What Do You Need To Buy A Brand New Car: Your Ultimate Guide to Driving Off the Lot

What Do You Need To Buy A Brand New Car: Your Ultimate Guide to Driving Off the Lot cars.truckstrend.com

The allure of a brand new car is undeniable: that fresh car smell, the pristine paint job, the latest technology, and the peace of mind that comes with a full warranty. For many, it represents a significant milestone, a symbol of freedom, or simply a reliable upgrade. However, the journey from dreaming about a new car to actually driving it off the lot involves much more than just picking a model and signing a check. It’s a multi-faceted process that requires careful planning, financial readiness, and a clear understanding of the various requirements.

So, what do you need to buy a brand new car? This comprehensive guide will break down every essential component, from the financial prerequisites and necessary documentation to the crucial research and practical steps involved, ensuring you’re fully prepared for a smooth and successful purchase.

What Do You Need To Buy A Brand New Car: Your Ultimate Guide to Driving Off the Lot

The Financial Foundation: What Money Do You Need?

The most significant aspect of buying a brand new car is undoubtedly the financial commitment. It’s not just about the sticker price; several other costs accumulate to form the total expenditure. Understanding these elements is fundamental to budgeting effectively and avoiding surprises.

-

The Purchase Price (MSRP vs. Negotiated Price):

- MSRP (Manufacturer’s Suggested Retail Price): This is the "sticker price" – what the manufacturer recommends.

- Invoice Price: What the dealer paid the manufacturer. This is usually lower than MSRP.

- Negotiated Price: The actual price you agree to pay. This will be the starting point for all other calculations. Your goal is often to negotiate below MSRP, closer to invoice price, depending on market conditions and demand for the specific model.

-

Sales Tax: Almost every state imposes a sales tax on vehicle purchases. This is typically a percentage of the negotiated purchase price and can add hundreds or even thousands of dollars to your total cost. Research your state’s specific sales tax rate beforehand.

-

Registration and Licensing Fees: Before you can legally drive your new car, it needs to be registered with your state’s Department of Motor Vehicles (DMV) or equivalent agency. This involves various fees for license plates, registration cards, and title transfer. These fees vary significantly by state and even by vehicle type and weight.

Documentation Fees (Doc Fees): Dealerships charge a "doc fee" to cover the cost of preparing and processing the sales paperwork, including title, registration, and other legal documents. These fees are often non-negotiable and can range from under $100 to over $1,000, depending on the state and dealership. While some states cap these fees, others do not, making it crucial to be aware of this potential cost.

-

Dealership Add-ons and Accessories: Be prepared for dealerships to offer additional products and services, such as extended warranties, paint protection, fabric protection, anti-theft systems, or nitrogen-filled tires. While some might offer value, many are high-profit items for the dealership. Carefully consider if you truly need them and if their cost justifies the benefit. You can often negotiate these or decline them entirely.

-

Down Payment: A down payment is the initial sum of money you pay upfront, reducing the amount you need to finance. While it’s possible to buy a car with no down payment, a larger down payment (typically 10-20% of the car’s value) can significantly lower your monthly payments, reduce the total interest paid over the life of the loan, and help you avoid being "upside down" (owing more than the car is worth) early in the loan term.

-

Car Insurance: You cannot legally drive a new car off the lot without proof of insurance. Before finalizing the purchase, you must have an active auto insurance policy for the vehicle. Get quotes from multiple providers to ensure you’re getting competitive rates. Your premium will be influenced by factors like the car’s value, safety features, your driving record, and your chosen coverage limits.

-

Loan Interest (If Financing): If you’re taking out an auto loan, the interest rate will directly impact your total cost. A lower interest rate means less money paid over time. Your credit score, the loan term, and current market rates all play a role in determining your interest rate. Getting pre-approved for a loan before visiting the dealership can give you negotiating leverage and a clear understanding of your borrowing power.

-

Initial Fuel/Charging Costs: Don’t forget the immediate cost of filling up the tank or charging the battery for your first drive home!

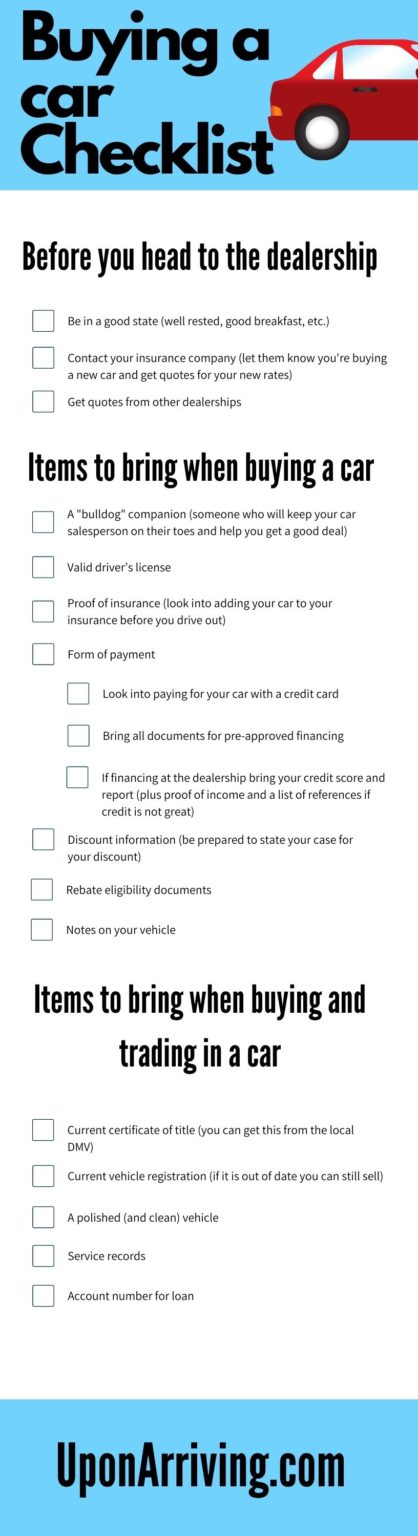

The Documentation Arsenal: What Papers Do You Need?

Beyond the financial resources, a specific set of documents is required to complete a new car purchase. Having these ready will streamline the process and prevent unnecessary delays.

-

Proof of Identity:

- Valid Driver’s License: This is essential for test drives and for proving your identity for the purchase. Ensure it’s current and matches your legal name.

- Other Photo ID (e.g., Passport, State ID Card): May be requested as a secondary form of identification, especially if your driver’s license is new or if there are discrepancies.

-

Proof of Residence:

- Utility Bill (within the last 30-60 days): An electricity, gas, or water bill with your current address.

- Bank Statement: A recent statement showing your address.

- Lease Agreement or Mortgage Statement: If you recently moved or prefer this method.

- Why needed: To verify your address for registration and financing purposes.

-

Proof of Income/Employment (If Financing):

- Recent Pay Stubs (typically 2-3 most recent): To verify your current income.

- W-2 Forms (for the last 1-2 years): Annual income verification.

- Bank Statements (for the last 2-3 months): To show consistent income and financial stability.

- Tax Returns (for self-employed individuals): To demonstrate income for those without traditional pay stubs.

- Why needed: Lenders use this to assess your ability to repay the loan.

-

Proof of Insurance:

- Insurance Binder or Policy Declaration Page: You must show proof that you have secured insurance coverage for the new vehicle before you can drive it off the lot. Contact your insurance provider as soon as you know which car you’re buying.

-

Trade-in Title and Registration (If Applicable):

- If you plan to trade in your current vehicle, you’ll need its clean title (proving you own it outright) and current registration. If you still owe money on your trade-in, bring your loan payoff information.

-

Proof of Funds (For Cash Buyers):

- If you’re paying cash, you may need to show a recent bank statement or a letter from your bank verifying the availability of funds, especially for large transactions, due to anti-money laundering regulations.

The Pre-Purchase Preparation: What Research and Steps Do You Need?

A significant part of what do you need to buy a brand new car happens long before you step onto a dealership lot. Thorough preparation is key to making an informed decision and securing the best deal.

-

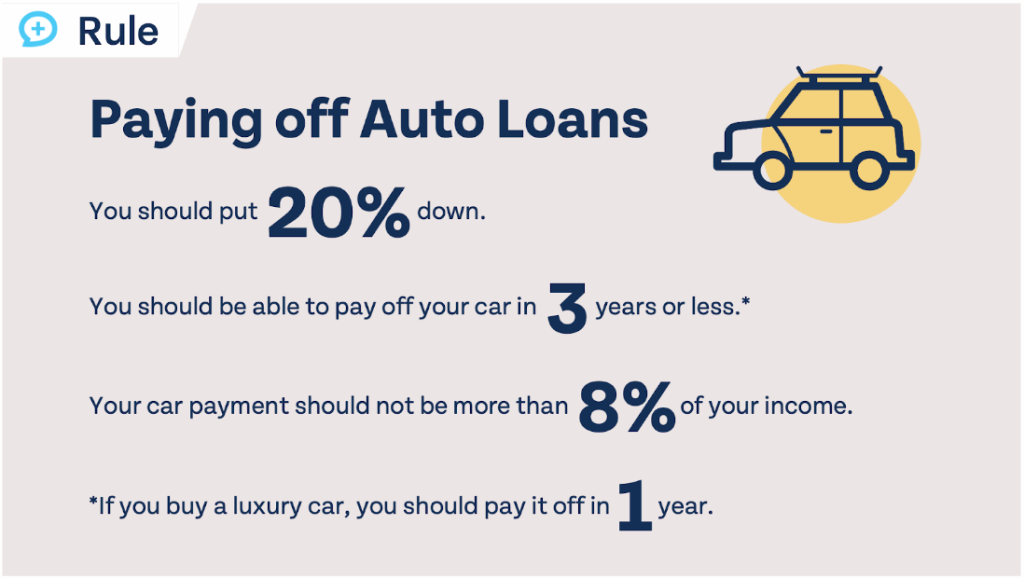

Budgeting and Affordability Assessment:

- Total Cost of Ownership: Look beyond the monthly payment. Consider insurance, fuel, maintenance, and potential depreciation. Use the "20/4/10 rule" as a guideline: 20% down payment, a loan term no longer than four years, and car expenses (payment, insurance, fuel) not exceeding 10% of your gross monthly income.

- Credit Score Check: Know your credit score. A higher score translates to better interest rates on loans. Obtain a copy of your credit report and address any discrepancies.

-

Needs Assessment:

- Lifestyle: How will you use the car? Commuting, family trips, off-roading, cargo?

- Features: What are your must-haves (e.g., fuel efficiency, safety tech, AWD, cargo space, infotainment)? What are nice-to-haves?

- Type of Vehicle: Sedan, SUV, truck, EV, hybrid?

-

Researching Models and Trims:

- Reliability and Safety Ratings: Consult reputable sources like Consumer Reports, J.D. Power, and the IIHS/NHTSA.

- Reviews: Read professional and user reviews.

- Compare Specs and Features: Use manufacturer websites and third-party car comparison tools.

- Resale Value: Consider how well the car holds its value over time.

-

Financing Options and Pre-Approval:

- Cash Purchase: Simple, no interest, but ties up liquid assets.

- Auto Loan: Most common. Shop around with banks, credit unions, and online lenders for pre-approval before visiting the dealership. This gives you a benchmark and strengthens your negotiating position.

- Leasing: An alternative where you pay to use the car for a set period. Requires different considerations (mileage limits, wear and tear). Understand if leasing is right for you.

-

Trade-in Valuation:

- If you’re trading in, get an independent appraisal from sources like Kelley Blue Book (KBB), Edmunds, or Carvana/CarMax. This gives you a realistic idea of your car’s value, so you know if the dealership’s offer is fair.

-

Test Drives:

- Once you’ve narrowed down your choices, schedule test drives for your top contenders. Pay attention to comfort, visibility, handling, acceleration, braking, and noise levels. Test on different road types.

-

Negotiation Skills:

- Be prepared to negotiate the price of the car and any add-ons. Don’t be afraid to walk away if the deal isn’t right. Focus on the total out-the-door price, not just the monthly payment.

The Post-Purchase Practicalities: What Else Do You Need?

Once the papers are signed and the keys are in hand, a few final considerations ensure you get the most out of your new investment.

- Understand Your Warranty: Familiarize yourself with the factory warranty (bumper-to-bumper, powertrain) and any extended warranties you purchased. Know what’s covered and for how long.

- Maintenance Schedule: Adhere to the manufacturer’s recommended maintenance schedule to keep your warranty valid and your car running smoothly.

- Essential Accessories: Consider floor mats, cargo organizers, phone mounts, or a car emergency kit.

- Learning Your Car’s Features: Take time to read the owner’s manual and understand all the features, especially safety and infotainment systems.

Challenges and Solutions:

- Overspending: Stick to your budget, get pre-approved financing.

- Hidden Fees: Read the buyer’s order carefully; ask for a breakdown of all charges.

- Pressure Tactics: Be firm, don’t rush, and be prepared to leave.

- Not Understanding Terms: Ask questions until you fully understand every document and financial term.

Estimated Costs Involved in Buying a New Car

The actual costs will vary based on the car’s price, your location, and individual circumstances. This table provides typical ranges for common expenditures:

| Cost Category | Description | Typical Range (USD) | Notes |

|---|---|---|---|

| Vehicle Price | Negotiated sale price of the car | $25,000 – $70,000+ | Varies immensely by make, model, trim. |

| Sales Tax | State-mandated tax on the purchase price | 0% – 10% of Vehicle Price | Check your state’s specific rate. |

| Down Payment | Initial upfront payment towards the car’s price | 10% – 20% of Vehicle Price (or more) | Higher down payment reduces loan amount and interest. |

| Registration Fees | Annual fees for license plates, title, and registration | $50 – $500+ | Varies by state, vehicle type, and weight. |

| Documentation Fees | Dealer fee for processing paperwork | $100 – $1,000+ | Varies by state and dealership; some states cap this. |

| Loan Interest | Cost of borrowing money (if financing) | Varies by APR and Loan Term | Lower credit score = higher APR. Long term = more interest. |

| Car Insurance | Annual premium for required auto insurance coverage | $1,000 – $3,000+ (annually) | Varies by driver, vehicle, location, and coverage. Must be active at purchase. |

| Optional Add-ons | Extended warranties, protection packages, accessories | $500 – $5,000+ (or more) | Negotiable; often high-profit items for dealer. |

| Trade-in Payoff | Amount owed on your current vehicle (if trading in with a loan) | Varies by outstanding loan | Deducted from trade-in value, or added to new loan. |

Frequently Asked Questions (FAQ)

Q1: Can I buy a brand new car without a down payment?

A1: Yes, it’s possible to buy a car with no down payment, often called "100% financing." However, it’s generally not recommended as it can lead to higher monthly payments, more interest paid over the loan term, and potentially being "upside down" on your loan (owing more than the car is worth) early on.

Q2: How much should I budget for a new car’s monthly payment?

A2: A common guideline is that your total car expenses (loan payment, insurance, and fuel/charging) should not exceed 10% of your gross monthly income. For the loan payment specifically, many financial experts suggest staying under 15% of your take-home pay.

Q3: What’s the difference between MSRP and invoice price?

A3: MSRP (Manufacturer’s Suggested Retail Price) is the sticker price, what the manufacturer recommends the dealer sell the car for. The invoice price is what the dealer paid the manufacturer for the car. Your goal in negotiation is often to get closer to the invoice price, especially for less popular models.

Q4: Do I need insurance before I buy the car?

A4: Yes, absolutely. Most dealerships will not allow you to drive a brand new car off the lot without proof of active insurance coverage for that specific vehicle. It’s best to arrange this with your insurance provider as soon as you finalize the make and model you intend to purchase.

Q5: What documents do I need if I’m trading in my old car?

A5: You’ll need your current car’s clean title (proof of ownership) and its current registration. If you still owe money on the car, bring your loan account information, as the dealership will need to facilitate the payoff with your current lender.

Q6: Is getting pre-approved for a loan necessary?

A6: While not strictly "necessary," getting pre-approved for an auto loan from a bank or credit union before visiting the dealership is highly recommended. It gives you a clear understanding of the interest rate you qualify for, strengthens your negotiating position with the dealership’s finance department, and helps you set a firm budget.

Conclusion

Buying a brand new car is an exciting endeavor that, with proper preparation, can be a rewarding experience. Understanding what do you need to buy a brand new car encompasses much more than just having enough money for the sticker price. It involves meticulous financial planning, gathering the right documentation, conducting thorough research, and approaching the dealership with confidence and knowledge. By following the guidance in this article – from setting a realistic budget and securing financing to understanding all associated costs and having your documents in order – you’ll be well-equipped to navigate the car-buying process efficiently and drive away in your dream car with peace of mind. Happy driving!