Top 100 Car Brands 2016: A Snapshot of Automotive Excellence and Evolution

Top 100 Car Brands 2016: A Snapshot of Automotive Excellence and Evolution cars.truckstrend.com

The year 2016 stands as a fascinating cross-section in automotive history. It was a period marked by robust global sales, particularly in burgeoning markets, while simultaneously grappling with the nascent yet undeniable shift towards electrification, connectivity, and autonomous driving. Understanding the "Top 100 Car Brands 2016" is not merely about listing names; it’s an exploration of market dominance, technological prowess, brand resilience, and consumer preference at a pivotal moment. This comprehensive article delves into the automotive landscape of 2016, offering insights into the brands that shaped the industry and the trends that foreshadowed the future. For enthusiasts, industry professionals, investors, and prospective car buyers, examining this list provides a valuable lens through which to comprehend the intricate dynamics of the global automotive sector.

The Automotive Landscape in 2016: A Year of Transition

Top 100 Car Brands 2016: A Snapshot of Automotive Excellence and Evolution

In 2016, the global automotive industry reached new heights in terms of vehicle sales, exceeding 90 million units for the first time. Key drivers included strong demand in China, continued recovery in the United States, and a stable, albeit slower, European market. SUVs and crossovers were rapidly gaining traction, signaling a significant shift in consumer preference away from traditional sedans. Diesel technology, while still prevalent, was under increasing scrutiny following the "Dieselgate" scandal, pushing manufacturers to accelerate research into alternative powertrains. Electric vehicles (EVs), though still a niche market, were beginning to show promise with models like the Tesla Model S gaining significant attention and traditional manufacturers like Chevrolet launching more accessible long-range EVs. This dynamic environment set the stage for a diverse and competitive brand hierarchy.

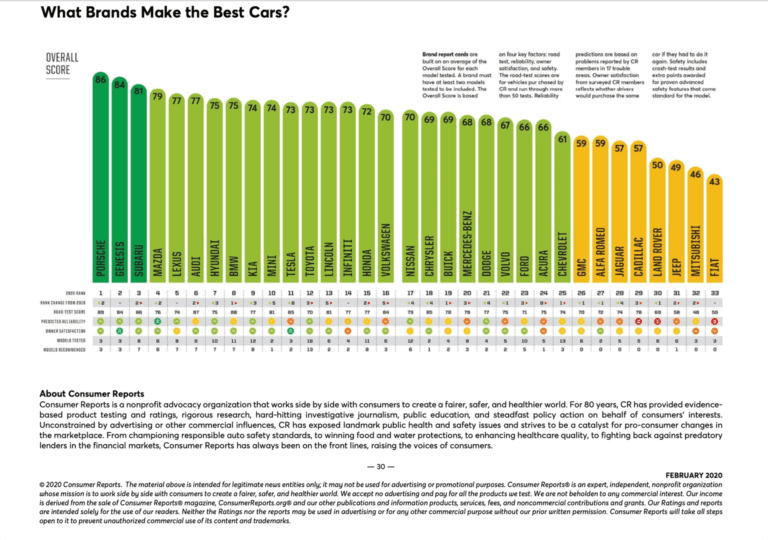

Methodologies for Ranking Car Brands

Defining a "Top 100 Car Brands" list requires clarity on the ranking methodology. Unlike a simple sales volume tally, a comprehensive brand assessment often considers multiple factors. In 2016, common metrics would have included:

- Global Sales Volume: The sheer number of vehicles sold worldwide. This is often the most straightforward metric but doesn’t account for profitability or brand value.

- Revenue/Profitability: A measure of a brand’s financial health and market power.

- Brand Value: An intangible asset reflecting consumer perception, loyalty, and market influence, often calculated by financial consultancies.

- Production Output: The number of vehicles manufactured.

- Market Capitalization (for publicly traded companies): Reflects investor confidence and future growth potential.

- Market Share: A brand’s percentage of total sales within a specific region or global market.

For the purpose of this article, our "Top 100 Car Brands 2016" table will reflect a broad spectrum of prominent global and regional players based on their general market presence, sales volume, and recognized brand strength during that period, rather than adhering to a single, proprietary ranking methodology. The focus is on highlighting the diversity and influence of these brands.

Key Trends and Dominant Players of 2016

The "Top 100 Car Brands 2016" list would naturally showcase several distinct categories of players:

- Mass-Market Giants: Brands like Toyota, Volkswagen, Ford, General Motors (with its various divisions like Chevrolet and Opel), Honda, Nissan, Hyundai, and Kia continued to dominate global sales. Their strength lay in diverse portfolios spanning compact cars, sedans, SUVs, and trucks, catering to a wide array of consumer needs and budgets across multiple continents. Their extensive dealer networks and established reputations for reliability and value were key assets.

- Luxury and Performance Elites: Mercedes-Benz, BMW, Audi, Lexus, Porsche, and Land Rover maintained their stronghold in the premium segments. These brands thrived on innovation, sophisticated design, advanced technology, and high-performance offerings. They represented aspiration and often led the way in introducing new features that would eventually trickle down to mass-market vehicles. Niche luxury and performance brands like Ferrari, Lamborghini, Aston Martin, and Rolls-Royce, while selling fewer units, commanded immense brand prestige and exclusivity.

- Emerging Challengers and Niche Players: 2016 was a significant year for brands like Tesla, which was rapidly expanding its Supercharger network and preparing for the Model 3 launch, signaling the growing viability of electric vehicles. Subaru continued its strong performance with its unique all-wheel-drive offerings and perceived reliability. Mazda gained recognition for its "Kodo" design language and Skyactiv technology. Volvo, under Geely’s ownership, was undergoing a significant renaissance, focusing on safety, Scandinavian design, and innovative powertrain solutions.

- Regional Strongholds: The list would also include brands with strong regional dominance, particularly from emerging markets. Chinese domestic brands like Geely, Chery, SAIC (with brands like MG and Roewe), Great Wall, and BYD were rapidly growing within their home market, laying the groundwork for future global expansion. Indian brands like Tata Motors and Mahindra & Mahindra were key players in the subcontinent. Russian brands like Lada (AvtoVAZ) continued to serve their local markets.

The Importance of Brand Resilience and Adaptability

Being among the top 100 car brands in 2016 required more than just producing vehicles; it demanded resilience and adaptability. Brands had to navigate:

- Economic Fluctuations: Global economic health directly impacts car sales. Brands with diversified market presence were better positioned to weather regional downturns.

- Regulatory Changes: Stricter emission standards, safety regulations, and fuel economy mandates (e.g., CAFE standards in the US) forced brands to invest heavily in R&D.

- Evolving Consumer Preferences: The shift towards SUVs, demand for connectivity features, and growing interest in sustainable mobility necessitated constant product portfolio adjustments.

- Technological Disruption: The advent of electric powertrains, advanced driver-assistance systems (ADAS), and the early discussions around autonomous driving meant traditional R&D cycles were accelerating. Brands that failed to innovate or adapt risked losing market share.

Practical Advice and Actionable Insights

Understanding the "Top 100 Car Brands 2016" provides valuable insights for various stakeholders:

- For Consumers: This historical data can inform buying decisions by highlighting brands with established reputations for reliability, innovation, or specific market segments. It shows which brands were investing in future technologies and which might have been more conservative. While market dynamics change, a brand’s historical performance and position often reflect its underlying strengths.

- For Investors and Industry Analysts: The list provides a snapshot of market leadership and competitive intensity. It can help identify brands that were poised for growth, those facing significant challenges, or those that might be acquisition targets. Analyzing the performance of brands in 2016 against current trends reveals which companies successfully adapted to the rapid shifts in the industry.

- For Automotive Professionals and Enthusiasts: It serves as a benchmark for understanding the industry’s structure and the relative strengths of various players. It allows for a deeper appreciation of the diverse strategies employed by manufacturers, from global mass production to niche luxury craftsmanship.

Concluding Summary

The "Top 100 Car Brands 2016" represents a pivotal moment in the automotive industry – a time of peak traditional sales interwoven with the early threads of a technological revolution. From the global dominance of established giants like Toyota and Volkswagen to the rising influence of luxury powerhouses and the disruptive potential of newcomers like Tesla, the list reflects a vibrant and highly competitive landscape. Examining these brands reminds us of the constant need for innovation, adaptability, and a deep understanding of consumer needs in an ever-evolving market. While the automotive world has continued to transform since 2016, the foundations laid by these top brands continue to shape the industry’s trajectory.

Top 100 Car Brands 2016: Illustrative Overview

This table provides an illustrative overview of 100 prominent car brands that were active and significant in 2016. The "Rank" is purely illustrative, reflecting general market presence and recognition rather than a definitive, statistically verified ranking. "Average Vehicle Price Range" is a simplified indicator: $ (Budget/Economy), $$ (Mid-Range/Volume), $$$ (Premium/Entry Luxury), $$$$ (Luxury/Performance/High-End).

| Illustrative Rank | Brand Name | Parent Company (2016) | Country of Origin (HQ) | Founding Year | Primary Market Segment | Illustrative Avg. Vehicle Price Range | Brief Note/Specialty |

|---|---|---|---|---|---|---|---|

| 1 | Toyota | Toyota Motor Corporation | Japan | 1937 | Mass Market | $$ | Global sales leader, reliability, hybrid technology |

| 2 | Volkswagen | Volkswagen AG | Germany | 1937 | Mass Market | $$ | European powerhouse, diverse portfolio |

| 3 | Ford | Ford Motor Company | USA | 1903 | Mass Market | $$ | Trucks, SUVs, global presence |

| 4 | Hyundai | Hyundai Motor Company | South Korea | 1967 | Mass Market | $$ | Rapid growth, value, design |

| 5 | Honda | Honda Motor Co., Ltd. | Japan | 1948 | Mass Market | $$ | Reliability, engines, motorcycles |

| 6 | Nissan | Nissan Motor Co., Ltd. | Japan | 1933 | Mass Market | $$ | SUVs, EVs (Leaf), global reach |

| 7 | Chevrolet | General Motors | USA | 1911 | Mass Market | $$ | Trucks, performance, global presence |

| 8 | Kia | Hyundai Motor Company | South Korea | 1944 | Mass Market | $$ | Value, design, improved quality |

| 9 | Mercedes-Benz | Daimler AG | Germany | 1926 | Luxury | $$$ | Luxury, prestige, innovation |

| 10 | BMW | BMW AG | Germany | 1916 | Luxury | $$$ | Driving dynamics, luxury, performance |

| 11 | Audi | Volkswagen AG | Germany | 1909 | Luxury | $$$ | Design, technology, Quattro AWD |

| 12 | Fiat | Fiat Chrysler Automobiles (FCA) | Italy | 1899 | Mass Market | $ | Small cars, European focus |

| 13 | Jeep | Fiat Chrysler Automobiles (FCA) | USA | 1941 | SUV/Off-road | $$ | Iconic off-road capability, SUVs |

| 14 | Renault | Renault S.A. | France | 1899 | Mass Market | $$ | European volume leader, EVs |

| 15 | Peugeot | PSA Group | France | 1810 | Mass Market | $$ | European focus, design |

| 16 | Skoda | Volkswagen AG | Czech Republic | 1895 | Mass Market | $$ | Value, practicality, European |

| 17 | Opel/Vauxhall | General Motors (GM Europe) | Germany/UK | 1862 | Mass Market | $$ | European volume, practicality |

| 18 | Mazda | Mazda Motor Corporation | Japan | 1920 | Mass Market | $$ | Driving dynamics, design, Skyactiv |

| 19 | Subaru | Subaru Corporation | Japan | 1953 | Mass Market | $$ | AWD, safety, boxer engines |

| 20 | Volvo | Geely Holding Group | Sweden | 1927 | Premium | $$$ | Safety, Scandinavian design |

| 21 | Land Rover | Tata Motors | UK | 1948 | Luxury SUV | $$$ | Premium SUVs, off-road capability |

| 22 | Lexus | Toyota Motor Corporation | Japan | 1989 | Luxury | $$$ | Reliability, luxury, refinement |

| 23 | Porsche | Volkswagen AG | Germany | 1931 | Luxury/Performance | $$$$ | Sports cars, luxury SUVs |

| 24 | Chrysler | Fiat Chrysler Automobiles (FCA) | USA | 1925 | Mass Market | $$ | Minivans, sedans, North American focus |

| 25 | Dodge | Fiat Chrysler Automobiles (FCA) | USA | 1900 | Mass Market/Performance | $$ | Muscle cars, trucks, minivans |

| 26 | Ram | Fiat Chrysler Automobiles (FCA) | USA | 2010 | Trucks | $$ | Pickup trucks, commercial vehicles |

| 27 | GMC | General Motors | USA | 1911 | Trucks/SUVs | $$ | Premium trucks & SUVs |

| 28 | Cadillac | General Motors | USA | 1902 | Luxury | $$$ | American luxury, performance |

| 29 | Lincoln | Ford Motor Company | USA | 1917 | Luxury | $$$ | American luxury |

| 30 | Acura | Honda Motor Co., Ltd. | Japan | 1986 | Luxury | $$$ | Performance luxury |

| 31 | Infiniti | Nissan Motor Co., Ltd. | Japan | 1989 | Luxury | $$$ | Design, performance luxury |

| 32 | Suzuki | Suzuki Motor Corporation | Japan | 1909 | Mass Market | $ | Small cars, SUVs, motorcycles |

| 33 | Mitsubishi | Mitsubishi Motors Corporation | Japan | 1970 | Mass Market | $$ | SUVs, electric vehicles |

| 34 | Tesla | Tesla, Inc. | USA | 2003 | EV Luxury/Performance | $$$$ | Electric vehicles, technology leader |

| 35 | Ferrari | Ferrari N.V. | Italy | 1947 | Ultra Luxury/Performance | $$$$ | Iconic sports cars, racing heritage |

| 36 | Lamborghini | Volkswagen AG | Italy | 1963 | Ultra Luxury/Performance | $$$$ | Exotic sports cars, design |

| 37 | Aston Martin | Aston Martin Lagonda Global Holdings plc | UK | 1913 | Ultra Luxury/Performance | $$$$ | Luxury sports cars, design |

| 38 | Rolls-Royce | BMW AG | UK | 1906 | Ultra Luxury | $$$$ | Ultimate luxury, bespoke craftsmanship |

| 39 | Bentley | Volkswagen AG | UK | 1919 | Ultra Luxury | $$$$ | Luxury, performance, craftsmanship |

| 40 | McLaren | McLaren Automotive | UK | 1985 | Ultra Luxury/Performance | $$$$ | Supercars, F1 heritage |

| 41 | Bugatti | Volkswagen AG | France | 1909 | Hypercar | $$$$ | Extreme performance, exclusivity |

| 42 | Maserati | Fiat Chrysler Automobiles (FCA) | Italy | 1914 | Luxury/Performance | $$$$ | Italian luxury, performance |

| 43 | Alfa Romeo | Fiat Chrysler Automobiles (FCA) | Italy | 1910 | Premium/Performance | $$$ | Italian style, driving pleasure |

| 44 | Mini | BMW AG | UK | 1959 | Premium Compact | $$ | Iconic design, fun-to-drive |

| 45 | Smart | Daimler AG | Germany | 1994 | Urban Microcar | $ | City mobility, small footprint |

| 46 | Dacia | Renault S.A. | Romania | 1966 | Budget/Economy | $ | Affordable, no-frills vehicles |

| 47 | Seat | Volkswagen AG | Spain | 1950 | Mass Market | $$ | Sporty design, European focus |

| 48 | Lada | AvtoVAZ (Renault-Nissan Alliance) | Russia | 1966 | Mass Market | $ | Russian market leader, robust |

| 49 | UAZ | UAZ (Ulyanovsk Automobile Plant) | Russia | 1941 | SUV/Commercial | $ | Off-road vehicles, military |

| 50 | Geely | Geely Holding Group | China | 1986 | Mass Market | $ | Growing Chinese automaker, global ambitions |

| 51 | Chery | Chery Automobile Co., Ltd. | China | 1997 | Mass Market | $ | Chinese exporter, varied lineup |

| 52 | SAIC | SAIC Motor Corporation Limited | China | 1955 | Mass Market | $ | Major Chinese automaker, joint ventures |

| 53 | Great Wall | Great Wall Motor Company Limited | China | 1984 | SUV/Pickup | $ | Leading Chinese SUV/pickup manufacturer |

| 54 | BYD | BYD Auto | China | 2003 | EV/Mass Market | $ | EV pioneer, battery technology |

| 55 | Changan | Changan Automobile | China | 1862 | Mass Market | $ | Major Chinese automaker |

| 56 | FAW | FAW Group | China | 1953 | Mass Market | $ | Oldest Chinese automaker, diverse brands |

| 57 | Tata Motors | Tata Motors Limited | India | 1945 | Mass Market | $ | Indian leader, commercial vehicles |

| 58 | Mahindra & Mahindra | Mahindra Group | India | 1945 | SUV/Commercial | $ | Indian SUV/utility vehicle specialist |

| 59 | Maruti Suzuki | Suzuki Motor Corporation (India) | India | 1981 | Mass Market | $ | Indian market leader, small cars |

| 60 | Proton | DRB-HICOM | Malaysia | 1983 | Mass Market | $ | Malaysian national car |

| 61 | SsangYong | Mahindra & Mahindra | South Korea | 1954 | SUV | $$ | South Korean SUV specialist |

| 62 | Isuzu | Isuzu Motors Ltd. | Japan | 1916 | Commercial/SUV | $$ | Trucks, diesel engines, SUVs |

| 63 | Daihatsu | Toyota Motor Corporation | Japan | 1907 | Compact/Kei | $ | Small cars, Japanese market focus |

| 64 | Perodua | Perusahaan Otomobil Kedua Sdn Bhd | Malaysia | 1993 | Compact/Kei | $ | Malaysian market leader, compact cars |

| 65 | BAIC | BAIC Group | China | 1958 | Mass Market | $ | Major Chinese state-owned automaker |

| 66 | GAC | GAC Group | China | 1997 | Mass Market | $ | Growing Chinese automaker |

| 67 | Haima | FAW Group (Hainan Auto) | China | 1988 | Mass Market | $ | Chinese automaker, Mazda origins |

| 68 | Soueast | Soueast Motor | China | 1995 | Mass Market | $ | Chinese automaker, Mitsubishi JV |

| 69 | Dongfeng | Dongfeng Motor Corporation | China | 1969 | Mass Market | $ | Major Chinese automaker |

| 70 | Zotye | Zotye Auto | China | 2005 | Mass Market | $ | Chinese automaker, known for design similarity |

| 71 | Hawtai | Hawtai Motor Group | China | 2000 | Mass Market | $ | Chinese automaker, SUV focus |

| 72 | JAC | JAC Motors | China | 1964 | Mass Market/Commercial | $ | Chinese automaker, commercial vehicles |

| 73 | Brilliance | Brilliance Auto Group | China | 1992 | Mass Market | $ | Chinese automaker, BMW JV |

| 74 | Foton | BAIC Group (Foton Motor) | China | 1996 | Commercial/SUV | $ | Chinese commercial vehicle leader |

| 75 | Maxus | SAIC Motor Corporation Limited | China | 2011 | MPV/Commercial | $ | Commercial vehicles, passenger vans |

| 76 | Wuling | SAIC-GM-Wuling | China | 2002 | Microvan/MPV | $ | Chinese market leader for microvans |

| 77 | JMC | Jiangling Motors Corporation Group | China | 1947 | Commercial/SUV | $ | Chinese commercial vehicle manufacturer |

| 78 | Beijing Auto (BJEV) | BAIC Group | China | 1958 | Mass Market/EV | $ | BAIC’s passenger car division, EV focus |

| 79 | Luxgen | Yulon Motor Co., Ltd. | Taiwan | 2009 | Mass Market | $$ | Taiwanese brand, tech-focused |

| 80 | Iran Khodro (IKCO) | Iran Khodro Industrial Group | Iran | 1962 | Mass Market | $ | Iranian national automaker |

| 81 | Saipa | SAIPA Group | Iran | 1966 | Mass Market | $ | Iranian automaker |

| 82 | GAZ | GAZ Group | Russia | 1932 | Commercial/SUV | $ | Russian commercial vehicles, SUVs |

| 83 | Tofas | Koç Holding / Fiat | Turkey | 1968 | Mass Market | $ | Turkish automaker, Fiat production |

| 84 | Proton (Lotus) | DRB-HICOM (Lotus Cars) | UK (Parent: Malaysia) | 1948 | Performance | $$$$ | Lightweight sports cars (under Proton in 2016) |

| 85 | Caterham | N/A | UK | 1973 | Niche Performance | $$$ | Lightweight, track-focused sports cars |

| 86 | Morgan | Morgan Motor Company | UK | 1910 | Niche Luxury | $$$$ | Hand-built retro sports cars |

| 87 | Wiesmann | N/A (Re-established later) | Germany | 1988 | Niche Performance | $$$$ | Hand-built sports cars (limited production in 2016) |

| 88 | Koenigsegg | Koenigsegg Automotive AB | Sweden | 1994 | Hypercar | $$$$ | Extreme performance, exclusivity |

| 89 | Pagani | Pagani Automobili S.p.A. | Italy | 1992 | Hypercar | $$$$ | Exotic hypercars, craftsmanship |

| 90 | Ruf | Ruf Automobile GmbH | Germany | 1939 | Niche Performance | $$$$ | Porsche tuners, bespoke supercars |

| 91 | Spyker | Spyker Cars N.V. | Netherlands | 1999 | Niche Luxury/Performance | $$$$ | Hand-built luxury sports cars |

| 92 | Karma Automotive | Wanxiang Group | USA | 2007 | Luxury EV | $$$$ | Reincarnated Fisker Karma, luxury EV |

| 93 | Genesis | Hyundai Motor Company | South Korea | 2015 | Luxury | $$$ | Hyundai’s newly launched luxury division |

| 94 | Datsun | Nissan Motor Co., Ltd. | Japan (Re-introduced) | 1931 | Budget/Emerging | $ | Budget brand for emerging markets |

| 95 | Infiniti (Renault-Nissan Alliance) | Renault-Nissan Alliance | Global | 1999 | Luxury/EV | $$$ | Renault’s luxury brand for China (not the main Infiniti) |

| 96 | Baojun | SAIC-GM-Wuling | China | 2010 | Mass Market | $ | Affordable cars for Chinese market |

| 97 | Jetour | Chery Automobile Co., Ltd. | China | 2018 (concept in 2016) | SUV/Mass Market | $ | Chery’s SUV-focused sub-brand (early stages) |

| 98 | Venucia | Dongfeng Motor Co., Ltd. | China | 2010 | Mass Market | $ | Nissan’s local JV brand in China |

| 99 | Roewe | SAIC Motor Corporation Limited | China | 2006 | Mass Market | $ | SAIC’s own brand, based on Rover assets |

| 100 | Qoros | Chery Automobile Co., Ltd. | China | 2007 | Mass Market | $$ | Chinese brand aiming for international quality |

Frequently Asked Questions (FAQ)

Q1: How was this "Top 100 Car Brands 2016" list compiled?

A1: This list is an illustrative representation of prominent global and regional car brands active in 2016. It considers factors like global sales presence, brand recognition, market share in key regions, and overall industry influence. It is not based on a single, definitive proprietary ranking method but aims to provide a comprehensive snapshot of the automotive landscape at that time.

Q2: Why isn’t Brand X or Y included in the list, or why is its ranking different from what I remember?

A2: The automotive industry is vast, and various entities use different metrics (e.g., sales volume, brand value, production numbers) to rank brands. Some brands might have strong regional presence but limited global reach, or vice versa. This illustrative list focuses on a broad representation. Specific rankings can vary significantly based on the exact criteria used.

Q3: How has the automotive industry changed since 2016?

A3: Since 2016, the industry has undergone rapid transformation. Key changes include a significant acceleration in electric vehicle (EV) adoption, increased investment in autonomous driving technology, a surge in SUV/crossover popularity, the rise of new mobility services (ride-sharing, car-sharing), and a growing focus on sustainability and digital connectivity. Many brands on this list have adapted their strategies to these new realities.

Q4: How can this 2016 list help me as a car buyer today?

A4: While specific models and technologies have evolved, this historical list can still provide valuable context. It highlights brands with a consistent track record of reliability, innovation, or market leadership. Understanding a brand’s historical position can inform its current reputation and potential future direction, though it’s crucial to research current models and market conditions.

Q5: What’s the difference between "sales volume" and "brand value"?

A5: "Sales volume" refers to the total number of vehicles a brand sells in a given period, indicating its market reach. "Brand value," on the other