Should I Buy A Brand New Car? Navigating the Ultimate Automotive Dilemma

Should I Buy A Brand New Car? Navigating the Ultimate Automotive Dilemma cars.truckstrend.com

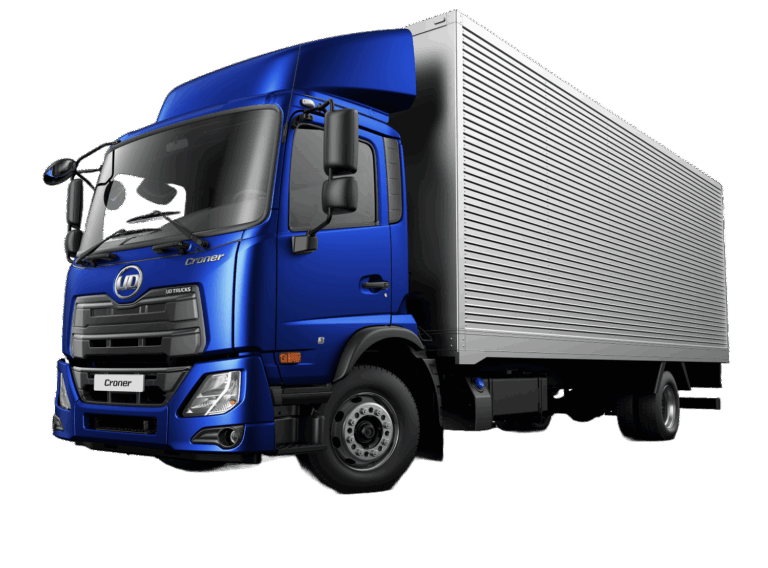

The gleaming paint, the pristine interior, the undeniable "new car smell"—there’s an undeniable allure to driving a brand-new vehicle off the dealership lot. It represents freedom, convenience, and often, a fresh start. But beneath the shiny exterior lies a complex financial decision that many grapple with: Should I buy a brand new car? This question isn’t just about personal preference; it’s a deep dive into budgeting, long-term financial health, and understanding the true cost of vehicle ownership. This comprehensive guide will help you navigate this significant purchase, providing the insights you need to make an informed decision tailored to your unique circumstances.

The Allure and the Reality: Pros and Cons of a Brand New Car

Should I Buy A Brand New Car? Navigating the Ultimate Automotive Dilemma

Before diving into the numbers, let’s weigh the emotional and practical aspects of purchasing a new vehicle. Understanding these can frame your perspective on whether you should buy a brand new car.

The Advantages of Going New

- Latest Technology and Features: New cars come equipped with the most current safety features, infotainment systems, and performance enhancements. From advanced driver-assistance systems (ADAS) to seamless smartphone integration, you get cutting-edge innovation.

- Full Manufacturer’s Warranty: Peace of mind is a major benefit. New cars typically come with bumper-to-bumper and powertrain warranties that cover repairs for several years, significantly reducing unexpected costs in the initial ownership period.

- Pristine Condition and No History: You’re the first owner, meaning no prior accidents, undisclosed damage, or questionable maintenance history. The car is exactly as intended by the manufacturer.

- Customization Options: You have the freedom to choose your preferred trim level, color, optional packages, and accessories, ensuring the car perfectly matches your desires.

- Better Fuel Efficiency (Often): Newer models often boast improved fuel economy due to advancements in engine technology and lighter materials, leading to lower running costs over time.

- Favorable Financing and Incentives: Manufacturers frequently offer low-interest financing rates, cash rebates, or lease deals to attract buyers, which can make monthly payments more manageable.

- Status and Prestige: For some, the psychological satisfaction and social perception of owning a brand-new car are significant factors.

The Disadvantages: Why You Might Rethink "New"

- Rapid Depreciation: This is the single biggest financial drawback. A new car can lose 20-30% of its value in the first year alone, and up to 50% or more within the first three to five years. This loss of value is money directly out of your pocket.

- Higher Initial Cost: The sticker price of a new car is considerably higher than a comparable used model, requiring a larger down payment or a bigger loan.

- Higher Insurance Premiums: Insurers typically charge more for new cars because their replacement cost is higher.

- Higher Registration and Taxes: In many regions, registration fees and sales taxes are calculated based on the vehicle’s purchase price, meaning new cars incur higher initial governmental costs.

- Fear of the First Scratch/Ding: For some, the worry of the first imperfection can detract from the enjoyment of a new vehicle.

Understanding Depreciation: The Elephant in the Room

When considering should I buy a brand new car, depreciation cannot be overstated. It’s the silent killer of your car’s value. Depreciation is the difference between what you paid for the car and what it’s worth when you sell or trade it in.

Think of it this way: as soon as you drive a new car off the lot, it becomes a "used" car. The most significant drop in value occurs immediately and continues steeply for the first few years. After about three years, the rate of depreciation slows down considerably. This means that if you buy a car that’s already 2-3 years old, someone else has absorbed the steepest part of that value loss for you.

Factors influencing depreciation include:

- Make and Model: Some brands and models hold their value better than others (e.g., Toyota, Honda, Subaru).

- Mileage: Higher mileage generally leads to faster depreciation.

- Condition: Excellent condition with a clean history slows depreciation.

- Market Demand: Popular models or those with unique features may depreciate slower.

The True Cost of Ownership: Beyond the Sticker Price

The sticker price is just the beginning. To truly answer should I buy a brand new car, you must factor in the total cost of ownership (TCO) over the years you plan to own the vehicle.

- Purchase Price (MSRP): The suggested retail price. Be aware of potential dealer markups or additional charges.

- Sales Tax, Registration, and Title Fees: These vary by state/province but can add thousands to your initial outlay.

- Insurance: Get quotes for the specific new car you’re considering. Comprehensive and collision coverage are almost always required for financed vehicles.

- Financing Costs: Unless you’re paying cash, the interest accrued on your car loan is a significant part of the TCO. Even low APRs add up over a 5-7 year loan term.

- Fuel: Consider the car’s fuel efficiency and the type of fuel it requires (regular vs. premium).

- Maintenance and Repairs: While new cars are covered by warranty for major issues, routine maintenance (oil changes, tire rotations, filter replacements) is still necessary. After the warranty expires, you’ll be responsible for all repairs.

- Wear and Tear: Tires, brakes, and other consumable parts will eventually need replacement.

Alternative Paths: Used and Certified Pre-Owned (CPO) Vehicles

If the idea of rapid depreciation is a deterrent, exploring alternatives is crucial.

- Used Cars: The most financially savvy option for many. Buying a used car, particularly one that’s 2-3 years old, allows you to benefit from someone else absorbing the initial depreciation. You can often get a higher trim level or a more luxurious model for the same price as a new, more basic car. The key is thorough research, a vehicle history report (like CarFax or AutoCheck), and an independent pre-purchase inspection by a trusted mechanic.

- Certified Pre-Owned (CPO) Vehicles: These are used cars (usually less than 5-6 years old and under a certain mileage) that have undergone a rigorous multi-point inspection by the manufacturer or dealership. They often come with an extended warranty backed by the manufacturer, roadside assistance, and other perks. CPO vehicles bridge the gap between new and used, offering more peace of mind than a standard used car but at a lower price point than new. They are an excellent middle-ground answer to should I buy a brand new car for those seeking a balance of value and security.

Making the Smart Decision: Factors to Consider

To help you decide should I buy a brand new car, ask yourself these critical questions:

- What’s Your Budget? Not just the monthly payment, but the total cost of ownership. Can you comfortably afford the purchase price, insurance, fuel, and maintenance without straining your finances?

- How Long Do You Plan to Keep the Car? If you keep cars for a long time (7+ years), the initial depreciation hit is spread out, making a new car a more reasonable investment. If you trade in every 2-3 years, you’ll constantly be taking the biggest depreciation hit.

- What Are Your Needs vs. Wants? Do you genuinely need the latest tech, or would a slightly older model fulfill your transportation needs just as well? Be honest about what features are essential.

- What Are Your Driving Habits? If you drive very few miles annually, a new car might not be the most efficient use of your money, as it will still depreciate significantly while sitting idle. High-mileage drivers might appreciate the warranty coverage of a new car.

- What is Your Financial Situation? Do you have a healthy emergency fund? Are you debt-free (aside from a mortgage)? A car purchase, especially new, should not compromise your financial stability.

- Do You Value Peace of Mind? For some, the complete assurance of a new car’s reliability and warranty is worth the premium.

Navigating the New Car Buying Process

If you’ve decided the answer to should I buy a brand new car is "yes," here’s how to approach the purchase:

- Research Thoroughly: Identify models that fit your needs and budget. Read reviews, compare features, and check reliability ratings.

- Get Pre-Approved for a Loan: Obtain financing from your bank or credit union before visiting the dealership. This gives you leverage and a benchmark for comparison against dealer financing offers.

- Test Drive Multiple Vehicles: Don’t rush. Drive different models and trim levels to find what feels right.

- Negotiate Smartly:

- Know the Invoice Price: This is what the dealer paid for the car, giving you a starting point for negotiation below MSRP.

- Focus on the Out-the-Door Price: Negotiate the total price of the car, not just the monthly payment.

- Separate Trade-in: Negotiate the new car price first, then discuss your trade-in as a separate transaction.

- Be Aware of Dealer Add-ons: Resist high-pressure sales for unnecessary extras like paint protection, extended warranties (unless truly beneficial), or fabric treatments.

- Time Your Purchase: End of the month, quarter, or year are often good times as dealers try to meet sales quotas. New model year introductions can also lead to discounts on previous year’s models.

Practical Advice and Actionable Insights

- Calculate TCO: Always do the math on the total cost of ownership for both new and used options over your intended ownership period.

- Don’t Fixate on Monthly Payments: A lower monthly payment often means a longer loan term, leading to more interest paid over time.

- Consider "Nearly New": A car that is 1-3 years old can offer the best value, having absorbed the initial depreciation while still being relatively modern and potentially under a factory warranty.

- Get an Independent Inspection: Even for CPO cars, a pre-purchase inspection by an independent mechanic is a wise investment for used vehicles.

- Be Patient: Car buying is a significant financial commitment. Don’t let emotion or high-pressure sales tactics rush your decision.

Price Comparison Table: New vs. Used Car (Conceptual Example)

This table illustrates the general differences in costs and characteristics when asking should I buy a brand new car versus a slightly used one. Actual figures vary wildly by make, model, condition, and market.

| Feature/Cost Category | Brand New Car (Example: Mid-size Sedan, $30,000 MSRP) | 3-Year-Old Used Car (Example: Same Model, $18,000 Market Value) | Notes |

|---|---|---|---|

| Initial Purchase Price | ~$30,000 (MSRP, before tax/fees) | ~$18,000 (already absorbed ~40% depreciation) | The most significant upfront cost difference. |

| Depreciation (First 3 Yrs) | Highest (Loses $12,000+ in 3 years) | Much Lower (already absorbed initial steep drop) | The biggest financial hit you avoid with used. |

| Warranty Coverage | Full Manufacturer Warranty (e.g., 3yr/36k mile bumper-to-bumper) | Often Expired or Limited (CPO may offer some extension) | New offers full peace of mind on repairs. |

| Maintenance Costs (First 3 Yrs) | Very Low (often just routine service, some covered) | Potentially Higher (routine service, minor wear & tear) | New cars typically require minimal unexpected work. |

| Insurance Premiums (Annual) | Higher (e.g., $1,500 – $2,500+) | Lower (e.g., $1,000 – $2,000+) | Due to higher replacement cost of a new vehicle. |

| Technology & Features | Latest & Greatest | 3 years behind, but still modern and capable | New cars get the newest tech first. |

| Financing Options | Often Better APRs/Manufacturer Incentives (e.g., 0-2%) | Can be Higher APRs (unless CPO), fewer incentives (e.g., 4-8%) | New car financing can be more attractive. |

| Registration & Taxes | Higher (based on $30k value) | Lower (based on $18k value) | Varies by state, but scales with vehicle value. |

| Customization | Full Choice of Trims/Colors/Options | Limited to Available Inventory | New cars allow for exact specifications. |

| Vehicle History | Pristine, No Prior Owners | Available via VIN (CarFax/AutoCheck required) | Used cars need careful vetting. |

| Overall Value Proposition | Higher Cost, Maximum Peace of Mind, Latest Tech | Lower Cost, Excellent Value, Still Modern | Depends on your priorities and budget. |

Frequently Asked Questions (FAQ)

Q1: How much does a new car depreciate in the first year?

A1: On average, a new car can depreciate by 20-30% in its first year. Some models may lose more, others slightly less.

Q2: Is it always cheaper to buy a used car?

A2: Generally, yes, especially considering the initial purchase price and depreciation. However, a very old or high-mileage used car might incur higher maintenance costs, potentially negating some of the initial savings over its lifespan. The "sweet spot" for value is often a 2-3 year old used car.

Q3: When is the best time of year to buy a new car?

A3: The end of the month, quarter, or year are often good times, as dealerships try to meet sales targets. Also, when new model years are released (typically late summer/fall), previous year’s models often see significant discounts.

Q4: Should I buy a Certified Pre-Owned (CPO) car instead of a new one?

A4: CPO cars offer a great balance. They are typically newer used vehicles that have passed stringent inspections and come with an extended manufacturer warranty. This offers much of the peace of mind of a new car at a significantly lower price point, making them an excellent alternative to buying a brand new car.

Q5: How can I get the best deal on a new car?

A5: Research thoroughly, know the invoice price, get pre-approved for financing, test drive extensively, and negotiate the "out-the-door" price, not just the monthly payment. Be prepared to walk away if the deal isn’t right, and avoid unnecessary add-ons.

Q6: What is the average lifespan of a modern car?

A6: With proper maintenance, modern cars can easily last 150,000 to 200,000 miles or more, often well beyond 10-15 years. This longevity makes a new car a better investment if you plan to keep it for a very long time.

Conclusion

The question of should I buy a brand new car is deeply personal, with no universally correct answer. It boils down to a careful balance of your financial situation, lifestyle needs, and personal priorities. While the allure of a new vehicle is strong, the significant depreciation and higher initial costs must be weighed against the peace of mind, latest technology, and warranty coverage it offers.

For those who prioritize cutting-edge features, full warranties, and don’t mind the financial hit of depreciation, a new car can be a rewarding purchase. However, for the majority seeking maximum value and minimal financial loss, a well-researched used car, particularly one that is 2-3 years old or a Certified Pre-Owned vehicle, often presents a more financially prudent path.

Ultimately, by understanding the true costs of ownership, exploring alternatives, and making an informed decision based on your unique circumstances, you can confidently drive away in the vehicle that best serves your needs and your wallet.