Selling A Brand New Car: A Comprehensive Guide to Navigating the Unexpected Resale

Selling A Brand New Car: A Comprehensive Guide to Navigating the Unexpected Resale cars.truckstrend.com

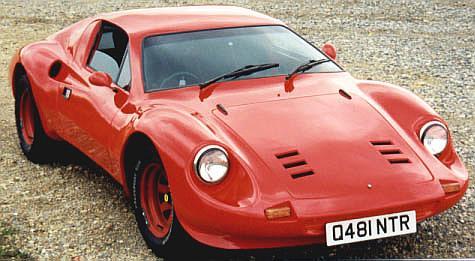

The allure of a brand new car is undeniable: that new car smell, the latest technology, a pristine finish, and the peace of mind of a full factory warranty. For most, buying a new car is a significant long-term investment and a source of excitement. However, life is unpredictable. Sometimes, for a myriad of reasons – be it an unexpected financial change, a sudden shift in lifestyle, buyer’s remorse, or simply finding a better fit – you might find yourself in the unique position of needing to sell a car that is, by all practical measures, still "brand new."

This isn’t about selling a well-loved used car with years of memories; it’s about navigating the delicate landscape of reselling a vehicle that has barely left the dealership lot. While it might seem counterintuitive to sell something you just bought, understanding the process, mitigating potential losses, and maximizing your return is crucial. This comprehensive guide will walk you through everything you need to know about selling a brand new car, transforming a potentially stressful situation into a manageable and informed decision.

Selling A Brand New Car: A Comprehensive Guide to Navigating the Unexpected Resale

Understanding "Brand New" in the Context of Resale

When we talk about "selling a brand new car" as an individual, we generally mean a vehicle that has been purchased recently – perhaps within a few weeks or months – and has accumulated very low mileage, typically under 1,000 to 5,000 miles. It’s still in immaculate condition, likely under its original factory warranty, and has not yet experienced the significant wear and tear associated with typical "used" vehicles.

The critical distinction here is the immediate and often substantial depreciation that occurs the moment a new car leaves the dealership lot. This "new car smell tax" is the primary financial challenge you’ll face. Unlike an asset that appreciates or holds its value, a car begins depreciating immediately, and a significant portion of its value is lost in the first year. Your goal when selling a "brand new" car is to minimize this inevitable loss by acting swiftly and strategically.

Why Are You Selling a Brand New Car? Common Scenarios

While unusual, there are several legitimate reasons why someone might need to sell a recently acquired new vehicle:

- Buyer’s Remorse or Wrong Fit: Perhaps the car doesn’t meet your needs as anticipated, the features aren’t practical, or you simply don’t love driving it as much as you thought you would.

- Sudden Financial Hardship: An unexpected job loss, medical emergency, or other significant financial strain might necessitate selling the vehicle to free up capital or reduce monthly expenses.

- Unexpected Life Changes: A new job requiring extensive travel, a move to a city where a car isn’t needed, an expanding family requiring a larger vehicle, or even a downsizing need can all trigger a sale.

- Discovered a Better Deal or Model: Sometimes, a truly irresistible offer on a different vehicle or a newly released model might make you reconsider your initial purchase.

- Relocation: Moving to another country or a city with excellent public transportation might make car ownership impractical or unnecessary.

Understanding your reason can help frame your approach to selling, particularly when explaining the sale to potential buyers.

Key Considerations Before You Sell

Before you even think about listing your car, there are several crucial factors to evaluate:

- Financial Impact and Depreciation: This is the biggest hurdle. Calculate your total investment: purchase price, sales tax, registration fees, and any interest paid if financed. Compare this to the current market value of your car. Be prepared for a loss; your objective is to make it as small as possible.

- Outstanding Loan: If you financed the car, you’ll need to know your payoff amount. This is often higher than the car’s current market value, leading to "negative equity." You’ll need to cover this difference out of pocket to clear the loan and transfer the title.

- Paperwork is Paramount: Gather all essential documents:

- Vehicle If you own it outright, you’ll have the physical title. If financed, the lienholder (bank) holds it.

- Loan Documents: Account number, payoff quote.

- Registration and Proof of Ownership: Current registration, bill of sale from your purchase.

- Service Records: Even if minimal, any initial checks or detailing receipts.

- Owner’s Manual and Spare Keys: These add value and complete the package.

- Warranty Transferability: Confirm if the factory warranty is transferable to a new owner. This is a significant selling point for a "brand new" car.

- Condition is Everything: Since the car is practically new, it should be in pristine condition. Address any minor dings, scratches, or interior imperfections immediately. A professional detail is a worthwhile investment.

- Market Value Research: Use online tools like Kelley Blue Book (KBB), Edmunds, and NADA Guides to get an estimated trade-in and private sale value. Browse listings for identical or very similar vehicles in your area to understand the competitive landscape.

- Time of Year: While less critical for a truly new car, demand for certain vehicle types (e.g., convertibles in summer, SUVs in winter) can fluctuate seasonally.

Methods for Selling Your Brand New Car

You have several avenues to explore, each with its own advantages and disadvantages:

1. Trade-in at a Dealership

- Pros: This is by far the most convenient and quickest option. You drive in with your old car and drive out with your new one (if you’re buying another). There can also be sales tax savings in some states, as you only pay tax on the difference between the new car’s price and your trade-in value.

- Cons: You will almost certainly get the lowest offer here. Dealerships need to make a profit on your car, so they’ll offer you wholesale value, which for a recently purchased new car, can mean a substantial loss.

- How-to: Get multiple trade-in quotes from different dealerships, even if you’re not buying another car from them. It creates leverage. Be transparent about the car’s "new" status and low mileage.

2. Sell to a Dealership (Without a Trade-in)

- Pros: Still more convenient than a private sale, and often quicker. Companies like CarMax, Vroom, and Carvana specialize in buying cars directly, offering quick cash or bank transfers. They handle all the paperwork.

- Cons: Offers will still be lower than what you could get in a private sale, but often slightly better than a traditional trade-in value from a franchise dealer.

- How-to: Get instant online offers from these companies. They’ll typically ask for your VIN, mileage, and condition details. Schedule an in-person appraisal if the offer seems reasonable.

3. Private Sale

- Pros: This method offers the highest potential return on your investment, allowing you to recoup more of your initial purchase price. You have direct control over the pricing and marketing.

- Cons: It’s the most time-consuming and effort-intensive option. You’ll handle everything from advertising and communicating with buyers to test drives, negotiations, and paperwork. There are also safety and scam risks to consider.

- How-to Guide for Private Sale:

- Preparation:

- Detailing: Invest in a professional interior and exterior detail. A truly "new" car should look the part.

- Gather Documents: Have your title, loan payoff info, registration, service records, owner’s manual, and all keys organized.

- Address Minor Flaws: Even tiny scratches or dings will detract from the "new" perception. Fix them.

- Pricing Strategically:

- Research current market values for identical or very similar models (year, make, model, trim, options, mileage).

- Price competitively, but account for your car’s "new" status and extremely low mileage. You can justify a slightly higher price than a typical "used" car of the same model year.

- Factor in your desired net amount, but be realistic about the depreciation.

- Creating an Irresistible Listing:

- High-Quality Photos: Take numerous, well-lit photos from all angles – interior, exterior, engine bay, trunk, tires. Highlight key features.

- Compelling Description: Emphasize its "brand new" condition, extremely low mileage, and any transferable warranty. State your reason for selling clearly and honestly (e.g., "unexpected relocation," "changed family needs") without going into excessive detail. List all features and options.

- Where to List: Online marketplaces like Autotrader, Cars.com, Facebook Marketplace, Craigslist, and local classifieds are popular.

- Screening Buyers & Safety:

- Be wary of vague inquiries, offers sight-unseen, or requests for personal financial information.

- Communicate through the platform’s messaging system initially.

- Meet in a well-lit, public place, ideally during the day. Consider a police station parking lot.

- Bring a friend or family member for test drives.

- Always accompany the buyer on a test drive.

- Negotiation:

- Be prepared for negotiation, but hold firm on your asking price, especially given the car’s condition.

- Highlight the benefits: transferable warranty, no hidden issues, all original parts, meticulously maintained.

- Paperwork and Payment:

- Bill of Sale: Draft a comprehensive bill of sale (templates available online) that includes buyer/seller details, vehicle VIN, mileage, sale price, and "as-is" clause. Both parties sign.

- Title Transfer: Sign the title over to the buyer. Ensure all necessary sections are completed accurately. You may need to visit your local DMV or tag agency together.

- Secure Payment: Accept only secure forms of payment:

- Cashier’s Check/Bank Check: Verify authenticity with the issuing bank while the buyer is present.

- Bank Transfer/Wire Transfer: Best for immediate, verifiable funds.

- Cash: Only for smaller amounts, and verify authenticity. Avoid personal checks.

- Loan Payoff: If you have an outstanding loan, the buyer’s funds (or a portion of them) will go directly to your lender to release the lien. Once the lien is released, the title will be sent to you or directly to the new owner, depending on state laws. It’s often safest to conduct this transaction at your bank.

- Preparation:

Maximizing Your Return on a Brand New Car

Given the immediate depreciation, your goal is to minimize the loss. Here’s how:

- Act Swiftly: The longer you own it, the more it depreciates. Sell it as soon as you realize it’s not the right fit.

- Maintain Perfection: Any imperfection, no matter how small, will undermine the "brand new" claim. Keep it immaculate.

- Highlight "Newness": Emphasize extremely low mileage, the fact it’s still under full factory warranty, and that it has all original parts, keys, and manuals. It’s essentially a new car without the initial dealer mark-up.

- Be Transparent: Explain your honest, concise reason for selling. This builds trust with buyers.

- Strategic Pricing: Don’t overprice, but don’t undervalue. Your car fills a unique niche: it’s not truly new, but it’s far from a typical used car. Price it slightly below a new equivalent from a dealer, but significantly above a comparable used model.

Potential Challenges and Solutions

- Significant Depreciation:

- Challenge: The unavoidable financial hit.

- Solution: Accept it as part of the cost of the unexpected change. Focus on maximizing the return, not eliminating the loss.

- Outstanding Loan/Negative Equity:

- Challenge: Owing more than the car is worth.

- Solution: You’ll need to pay the difference to your lender out of pocket to get the title. Factor this into your financial planning.

- Buyer Skepticism:

- Challenge: Buyers wonder why you’re selling a "brand new" car.

- Solution: Be honest and concise about your reason (e.g., "sudden job relocation," "need a larger vehicle for family"). Transparency builds trust.

- Scams and Fraud:

- Challenge: Private sales can attract dishonest individuals.

- Solution: Follow safety guidelines: meet in public, don’t share personal info, verify payment, be wary of overpayments or unusual requests.

Comparative Selling Methods Overview

| Feature | Trade-in at Dealership | Sell to Dealership (CarMax, Vroom) | Private Sale |

|---|---|---|---|

| Potential Return | Lowest | Low to Moderate | Highest |

| Time Commitment | Very Low | Low | High |

| Effort Required | Minimal | Minimal | High (Advertising, screening, meetings) |

| Convenience | Highest (One-stop shop) | High | Lowest |

| Associated Costs | Potential tax savings on new purchase | Usually none (they pay you) | Detailing, advertising fees, potential DMV fees |

| Ideal For | Those prioritizing speed and convenience, buying another car | Those prioritizing speed, not buying another car | Those prioritizing maximum return, willing to invest time/effort |

| Loan Handling | Dealer handles payoff | Company handles payoff | You manage payoff with buyer’s funds |

| Condition Impact | Significant | Significant | Highly Significant |

Frequently Asked Questions (FAQ)

Q1: How much will I lose selling a brand new car?

A1: It’s impossible to give an exact number, as it depends on the car’s make, model, original price, how long you’ve owned it, and current market demand. However, expect a significant loss due to immediate depreciation. Vehicles can lose 20-30% of their value in the first year alone.

Q2: Is it better to trade in or sell privately?

A2: If your priority is convenience and speed, trade-in or selling to a large buyer (like CarMax) is better, but you’ll get less money. If your priority is maximizing your return, a private sale is almost always better, but it requires more time and effort.

Q3: How do I sell a car if I still have a loan on it?

A3: This is common. You’ll need to obtain a payoff quote from your lender. During the sale, the buyer’s payment will either go directly to your lender to clear the loan (and release the lien), or you’ll pay off the difference out of pocket if you have negative equity, then the title is transferred. Many banks can facilitate this process at a branch.

Q4: What paperwork do I need to sell a brand new car?

A4: You’ll need the vehicle title (or loan payoff information), current registration, a bill of sale (signed by both parties), and potentially a lien release document from your lender if applicable. Having all original owner’s manuals, service records, and extra keys also helps.

Q5: How do I price a brand new car for resale?

A5: Research is key. Use online valuation tools (KBB, Edmunds) and look at similar listings in your area. Price it competitively, slightly below a new car from a dealer but above a typical used car of the same model year. Emphasize its extremely low mileage and pristine condition to justify your price.

Q6: What if I haven’t even registered the car yet, or only driven a few miles?

A6: This is the ideal "brand new" scenario for resale. You’ll still face the immediate depreciation, but its pristine, unregistered status is a strong selling point. The process is similar to selling a registered car, but ensure all original purchase documents are ready for the buyer to register it in their name.

Q7: Should I pay off the loan before selling the car?

A7: You don’t have to, especially if you plan to use the sale proceeds to pay off the loan. However, some buyers might prefer a clear title. It’s often safest to coordinate the transaction with your bank or the buyer’s bank to ensure the loan is paid off and the title is transferred securely.

Conclusion

Selling a brand new car is an unusual but sometimes necessary undertaking. While the initial sting of depreciation is unavoidable, approaching the process with a clear understanding of your options, diligent preparation, and realistic expectations can significantly minimize your financial loss. Whether you opt for the convenience of a dealership sale or the higher potential return of a private transaction, transparency, meticulous documentation, and strategic pricing are your greatest assets. Remember, it’s not just about selling a car; it’s about navigating an unexpected turn in your financial and personal journey with confidence and smart decision-making.