Us Car Sales By Brand: A Comprehensive Look at the Automotive Landscape

Us Car Sales By Brand: A Comprehensive Look at the Automotive Landscape cars.truckstrend.com

The United States automotive market is a dynamic and fiercely competitive arena, where the fortunes of global and domestic brands ebb and flow with economic currents, technological shifts, and evolving consumer preferences. Understanding "Us Car Sales By Brand" is not merely about tallying numbers; it’s about dissecting the very pulse of the American economy, identifying consumer trends, gauging brand strength, and forecasting the future of mobility. This comprehensive guide delves into the intricate world of US automotive sales, exploring the key players, the forces shaping their performance, and what these trends mean for consumers, investors, and the industry at large.

Understanding the Landscape: Key Players and Market Dynamics

Us Car Sales By Brand: A Comprehensive Look at the Automotive Landscape

At its core, "Us Car Sales By Brand" refers to the volume of vehicles sold by each distinct automotive brand within the United States market over a specific period, typically reported monthly, quarterly, or annually. This data provides crucial insights into market share, brand popularity, and the overall health of the automotive sector. The US market is dominated by a mix of traditional domestic giants, formidable Asian manufacturers, and increasingly, innovative European and electric vehicle (EV) specialists.

Key Automotive Groups and Their Brands:

- Domestic Powerhouses: General Motors (Chevrolet, GMC, Cadillac, Buick), Ford Motor Company (Ford, Lincoln), and Stellantis (Jeep, Ram, Dodge, Chrysler, Fiat, Alfa Romeo). These companies traditionally hold significant market share, particularly in trucks and SUVs.

- Asian Titans: Toyota Motor Corporation (Toyota, Lexus), Honda Motor Co. (Honda, Acura), Hyundai Motor Group (Hyundai, Kia, Genesis), and Nissan Motor Co. (Nissan, Infiniti). Renowned for reliability, efficiency, and value, they have steadily gained ground.

- European Contenders: Volkswagen Group (Volkswagen, Audi, Porsche, Lamborghini, Bentley), BMW Group (BMW, Mini), and Mercedes-Benz Group (Mercedes-Benz). These typically focus on luxury, performance, or specific niche segments.

- The EV Disruptor: Tesla, which has carved out a dominant position in the electric vehicle segment, challenging traditional manufacturers.

The market dynamics are influenced by a myriad of factors, including interest rates, fuel prices, overall economic health, consumer confidence, and global supply chain stability. Recent years, particularly post-pandemic, have seen unprecedented disruptions, from semiconductor shortages to logistics challenges, significantly impacting vehicle availability and pricing.

Top-Selling Brands and Their Strategies

While overall market share shifts, certain brands consistently remain at the top of the sales charts, often due to a combination of strong product offerings, brand loyalty, and effective market positioning.

- Ford: Consistently leads with its F-Series pickup trucks, which have been America’s best-selling vehicle for decades. Ford’s strategy heavily leans on its truck and SUV dominance, alongside a growing commitment to electric vehicles like the F-150 Lightning and Mustang Mach-E.

- Chevrolet: A cornerstone of GM, Chevrolet boasts a diverse portfolio, from the Silverado pickup to popular SUVs like the Equinox and Traverse, and iconic sports cars like the Corvette. Their strength lies in catering to a broad demographic with a mix of utility and performance.

- Toyota: Renowned for its unparalleled reliability and strong resale values, Toyota’s sales are driven by popular models like the RAV4 SUV, Camry sedan, and Tacoma pickup. Toyota has also been a pioneer in hybrid technology, giving it an edge in fuel efficiency.

- Honda: Similar to Toyota, Honda is celebrated for its engineering and dependable vehicles. The CR-V SUV and Civic compact car are consistent top sellers, appealing to families and commuters alike.

- Ram: Stellantis’s Ram brand focuses exclusively on trucks, competing fiercely with Ford and Chevrolet. Its success highlights the enduring American appetite for full-size pickups.

- Jeep: Another Stellantis gem, Jeep commands the SUV and off-road segment with its iconic Wrangler and Grand Cherokee models, leveraging a powerful brand image associated with adventure and capability.

- Tesla: Despite a smaller model lineup, Tesla’s innovative technology, strong brand identity, and early mover advantage in EVs have propelled it to the top of the electric vehicle sales charts, significantly impacting the luxury and tech-savvy segments.

The overarching trend across most brands has been a strategic shift away from sedans towards higher-margin SUVs and pickup trucks, driven by consumer preference for versatility, cargo space, and a commanding driving position.

The Rise of Electrification and New Entrants

The automotive landscape is undergoing its most significant transformation in a century, driven by electrification. This shift is profoundly impacting brand sales and market strategies.

- Tesla’s Dominance: Tesla’s early and aggressive focus on EVs allowed it to capture a substantial lead, forcing traditional OEMs to accelerate their own EV development. Their direct-to-consumer sales model also challenges the traditional dealership network.

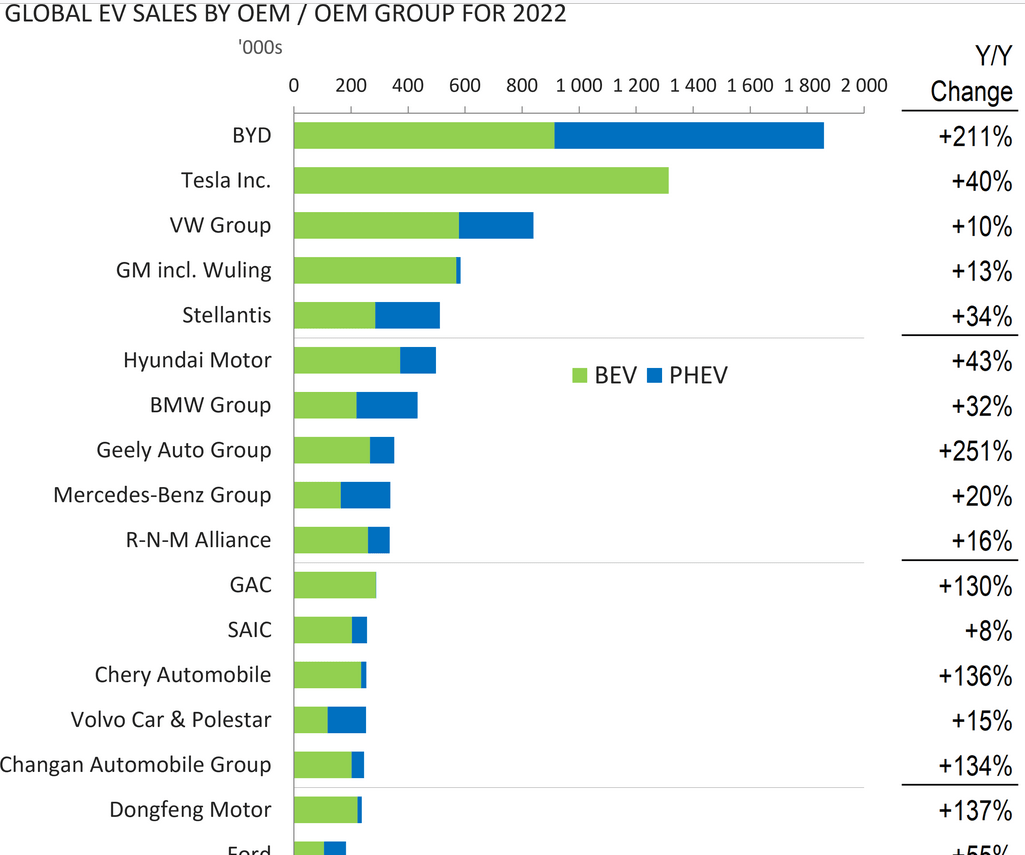

- Traditional OEM Response: Brands like Ford (Mustang Mach-E, F-150 Lightning), General Motors (Chevy Bolt, Cadillac Lyriq, upcoming Ultium platform vehicles), Hyundai (Ioniq 5), Kia (EV6), and Volkswagen (ID.4) are rapidly expanding their EV portfolios. Their challenge is to leverage existing brand loyalty and vast production capabilities to catch up.

- New Players: Companies like Rivian (electric trucks and SUVs) and Lucid (luxury electric sedans) represent a new wave of automotive startups, carving out niche segments and further intensifying competition.

The transition to EVs presents both immense opportunities and significant challenges, including the need for massive investments in R&D, manufacturing, charging infrastructure, and raw materials for batteries. Brands that successfully navigate this transition will secure their future market position.

Factors Influencing Brand Sales Performance

A brand’s sales performance is a complex interplay of numerous factors:

- Product Portfolio & Relevance: Does the brand offer vehicles that meet current consumer demands (e.g., a strong lineup of SUVs and trucks, compelling EV options)? Is there a good mix of price points and segments?

- Brand Reputation & Reliability: Long-standing trust, quality perception, and strong performance in reliability surveys (like J.D. Power) significantly influence purchase decisions and resale values.

- Marketing & Advertising: Effective campaigns, brand storytelling, and digital presence are crucial for building awareness and shaping consumer perception.

- Pricing & Incentives: Competitive pricing, attractive financing options, lease deals, and rebates can sway buyers, especially in a price-sensitive market.

- Dealership Network & Customer Service: The quality of the sales experience, availability of inventory, and post-purchase service (maintenance, repairs) are vital for customer satisfaction and repeat business.

- Supply Chain & Production Capacity: The ability to produce vehicles consistently and efficiently, free from disruptions like semiconductor shortages, directly impacts sales volume and market share.

- Technological Innovation: Features like advanced driver-assistance systems (ADAS), infotainment, connectivity, and battery technology are increasingly important differentiators.

Analyzing Sales Data: How to Interpret Trends

For consumers, industry observers, or potential investors, understanding how to interpret sales data is key:

- Year-over-Year (YoY) vs. Month-over-Month (MoM): YoY comparisons are generally more meaningful as they smooth out seasonal fluctuations. MoM can show immediate trends but should be viewed cautiously.

- Market Share: A brand’s percentage of total sales indicates its relative strength in the market. Gaining market share in a growing market is ideal; maintaining it in a shrinking market shows resilience.

- Retail vs. Fleet Sales: Retail sales represent individual consumer purchases and are a better indicator of consumer demand. Fleet sales (to rental companies, businesses, governments) can inflate overall numbers but are often lower-margin.

- Average Transaction Price (ATP): This metric reflects the average price consumers pay for a vehicle from a specific brand, including options and trims. A rising ATP often indicates a shift towards higher-value models or strong demand.

Practical Advice and Actionable Insights:

- For Car Buyers:

- Research Beyond Sales Numbers: While high sales often indicate popularity and potentially good resale value, also consider reliability ratings, safety scores, and long-term ownership costs.

- Leverage Sales Trends: If a brand’s sales are slowing, dealerships might be more willing to offer incentives. Conversely, for hot-selling models, expect less room for negotiation.

- Consider Future Value: Brands with strong market presence and reliability often hold their value better, which is crucial if you plan to sell or trade in your vehicle.

- Explore Emerging Brands: Don’t dismiss newer EV brands or less common imports; they might offer compelling technology or unique value propositions.

- For Industry Observers/Investors:

- Watch for Strategic Shifts: Pay attention to a brand’s commitment to EVs, autonomous technology, and new mobility services.

- Monitor Supply Chain Health: Production announcements and inventory levels are key indicators of a brand’s ability to meet demand.

- Analyze Profitability vs. Volume: High sales volume doesn’t always equal high profits, especially if it’s driven by heavy incentives or low-margin fleet sales. Look at average transaction prices and profit margins.

Challenges and Future Outlook

The US automotive market faces several ongoing challenges:

- Economic Headwinds: Inflation, rising interest rates, and the potential for an economic slowdown can dampen consumer demand and make vehicle financing more expensive.

- Supply Chain Resilience: While semiconductor shortages have eased, geopolitical tensions and natural disasters still pose risks to the global supply chain.

- Intense EV Competition: The race to electrify is costly and competitive. Brands must differentiate themselves on range, charging speed, performance, and price.

- Evolving Consumer Preferences: The desire for connectivity, personalized experiences, and sustainable options continues to shape vehicle design and sales strategies.

The future of Us Car Sales By Brand will be defined by continued electrification, the eventual rise of autonomous driving, and potentially new ownership models like subscriptions or ride-sharing dominance. Brands that demonstrate agility, innovate effectively, and maintain strong customer relationships will be the ones that thrive.

Key US Car Sales by Brand: Illustrative Performance Metrics

Below is an illustrative table summarizing key performance metrics for major automotive brands in the US. Please note that exact, real-time sales figures fluctuate constantly and are typically released quarterly or annually by manufacturers. The "Estimated Sales Volume" and "Estimated Market Share" are generalized for a recent period (e.g., mid-2023 performance) for illustrative purposes, and "Average Transaction Price (ATP)" is a notional average across a brand’s entire lineup.

| Brand Name | Parent Company | Estimated Annual Sales Volume (Illustrative) | Estimated Market Share (Illustrative) | Key Market Segment Focus | Notional Average Transaction Price (ATP) (Illustrative) |

|---|---|---|---|---|---|

| Ford | Ford Motor Co. | 1,800,000 – 2,000,000 units | 12.5% – 13.5% | Trucks, SUVs, EVs | $50,000 – $65,000 |

| Chevrolet | General Motors | 1,600,000 – 1,800,000 units | 11.0% – 12.0% | Trucks, SUVs, Broad Appeal | $45,000 – $60,000 |

| Toyota | Toyota Motor Corp. | 1,800,000 – 2,000,000 units | 12.5% – 13.5% | Reliability, Hybrids, SUVs | $38,000 – $55,000 |

| Honda | Honda Motor Co. | 1,000,000 – 1,200,000 units | 7.0% – 8.0% | Reliability, Compacts, SUVs | $35,000 – $50,000 |

| Ram | Stellantis | 600,000 – 700,000 units | 4.0% – 4.5% | Full-Size Pickups | $60,000 – $75,000 |

| Jeep | Stellantis | 600,000 – 700,000 units | 4.0% – 4.5% | SUVs, Off-Road | $45,000 – $65,000 |

| Hyundai | Hyundai Motor Group | 700,000 – 800,000 units | 4.5% – 5.5% | Value, EVs, SUVs | $32,000 – $48,000 |

| Kia | Hyundai Motor Group | 650,000 – 750,000 units | 4.0% – 5.0% | Value, Style, SUVs, EVs | $30,000 – $45,000 |

| Nissan | Nissan Motor Co. | 800,000 – 900,000 units | 5.0% – 6.0% | Value, Crossovers | $30,000 – $45,000 |

| Tesla | Tesla Inc. | 600,000 – 700,000 units | 4.0% – 4.5% | Electric Vehicles (EVs) | $55,000 – $80,000 |

| BMW | BMW Group | 350,000 – 400,000 units | 2.0% – 2.5% | Luxury, Performance | $60,000 – $85,000 |

| Mercedes-Benz | Mercedes-Benz Group | 300,000 – 350,000 units | 2.0% – 2.5% | Luxury, Technology | $65,000 – $90,000 |

| Audi | Volkswagen Group | 200,000 – 250,000 units | 1.0% – 1.5% | Luxury, AWD | $55,000 – $75,000 |

| Subaru | Subaru Corp. | 500,000 – 600,000 units | 3.0% – 4.0% | AWD, Safety, Outdoors | $30,000 – $45,000 |

Note: Sales volumes and market shares are approximate and illustrative for a recent annual period. Average Transaction Price (ATP) is a generalized estimate and varies significantly by model, trim, and options.

Frequently Asked Questions (FAQ) About US Car Sales By Brand

Q1: Which car brand sells the most vehicles in the US?

A1: Historically, Ford and Chevrolet (General Motors) often compete for the top spot in terms of overall unit sales, largely driven by their dominant truck and SUV sales. Toyota is also a very strong contender, often leading in passenger car sales and overall brand market share when combining cars and light trucks. The specific leader can vary quarter by quarter or year by year.

Q2: How do economic factors like interest rates and inflation impact car sales by brand?

A2: Higher interest rates increase the cost of financing a vehicle, potentially making new cars less affordable and reducing demand. Inflation can reduce consumer purchasing power and increase manufacturing costs, leading to higher vehicle prices, which can also depress sales. Brands catering to budget-conscious buyers might be more affected, while luxury brands might show more resilience.

Q3: What’s the difference between retail sales and fleet sales, and why does it matter?

A3: Retail sales are vehicles sold directly to individual consumers. Fleet sales are vehicles sold in bulk to businesses (e.g., rental car companies, government agencies, corporate fleets). Retail sales are generally considered a better indicator of consumer demand and brand health, as fleet sales often involve lower profit margins and can inflate overall sales figures without reflecting true consumer preference.

Q4: How important are electric vehicles (EVs) to a brand’s overall sales strategy now?

A4: Extremely important. EVs are the future of the automotive industry. Brands that do not develop a compelling EV lineup risk losing market share and relevance. Tesla’s success has demonstrated the strong consumer appetite for EVs, pushing all major traditional brands to invest heavily in electrification and introduce numerous new EV models.

Q5: Do luxury car brands always have higher profit margins than mainstream brands?

A5: Generally, yes. Luxury brands typically command higher prices due to their premium features, advanced technology, brand prestige, and superior materials, leading to higher profit margins per vehicle. While they sell fewer units than mainstream brands, their profitability can be significant. However, the EV transition is adding significant R&D costs even for luxury brands.

Conclusion

The landscape of Us Car Sales By Brand is a complex tapestry woven with threads of innovation, economic forces, consumer desires, and intense competition. From the enduring dominance of American pickups and SUVs to the disruptive rise of electric vehicles and the unwavering pursuit of reliability by Asian manufacturers, each brand tells a story of strategic adaptation and market positioning. Understanding these trends provides invaluable insights for anyone interested in the automotive industry – whether you’re a prospective buyer seeking value, an investor tracking market performance, or simply an observer fascinated by the evolution of transportation. The road ahead promises continued transformation, making the analysis of "Us Car Sales By Brand" an ever-engaging and crucial endeavor.