Repo Tow Trucks For Sale: Your Comprehensive Guide to Smart Acquisition

Repo Tow Trucks For Sale: Your Comprehensive Guide to Smart Acquisition cars.truckstrend.com

The world of commercial vehicles offers a myriad of opportunities for entrepreneurs and expanding businesses. Among the most intriguing and often cost-effective options are "repo" tow trucks for sale. These repossessed assets, sold by banks, financial institutions, and sometimes government entities, present a unique avenue for acquiring essential equipment at a potentially significant discount. Far from being merely "used," a repo tow truck can represent a diamond in the rough, offering robust functionality and a rapid return on investment for the savvy buyer.

This comprehensive guide will delve deep into the landscape of repo tow trucks for sale. We’ll explore what makes them a viable option, where to find them, the critical steps involved in a successful purchase, and the essential considerations to ensure you make an informed decision. Whether you’re a budding towing business owner, looking to expand your fleet, or simply curious about this specialized market, understanding the intricacies of repo tow trucks is paramount.

Repo Tow Trucks For Sale: Your Comprehensive Guide to Smart Acquisition

Understanding "Repo" in Tow Trucks: The Basics

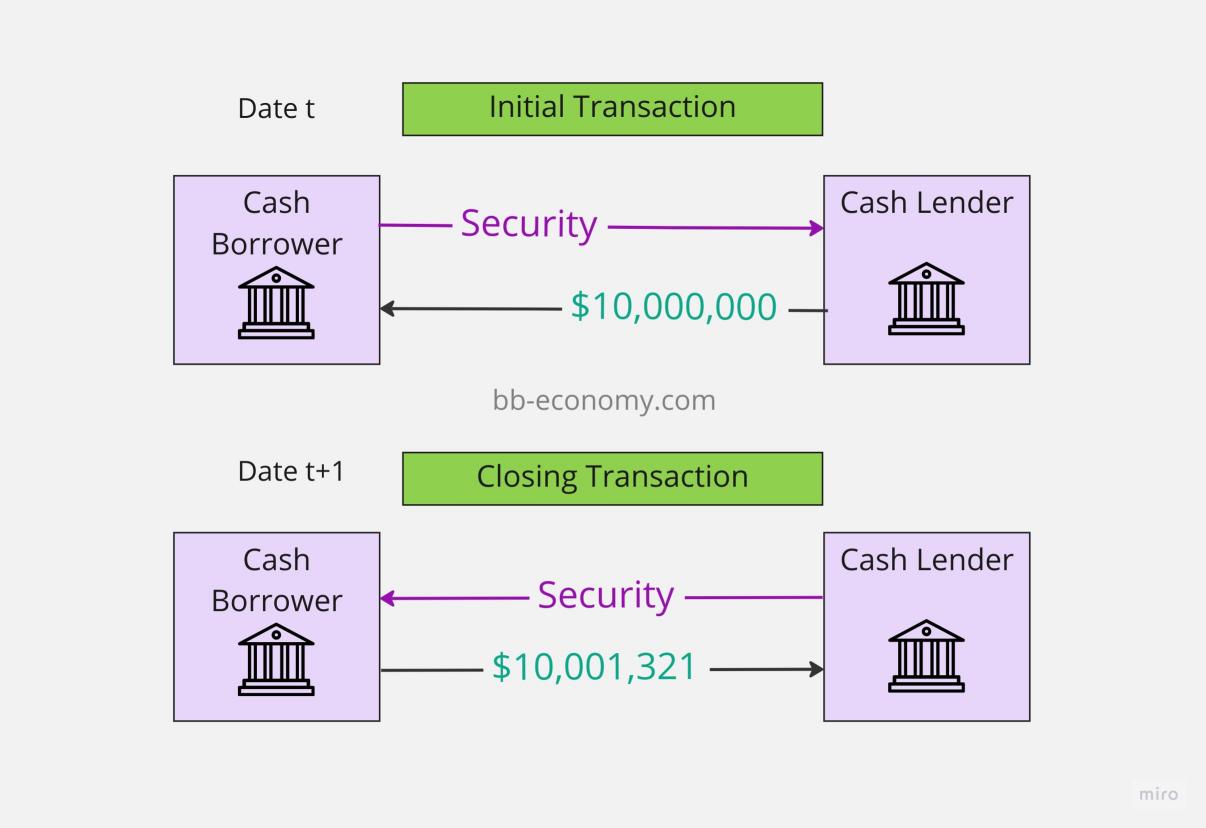

At its core, "repo" is short for repossessed. When a borrower defaults on a loan for a vehicle, the lender has the legal right to take possession of the asset – in this case, a tow truck – to mitigate their financial loss. Once repossessed, these vehicles are then sold to recover outstanding debts.

Why are they for sale? Banks, credit unions, and finance companies are not in the business of operating tow trucks. Their primary goal is to liquidate these assets quickly and efficiently to recoup their investment. This often translates into competitive pricing, as the focus is on recovery rather than maximizing profit in the way a traditional dealership might.

Advantages of Buying a Repo Tow Truck:

- Cost-Effectiveness: This is arguably the biggest draw. Repo trucks are typically sold below market value, offering substantial savings compared to new or even conventionally used trucks.

- Quick Availability: Unlike ordering a new truck which can involve lead times, repo trucks are available for immediate purchase and deployment.

- Often Well-Maintained (Initially): Many repossessed trucks were actively working vehicles and were maintained, at least initially, by their previous owners to keep them operational.

- Variety: The market can offer a diverse range of makes, models, and types of tow trucks.

Disadvantages/Risks:

- "As-Is" Sales: Most repo sales are "as-is," meaning no warranties or guarantees. What you see (or don’t see) is what you get.

- Unknown History: Detailed service records might be scarce or non-existent, making it harder to assess past maintenance.

- Potential Hidden Issues: While some may be in great shape, others might have underlying mechanical or structural problems that aren’t immediately apparent.

- Cosmetic Imperfections: Dings, dents, and wear-and-tear are common, as these were working vehicles.

Types of Repo Tow Trucks You Might Find

The "repo" market isn’t limited to a single type of tow truck. You can find a variety of configurations, each suited for different towing needs:

- Wheel-Lift Tow Trucks: These are the most common for repossession work due to their efficiency and maneuverability. They lift either the front or rear wheels of a vehicle off the ground. Often referred to as "self-loaders" or "stingers," they are ideal for quick pickups, especially in tight urban spaces.

- Flatbed/Rollback Tow Trucks: While less common specifically for repossession, these versatile trucks are frequently repossessed and available. They feature a hydraulic bed that tilts and slides back to allow a vehicle to be driven or winched onto it. They are excellent for transporting damaged vehicles, luxury cars, or equipment that cannot be lifted.

- Integrated/Self-Loader Tow Trucks: A sub-category of wheel-lifts, these often have a boom and a wheel-lift integrated into a single unit, providing robust towing capabilities. They are highly efficient for quick, single-vehicle repos.

- Heavy-Duty Tow Trucks: Less frequently repossessed due to their high initial cost and specialized usage, but not unheard of. These are designed for towing large commercial vehicles, buses, or heavy equipment. If found as a repo, they can represent significant savings for heavy-duty operators.

When browsing, pay attention to features like winch capacity, boom reach, under-reach capabilities, camera systems, and whether it’s equipped for specific types of vehicles.

Where to Find Repo Tow Trucks For Sale

The key to finding a good deal on a repo tow truck is knowing where to look. The market is diverse, with various platforms and channels:

- Online Auction Platforms: These are perhaps the most common and accessible avenues.

- GovPlanet / IronPlanet: Specializes in government and heavy equipment auctions, including commercial trucks.

- Ritchie Bros. Auctioneers: One of the largest industrial auctioneers globally, often featuring a wide range of commercial vehicles.

- Copart / IAAI (Insurance Auto Auctions): While primarily known for salvage vehicles, they often feature repossessed and recovered vehicles, including tow trucks. Be very cautious here, as many will have significant damage.

- Specialized Online Auction Sites: Some smaller, niche auction sites focus specifically on repossessed commercial vehicles.

- Bank/Lender Websites: Many larger banks, credit unions, and finance companies have dedicated "asset recovery" or "repossessed assets for sale" sections on their websites. These are often direct sales, bypassing auction fees.

- Specialized Tow Truck Dealers: Some used tow truck dealers specialize in acquiring and reselling repossessed units. They might offer some level of reconditioning or even limited warranties, albeit at a higher price point than a direct auction.

- Government/Police Auctions: Local government agencies or police departments sometimes auction off seized or surplus vehicles, which can occasionally include tow trucks. These are often in-person auctions.

- Word-of-Mouth & Local Classifieds: Networking within the towing industry or checking local commercial vehicle classifieds (online and print) can sometimes unearth private sales of repossessed trucks.

The Buying Process: A Step-by-Step Guide

Acquiring a repo tow truck requires a structured approach to minimize risks and maximize value:

-

Research and Due Diligence:

- Identify Your Needs: What type of towing will you primarily do? What capacity do you need?

- Budget Setting: Determine your maximum budget, including potential repair costs.

- Model Research: Once you identify potential trucks, research common issues for that make, model, and year.

- VIN Check: Obtain the Vehicle Identification Number (VIN) and run a comprehensive history report (e.g., CarFax, AutoCheck, NICB for commercial vehicles). This can reveal accident history, previous ownership, odometer fraud, and service records.

-

Inspection (Crucial!):

- On-Site Inspection: If possible, always inspect the truck in person. Pictures can be deceiving.

- Third-Party Inspection: If you’re not mechanically inclined or can’t travel, hire a reputable mobile heavy-duty mechanic to perform a pre-purchase inspection. This is perhaps the most important step for an "as-is" sale.

- What to Look For:

- Frame & Chassis: Check for cracks, bends, rust, or previous repairs.

- Engine & Transmission: Listen for unusual noises, check for leaks, test starting, shifting.

- Hydraulics: Inspect cylinders, hoses, pumps for leaks or damage. Test the boom, winch, and wheel-lift.

- Tires & Brakes: Check tread depth, tire condition, and brake responsiveness.

- Electrical System: Test lights, gauges, auxiliary equipment, and battery.

- Interior: Check for excessive wear, non-functional controls, or foul odors.

- Winch & Cables: Inspect for fraying, kinks, or damage.

- PTO (Power Take-Off): Ensure it engages properly.

-

Bidding/Negotiation:

- Understand Auction Dynamics: Online auctions move fast. Set a maximum bid and stick to it.

- Direct Sales: If buying directly from a bank, there might be room for negotiation, especially if the truck has been listed for a while.

-

Financing Options:

- Cash: The simplest method, offering the most leverage.

- Specialized Equipment Loans: Many commercial lenders specialize in financing used heavy equipment.

- In-House Financing: Some larger dealers might offer their own financing.

- SBA Loans: Small Business Administration loans can be an option for qualifying businesses.

-

Transportation and Registration:

- Plan how you’ll get the truck from the sale location to your base. Factor in transportation costs.

- Understand the local Department of Motor Vehicles (DMV) or equivalent regulations for titling and registering commercial vehicles.

Key Considerations Before Buying

Beyond the immediate buying process, several strategic considerations will impact your long-term satisfaction and profitability:

- Condition vs. Price: A lower price often means more required repairs. Balance the initial savings with the potential cost of bringing the truck up to operational standards. Sometimes, a slightly more expensive truck in better condition is a better value.

- Maintenance History: While often limited, any available service records are invaluable. Look for evidence of regular oil changes, fluid checks, and major component replacements.

- Legal & Regulatory Compliance: Tow trucks are heavily regulated. Ensure the truck meets all federal (DOT) and state/local regulations for weight limits, safety equipment, lighting, and emissions. You will need proper licensing and permits to operate.

- Specific Needs: A heavy-duty wrecker won’t be efficient for light-duty repossessions, and a wheel-lift might struggle with larger vehicles. Match the truck to your primary business model.

- Hidden Costs: Always factor in costs beyond the purchase price: transportation, sales tax, registration, insurance, immediate repairs, pre-purchase inspection fees, and potentially new tires or a full service.

Tips for a Successful Purchase

- Set a Firm Budget (and stick to it!): Include the purchase price plus a realistic contingency for repairs and immediate maintenance.

- Be Patient: Don’t rush into the first deal you see. The repo market constantly cycles.

- Don’t Skip the Inspection: This cannot be stressed enough. A thorough inspection by a qualified professional is your best defense against buyer’s remorse.

- Know Your Local Regulations: Before you even bid, understand the licensing, insurance, and operational requirements for tow trucks in your area.

- Factor in Post-Purchase Costs: Assume you’ll need to do a full fluid change, filter replacements, and possibly new tires or minor repairs immediately after purchase.

- Document Everything: Keep records of the VIN, seller details, inspection reports, and all transaction documents.

Potential Challenges and Solutions

- "As-Is" Sales: The biggest challenge. Solution: Rigorous pre-purchase inspection, budget for potential repairs, and consider a "fixer-upper" only if you have the mechanical expertise or a trusted, affordable mechanic.

- Unknown History: Solution: VIN checks are crucial. Also, a very thorough visual and mechanical inspection can reveal signs of neglect or abuse even without records.

- Competitive Bidding: Solution: Set a maximum bid beforehand and be disciplined. Don’t get caught in a bidding war that pushes you beyond your budget. There will always be another truck.

- Transportation Logistics: Solution: Plan this early. Get quotes from heavy haulage companies if you can’t drive it yourself. Ensure the truck is roadworthy (or can be made so) for transport.

Repo Tow Trucks For Sale: Estimated Price Ranges

It’s crucial to understand that prices for repo tow trucks vary wildly based on make, model, year, mileage, condition, specific features, and the urgency of the seller. The table below provides estimated ranges for common types and conditions. These are NOT fixed prices but rather a general guide. Always perform your own research for specific listings.

| Truck Type | Year Range | Condition (Estimated) | Estimated Price Range (USD) | Key Considerations |

|---|---|---|---|---|

| Light-Duty Wheel-Lift (e.g., Ford F-Series, Dodge Ram) | 2008-2015 | Fair (Needs Work) | $10,000 – $25,000 | High mileage, some cosmetic/mechanical issues, good for parts/project. |

| Light-Duty Wheel-Lift (e.g., Ford F-Series, Dodge Ram) | 2012-2018 | Good (Operational) | $25,000 – $45,000 | Ready to work, minor cosmetic wear, routine maintenance. |

| Light-Duty Wheel-Lift (e.g., Ford F-Series, Dodge Ram) | 2018-2022 | Excellent (Low Miles) | $45,000 – $70,000+ | Newer, well-maintained, minimal issues, competitive. |

| Medium-Duty Flatbed/Rollback (e.g., Freightliner M2, Hino) | 2008-2015 | Fair (Needs Work) | $20,000 – $40,000 | Older, higher mileage, potential hydraulic/engine issues. |

| Medium-Duty Flatbed/Rollback (e.g., Freightliner M2, Hino) | 2015-2020 | Good (Operational) | $40,000 – $75,000 | Reliable, good for general towing, some wear. |

| Medium-Duty Flatbed/Rollback (e.g., Freightliner M2, Hino) | 2020-2023 | Excellent (Low Miles) | $75,000 – $120,000+ | Nearly new, excellent condition, high demand. |

| Integrated/Self-Loader (e.g., International, Kenworth) | 2010-2017 | Fair (Needs Work) | $30,000 – $60,000 | Complex systems, higher repair potential, specialized. |

| Integrated/Self-Loader (e.g., International, Kenworth) | 2017-2022 | Good (Operational) | $60,000 – $100,000+ | Versatile, efficient, good for heavy-duty light work. |

| Heavy-Duty Wrecker (e.g., Peterbilt, Volvo) | 2005-2015 | Fair (Needs Major Work) | $50,000 – $100,000+ | Significant investment in repairs likely, very specialized. |

| Heavy-Duty Wrecker (e.g., Peterbilt, Volvo) | 2015-2022 | Good (Operational) | $100,000 – $250,000+ | High initial cost, but immense capacity, rare as repo. |

Note: Prices are highly speculative and depend heavily on the specific market, seller, and truck’s individual characteristics. Always perform due diligence.

Frequently Asked Questions (FAQ)

Q1: Is it safe to buy a repo tow truck?

A1: Yes, it can be safe and highly beneficial, provided you conduct thorough due diligence, including a comprehensive inspection by a qualified mechanic and a VIN history check. Without these steps, it carries significant risk.

Q2: Can I finance a repo tow truck?

A2: Yes, financing is often available through specialized equipment lenders, commercial banks, or even some auction houses. Be prepared for potentially higher interest rates or stricter terms than for a new vehicle, given the "as-is" nature.

Q3: What’s the typical mileage on a repo tow truck?

A3: Mileage varies widely. Light-duty repo trucks can have high mileage (200,000+ miles) due to constant use. Medium and heavy-duty trucks might have lower mileage but significant engine hours. Always verify odometer readings with a VIN check.

Q4: Do repo tow trucks come with a warranty?

A4: Almost never. The vast majority of repo sales are "as-is, where-is," meaning no warranties or guarantees are offered. Any issues that arise after purchase are the buyer’s responsibility.

Q5: What should I look for during an inspection?

A5: Key areas include the frame for damage/rust, engine for leaks/noises, transmission for smooth shifting, hydraulic system (boom, winch, wheel-lift) for leaks and function, tires, brakes, and all electrical components. Don’t forget to check for a working PTO.

Q6: Are there specific licenses needed to operate a tow truck?

A6: Yes, in most jurisdictions, operating a commercial tow truck requires a Commercial Driver’s License (CDL), particularly for heavier vehicles. You will also need proper business licenses, permits, and commercial insurance, which are often extensive for towing operations. Always check local, state, and federal regulations.

Conclusion

Acquiring a repo tow truck for sale can be an incredibly smart business move, offering a pathway to significant cost savings and rapid fleet expansion. However, it’s not a decision to be taken lightly. Success in this market hinges on meticulous research, rigorous inspection, and a clear understanding of the risks and rewards involved. By approaching the process with diligence, patience, and the practical advice outlined in this guide, you can confidently navigate the repo market and secure a valuable asset that drives your business forward. The opportunity is real, but the informed buyer is the successful buyer.