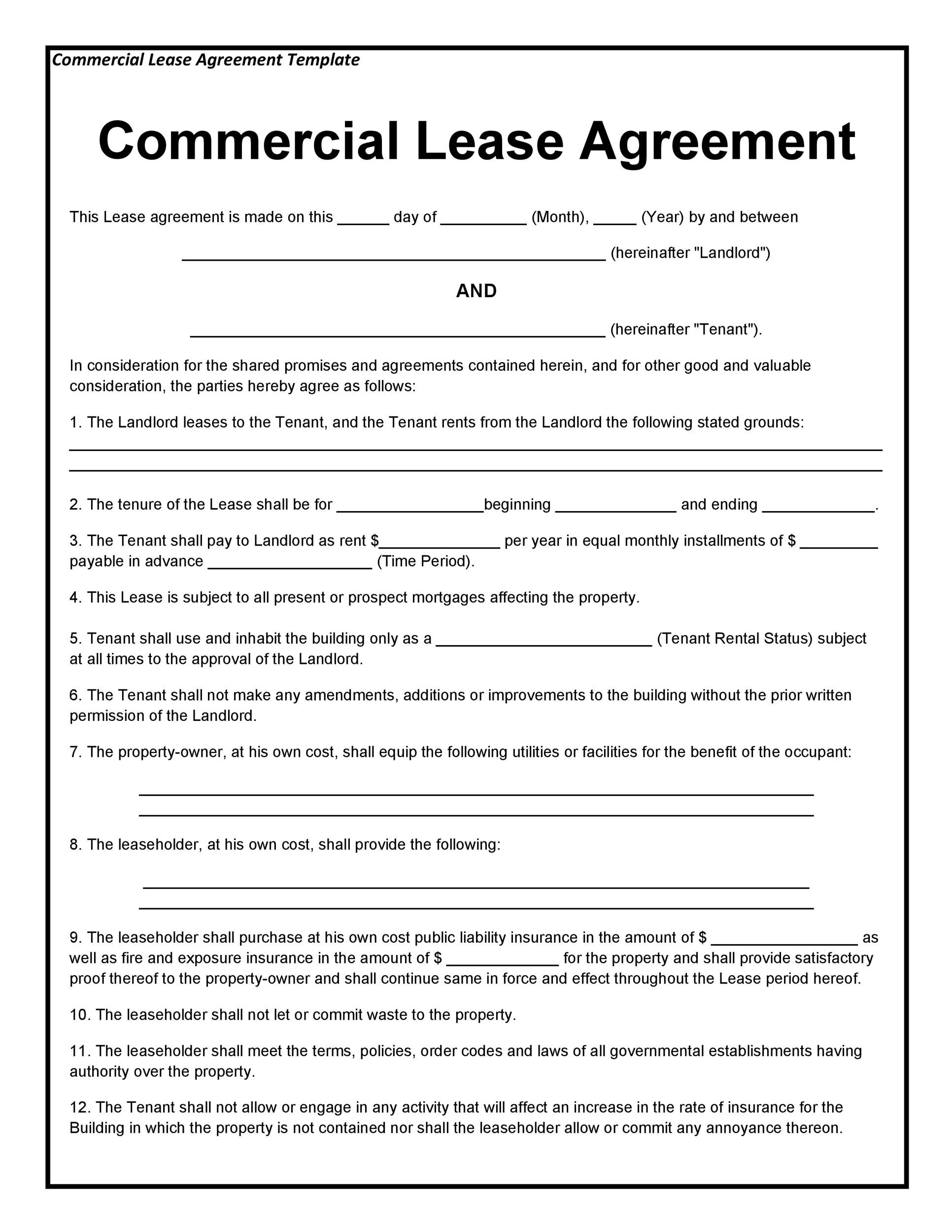

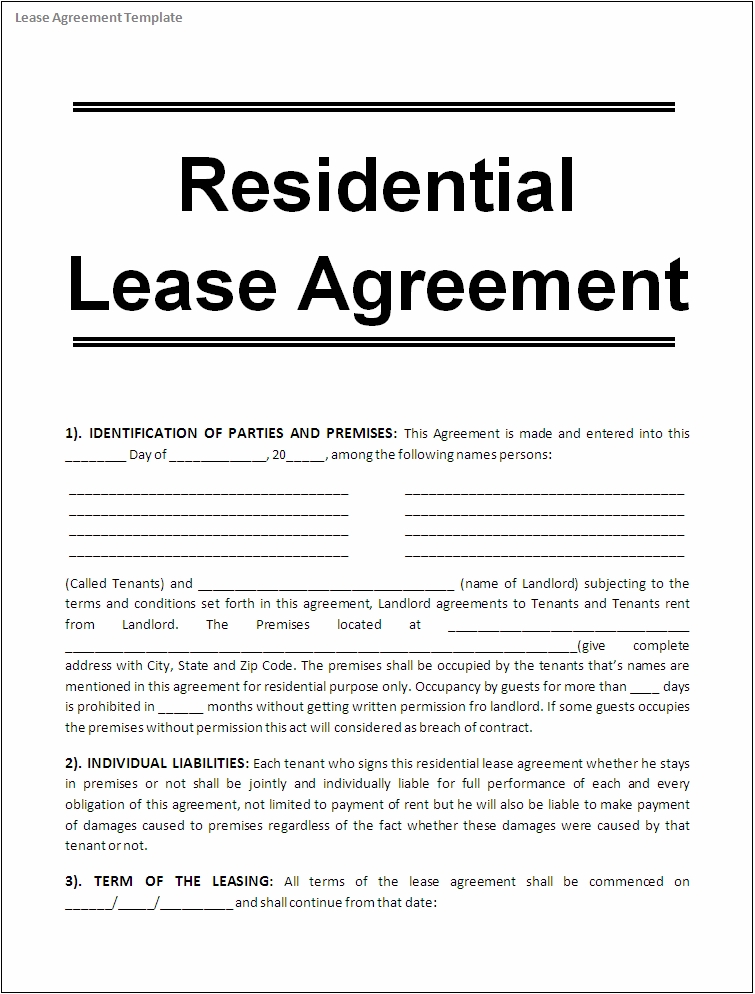

At its core, "Lease Semi Trucks For Sale" signifies that a semi-truck is being offered under a lease agreement, which may or may not include a future purchase option. It’s a marketing term used by dealerships, manufacturers, and specialized leasing companies to highlight their inventory available for lease. Unlike a direct sale, where you take immediate ownership, a lease allows you to use the truck for a specified period in exchange for regular payments, with ownership remaining with the lessor.

The "For Sale" aspect often points to two key scenarios:

- Lease-to-Own Programs: These are hybrid agreements where a portion of your lease payments contributes towards the eventual purchase of the truck. At the end of the lease term, you typically have the option to buy the truck at a pre-determined residual value, or sometimes for a nominal fee. This is particularly appealing to owner-operators who want to build equity while mitigating the initial financial strain of outright buying.

- Available Inventory for Lease: Simply put, it refers to the list or inventory of semi-trucks that are currently available to be leased. A provider might advertise "Semi Trucks For Lease" or "Lease Options Available," and this is what the phrase generally encompasses.

Understanding this distinction is crucial, as it shapes your long-term financial commitment and ownership prospects.

Types of Semi-Truck Leases Available

The world of semi-truck leasing offers several structures, each with its own advantages and responsibilities. Knowing these types will help you choose the option that best aligns with your operational and financial goals.

-

Full-Service Lease (FSL): This is the most comprehensive lease type. The lessor (the leasing company or dealer) retains ownership and is responsible for virtually all aspects of truck maintenance, repairs, and often even road service, licensing, and permitting.

- Pros: Predictable monthly costs, no unexpected repair bills, access to newer equipment, reduced administrative burden.

- Cons: Higher monthly payments, less control over maintenance schedules and providers, typically no equity building.

- Best For: Companies focused purely on transportation, desiring predictable costs and minimal operational hassle.

-

Finance Lease (TRAC Lease – Terminal Rental Adjustment Clause): This type of lease is structured more like a loan. The lessee (you) is responsible for all maintenance, repairs, insurance, and taxes. At the end of the term, there’s a pre-determined residual value. If the truck sells for more than this value, you get the difference; if less, you pay the difference. This structure often allows for off-balance sheet financing for accounting purposes.

- Pros: Lower monthly payments than FSL, potential tax advantages (payments are typically deductible), flexibility to choose your own maintenance providers, path to ownership if you purchase at residual.

- Cons: Full responsibility for maintenance and repairs, risk of residual value adjustments.

- Best For: Businesses with in-house maintenance capabilities or established relationships with service providers, seeking lower monthly payments and potential tax benefits.

-

Operating Lease: Similar to a long-term rental, an operating lease typically has a shorter term (2-5 years) and usually does not include a purchase option. It’s designed for short-term use and provides maximum flexibility. The truck is returned to the lessor at the end of the term.

- Pros: Maximum flexibility, off-balance sheet financing (can improve financial ratios), allows frequent upgrades to newer models.

- Cons: No equity building, potential for mileage overage and wear-and-tear charges.

- Best For: Companies with fluctuating needs, those who want to avoid asset depreciation, or those who frequently update their fleet.

-

Lease-to-Own / Purchase Option Lease: As mentioned, this is a hybrid. It’s often a type of finance lease where the intention from the outset is for the lessee to eventually purchase the truck. A portion of each payment may be allocated towards equity, or there might be a pre-agreed purchase price at the end of the term.

- Pros: Builds equity, lower upfront costs than outright purchase, allows time to build credit/capital, predictable path to ownership.

- Cons: Still responsible for maintenance, often higher overall cost than a direct purchase, long-term commitment.

- Best For: New owner-operators, individuals looking to eventually own their truck but lack immediate capital or established credit.

Benefits of Leasing Semi Trucks

Leasing offers a compelling array of advantages that make it an attractive option for many in the trucking industry:

- Lower Upfront Costs: Compared to purchasing, leasing typically requires a significantly lower down payment, or sometimes none at all. This preserves crucial working capital.

- Predictable Monthly Expenses: Lease payments are fixed, making budgeting easier and eliminating the surprise of large, unexpected repair bills (especially with full-service leases).

- Access to Newer Equipment: Leasing allows businesses to regularly upgrade to the latest models with advanced technology, better fuel efficiency, and improved safety features, enhancing operational efficiency and driver satisfaction.

- Tax Advantages: Lease payments are often fully tax-deductible as an operating expense, which can lead to significant tax savings compared to depreciation write-offs from ownership. (Consult with a tax professional for specific advice).

- Flexibility and Scalability: Leasing can be ideal for businesses experiencing growth or fluctuating demand. It allows them to scale their fleet up or down more easily without being burdened by depreciating assets.

- Reduced Maintenance Burden: For full-service leases, the lessor handles all maintenance, repairs, and even roadside assistance, freeing up your time and resources to focus on your core business.

- Improved Cash Flow: By avoiding large capital expenditures, companies can maintain healthier cash reserves, which can be reinvested into other areas of the business.

Who Should Consider Leasing?

Leasing is not a one-size-fits-all solution, but it particularly benefits:

- New Owner-Operators: Without a substantial down payment or established credit, leasing (especially lease-to-own) can be the most accessible entry point into the industry.

- Small to Medium-Sized Fleets: These businesses often benefit from preserved capital and predictable costs, allowing them to compete with larger players without heavy investment.

- Businesses with Fluctuating Needs: Companies with seasonal demands or project-based work can leverage operating leases for short-term flexibility.

- Companies Prioritizing Cash Flow: Any business that wants to maximize its working capital and avoid asset depreciation risk will find leasing appealing.

Key Considerations Before Leasing

Before signing any agreement, thorough due diligence is paramount. Consider these critical factors:

- Lease Term and Mileage Limits: Understand the duration of the lease (e.g., 36, 48, 60 months) and any mileage restrictions. Exceeding mileage limits can incur significant penalties.

- Maintenance Responsibilities: Clearly define who is responsible for routine maintenance, major repairs, tires, and breakdowns. This is a major differentiator between lease types.

- Insurance Requirements: Lessors will have specific insurance requirements. Ensure you can meet them and factor the cost into your budget.

- End-of-Lease Options: What happens when the lease ends? Can you purchase the truck? Renew the lease? Or simply return it? Understand the conditions for each option, including potential wear-and-tear charges upon return.

- Credit Requirements: Leasing companies will review your credit history and financial stability. Be prepared to provide financial statements and potentially a business plan.

- Hidden Fees/Penalties: Scrutinize the contract for any clauses regarding early termination fees, excessive wear and tear charges, late payment penalties, or administrative fees.

- Specific Truck Needs: Define your operational requirements:

- Truck Type: Day cab, sleeper, vocational?

- Engine & Transmission: Horsepower, torque, manual/automatic.

- Age & Condition: New vs. used (used leases can be cheaper but might come with more maintenance risk if not full-service).

- Specifications: Axle configuration, fifth wheel type, specialized equipment.

The Process: How to Find and Secure a Lease Semi Truck

Navigating the leasing process involves several key steps:

- Assess Your Needs: Before looking at trucks, define your operational requirements, budget, desired lease type, and long-term goals (e.g., do you want to own it eventually?).

- Research Providers: Look for reputable dealerships (often have in-house leasing), independent leasing companies, and direct manufacturer leasing programs (e.g., Volvo Financial Services, Daimler Truck Financial).

- Compare Offers: Don’t settle for the first quote. Obtain proposals from multiple providers. Compare not just the monthly payment but also:

- Total cost over the lease term.

- Included services (maintenance, roadside assistance).

- Mileage allowances.

- End-of-lease options and associated costs.

- Insurance requirements.

- Early termination clauses.

- Review the Lease Agreement Carefully: This is perhaps the most critical step. Read every line. If you don’t understand something, ask for clarification. Consider having a legal professional review it.

- Application and Approval: Submit your application with all required financial documents. Be transparent and honest.

- Vehicle Inspection and Pickup: Before taking possession, thoroughly inspect the truck. Document any existing damage, and ensure all features and specifications match the agreement.

Potential Challenges and Solutions

While beneficial, leasing isn’t without its potential pitfalls:

- Mileage Overages: Running over your agreed mileage limit can result in hefty per-mile penalties.

- Solution: Accurately estimate your annual mileage. Negotiate a higher allowance upfront if uncertain.

- Wear and Tear Charges: If the truck is returned with damage beyond "normal wear and tear," you’ll be charged.

- Solution: Maintain the vehicle meticulously. Understand the lessor’s definition of "normal wear and tear" and keep detailed maintenance records.

- Long-Term Cost vs. Ownership: Over a very long period, the total cost of leasing might exceed the cost of purchasing, especially for pure operating leases where you never build equity.

- Solution: Conduct a Total Cost of Ownership (TCO) analysis comparing leasing vs. buying for your specific scenario. Factor in depreciation, maintenance, financing, and tax implications.

- Lack of Equity (for pure leases): You don’t build equity with operating or full-service leases, meaning you have no asset to sell or trade in at the end.

- Solution: Understand this trade-off. If equity is important, opt for a finance lease or lease-to-own program.

- Credit Hurdles: New businesses or individuals with limited credit history might struggle to get approved for favorable lease terms.

- Solution: Build a strong business credit profile. Consider a higher down payment or finding a co-signer if necessary. Some programs cater specifically to new owner-operators.

Illustrative Semi-Truck Lease Price Ranges (Sample Table)

Please note: These figures are highly illustrative and can vary dramatically based on the truck’s make, model, year, condition, engine, specific features, the leasing company, your creditworthiness, and prevailing market conditions. Always obtain detailed, personalized quotes.

| Lease Type | Truck Type (Example) | Year Range (Example) | Est. Down Payment (USD) | Est. Monthly Payment Range (USD) | Typical Lease Term (Months) | Notes/Inclusions |

|---|---|---|---|---|---|---|

| Full-Service Lease | New Sleeper Cab (e.g., Volvo VNL) | New | $0 – $5,000 | $3,000 – $5,000+ | 36 – 72 | Includes maintenance, repairs, roadside, often tires. |

| Finance Lease (TRAC) | New Sleeper Cab (e.g., Freightliner Cascadia) | New | $5,000 – $15,000 | $2,000 – $3,500 | 48 – 84 | Lessee responsible for all maintenance. Purchase option. |

| Operating Lease | Used Day Cab (e.g., Kenworth T680) | 3-5 Years Old | $0 – $3,000 | $1,500 – $2,500 | 24 – 48 | Shorter term, no purchase option. Maintenance varies. |

| Lease-to-Own | Used Sleeper Cab (e.g., Peterbilt 379) | 5-8 Years Old | $5,000 – $10,000 | $1,800 – $3,000 | 36 – 72 | Builds equity towards ownership. Lessee often handles maint. |

Disclaimer: These are rough estimates for educational purposes only. Actual costs will vary significantly. Always get multiple, detailed quotes from reputable providers.

Frequently Asked Questions (FAQ)

Q1: Is leasing a semi-truck better than buying one?

A1: Neither is inherently "better"; it depends on your specific financial situation, operational needs, and long-term goals. Leasing offers lower upfront costs, predictable expenses, and access to newer equipment. Buying offers full ownership, equity, and no mileage limits, but comes with higher initial costs and full responsibility for maintenance and depreciation.

Q2: Can I lease a used semi-truck?

A2: Yes, absolutely. Many dealerships and leasing companies offer leases on used semi-trucks. Used truck leases typically have lower monthly payments than new truck leases but may come with higher maintenance responsibilities unless it’s a full-service used truck lease.

Q3: What credit score do I need to lease a semi-truck?

A3: While there’s no single minimum, a strong credit score (typically 650+ for individuals, or strong business credit) will qualify you for the best rates and terms. However, some programs cater to individuals with less-than-perfect credit, often requiring a larger down payment or higher interest rates.

Q4: What happens at the end of a semi-truck lease?

A4: It depends on the lease type:

- Operating Lease: You return the truck to the lessor. Be mindful of mileage overages and excessive wear-and-tear charges.

- Finance Lease (TRAC) / Lease-to-Own: You typically have the option to purchase the truck at a pre-determined residual value, renew the lease, or return the truck.

Q5: Are maintenance costs included in all semi-truck leases?

A5: No. Full-Service Leases (FSL) typically include comprehensive maintenance. Finance Leases (TRAC) and most Lease-to-Own programs usually place the responsibility for maintenance squarely on the lessee. Always clarify this in your lease agreement.

Q6: Can I customize a leased truck?

A6: Generally, no significant structural or performance modifications are allowed on leased trucks without explicit written permission from the lessor. Minor aesthetic changes (e.g., decals) might be permitted but often need to be reversible without damage. Always check your lease agreement.

Conclusion

"Lease Semi Trucks For Sale" represents a vital pathway for individuals and businesses seeking to enter or expand within the competitive trucking industry without the prohibitive upfront costs of outright ownership. Whether you’re a budding owner-operator looking for a lease-to-own opportunity, or an established fleet manager aiming for predictable costs and fleet flexibility through a full-service lease, understanding the various options is paramount.

By carefully assessing your needs, thoroughly researching providers, scrutinizing lease agreements, and understanding the long-term implications, you can make an informed decision that drives your success on the open road. Leasing is not just a financial transaction; it’s a strategic partnership that, when chosen wisely, can significantly contribute to your operational efficiency and profitability.